Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the results from the tests above about serial correlation, multicollinearity and heteroskedasticity, is it appropriate to use the estimated coefficients for statistical inference without

Given the results from the tests above about serial correlation, multicollinearity and heteroskedasticity, is it appropriate to use the estimated coefficients for statistical inference without trying any fixes? Explain why or why not.

What suggestions would you have for another estimation of this regression? (For example, dropping some variable, changing the functional form, re-estimating using the Prais-Winsten GLS method, compute Newey-West standard errors or compute White heteroskedasticity corrected standard errors.)

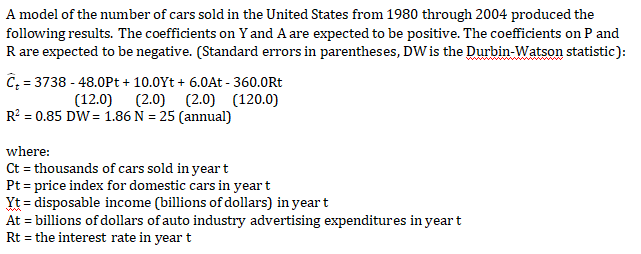

A model of the number of cars sold in the United States from 1980 through 2004 produced the following results. The coefficients on Y and A are expected to be positive. The coefficients on P and Rare expected to be negative. (Standard errors in parentheses, DW is the Durbin-Watson statistic): Co = 3738 - 48.0Pt + 10.0Yt + 6.0At - 360.0Rt (12.0) (2.0) (2.0) (120.0) R2 = 0.85 DW = 1.86 N = 25 (annual) where: Ct = thousands of cars sold in yeart Pt = price index for domestic cars in yeart Yt = disposable income (billions of dollars) in yeart At = billions of dollars of auto industry advertising expenditures in yeart Rt = the interest rate in year t A model of the number of cars sold in the United States from 1980 through 2004 produced the following results. The coefficients on Y and A are expected to be positive. The coefficients on P and Rare expected to be negative. (Standard errors in parentheses, DW is the Durbin-Watson statistic): Co = 3738 - 48.0Pt + 10.0Yt + 6.0At - 360.0Rt (12.0) (2.0) (2.0) (120.0) R2 = 0.85 DW = 1.86 N = 25 (annual) where: Ct = thousands of cars sold in yeart Pt = price index for domestic cars in yeart Yt = disposable income (billions of dollars) in yeart At = billions of dollars of auto industry advertising expenditures in yeart Rt = the interest rate in year tStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started