given the provided information, find the emergency fund ratio

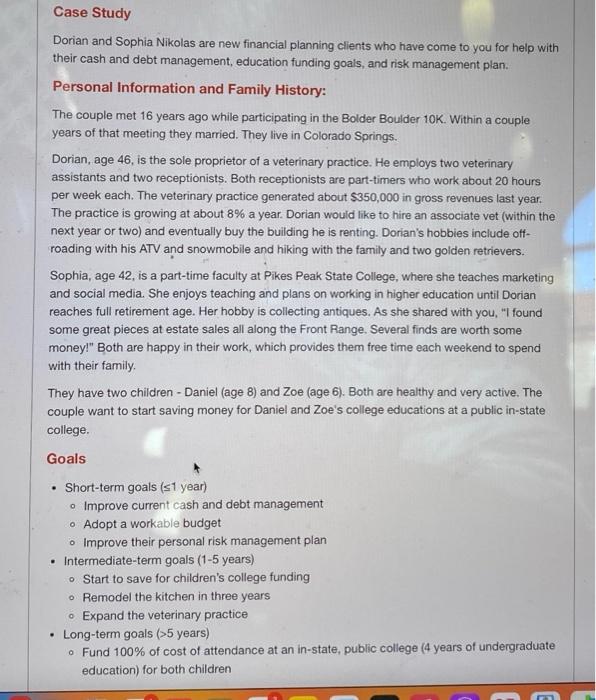

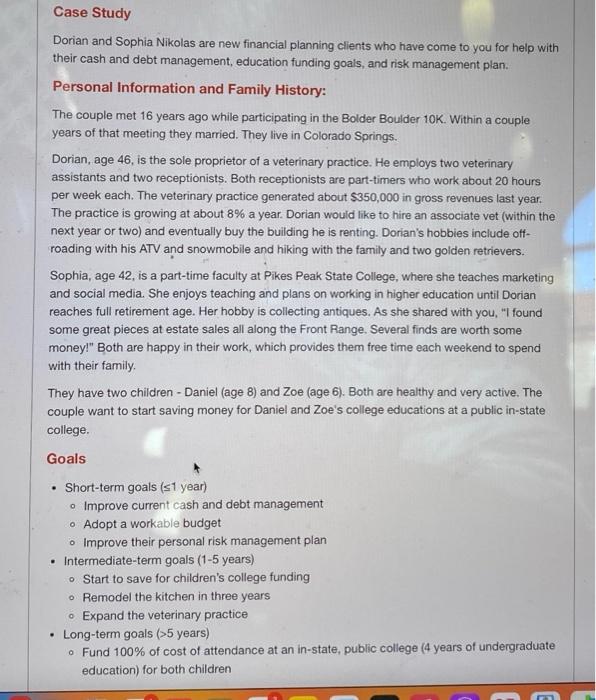

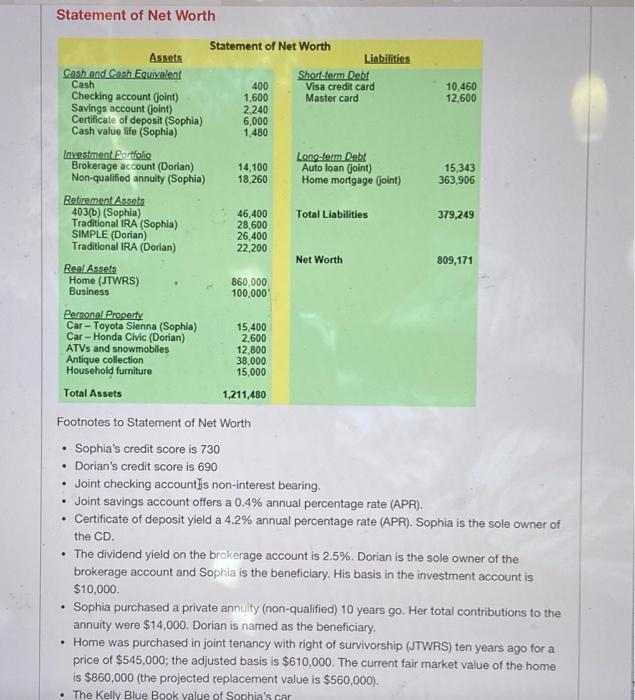

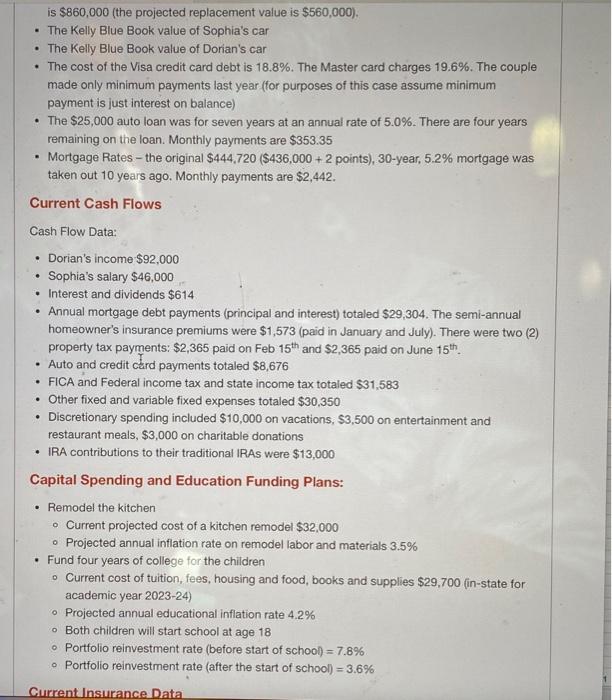

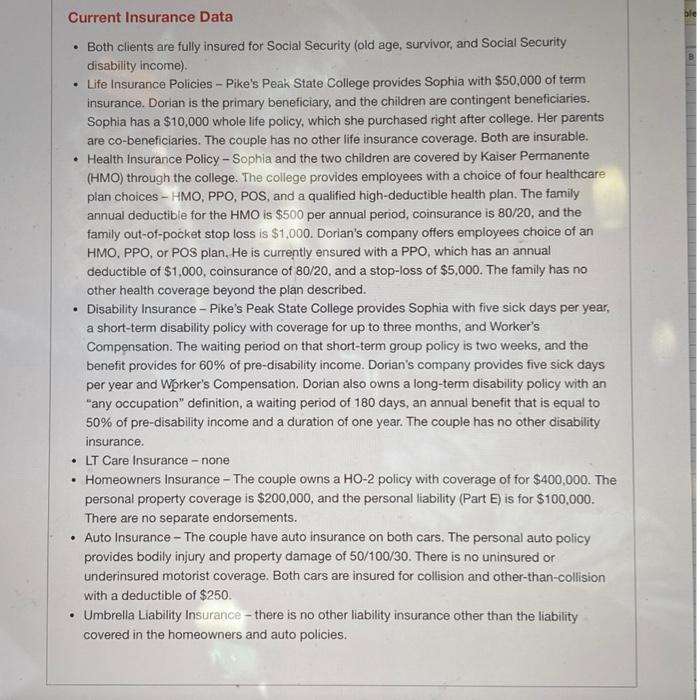

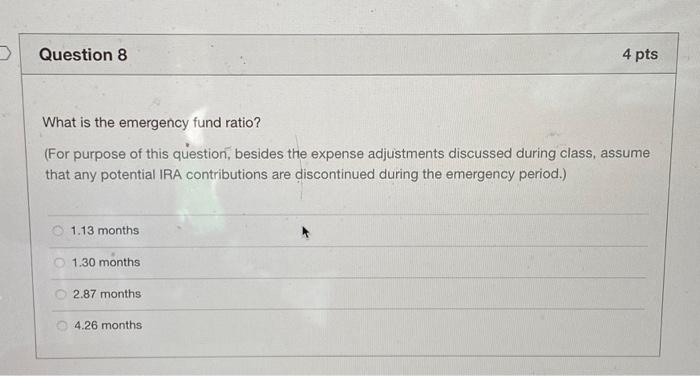

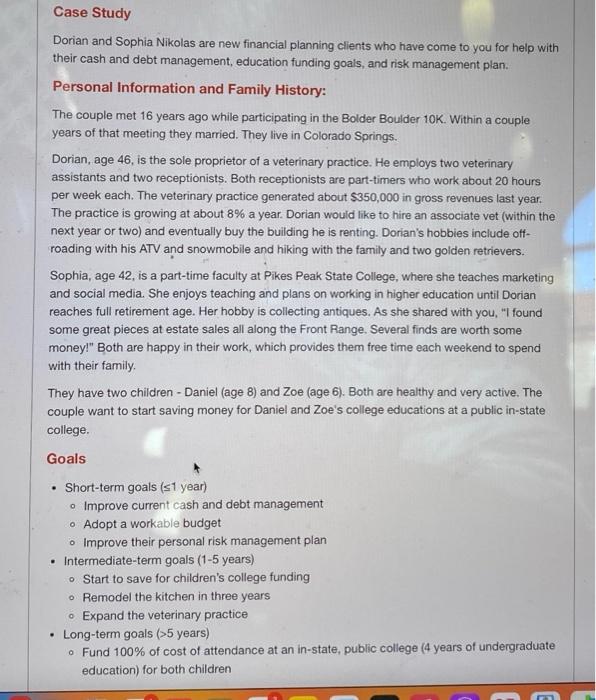

Dorian and Sophia Nikolas are new financial planning clients who have come to you for help with their cash and debt management, education funding goals, and risk management plan. Personal Information and Family History: The couple met 16 years ago while participating in the Bolder Boulder 10K. Within a couple years of that meeting they married. They live in Colorado Springs. Dorian, age 46 , is the sole proprietor of a veterinary practice. He employs two veterinary assistants and two receptionists. Both receptionists are part-timers who work about 20 hours per week each. The veterinary practice generated about $350,000 in gross revenues last year. The practice is growing at about 8% a year. Dorian would like to hire an associate vet (within the next year or two) and eventually buy the building he is renting. Dorian's hobbies include offroading with his ATV and snowmobile and hiking with the family and two goiden retrievers. Sophia, age 42 , is a part-time faculty at Pikes Peak State College, where she teaches marketing and social media. She enjoys teaching and plans on working in higher education until Dorian reaches full retirement age. Her hobby is collecting antiques. As she shared with you, "I found some great pieces at estate sales all along the Front Range. Several finds are worth some money!" Both are happy in their work, which provides them free time each weekend to spend with their family. They have two children - Daniel (age 8) and Zoe (age 6). Both are healthy and very active. The couple want to start saving money for Daniel and Zoe's college educations at a public in-state college. Goals - Short-term goals ( 1 year) - Improve current cash and debt management - Adopt a workable budget - Improve their personal risk management plan - Intermediate-term goals (1-5 years) - Start to save for children's college funding - Remodel the kitchen in three years - Expand the veterinary practice - Long-term goals ( >5 years) - Fund 100% of cost of attendance at an in-state, public college (4 years of undergraduate education) for both children Statement of Net Worth Footnotes to Statement of Net Worth - Sophia's credit score is 730 - Dorian's credit score is 690 - Joint checking accountlis non-interest bearing. - Joint savings account offers a 0.4% annual percentage rate (APR). - Certificate of deposit yield a 4.2% annual percentage rate (APR). Sophia is the sole owner of the CD. - The dividend yield on the brokerage account is 2.5%. Dorian is the sole owner of the brokerage account and Sophia is the beneficiary. His basis in the investment account is $10,000. - Sophia purchased a private annuity (non-qualified) 10 years go. Her total contributions to the annuity were $14,000. Dorian is named as the beneficiary. - Home was purchased in joint tenancy with right of survivorship (JTWRS) ten years ago for a price of $545,000; the adjusted basis is $610,000. The current fair market value of the home is $860,000 (the projected replacement value is $560,000 ). is $860,000 (the projected replacement value is $560,000 ). - The Kelly Blue Book value of Sophia's car - The Kelly Blue Book value of Dorian's car - The cost of the Visa credit card debt is 18.8%. The Master card charges 19.6%. The couple made only minimum payments last year (for purposes of this case assume minimum payment is just interest on balance) - The $25,000 auto loan was for seven years at an annual rate of 5.0%. There are four years remaining on the loan. Monthly payments are $353.35 - Mortgage Rates - the original $444,720 ( $436,000+2 points), 30 -year, 5.2% mortgage was taken out 10 years ago. Monthly payments are $2,442. Current Cash Flows Cash Flow Data: - Dorian's income $92,000 - Sophia's salary $46,000 - Interest and dividends $614 - Annual mortgage debt payments (principal and interest) totaled $29,304. The semi-annual homeowner's insurance premiums were $1,573 (paid in January and July). There were two (2) property tax payments: $2,365 paid on Feb 15th and $2,365 paid on June 15th. - Auto and credit crd payments totaled $8,676 - FICA and Federal income tax and state income tax totaled $31,583 - Other fixed and variable fixed expenses totaled $30,350 - Discretionary spending included $10,000 on vacations, $3,500 on entertainment and restaurant meals, $3,000 on charitable donations - IRA contributions to their traditional IRAs were $13,000 Capital Spending and Education Funding Plans: - Remodel the kitchen - Current projected cost of a kitchen remodel $32,000 - Projected annual inflation rate on remodel labor and materials 3.5% - Fund four years of college for the children - Current cost of tuition, fees, housing and food, books and supplies $29,700 (in-state for academic year 2023-24) - Projected annual educational inflation rate 4.2% - Both children will start school at age 18 - Portfolio reinvestment rate (before start of schooi)=7.8% - Portfolio reinvestment rate (after the start of school) =3.6% Current Insurance Data - Both clients are fully insured for Social Security (old age, survivor, and Social Security disability income). - Life Insurance Policies - Pike's Peak State College provides Sophia with $50,000 of term insurance. Dorian is the primary beneficiary, and the children are contingent beneficiaries. Sophia has a $10,000 whole life policy, which she purchased right after college. Her parents are co-beneficiaries. The couple has no other life insurance coverage. Both are insurable. - Health Insurance Policy - Sophia and the two children are covered by Kaiser Permanente (HMO) through the college. The college provides employees with a choice of four healthcare plan choices - HMO, PPO, POS, and a qualified high-deductible health plan. The family annual deductible for the HMO is $500 per annual period, coinsurance is 80/20, and the family out-of-pocket stop loss is \$1,000. Dorian's company offers employees choice of an HMO, PPO, or POS plan, He is currently ensured with a PPO, which has an anual deductible of $1,000, coinsurance of 80/20, and a stop-loss of $5,000. The family has no other health coverage beyond the plan described. - Disability Insurance - Pike's Peak State College provides Sophia with five sick days per year, a short-term disability policy with coverage for up to three months, and Worker's Compensation. The waiting period on that short-term group policy is two weeks, and the benefit provides for 60% of pre-disability income. Dorian's company provides five sick days per year and Whrker's Compensation. Dorian also owns a long-term disability policy with an "any occupation" definition, a waiting period of 180 days, an annual benefit that is equal to 50% of pre-disability income and a duration of one year. The couple has no other disability insurance. - LT Care Insurance - none - Homeowners Insurance - The couple owns a HO-2 policy with coverage of for $400,000. The personal property coverage is $200,000, and the personal liability ( P art E ) is for $100,000. There are no separate endorsements. - Auto Insurance - The couple have auto insurance on both cars. The personal auto policy provides bodily injury and property damage of 50/100/30. There is no uninsured or underinsured motorist coverage. Both cars are insured for collision and other-than-collision with a deductible of $250. - Umbrella Liability Insurance - there is no other liability insurance other than the liability covered in the homeowners and auto policies. What is the emergency fund ratio? (For purpose of this question, besides the expense adjustments discussed during class, assume that any potential IRA contributions are discontinued during the emergency period.) 1.13 months 1.30 months 2.87 months 4.26 months