Answered step by step

Verified Expert Solution

Question

1 Approved Answer

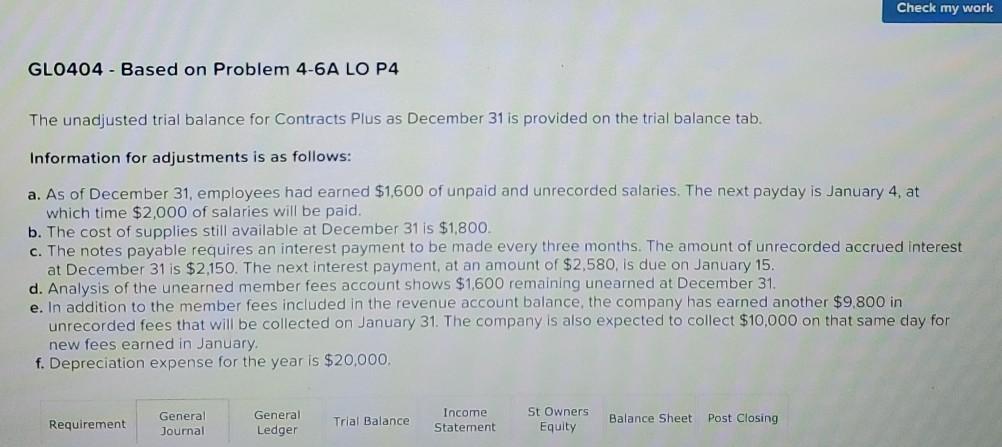

GL0404 - Based on Problem 4-6A LO P4 Check my work GLO404 - Based on Problem 4-6A LO P4 The unadjusted trial balance for Contracts

GL0404 - Based on Problem 4-6A LO P4

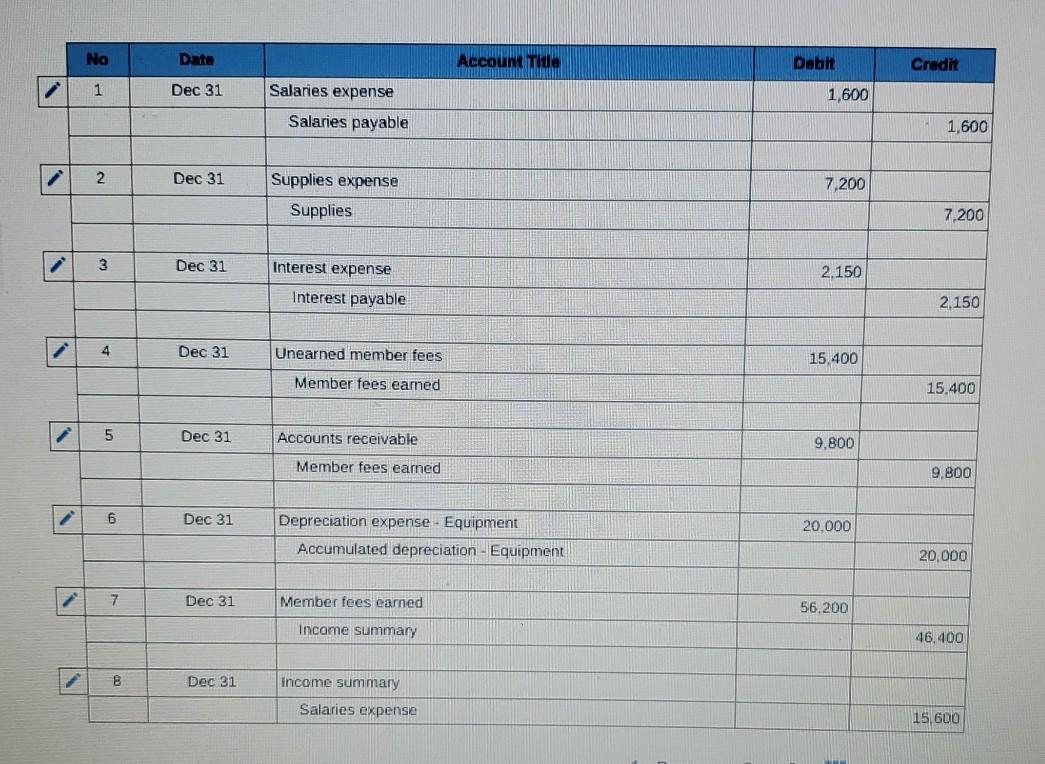

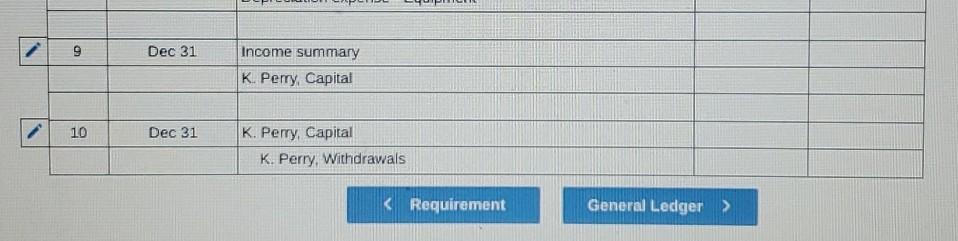

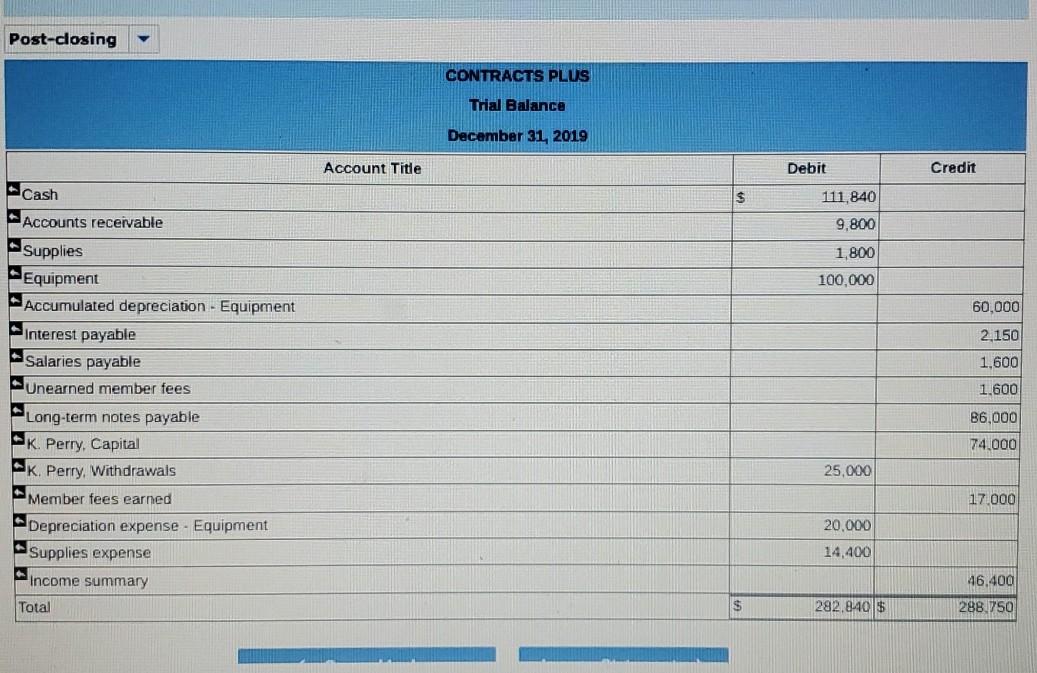

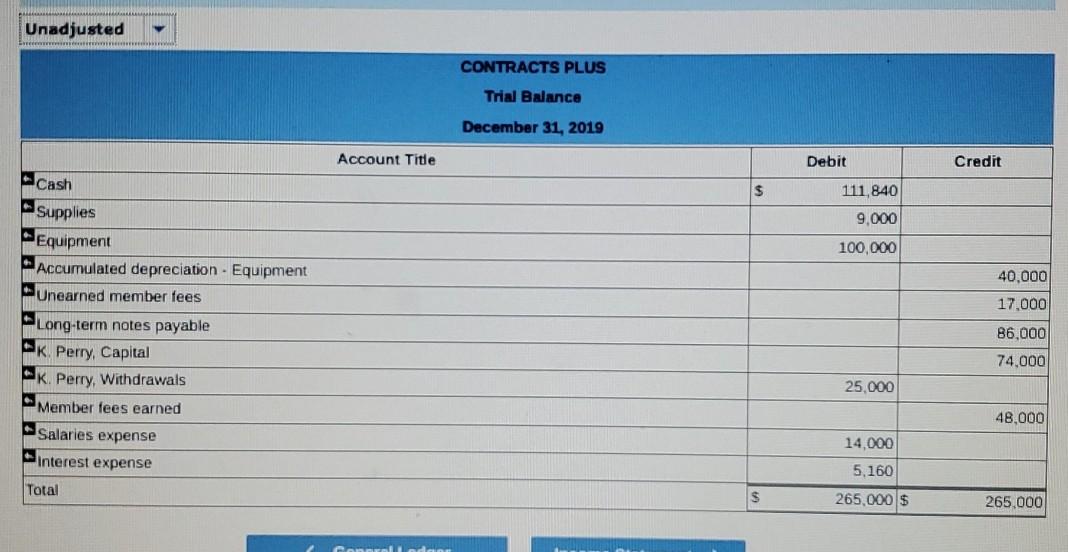

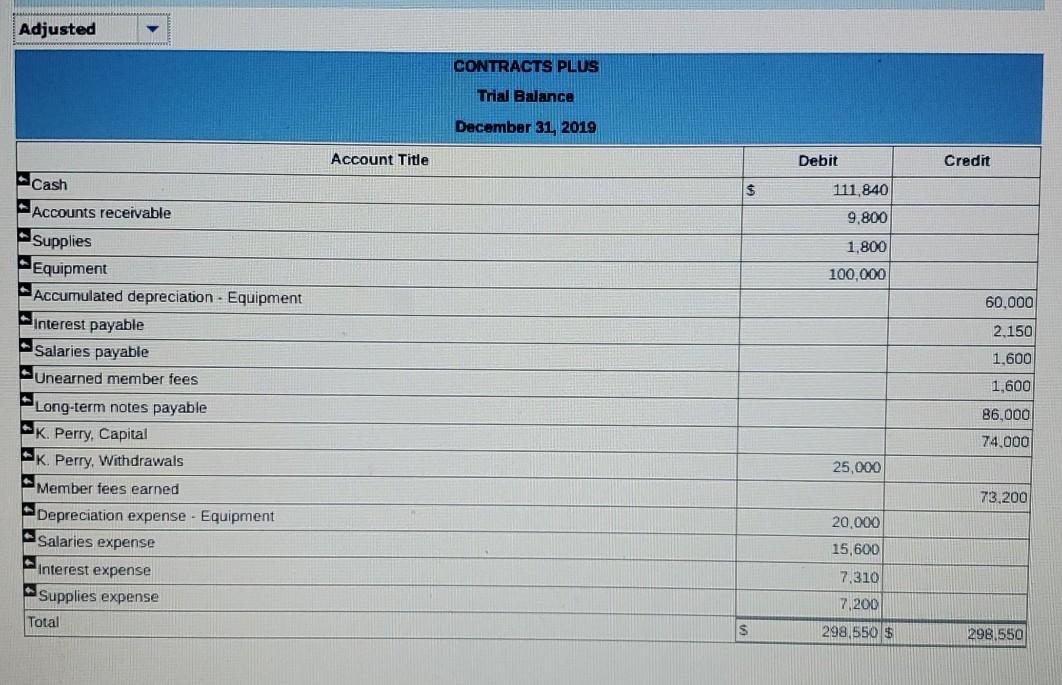

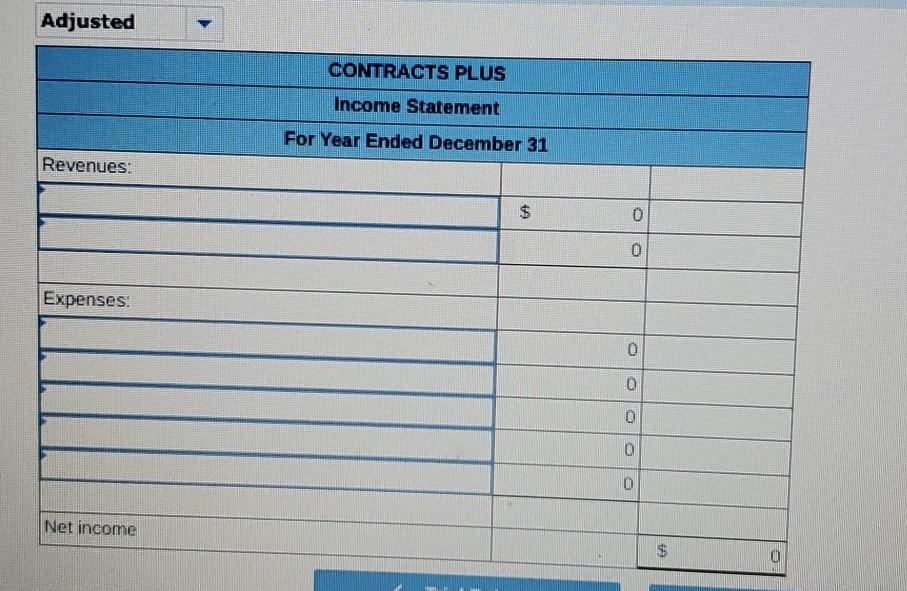

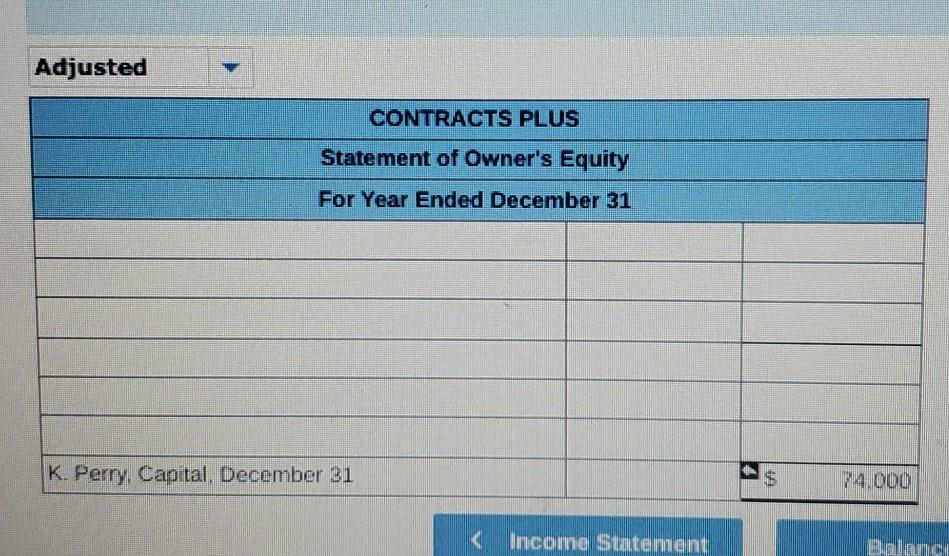

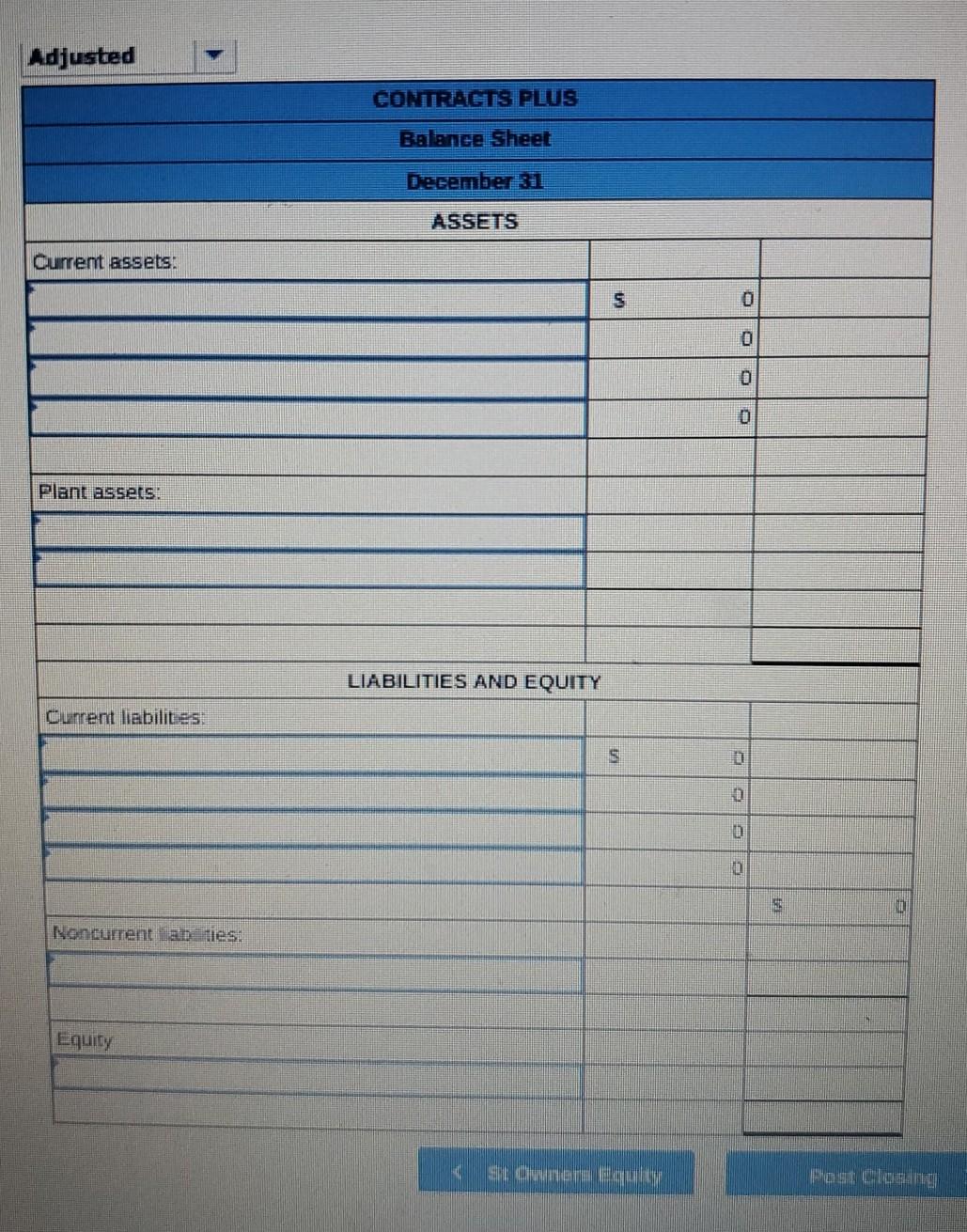

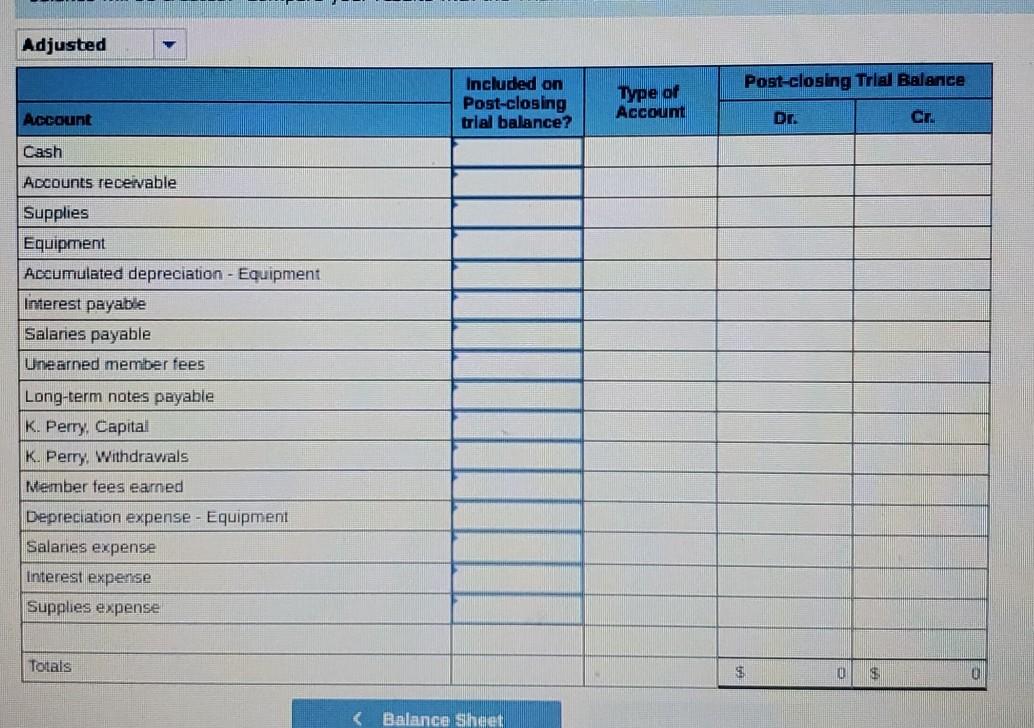

Check my work GLO404 - Based on Problem 4-6A LO P4 The unadjusted trial balance for Contracts Plus as December 31 is provided on the trial balance tab. Information for adjustments is as follows: a. As of December 31, employees had earned $1.600 of unpaid and unrecorded salaries. The next payday is January 4, at which time $2,000 of salaries will be paid. b. The cost of supplies still available at December 31 is $1,800. c. The notes payable requires an interest payment to be made every three months. The amount of unrecorded accrued interest at December 31 is $2,150. The next interest payment, at an amount of $2,580, is due on January 15. d. Analysis of the unearned member fees account shows $1,600 remaining unearned at December 31. e. In addition to the member fees included in the revenue account balance, the company has earned another $9.800 in unrecorded fees that will be collected on January 31. The company is also expected to collect $10,000 on that same day for new fees earned in January. f. Depreciation expense for the year is $20,000 Requirement General Journal General Ledger Trial Balance Income Statement St Owners Equity Balance Sheet Post Closing No Date Account The Dobit Credit 1 Dec 31 Salaries expense 1,600 Salaries payable 1,600 2 Dec 31 7,200 Supplies expense Supplies 7,200 3 Dec 31 2,150 Interest expense Interest payable 2.150 4 Dec 31 Unearned member fees 15,400 Member fees earned 15,400 5 Dec 31 Accounts receivable 9,800 Member fees earned 9,800 6 Dec 31 20.000 Depreciation expense - Equipment Accumulated depreciation - Equipment 20.000 7 Dec 31 Member fees earned 56,200 Income summary 46.400 1 B Dec 31 Income summary Salaries expense 15,600 9 9 Dec 31 Income summary K. Perry, Capital 10 Dec 31 K. Perry, Capital K. Perry, Withdrawals Post-closing CONTRACTS PLUS Trial Balance December 31, 2019 Account Title Debit Credit cash $ 111,840 9,800 1,800 100,000 Accounts receivable Supplies Equipment Accumulated depreciation - Equipment interest payable Salaries payable Unearned member fees 60,000 2.150 1,600 1.600 86.000 74.000 25,000 Long-term notes payable K. Perry, Capital K. Perry. Withdrawals Member fees earned Depreciation expense - Equipment Supplies expense Income summary 17.000 20.000 14,400 46.400 Total $ 292.840$ 288.750 Unadjusted CONTRACTS PLUS Trial Balance December 31, 2019 Account Title Debit Credit Cash $ 111,840 9,000 100,000 40.000 Supplies Equipment Accumulated depreciation - Equipment Unearned member fees Long-term notes payable K. Perry, Capital K. Perry, Withdrawals Member fees earned 17.000 B6,000 74.000 25,000 48,000 Salaries expense Interest expense 14,000 5.160 Total 265,000 $ 265.000 Adjusted CONTRACTS PLUS Trial Balance December 31, 2019 Account Title Debit Credit -Cash $ 111,840 Accounts receivable 9,800 1,800 100,000 60.000 2.150 1.600 Supplies Equipment Accumulated depreciation - Equipment Interest payable Salaries payable Unearned member fees Long-term notes payable K. Perry, Capital K. Perry, Withdrawals Member fees earned Depreciation expense - Equipment Salaries expense 1,600 86,000 74.000 25,000 73,200 20.000 Interest expense Supplies expense 15,600 7,310 7,200 298,550 $ Total S 298,550 Adjusted CONTRACTS PLUS Income Statement For Year Ended December 31 Revenues: $ 0 0 Expenses: 0 0 0 0 0 Net income $ 0 Adjusted CONTRACTS PLUS Statement of Owner's Equity For Year Ended December 31 K. Perry, Capital, December 31 $ 4,000 K income Statement Balanc Adjusted CONTRACTS PLUS Balance Sheet December 31 ASSETS Current assets: S O 0 0 0 Plant assets: LIABILITIES AND EQUITY Current liabilites: S D. Noncurrent ab ties: Equity St Owners Equu Pas Closing Adjusted Post-closing Trial Balance Included on Post-closing trial balance? Type of Account Account Dr. CE Cash Ancounts receivable Supplies Equipment Accumulated depreciation - Equipment Interest payable Salaries payable Unearned member fees Long-term notes payable K. Perry, Capital K. Perry, Withdrawals Member fees earned Depreciation expense - Equipment Salanes expense Interest expense Supplies expense Totals O $ Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started