Answered step by step

Verified Expert Solution

Question

1 Approved Answer

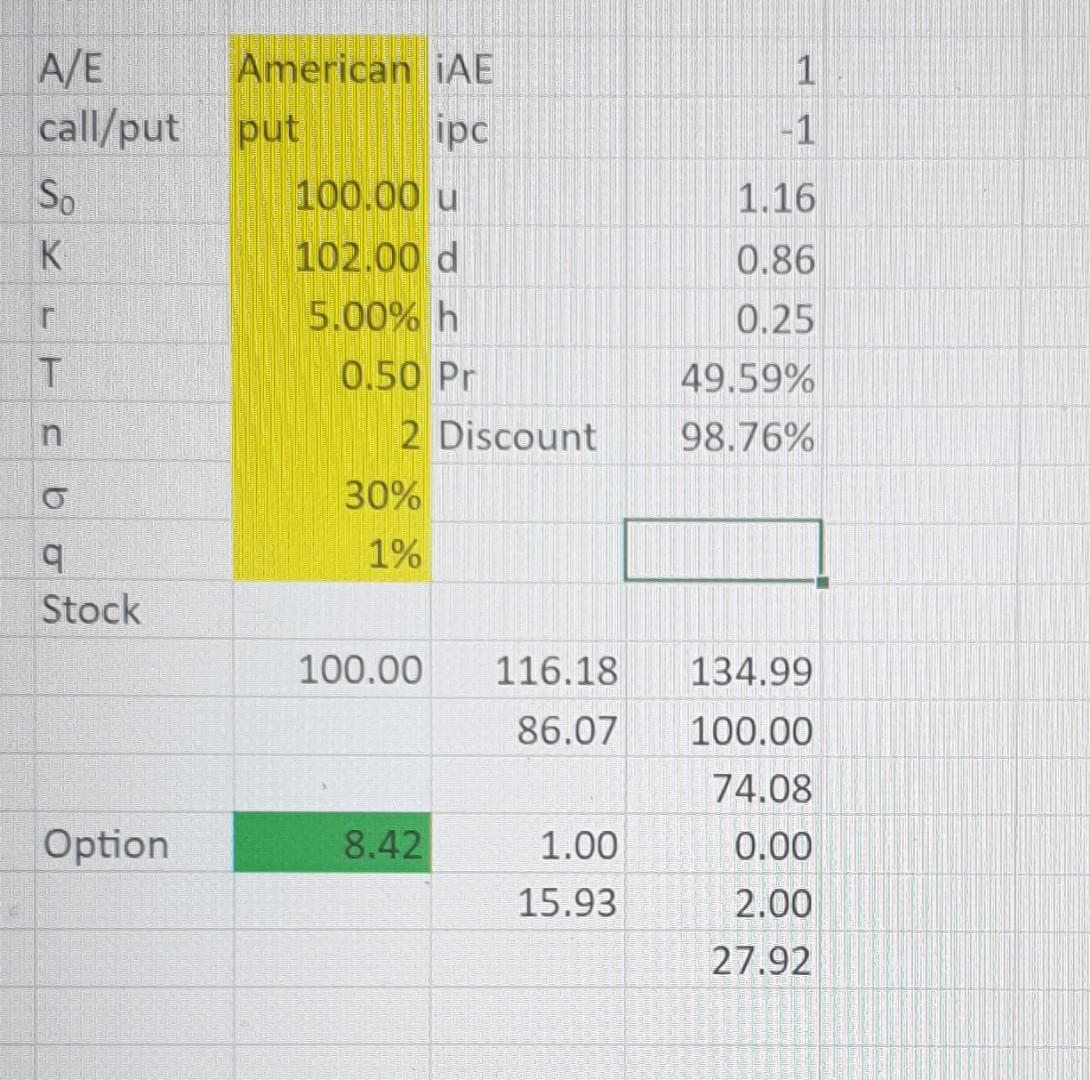

Given these formulas and values can you help find the answer to each? The max(k - S, 0) is confusing me. I tried to calculate

Given these formulas and values can you help find the answer to each?

The max(k - S, 0) is confusing me.

I tried to calculate P_u but I got

P_u = max( 0.99 , max(2,0) )

as for P_d, I got

P_d = ( 14.88 , max(2,0) )

14.88 is the same as the EU option, so there must be a problem because im the excel P_d for American option is 15.93

Also do I take 2 or 0?

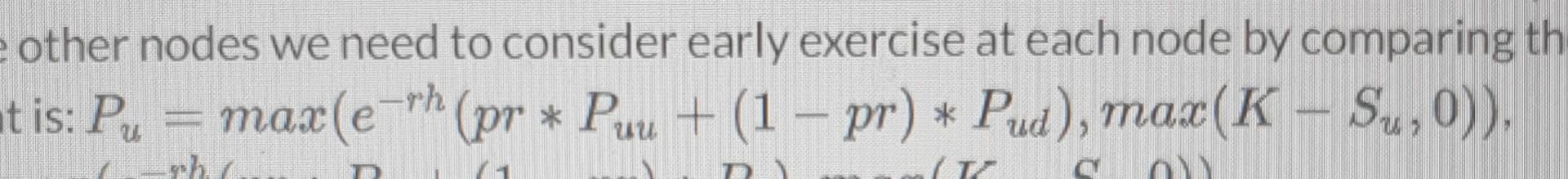

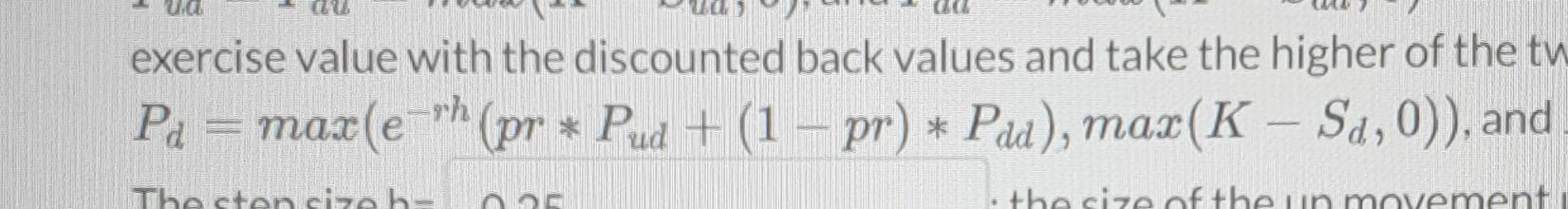

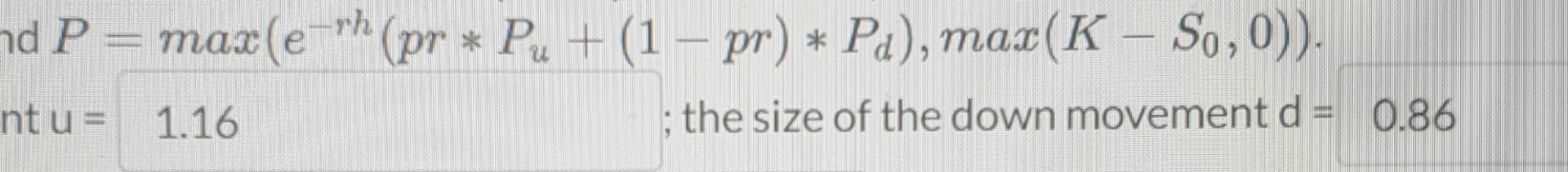

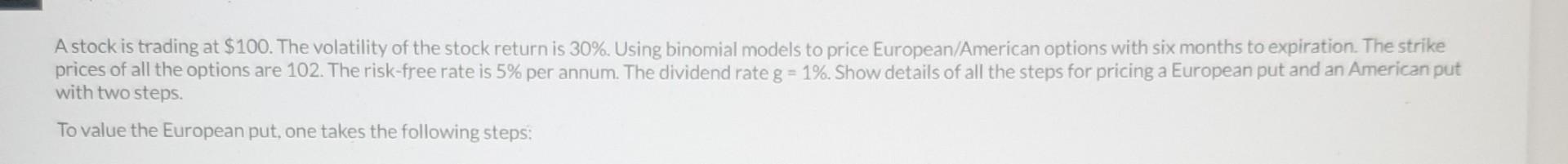

P=max(erh(prPu+(1pr)Pd),max(KS0,0)) ; the size of the down movement d=0.86 other nodes we need to consider early exercise at each node by comparing t is: Pu=max(erh(prPuu+(1pr)Pud),max(KSu,0)) A stock is trading at $100. The volatility of the stock return is 30%. Using binomial models to price European/American options with six months to expiration. The strike prices of all the options are 102 . The risk-free rate is 5% per annum. The dividend rate g=1%. Show details of all the steps for pricing a European put and an American put with two steps. To value the European put, one takes the following steps: \begin{tabular}{|c|c|c|c|} \hlineA/E & American & iAE & 1 \\ \hline call/put & put & ipc & -1 \\ \hline S0 & 100.00 & u & 1.16 \\ \hline K & 102.00 & d & 0.86 \\ \hline r & 5.00% & h & 0.25 \\ \hline T & 0.50 & Pr & 49.59% \\ \hline n & 2 & Discount & 98.76% \\ \hline & 30% & & \\ \hline q & 1% & & \\ \hline \multicolumn{4}{|l|}{ Stock } \\ \hline & 100.00 & 116.18 & 134.99 \\ \hline & & 86.07 & 100.00 \\ \hline & & & 74.08 \\ \hline \multirow[t]{3}{*}{ Option } & 8.42 & 1.00 & 0.00 \\ \hline & & 15.93 & 2.00 \\ \hline & & & 27.92 \\ \hline \end{tabular} exercise value with the discounted back values and take the higher of the t Pd=max(erh(prPud+(1pr)Pdd),max(KSd,0)), andStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started