Answered step by step

Verified Expert Solution

Question

1 Approved Answer

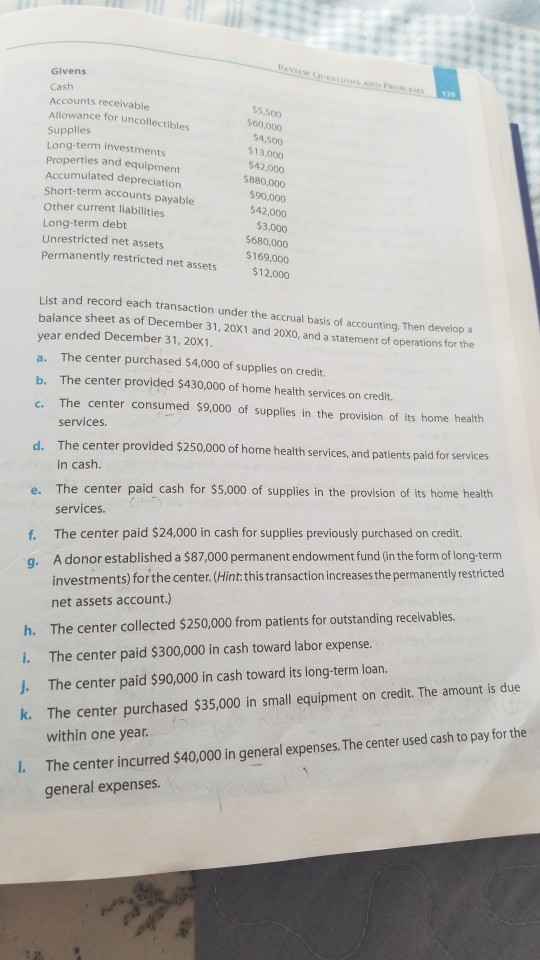

Givens Cash Accounts receivable Allowance for uncollectibles Supplies Long-term investments Properties and equipment Accumulated depreciation Short-term accounts payable Other current liabilities Long-term debt Unrestricted net

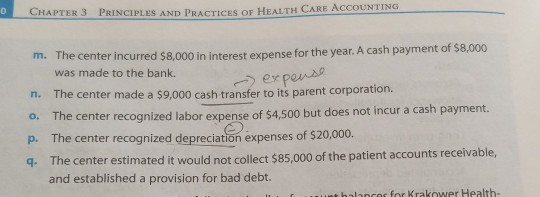

Givens Cash Accounts receivable Allowance for uncollectibles Supplies Long-term investments Properties and equipment Accumulated depreciation Short-term accounts payable Other current liabilities Long-term debt Unrestricted net assets Permanently restricted net assets 55.500 560,000 54,500 $13,000 $42.000 5880.000 $90,000 $42.000 $3,000 $680,000 5169,000 $12,000 a. c. List and record each transaction under the accrual basis of accounting. Then develop a balance sheet as of December 31, 20X1 and 20X0, and a statement of operations for the year ended December 31, 20X1. The center purchased $4,000 of supplies on credit. b. The center provided $430,000 of home health services on credit. The center consumed $9,000 of supplies in the provision of its home health services. d. The center provided $250,000 of home health services, and patients paid for services in cash. The center paid cash for $5,000 of supplies in the provision of its home health services. The center paid $24,000 in cash for supplies previously purchased on credit. g. A donor established a $87,000 permanent endowment fund (in the form of long-term investments) for the center. (Hint: this transaction increases the permanently restricted e. f. net assets account.) h. The center collected $250,000 from patients for outstanding receivables. i. The center paid $300,000 in cash toward labor expense. j. The center paid $90,000 in cash toward its long-term loan k. The center purchased $35,000 in small equipment on credit. The amount is due within one year. The center incurred $40,000 in general expenses. The center used cash to pay for the general expenses. I. 0 CHAPTER 3 PRINCIPLES AND PRACTICES OF HEALTH CARE ACCOUNTING - expense n. m. The center incurred $8,000 in interest expense for the year. A cash payment of $8,000 was made to the bank. The center made a $9,000 cash transfer to its parent corporation The center recognized labor expense of $4,500 but does not incur a cash payment. p. The center recognized depreciation expenses of $20,000. 4. The center estimated it would not collect $85,000 of the patient accounts receivable, and established a provision for bad debt. O. balancos for Krakower Health- established a provision of Dau uu are shown in the following list. 12. Transactions plus multiple statements. The following are the financial transactions the Family Home Health Care Center, a not-for-profit, business-oriented organization Beginning balances at January 1, 20X1, for its assets, liabilities, and net assets account Givens Cash Accounts receivable Allowance for uncollectibles Supplies Long-term investments Properties and equipment Accumulated depreciation Short-term accounts payable Other current liabilities Long-term debt Unrestricted net assets Permanently restricted net assets 55.500 560,000 54,500 $13,000 $42.000 5880.000 $90,000 $42.000 $3,000 $680,000 5169,000 $12,000 a. c. List and record each transaction under the accrual basis of accounting. Then develop a balance sheet as of December 31, 20X1 and 20X0, and a statement of operations for the year ended December 31, 20X1. The center purchased $4,000 of supplies on credit. b. The center provided $430,000 of home health services on credit. The center consumed $9,000 of supplies in the provision of its home health services. d. The center provided $250,000 of home health services, and patients paid for services in cash. The center paid cash for $5,000 of supplies in the provision of its home health services. The center paid $24,000 in cash for supplies previously purchased on credit. g. A donor established a $87,000 permanent endowment fund (in the form of long-term investments) for the center. (Hint: this transaction increases the permanently restricted e. f. net assets account.) h. The center collected $250,000 from patients for outstanding receivables. i. The center paid $300,000 in cash toward labor expense. j. The center paid $90,000 in cash toward its long-term loan k. The center purchased $35,000 in small equipment on credit. The amount is due within one year. The center incurred $40,000 in general expenses. The center used cash to pay for the general expenses. I. 0 CHAPTER 3 PRINCIPLES AND PRACTICES OF HEALTH CARE ACCOUNTING - expense n. m. The center incurred $8,000 in interest expense for the year. A cash payment of $8,000 was made to the bank. The center made a $9,000 cash transfer to its parent corporation The center recognized labor expense of $4,500 but does not incur a cash payment. p. The center recognized depreciation expenses of $20,000. 4. The center estimated it would not collect $85,000 of the patient accounts receivable, and established a provision for bad debt. O. balancos for Krakower Health- established a provision of Dau uu are shown in the following list. 12. Transactions plus multiple statements. The following are the financial transactions the Family Home Health Care Center, a not-for-profit, business-oriented organization Beginning balances at January 1, 20X1, for its assets, liabilities, and net assets account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started