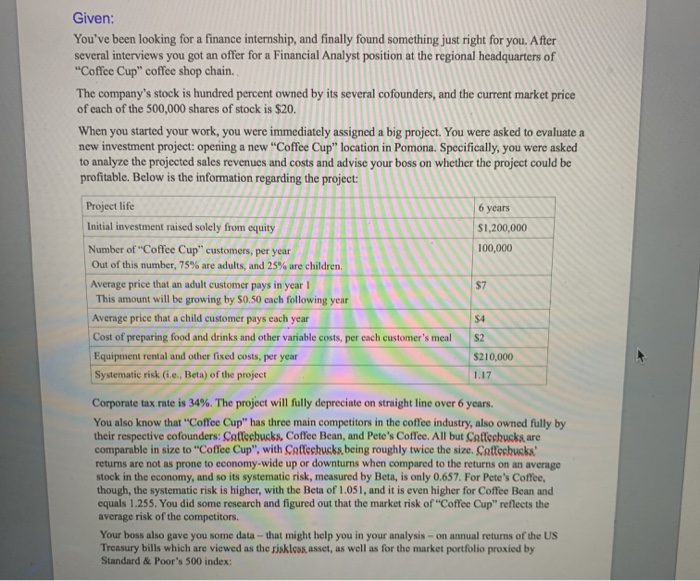

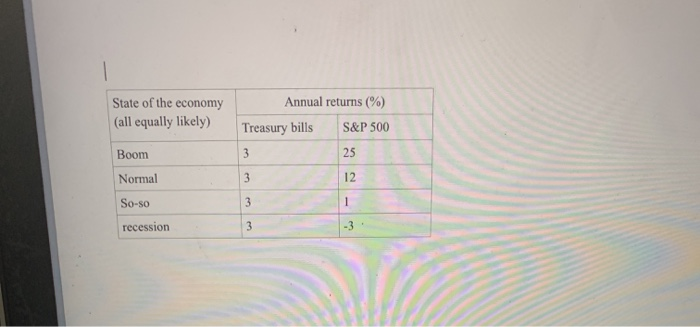

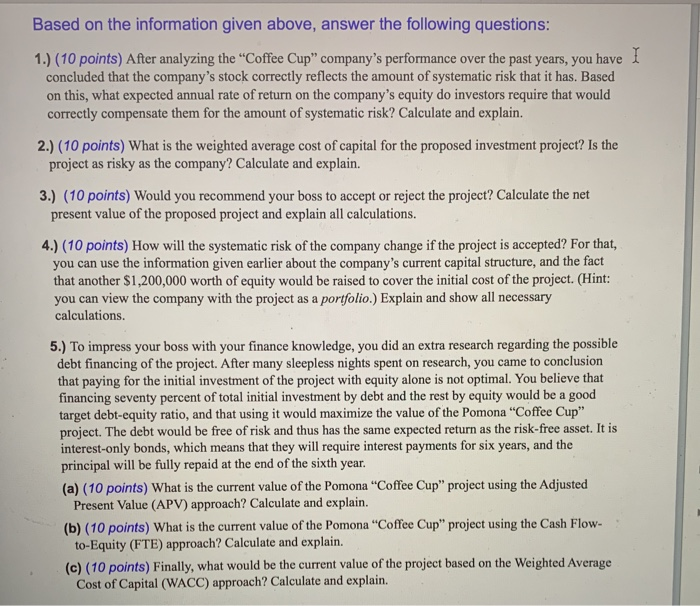

Given: You've been looking for a finance internship, and finally found something just right for you. After several interviews you got an offer for a Financial Analyst position at the regional headquarters of "Coffee Cup" coffee shop chain. The company's stock is hundred percent owned by its several cofounders, and the current market price of each of the 500,000 shares of stock is $20. When you started your work, you were immediately assigned a big project. You were asked to evaluate a new investment project: opening a new "Coffee Cup" location in Pomona. Specifically, you were asked to analyze the projected sales revenues and costs and advise your boss on whether the project could be profitable. Below is the information regarding the project: 6 years $1,200,000 100,000 Project life Initial investment raised solely from equity Number of "Coffee Cup" customers, per year Out of this number, 75% are adults, and 25% are children. Average price that an adult customer pays in year This amount will be growing by 50.50 cach following year Average price that a child customer pays each year Cost of preparing food and drinks and other variable costs, per each customer's meal Equipment rental and other fixed costs, per year Systematic riski.e., Beta) of the project $210,000 1.17 Corporate tax rate is 34%. The project will fully depreciate on straight line over 6 years. You also know that "Coffee Cup" has three main competitors in the coffee industry, also owned fully by their respective cofounders: Catleehucks, Coffee Bean, and Pete's Coffee. All but Coffeebucks are comparable in size to "Coffee Cup", with Callesbucks being roughly twice the size. Cattesbucks' returns are not as prone to economy-wide up or downturns when compared to the returns on an average stock in the economy, and so its systematic risk, measured by Beta, is only 0.657. For Pete's Coffee though, the systematic risk is higher, with the Beta of 1.051, and it is even higher for Coffee Bean and equals 1.255. You did some research and figured out that the market risk of "Coffee Cup" reflects the average risk of the competitors. Your boss also gave you some data-that might help you in your analysis on annual returns of the US Treasury bills which are viewed as the riskless asset, as well as for the market portfolio proxied by Standard & Poor's 500 index: State of the economy (all equally likely) Annual returns (%) Treasury bills S&P 500 Boom Normal So-so recession Based on the information given above, answer the following questions: 1.) (10 points) After analyzing the Coffee Cup" company's performance over the past years, you have concluded that the company's stock correctly reflects the amount of systematic risk that it has. Based on this, what expected annual rate of return on the company's equity do investors require that would correctly compensate them for the amount of systematic risk? Calculate and explain. 2.) (10 points) What is the weighted average cost of capital for the proposed investment project? Is the project as risky as the company? Calculate and explain. 3.) (10 points) Would you recommend your boss to accept or reject the project? Calculate the net present value of the proposed project and explain all calculations. 4.) (10 points) How will the systematic risk of the company change if the project is accepted? For that, you can use the information given earlier about the company's current capital structure, and the fact that another $1,200,000 worth of equity would be raised to cover the initial cost of the project. (Hint: you can view the company with the project as a portfolio.) Explain and show all necessary calculations. 5.) To impress your boss with your finance knowledge, you did an extra research regarding the possible debt financing of the project. After many sleepless nights spent on research, you came to conclusion that paying for the initial investment of the project with equity alone is not optimal. You believe that financing seventy percent of total initial investment by debt and the rest by equity would be a good target debt-equity ratio, and that using it would maximize the value of the Pomona "Coffee Cup" project. The debt would be free of risk and thus has the same expected return as the risk-free asset. It is interest-only bonds, which means that they will require interest payments for six years, and the principal will be fully repaid at the end of the sixth year. (a) (10 points) What is the current value of the Pomona "Coffee Cup" project using the Adjusted Present Value (APV) approach? Calculate and explain. (b) (10 points) What is the current value of the Pomona "Coffee Cup" project using the Cash Flow- to-Equity (FTE) approach? Calculate and explain. (c) (10 points) Finally, what would be the current value of the project based on the Weighted Average Cost of Capital (WACC) approach? Calculate and explain. Given: You've been looking for a finance internship, and finally found something just right for you. After several interviews you got an offer for a Financial Analyst position at the regional headquarters of "Coffee Cup" coffee shop chain. The company's stock is hundred percent owned by its several cofounders, and the current market price of each of the 500,000 shares of stock is $20. When you started your work, you were immediately assigned a big project. You were asked to evaluate a new investment project: opening a new "Coffee Cup" location in Pomona. Specifically, you were asked to analyze the projected sales revenues and costs and advise your boss on whether the project could be profitable. Below is the information regarding the project: 6 years $1,200,000 100,000 Project life Initial investment raised solely from equity Number of "Coffee Cup" customers, per year Out of this number, 75% are adults, and 25% are children. Average price that an adult customer pays in year This amount will be growing by 50.50 cach following year Average price that a child customer pays each year Cost of preparing food and drinks and other variable costs, per each customer's meal Equipment rental and other fixed costs, per year Systematic riski.e., Beta) of the project $210,000 1.17 Corporate tax rate is 34%. The project will fully depreciate on straight line over 6 years. You also know that "Coffee Cup" has three main competitors in the coffee industry, also owned fully by their respective cofounders: Catleehucks, Coffee Bean, and Pete's Coffee. All but Coffeebucks are comparable in size to "Coffee Cup", with Callesbucks being roughly twice the size. Cattesbucks' returns are not as prone to economy-wide up or downturns when compared to the returns on an average stock in the economy, and so its systematic risk, measured by Beta, is only 0.657. For Pete's Coffee though, the systematic risk is higher, with the Beta of 1.051, and it is even higher for Coffee Bean and equals 1.255. You did some research and figured out that the market risk of "Coffee Cup" reflects the average risk of the competitors. Your boss also gave you some data-that might help you in your analysis on annual returns of the US Treasury bills which are viewed as the riskless asset, as well as for the market portfolio proxied by Standard & Poor's 500 index: State of the economy (all equally likely) Annual returns (%) Treasury bills S&P 500 Boom Normal So-so recession Based on the information given above, answer the following questions: 1.) (10 points) After analyzing the Coffee Cup" company's performance over the past years, you have concluded that the company's stock correctly reflects the amount of systematic risk that it has. Based on this, what expected annual rate of return on the company's equity do investors require that would correctly compensate them for the amount of systematic risk? Calculate and explain. 2.) (10 points) What is the weighted average cost of capital for the proposed investment project? Is the project as risky as the company? Calculate and explain. 3.) (10 points) Would you recommend your boss to accept or reject the project? Calculate the net present value of the proposed project and explain all calculations. 4.) (10 points) How will the systematic risk of the company change if the project is accepted? For that, you can use the information given earlier about the company's current capital structure, and the fact that another $1,200,000 worth of equity would be raised to cover the initial cost of the project. (Hint: you can view the company with the project as a portfolio.) Explain and show all necessary calculations. 5.) To impress your boss with your finance knowledge, you did an extra research regarding the possible debt financing of the project. After many sleepless nights spent on research, you came to conclusion that paying for the initial investment of the project with equity alone is not optimal. You believe that financing seventy percent of total initial investment by debt and the rest by equity would be a good target debt-equity ratio, and that using it would maximize the value of the Pomona "Coffee Cup" project. The debt would be free of risk and thus has the same expected return as the risk-free asset. It is interest-only bonds, which means that they will require interest payments for six years, and the principal will be fully repaid at the end of the sixth year. (a) (10 points) What is the current value of the Pomona "Coffee Cup" project using the Adjusted Present Value (APV) approach? Calculate and explain. (b) (10 points) What is the current value of the Pomona "Coffee Cup" project using the Cash Flow- to-Equity (FTE) approach? Calculate and explain. (c) (10 points) Finally, what would be the current value of the project based on the Weighted Average Cost of Capital (WACC) approach? Calculate and explain