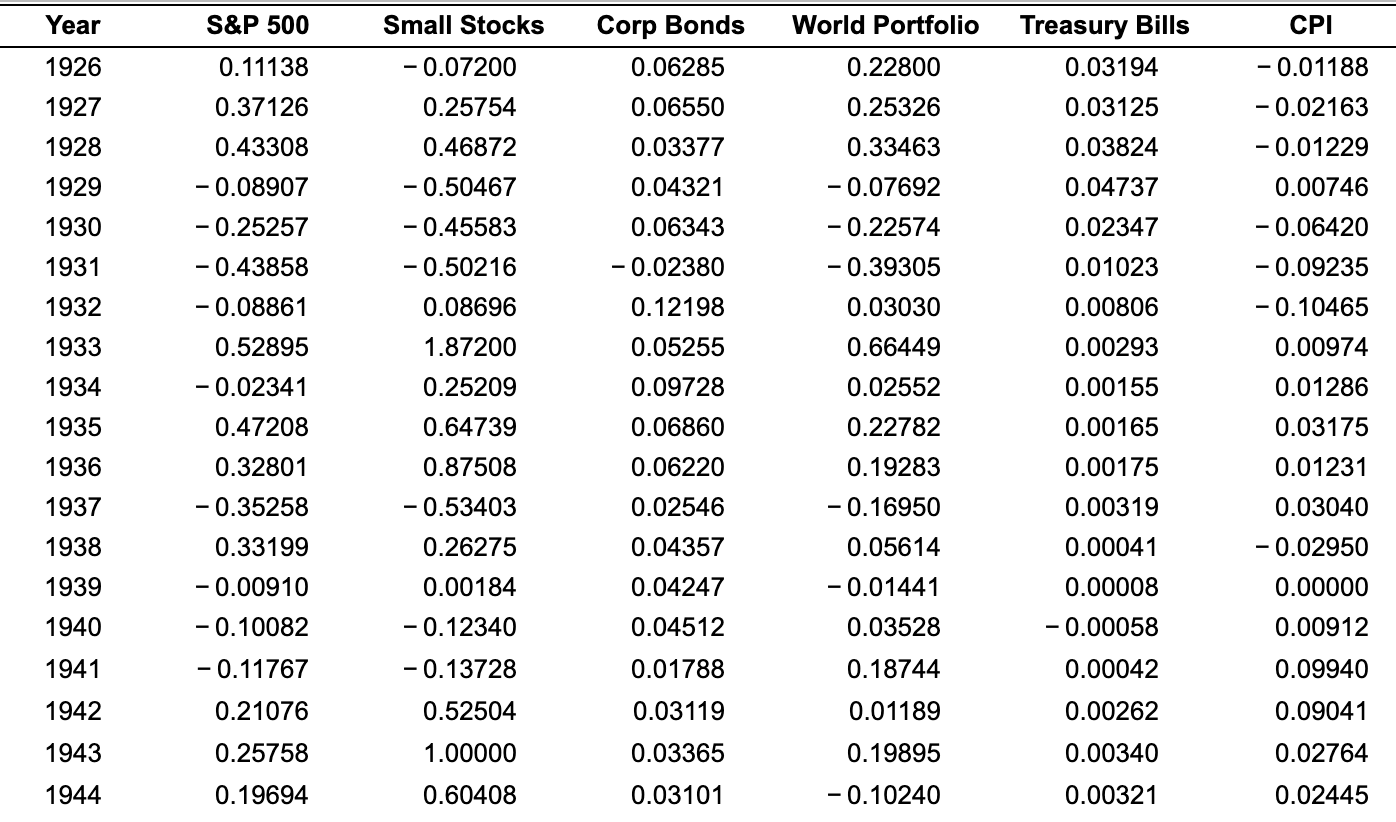

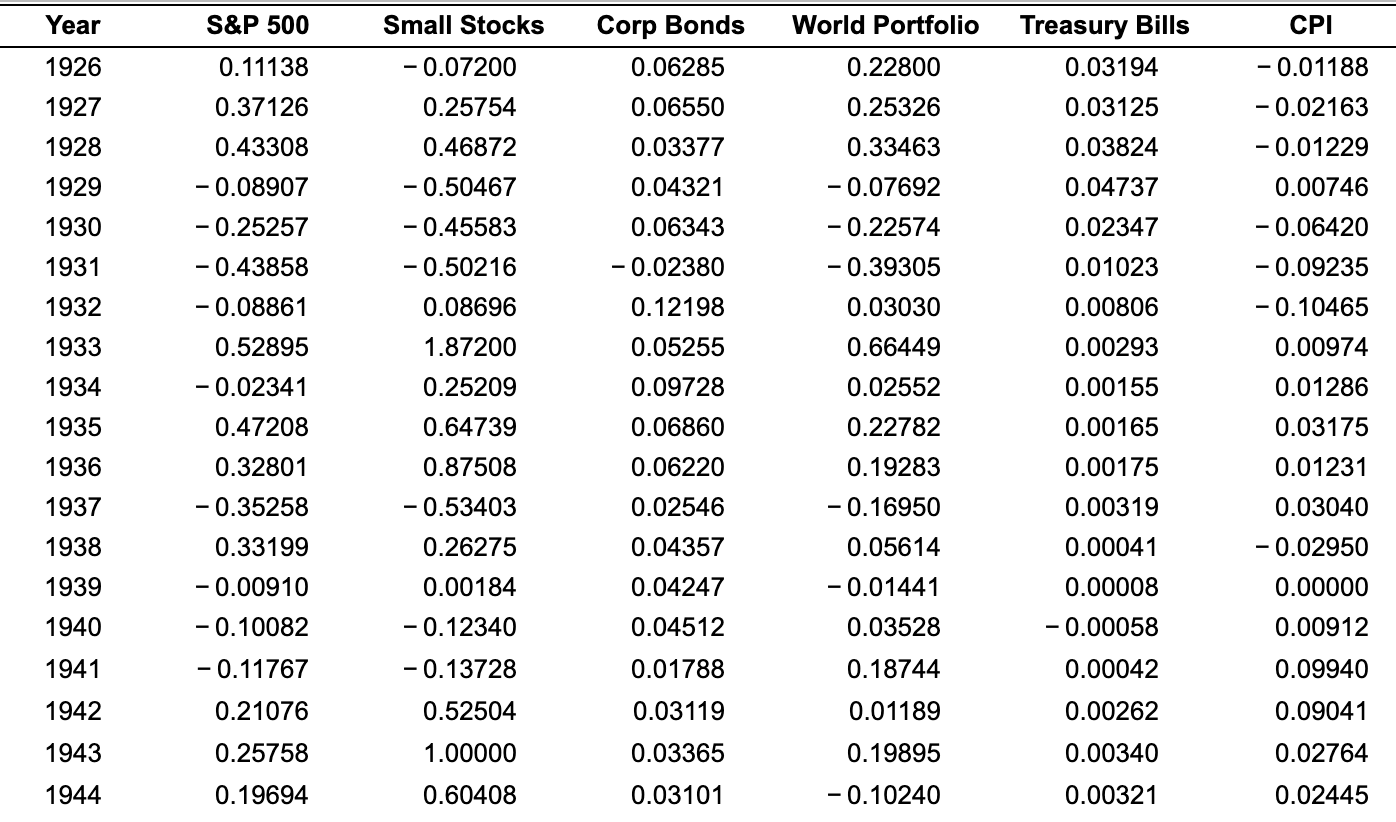

Given the spreadsheet, LOADING..., containing the realized return of the S&P 500 from 1926-2014. Starting in 1929, divide the next 80 years (1929-2008) of the sample into four periods of 20 years each. For each 20-year period, calculate the final amount an investor would have earned given a $2,750 initial investment. Also express your answer as an annualized return. If risk were eliminated by holding stocks for 20 years, what would you expect to find? What can you conclude about long-run diversification?

These are the right answers: show work why please:

Year S&P 500 Small Stocks Corp Bonds World Portfolio Treasury Bills 0.03194 1926 -0.07200 0.06285 0.11138 0.37126 1927 0.06550 0.03125 0.03824 1928 0.43308 0.03377 0.25754 0.46872 -0.50467 -0.45583 1929 0.04737 -0.08907 -0.25257 -0.43858 0.04321 0.06343 0.22800 0.25326 0.33463 -0.07692 -0.22574 -0.39305 0.03030 0.66449 CPI -0.01188 -0.02163 -0.01229 0.00746 - 0.06420 -0.09235 - 0.10465 0.00974 1930 0.02347 0.01023 1931 -0.50216 -0.02380 1932 0.08696 -0.08861 0.52895 0.12198 0.05255 0.00806 0.00293 1933 1.87200 1934 -0.02341 0.25209 0.09728 0.02552 0.00155 0.01286 1935 0.06860 0.00165 0.47208 0.32801 0.64739 0.87508 -0.53403 0.22782 0.19283 0.03175 0.01231 1936 0.06220 0.00175 1937 -0.35258 0.02546 -0.16950 0.00319 1938 0.33199 0.26275 0.04357 0.05614 0.00041 0.03040 -0.02950 0.00000 1939 0.04247 0.00008 -0.00910 -0.10082 0.00184 -0.12340 -0.01441 0.03528 1940 0.04512 -0.00058 0.00912 1941 -0.11767 0.01788 0.18744 0.00042 0.09940 -0.13728 0.52504 1942 0.21076 0.03119 0.01189 0.00262 0.09041 1943 0.25758 1.00000 0.03365 0.19895 0.00340 0.02764 1944 0.19694 0.60408 0.03101 -0.10240 0.00321 0.02445 Year S&P 500 Small Stocks Corp Bonds World Portfolio Treasury Bills 0.03194 1926 -0.07200 0.06285 0.11138 0.37126 1927 0.06550 0.03125 0.03824 1928 0.43308 0.03377 0.25754 0.46872 -0.50467 -0.45583 1929 0.04737 -0.08907 -0.25257 -0.43858 0.04321 0.06343 0.22800 0.25326 0.33463 -0.07692 -0.22574 -0.39305 0.03030 0.66449 CPI -0.01188 -0.02163 -0.01229 0.00746 - 0.06420 -0.09235 - 0.10465 0.00974 1930 0.02347 0.01023 1931 -0.50216 -0.02380 1932 0.08696 -0.08861 0.52895 0.12198 0.05255 0.00806 0.00293 1933 1.87200 1934 -0.02341 0.25209 0.09728 0.02552 0.00155 0.01286 1935 0.06860 0.00165 0.47208 0.32801 0.64739 0.87508 -0.53403 0.22782 0.19283 0.03175 0.01231 1936 0.06220 0.00175 1937 -0.35258 0.02546 -0.16950 0.00319 1938 0.33199 0.26275 0.04357 0.05614 0.00041 0.03040 -0.02950 0.00000 1939 0.04247 0.00008 -0.00910 -0.10082 0.00184 -0.12340 -0.01441 0.03528 1940 0.04512 -0.00058 0.00912 1941 -0.11767 0.01788 0.18744 0.00042 0.09940 -0.13728 0.52504 1942 0.21076 0.03119 0.01189 0.00262 0.09041 1943 0.25758 1.00000 0.03365 0.19895 0.00340 0.02764 1944 0.19694 0.60408 0.03101 -0.10240 0.00321 0.02445