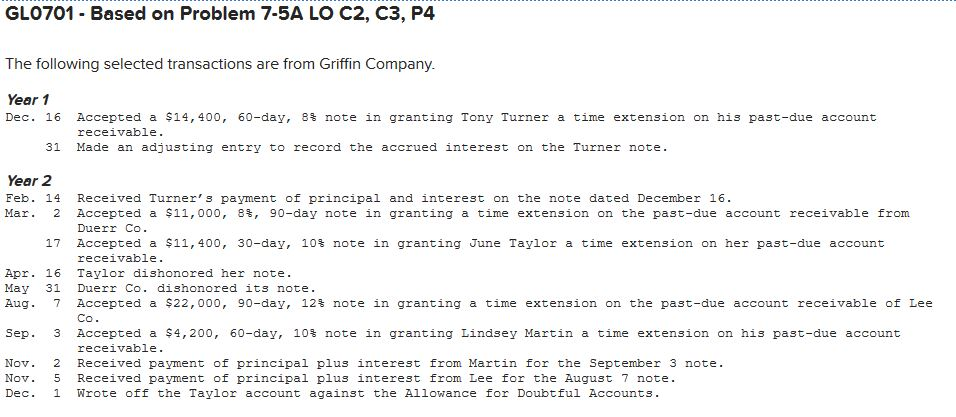

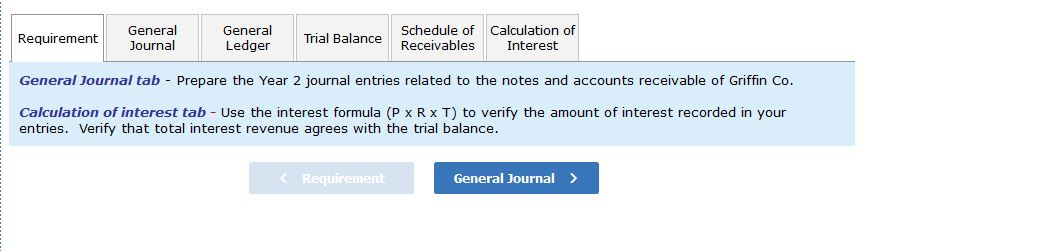

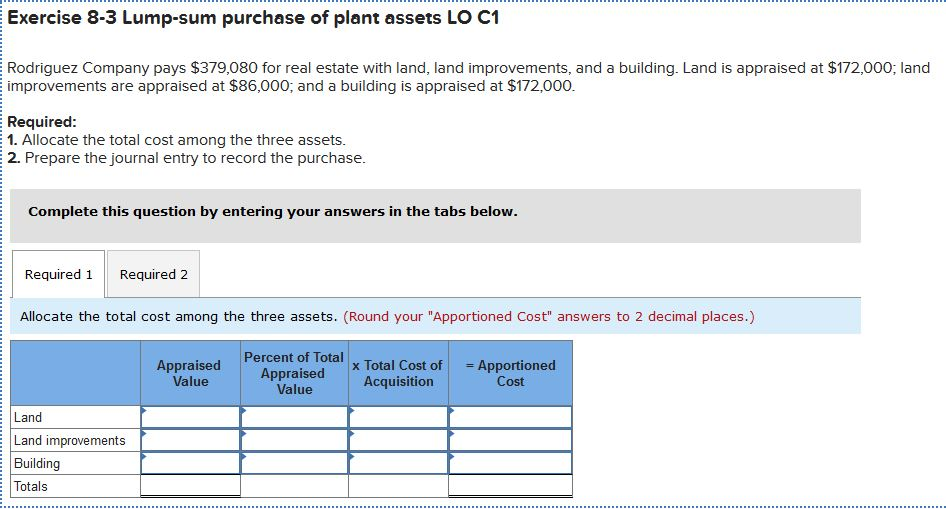

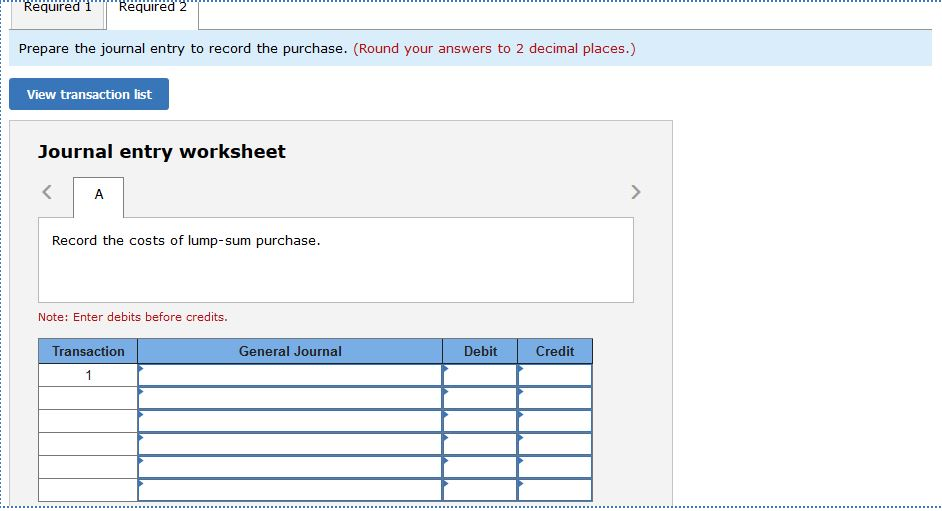

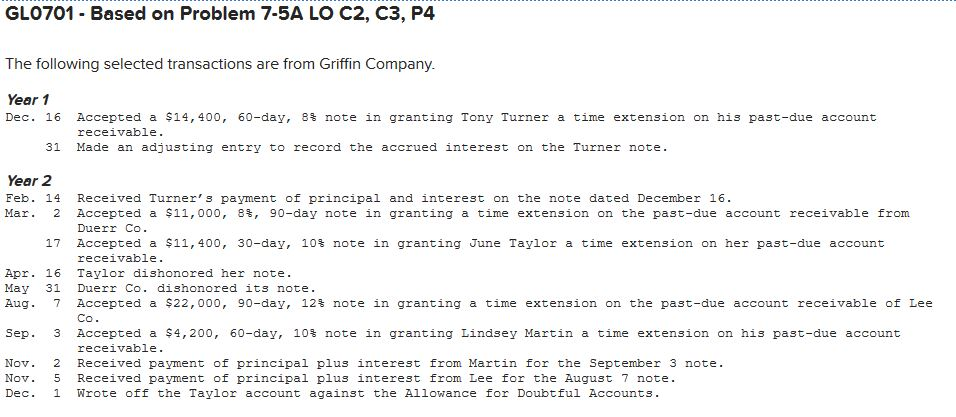

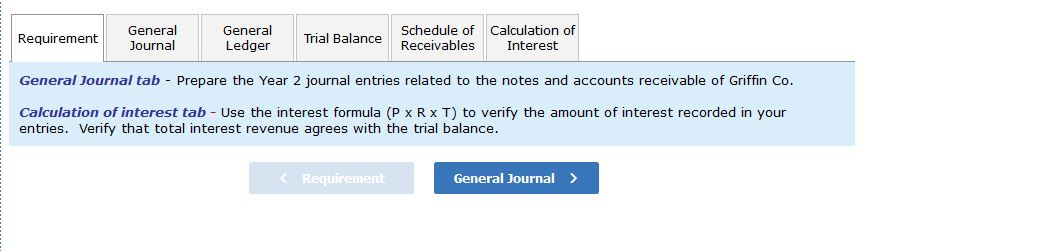

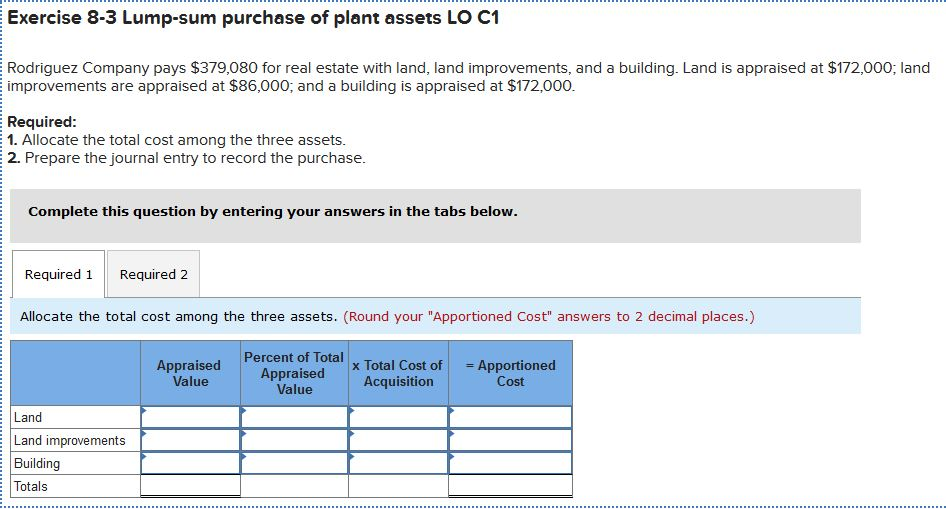

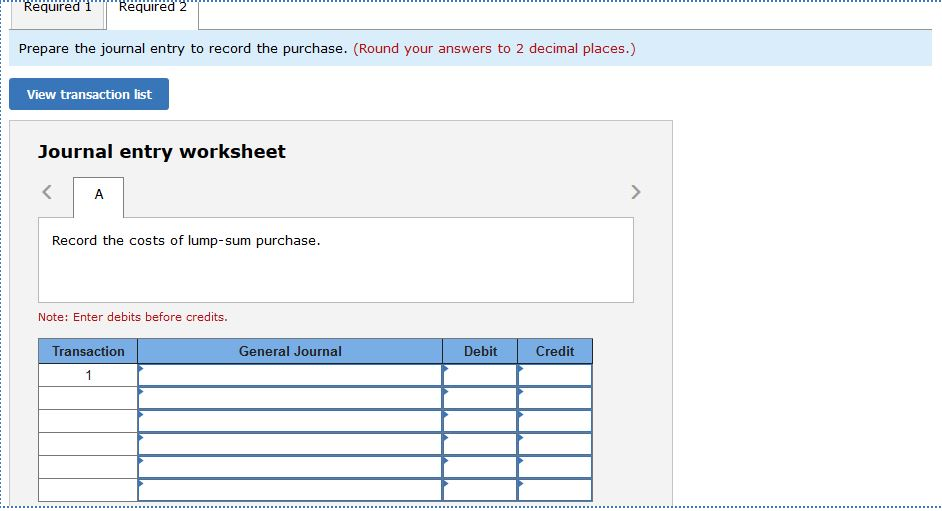

GL0701 - Based on Problem 7-5A LO C2, C3, P4 The following selected transactions are from Griffin Company. Year 1 Dec. 16 Accepted a $14, 400, 60-day, 8: note in granting Tony Turner a time extension on his past-due account receivable. Made an adjusting entry to record the accrued interest on the Turner not 31 lote. Year 2 Feb. 14 Mar. 2 17 Apr. 16 May 31 Aug. 7 Received Turner's payment of principal and interest on the note dated December 16. Accepted a $11,000, 83, 90-day note in granting a time extension on the past-due account receivable from Duerr Co. Accepted a $11,400, 30-day, 10% note in granting June Taylor a time extension on her past-due account receivable. Taylor dishonored her note. Duerr Co. dishonored its note. Accepted a $22,000, 90-day, 123 note in granting a time extension on the past-due account receivable of Lee Co. Accepted a $4,200, 60-day, 103 note in granting Lindsey Martin a time extension on his past-due account receivable. Received payment of principal plus interest from Martin for the September 3 note. Received payment of principal plus interest from Lee for the August 7 note. Wrote off the Taylor account against the Allowance for Doubtful Accounts. Sep. 3 Nov. Nov. Dec. 2 5 1 Requirement General Journal General Ledger Trial Balance Schedule of Calculation of Receivables Interest General Journal tab - Prepare the Year 2 journal entries related to the notes and accounts receivable of Griffin Co. Calculation of interest tab - Use the interest formula (P xRxT) to verify the amount of interest recorded in your entries. Verify that total interest revenue agrees with the trial balance. Exercise 8-3 Lump-sum purchase of plant assets LO C1 Rodriguez Company pays $379,080 for real estate with land, land improvements, and a building. Land is appraised at $172,000; land improvements are appraised at $86,000; and a building is appraised at $172,000. Required: 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate the total cost among the three assets. (Round your "Apportioned Cost" answers to 2 decimal places.) Appraised Value Percent of Total Appraised x Total Cost of = Apportioned Acquisition Cost Value Land Land improvements Building Totals Required 1 Required 2 Prepare the journal entry to record the purchase. (Round your answers to 2 decimal places.) View transaction list Journal entry worksheet A Record the costs of lump-sum purchase. Note: Enter debits before credits. Transaction General Journal Debit Credit 1