PIE Corporation Income Statement December 2010 in Millions Sales COGS Dep EBIT Interest paid Taxable income Taxes (34%) Net income Dividends Addition to Retained

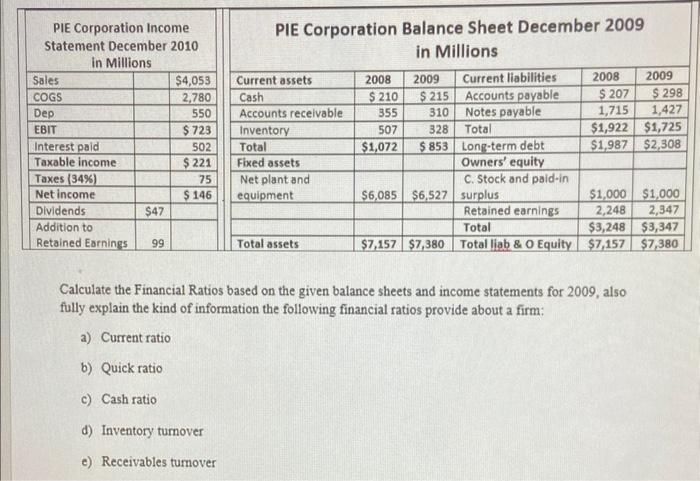

PIE Corporation Income Statement December 2010 in Millions Sales COGS Dep EBIT Interest paid Taxable income Taxes (34%) Net income Dividends Addition to Retained Earnings 99 $47 $4,053 2,780 550 $723 502 $ 221 75 $ 146 PIE Corporation Balance Sheet December 2009 in Millions Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets 2008 $ 210 355 507 2009 $ 215 310 328 $1,072 $ 853 Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity C. Stock and paid-in $6,085 $6,527 surplus Retained earnings Total $7,157 $7,380 Total liab & O Equity 2008 2009 $ 207 $ 298 1,715 1,427 $1,922 $1,725 $1,987 $2,308 $1,000 $1,000 2,248 2,347 $3,248 $3,347 $7,157 $7,380 Calculate the Financial Ratios based on the given balance sheets and income statements for 2009, also fully explain the kind of information the following financial ratios provide about a firm: a) Current ratio b) Quick ratio c) Cash ratio d) Inventory turnover e) Receivables turnover

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below A Current Ratio The current ratio is a financial ratio that measures a companys ability to cover its shortterm liabilities with its current ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started