Answered step by step

Verified Expert Solution

Question

1 Approved Answer

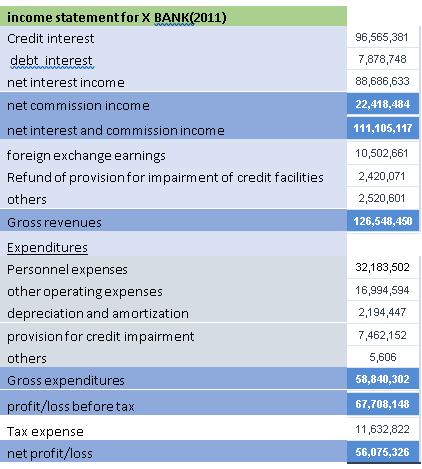

giving the above financial statements for X BANK; DO financial ratios: profitability, solvency, market and any other ratios by using excel. 96,565,381 7,878,748 88,686,633 22,418,484

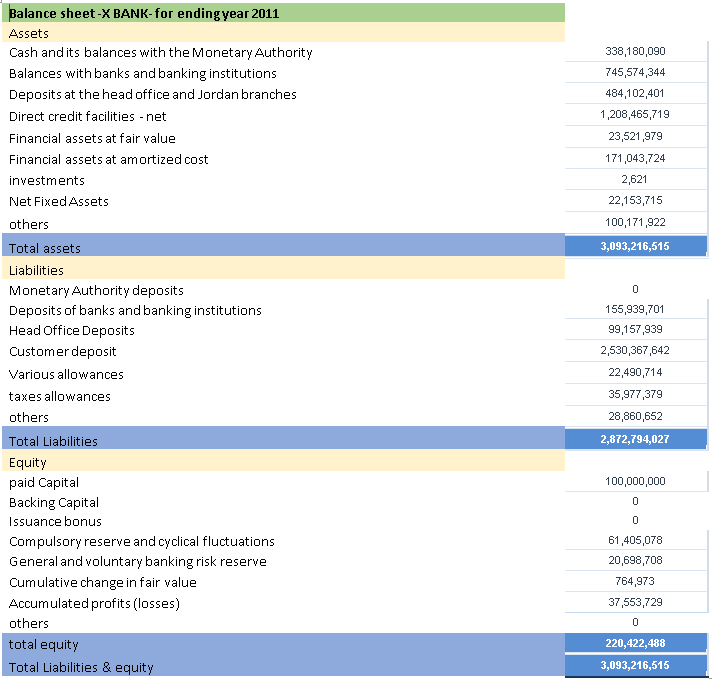

giving the above financial statements for X BANK;

DO financial ratios: profitability, solvency, market and any other ratios by using excel.

96,565,381 7,878,748 88,686,633 22,418,484 111,105,117 10,502,661 2,420,071 2,520,601 126,548,450 income statementfor X BANK(2011) Credit interest debt interest net interest income net commission income net interest and commission income foreign exchange earnings Refund of provision for impairment of credit facilities others Gross revenues Expenditures Personnel expenses other operating expenses depreciation and amortization provision for credit impairment others Gross expenditures profit/loss beforetax Tax expense net profit/loss 32,183,502 16,994,594 2,194,447 7,462,152 5,606 58,840,302 67,708,148 11,632,822 56,075,326 338,180,090 745,574,344 484,102,401 1,208,465,719 23,521,979 171,043,724 2,621 22,153,715 100,171,922 3,093,216,515 0 Balance sheet-X BANK-for ending year 2011 Assets Cash and its balances with the Monetary Authority Balances with banks and banking institutions Deposits at the head office and Jordan branches Direct credit facilities - net Financial assets at fair value Financial assets at amortized cost investments Net Fixed Assets others Total assets Liabilities Monetary Authority deposits Deposits of banks and banking institutions Head Office Deposits Customer deposit Various allowances taxes allowances others Total Liabilities Equity paid Capital Backing Capital Issuance bonus Compulsory reserve and cyclical fluctuations General and voluntary banking risk reserve Cumulative change in fair value Accumulated profits (losses) others total equity Total Liabilities & equity 155,939,701 99,157,939 2,530,367,642 22,490,714 35,977,379 28,860,652 2,872,794,027 100,000,000 0 0 61,405,078 20,698,708 764,973 37,553,729 0 220,422,488 3,093,216,515Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started