Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gold Limited (GL) is a dealer of specialized engines. GL acquires each engine from a manufacturer at a cost of Rs. 58 million and

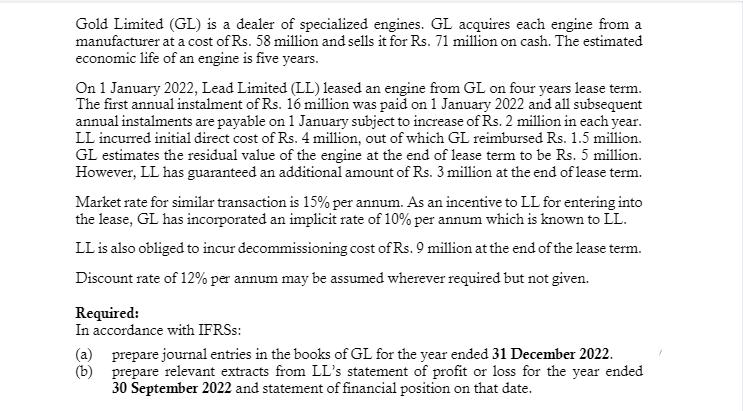

Gold Limited (GL) is a dealer of specialized engines. GL acquires each engine from a manufacturer at a cost of Rs. 58 million and sells it for Rs. 71 million on cash. The estimated economic life of an engine is five years. On 1 January 2022, Lead Limited (LL) leased an engine from GL on four years lease term. The first annual instalment of Rs. 16 million was paid on 1 January 2022 and all subsequent annual instalments are payable on 1 January subject to increase of Rs. 2 million in each year. LL incurred initial direct cost of Rs. 4 million, out of which GL reimbursed Rs. 1.5 million. GL estimates the residual value of the engine at the end of lease term to be Rs. 5 million. However, LL has guaranteed an additional amount of Rs. 3 million at the end of lease term. Market rate for similar transaction is 15% per annum. As an incentive to LL for entering into the lease, GL has incorporated an implicit rate of 10% per annum which is known to LL. LL is also obliged to incur decommissioning cost of Rs. 9 million at the end of the lease term. Discount rate of 12% per annum may be assumed wherever required but not given. Required: In accordance with IFRSS: (a) prepare journal entries in the books of GL for the year ended 31 December 2022. prepare relevant extracts from LL's statement of profit or loss for the year ended 30 September 2022 and statement of financial position on that date. (b)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the total costs for Gizmos Inc you need to consider the fixed costs va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started