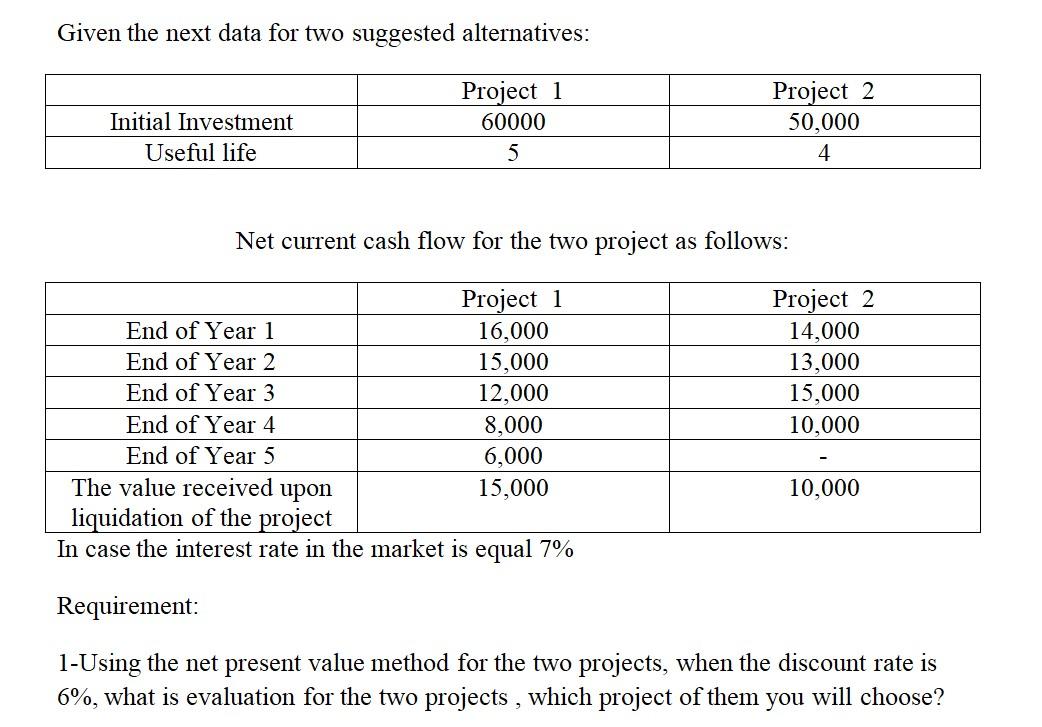

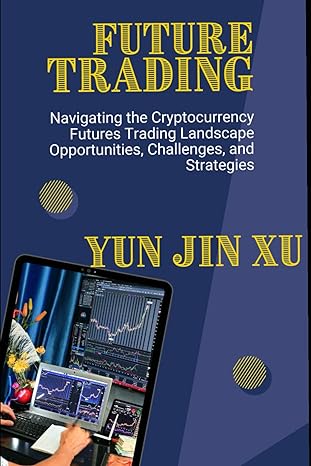

Given the next data for two suggested alternatives: Initial Investment Useful life Project 1 60000 5 Project 2 50,000 4 Net current cash flow for the two project as follows: Project 1 End of Year 1 16,000 End of Year 2 15,000 End of Year 3 12,000 End of Year 4 8,000 End of Year 5 6,000 The value received upon 15,000 liquidation of the project In case the interest rate in the market is equal 7% Project 2 14,000 13,000 15,000 10,000 10,000 Requirement: 1-Using the net present value method for the two projects, when the discount rate is 6%, what is evaluation for the two projects, which project of them you will choose? 2-Calculate the net present value method for project (1) when the discount rate is Sand for alternative (2) when the discount rate is 9%, what is evaluation for the two alternatives, which alternative of them you will choose? 3-using the results of the previous questions, calculate the IRR for the two projects, which locate between 6% and 8% for project (1), and between (6% -9%) for project (2), what is evaluation for the two projects, which project of them you will choose? Given the next data for two suggested alternatives: Initial Investment Useful life Project 1 60000 5 Project 2 50,000 4 Net current cash flow for the two project as follows: Project 1 End of Year 1 16,000 End of Year 2 15,000 End of Year 3 12,000 End of Year 4 8,000 End of Year 5 6,000 The value received upon 15,000 liquidation of the project In case the interest rate in the market is equal 7% Project 2 14,000 13,000 15,000 10,000 10,000 Requirement: 1-Using the net present value method for the two projects, when the discount rate is 6%, what is evaluation for the two projects, which project of them you will choose? 2-Calculate the net present value method for project (1) when the discount rate is Sand for alternative (2) when the discount rate is 9%, what is evaluation for the two alternatives, which alternative of them you will choose? 3-using the results of the previous questions, calculate the IRR for the two projects, which locate between 6% and 8% for project (1), and between (6% -9%) for project (2), what is evaluation for the two projects, which project of them you will choose