Answered step by step

Verified Expert Solution

Question

1 Approved Answer

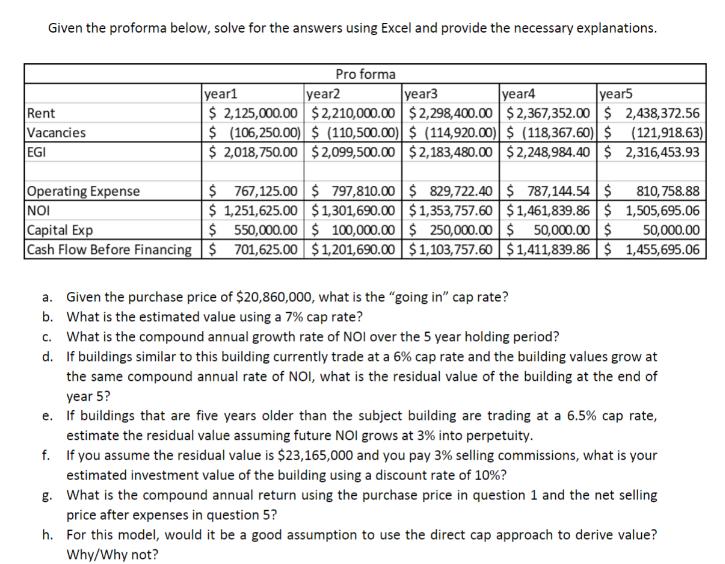

Given the proforma below, solve for the answers using Excel and provide the necessary explanations. Rent Vacancies EGI Pro forma year2 year1 year3 year4

Given the proforma below, solve for the answers using Excel and provide the necessary explanations. Rent Vacancies EGI Pro forma year2 year1 year3 year4 year5 $ 2,125,000.00 $2,210,000.00 $2,298,400.00 $2,367,352.00 $ 2,438,372.56 $ (106,250.00) $ (110,500.00) $ (114,920.00) $ (118,367.60) $ (121,918.63) $ 2,018,750.00 $2,099,500.00 $2,183,480.00 $2,248,984.40 $2,316,453.93 Operating Expense NOI $ 767,125.00 $ 797,810.00 $ 829,722.40 $ 787,144.54 $ 810,758.88 $ 1,251,625.00 $1,301,690.00 $1,353,757.60 $1,461,839.86 $ 1,505,695.06 $ 550,000.00 $ 100,000.00 $ 250,000.00 $ 50,000.00 $ 50,000.00 Cash Flow Before Financing $ 701,625.00 $1,201,690.00 $1,103,757.60 $1,411,839.86 $ 1,455,695.06 Capital Exp a. Given the purchase price of $20,860,000, what is the "going in" cap rate? b. What is the estimated value using a 7% cap rate? c. What is the compound annual growth rate of NOI over the 5 year holding period? d. If buildings similar to this building currently trade at a 6% cap rate and the building values grow at the same compound annual rate of NOI, what is the residual value of the building at the end of year 5? e. If buildings that are five years older than the subject building are trading at a 6.5% cap rate, estimate the residual value assuming future NOI grows at 3% into perpetuity. f. If you assume the residual value is $23,165,000 and you pay 3% selling commissions, what is your estimated investment value of the building using a discount rate of 10%? g. What is the compound annual return using the purchase price in question 1 and the net selling price after expenses in question 5? h. For this model, would it be a good assumption to use the direct cap approach to derive value? Why/Why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It seems like youre looking for help with a real estate finance exercise I can explain how to calculate the different parts of the question but since I cannot execute code or use Excel in this interfa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started