Answered step by step

Verified Expert Solution

Question

1 Approved Answer

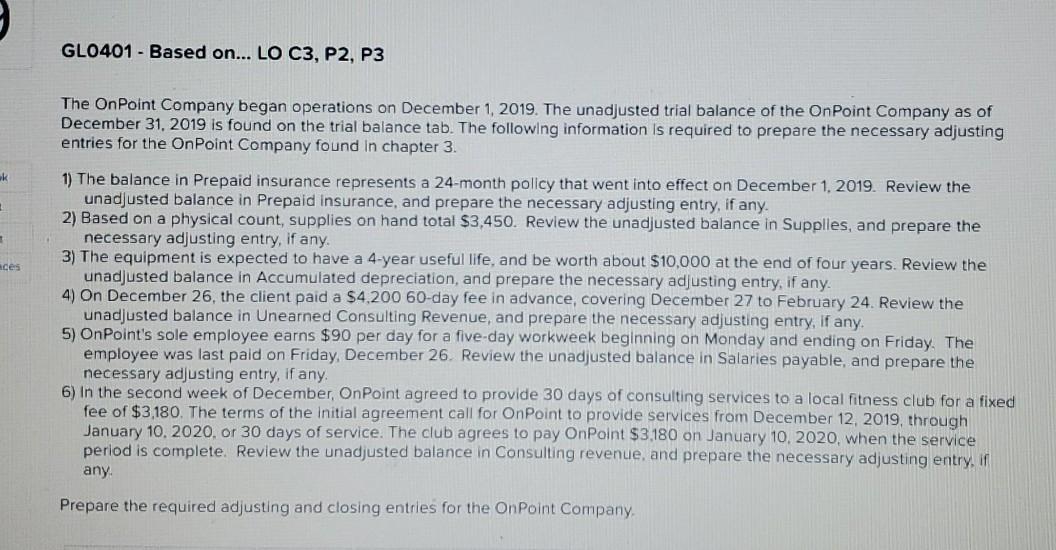

GL0401 - Based on... LO C3, P2, P3 what am I missing? thank you in advance GLO401 - Based on... LO C3, P2, P3 The

GL0401 - Based on... LO C3, P2, P3

what am I missing? thank you in advance

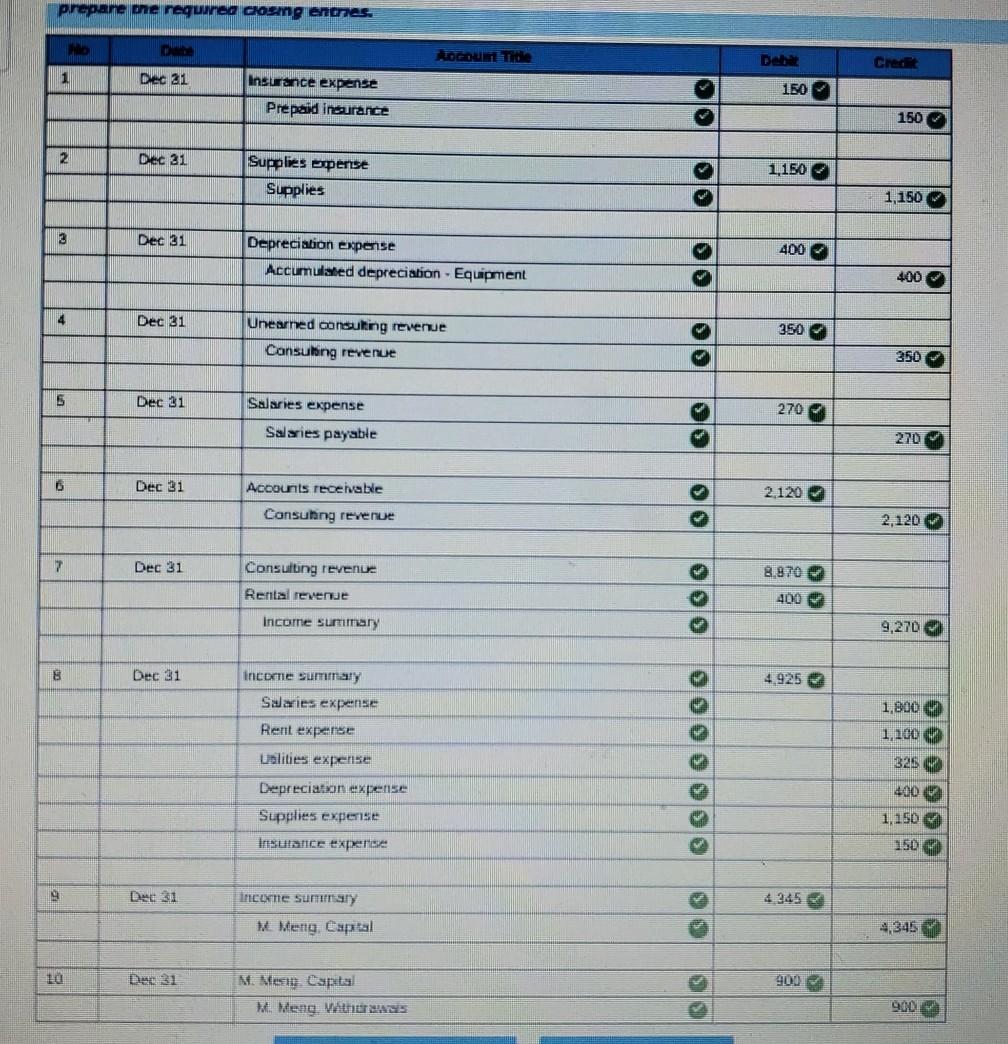

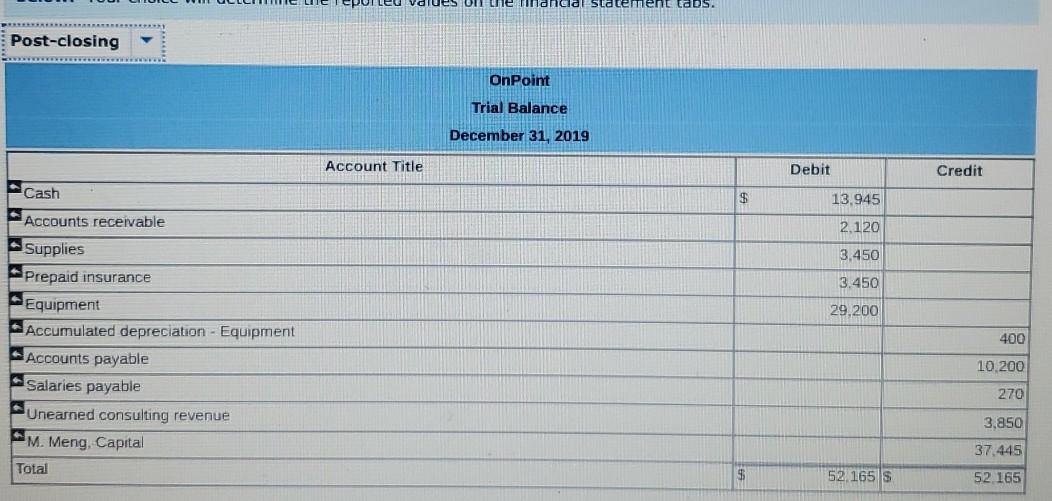

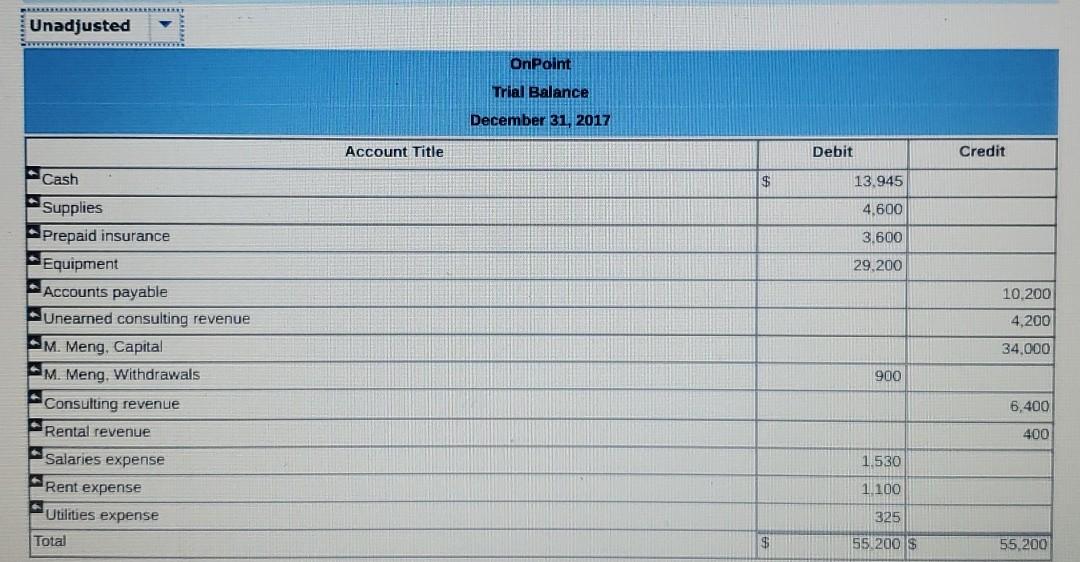

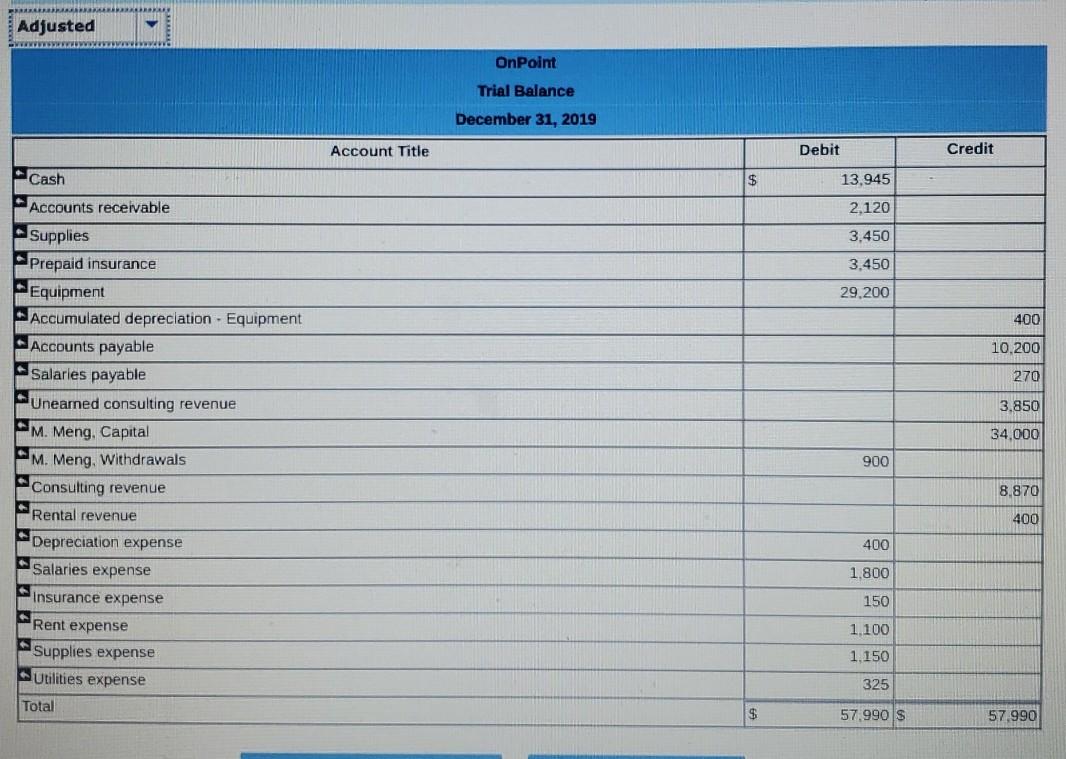

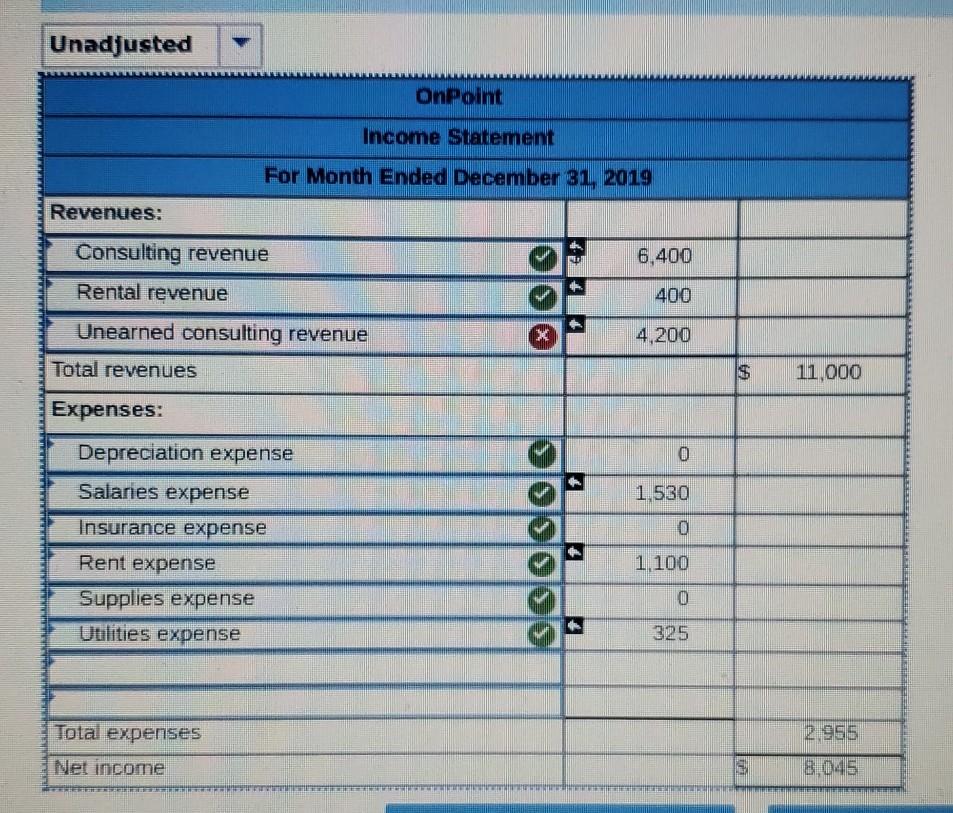

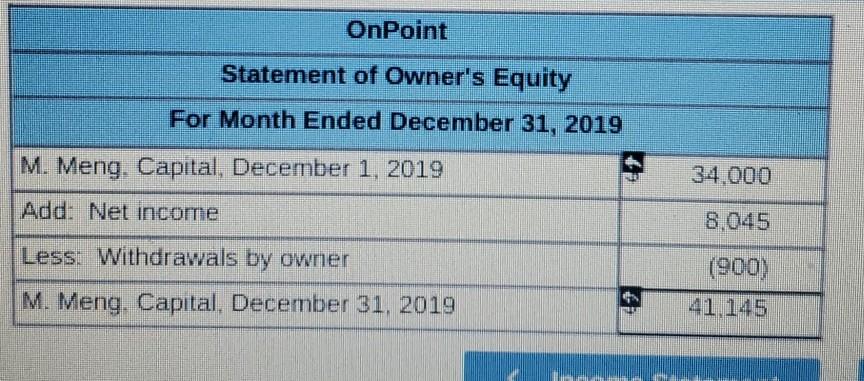

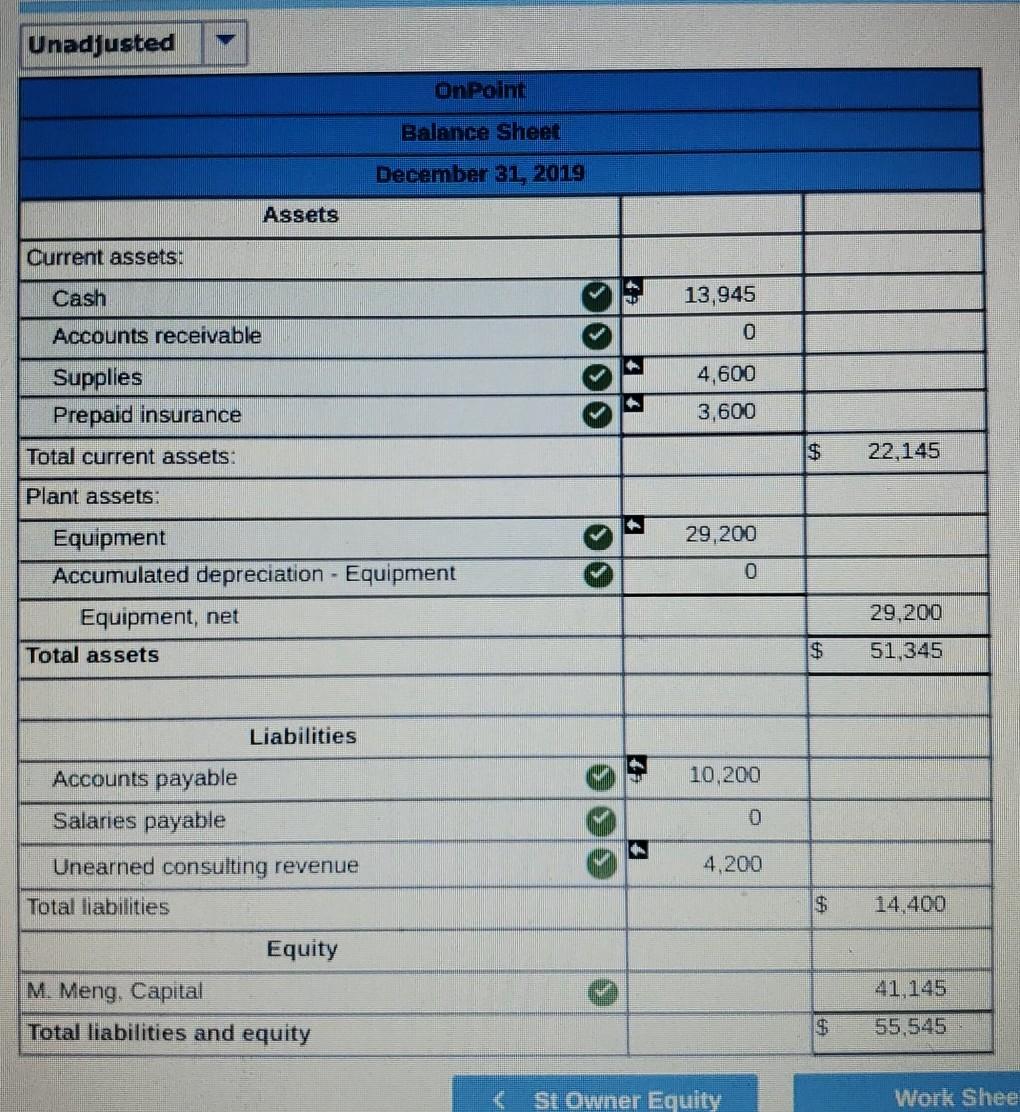

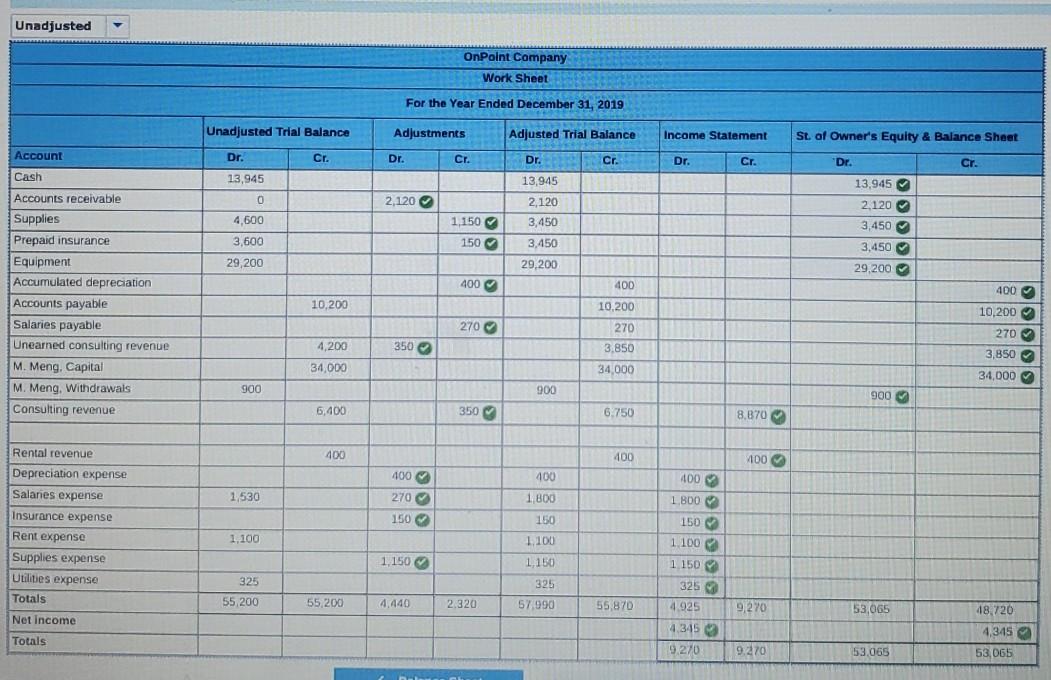

GLO401 - Based on... LO C3, P2, P3 The On Point Company began operations on December 1, 2019. The unadjusted trial balance of the On Point Company as of December 31, 2019 is found on the trial balance tab. The following information is required to prepare the necessary adjusting entries for the On Point Company found in chapter 3. K aces 1) The balance in Prepaid insurance represents a 24-month policy that went into effect on December 1, 2019. Review the unadjusted balance in Prepaid insurance, and prepare the necessary adjusting entry, if any. 2) Based on a physical count, supplies on hand total $3,450. Review the unadjusted balance in Supplies, and prepare the necessary adjusting entry, if any. 3) The equipment is expected to have a 4-year useful life, and be worth about $10,000 at the end of four years. Review the unadjusted balance in Accumulated depreciation, and prepare the necessary adjusting entry, if any. 4) On December 26, the client paid a $4,200 60-day fee in advance, covering December 27 to February 24. Review the unadjusted balance in Unearned Consulting Revenue, and prepare the necessary adjusting entry, if any. 5) On Point's sole employee earns $90 per day for a five-day workweek beginning on Monday and ending on Friday. The employee was last paid on Friday, December 26. Review the unadjusted balance in Salaries payable, and prepare the necessary adjusting entry, if any. 6) in the second week of December, OnPoint agreed to provide 30 days of consulting services to a local fitness club for a fixed fee of $3,180. The terms of the initial agreement call for On Point to provide services from December 12, 2019, through January 10, 2020, or 30 days of service. The club agrees to pay On Point $3.180 on January 10, 2020, when the service period is complete. Review the unadjusted balance in Consulting revenue and prepare the necessary adjusting entry, if any Prepare the required adjusting and closing entries for the On Point Company prepare the negured cosmg enenes. MO D LOGOUT de Debe Cret 1 Dec 21 Insurance expense 160 Prepaid insurance 150 2 Dec 21 Supplies pense Supplies 1,150 V 1,150 3 Dec 31 400 Depreciation expense Accumulated depreciation - Equipment 400 4 Dec 31 350 Unearned consulting revenue Consulting revenue 350 5 Dec 31 Salaries expense 270 Salaries payable 270 6 Dec 31 Accounts receivable 2.120 Cansuring revenue 2,120 7 Dec 31 Consulting revenue 8,870 Rental revende 400 Income Surinary 9,270 8 Dec 31 Income summary 4.925 Salaries expense 1,900 Rent expense 1100 Uslities expense 325 40002 Depreciation expense Supplies expense Insurance expense 1,150 150 9 Dec 31 incone summary 4 345 M. Meng, Capital 4,345 Dec 31 900 M. Mesin Capital Mat. Meng Matas Tent tabs. Post-closing OnPoint Trial Balance December 31, 2019 Account Title Debit Credit Credit Cash $ 13.945 2.120 3,450 3.450 29,200 Accounts receivable Supplies Prepaid insurance Equipment Accumulated depreciation - Equipment Accounts payable Salaries payable Unearned consulting revenue M. Meng, Capital 400 10.200 270 3,850 37.445 Total $ 52 165 S 52 165 Unadjusted OnPaint Trial Balance December 31, 2017 Account Title Debit Credit Cash $ 13.945 4,600 3.600 29,200 10.200 Supplies Prepaid insurance Equipment Accounts payable Unearned consulting revenue M. Meng, Capital M. Meng, Withdrawals Consulting revenue Rental revenue 4,200 34.000 900 6,400 400 Salaries expense 1.530 Rent expense 1 100 Utilities expense Total 325 55,200 $ $ 55,200 Adjusted OnPoint Trial Balance December 31, 2019 Account Title Debit Credit Cash $ 13.945 2,120 3.450 3.450 29,200 400 Accounts receivable Supplies Prepaid insurance Equipment Accumulated depreciation - Equipment Accounts payable Salarles payable Unearned consulting revenue M. Meng, Capital M. Meng. Withdrawals Consulting revenue 10.200 270 3.850 34.000 900 8.870 400 400 Rental revenue Depreciation expense Salaries expense Insurance expense 1.800 150 1.100 Rent expense Supplies expense Utilities expense 1.150 325 Total $ 57 990 $ 57,990 Unadjusted OnPoint Income Statement For Month Ended December 31, 2019 Revenues: Consulting revenue 6,400 Rental revenue 400 EX 4,200 Unearned consulting revenue Total revenues 11,000 Expenses: Depreciation expense 0 1,530 0 Salaries expense Insurance expense Rent expense Supplies expense Utilities expense 1100 0 325 Total expenses 2,955 8,045 Net income OnPoint Statement of Owner's Equity For Month Ended December 31, 2019 M. Meng. Capital, December 1, 2019 34.000 Add: Net income 8,045 Less: Withdrawals by owner (900) 41 145 M. Meng. Capital, December 31, 2019 Unadjusted On Point Balance Sheet December 31, 2019 Assets Current assets: Cash 13,945 Accounts receivable 0 4,600 Supplies Prepaid insurance 3,600 Total current assets: $ 22,145 Plant assets: 29,200 0 Equipment Accumulated depreciation - Equipment Equipment, net Total assets 29,200 $ 51,345 Liabilities 10.200 Accounts payable Salaries payable 0 4.200 Unearned consulting revenue Total liabilities $ 14,400 Equity M. Meng, Capital Total liabilities and equity 41,145 55,545 St Owner Equity Work Shee Unadjusted OnPaint Company Work Sheet For the Year Ended December 31, 2019 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement St. of Owner's Equity & Balance Sheet Account Dr. Cr. Dr. Cr. Cr. Dr. Cr. Dr. Cr. Dr. 13,945 13,945 o 0 2,120 4,600 1,150 150 2,120 3,450 3,450 29,200 13,945 2.120 3,450 3,450 29,200 Do Solol 3,600 29,200 400 400 Cash Accounts receivable Supplies Prepaid insurance Equipment Accumulated depreciation Accounts payable Salaries payable Unearned consulting revenue M. Meng. Capital M. Meng, Withdrawals Consulting revenue 400 10.200 10,200 270 10,200 270 270 4,200 350 3,850 34,000 3,850 34,000 34,000 god 900 900 6,400 350 6.750 8,870 400 400 7100 400 400 1.530 400 1.800 270 1,800 150 Rental revenue Depreciation expense Salaries expense Insurance expense Rent expense Supplies expense Utilities expense Totals 150 1.100 1.100 150 1.100 1150 325 1.150 1 150 325 325 55 200 55,200 4,440 2.320 57,990 55,870 4.925 9270 53,065 48.720 Net Income 4.345 4,345 Totals 9.270 9.270 53.065 53,065Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started