Answered step by step

Verified Expert Solution

Question

1 Approved Answer

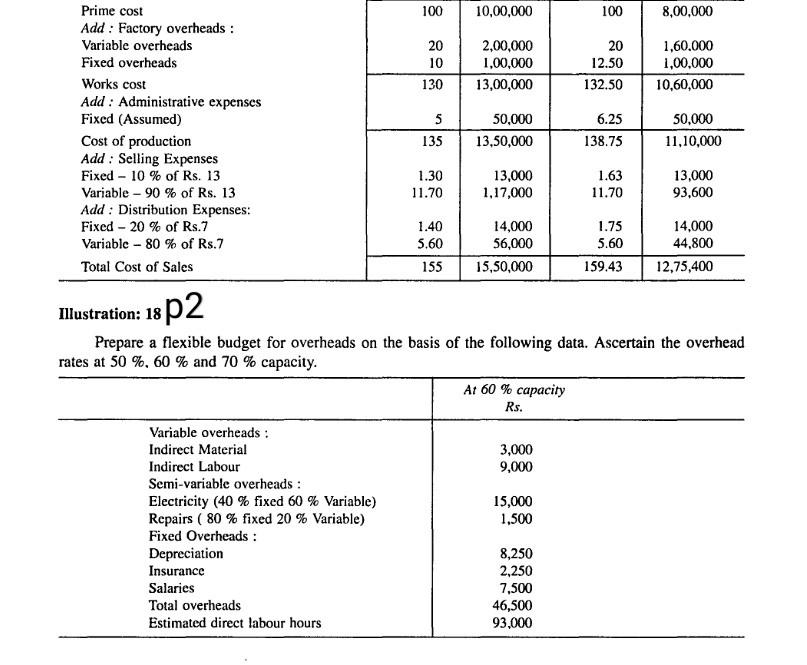

gj Prime cost 100 10,00,000 100 8,00,000 Add : Factory overheads : Variable overheads 20 2,00,000 20 1,60,000 Fixed overheads 10 1,00,000 12.50 1,00,000 Works

gj

Prime cost 100 10,00,000 100 8,00,000 Add : Factory overheads : Variable overheads 20 2,00,000 20 1,60,000 Fixed overheads 10 1,00,000 12.50 1,00,000 Works cost 130 13,00,000 132.50 10,60,000 Add : Administrative expenses Fixed (Assumed) 5 50,000 6.25 50,000 Cost of production 135 13,50,000 138.75 11.10,000 Add : Selling Expenses Fixed - 10 % of Rs. 13 1.30 13,000 1.63 13,000 Variable - 90 % of Rs. 13 11.70 1,17,000 11.70 93,600 Add : Distribution Expenses: Fixed - 20 % of Rs.7 1.40 14,000 1.75 14.000 Variable - 80 % of Rs.7 5.60 56,000 5.60 44,800 Total Cost of Sales 155 15,50,000 159.43 12,75,400 Illustration: 18 p2 Prepare a flexible budget for overheads on the basis of the following data. Ascertain the overhead rates at 50 %, 60 % and 70 % capacity. At 60 % capacity Rs. Variable overheads : Indirect Material 3,000 Indirect Labour 9,000 Semi-variable overheads : Electricity (40 % fixed 60 % Variable) 15,000 Repairs ( 80 % fixed 20 % Variable) 1,500 Fixed Overheads : Depreciation 8,250 Insurance 2,250 Salaries 7,500 Total overheads 46,500 Estimated direct labour hours 93,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started