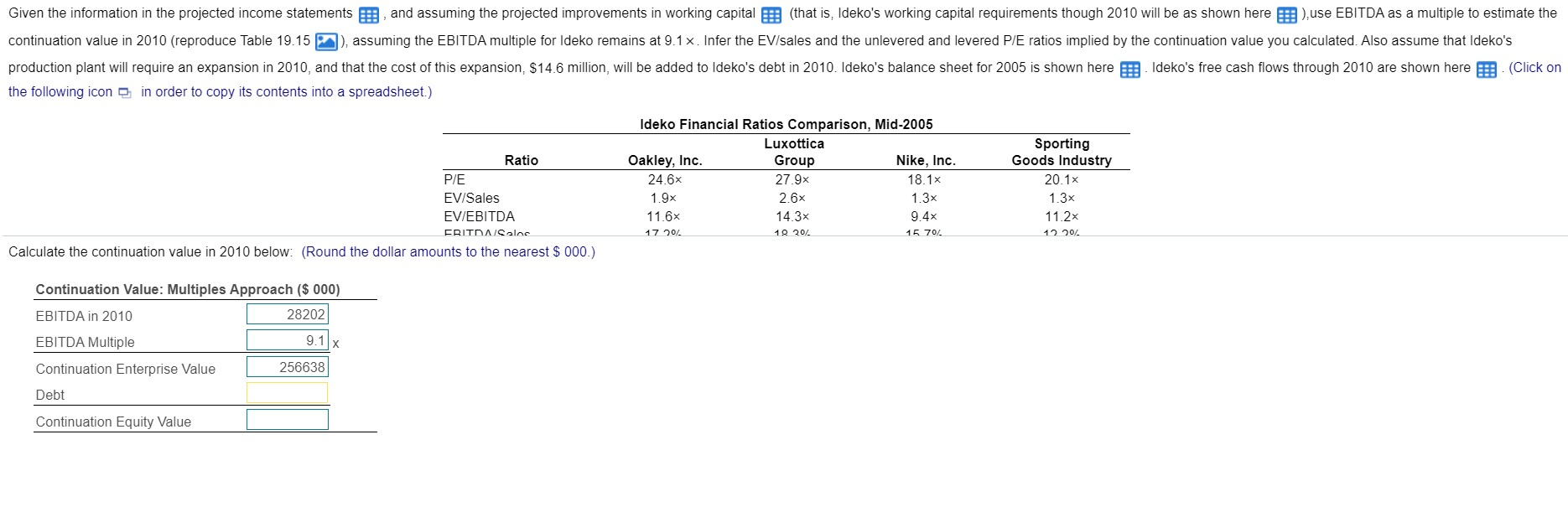

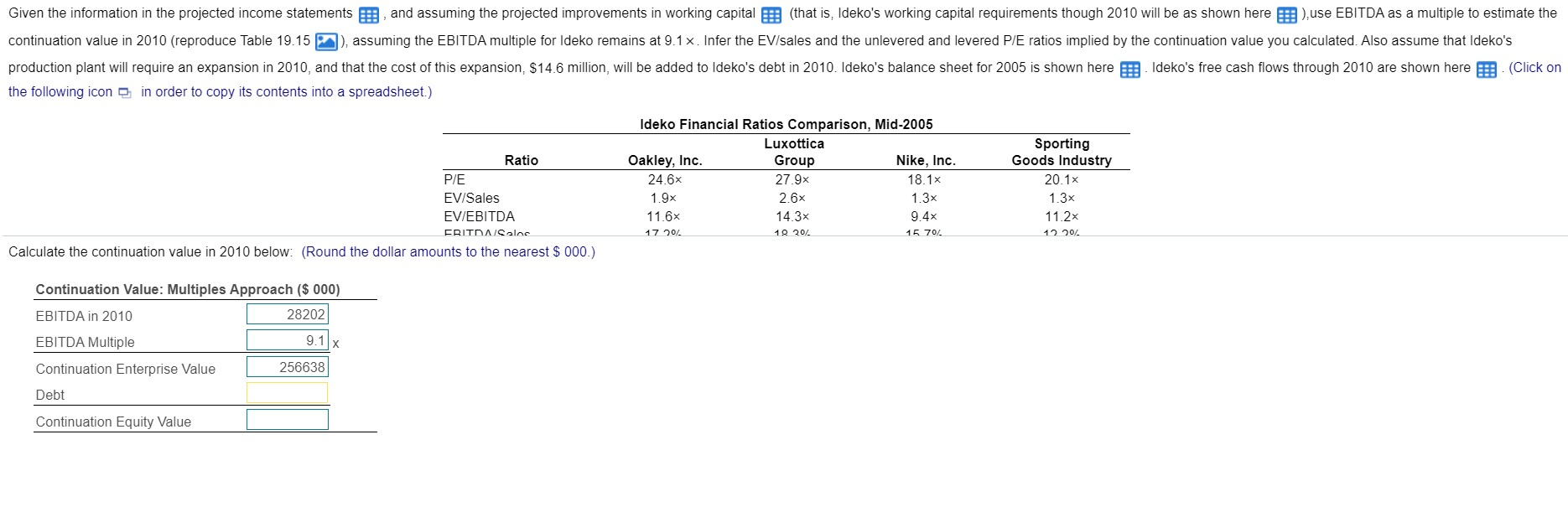

Given the information in the projected income statements , and assuming the projected improvements in working capital (that is, Ideko's working capital requirements though 2010 will be as shown here ),use EBITDA as a multiple to estimate the continuation value in 2010 (reproduce Table 19.15 ), assuming the EBITDA multiple for Ideko remains at 9.1 x. Infer the EV/sales and the unlevered and levered P/E ratios implied by the continuation value you calculated. Also assume that Ideko's production plant will require an expansion in 2010, and that the cost of this expansion, $14.6 million, will be added to Ideko's debt in 2010. Ideko's balance sheet for 2005 is shown here Ideko's free cash flows through 2010 are shown here (Click on the following icon in order to copy its contents into a spreadsheet.) Ratio P/E EV/Sales EV/EBITDA ERITDA/Salos Calculate the continuation value in 2010 below: (Round the dollar amounts to the nearest $ 000.) Ideko Financial Ratios Comparison, Mid-2005 Luxottica Oakley, Inc. Group Nike, Inc. 24.6x 27.9x 18.1x 1.9x 2.6x 1.3x 11.6% 14.3x 9.4x 17 20/. 19 201 15 70/ Sporting Goods Industry 20.1% 1.3x 11.2x 12.2012 Continuation Value: Multiples Approach ($ 000) EBITDA in 2010 28202 EBITDA Multiple Continuation Enterprise Value 256638 9.1 x Debt Continuation Equity Value Given the information in the projected income statements , and assuming the projected improvements in working capital (that is, Ideko's working capital requirements though 2010 will be as shown here ),use EBITDA as a multiple to estimate the continuation value in 2010 (reproduce Table 19.15 ), assuming the EBITDA multiple for Ideko remains at 9.1 x. Infer the EV/sales and the unlevered and levered P/E ratios implied by the continuation value you calculated. Also assume that Ideko's production plant will require an expansion in 2010, and that the cost of this expansion, $14.6 million, will be added to Ideko's debt in 2010. Ideko's balance sheet for 2005 is shown here Ideko's free cash flows through 2010 are shown here (Click on the following icon in order to copy its contents into a spreadsheet.) Ratio P/E EV/Sales EV/EBITDA ERITDA/Salos Calculate the continuation value in 2010 below: (Round the dollar amounts to the nearest $ 000.) Ideko Financial Ratios Comparison, Mid-2005 Luxottica Oakley, Inc. Group Nike, Inc. 24.6x 27.9x 18.1x 1.9x 2.6x 1.3x 11.6% 14.3x 9.4x 17 20/. 19 201 15 70/ Sporting Goods Industry 20.1% 1.3x 11.2x 12.2012 Continuation Value: Multiples Approach ($ 000) EBITDA in 2010 28202 EBITDA Multiple Continuation Enterprise Value 256638 9.1 x Debt Continuation Equity Value