1. Given three entrepreneurs: one is in her early 20s, two is in his mid-40s, and the third is just approaching 65. Each one

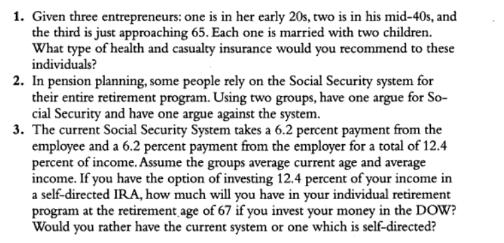

1. Given three entrepreneurs: one is in her early 20s, two is in his mid-40s, and the third is just approaching 65. Each one is married with two children. What type of health and casualty insurance would you recommend to these individuals? 2. In pension planning, some people rely on the Social Security system for their entire retirement program. Using two groups, have one argue for So- cial Security and have one argue against the system. 3. The current Social Security System takes a 6.2 percent payment from the employee and a 6.2 percent payment from the employer for a total of 12.4 percent of income. Assume the groups average current age and average income. If you have the option of investing 12.4 percent of your income in a self-directed IRA, how much will you have in your individual retirement program at the retirement age of 67 if you invest your money in the DOW? Would you rather have the current system or one which is self-directed?

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 For the entrepreneur in her early 20s I would recommend health insurance that c...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started