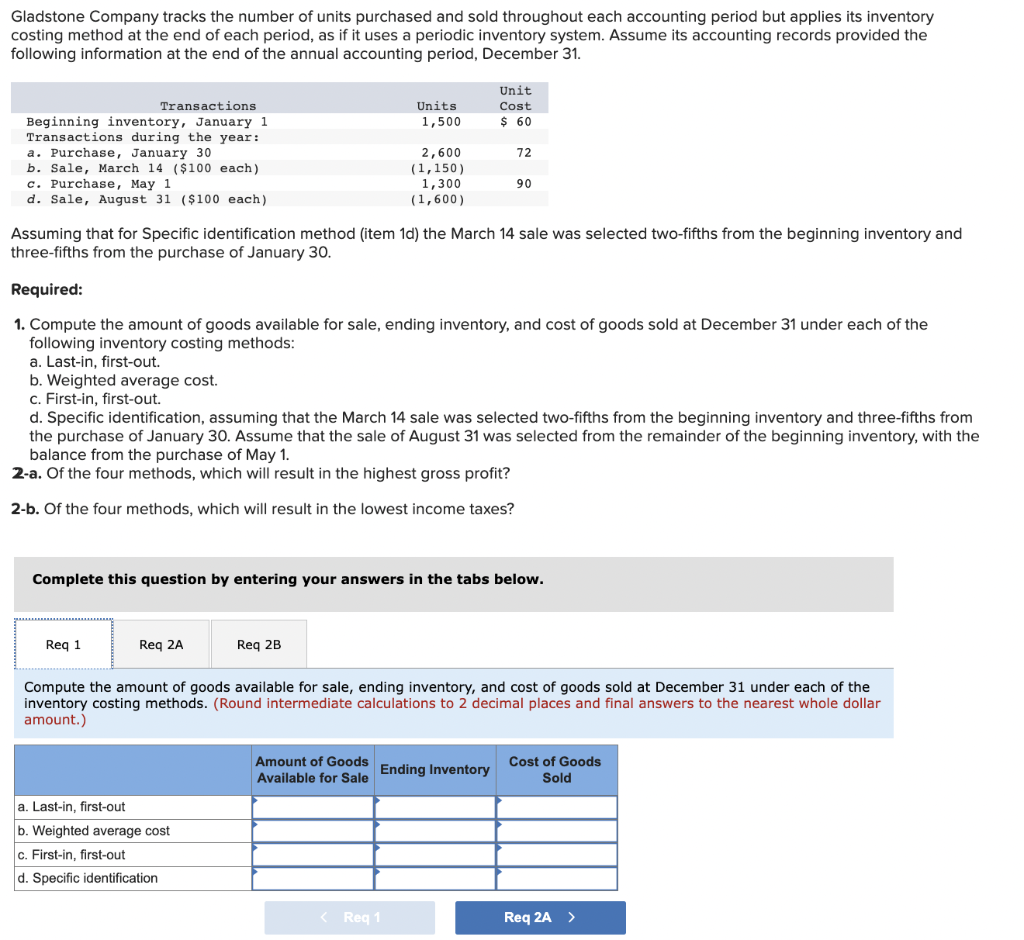

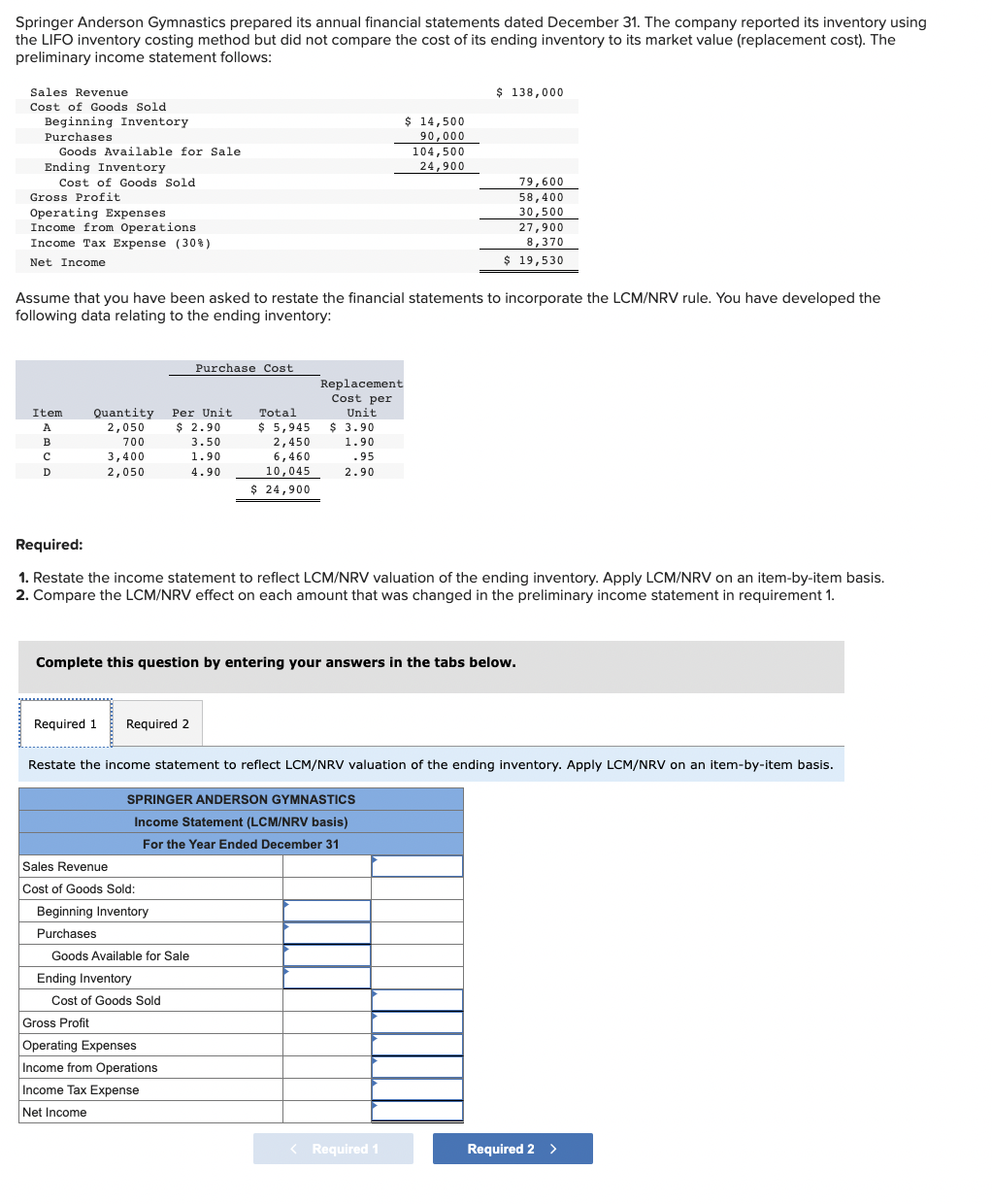

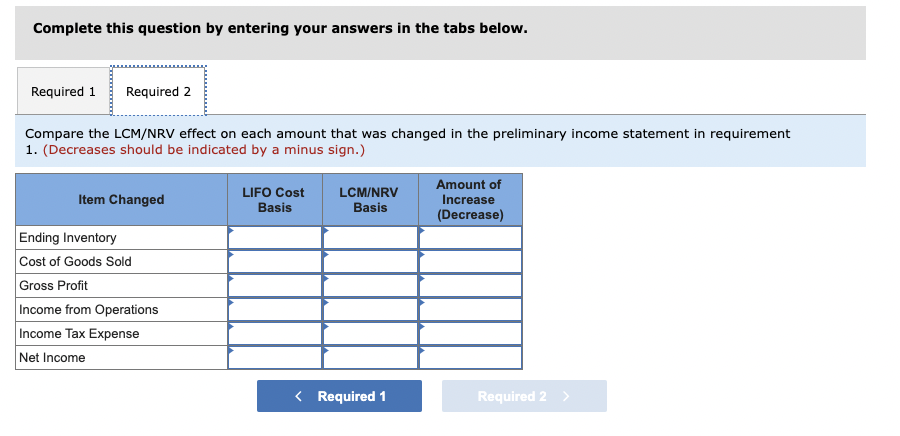

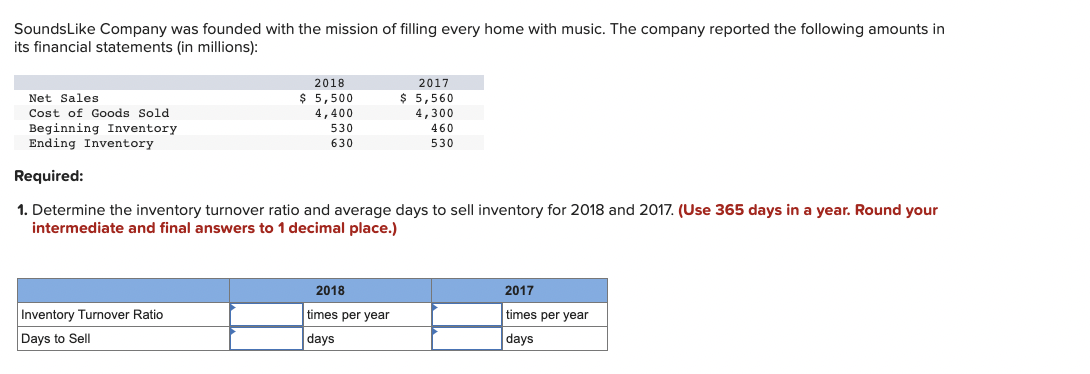

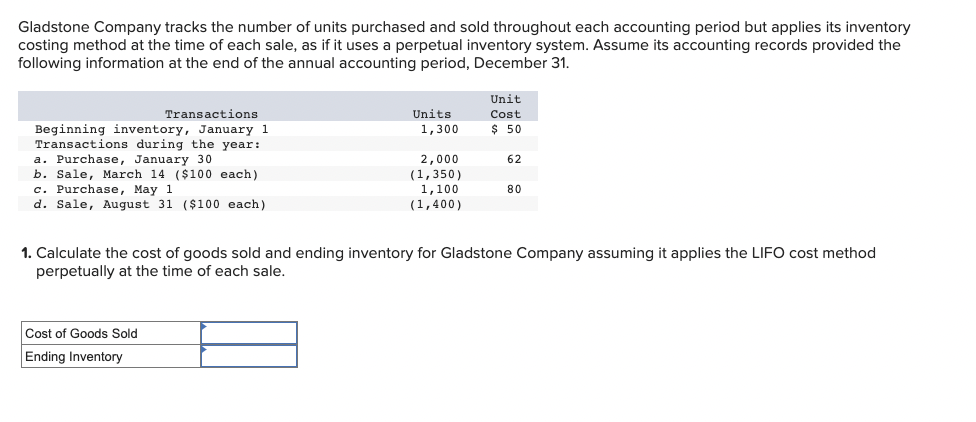

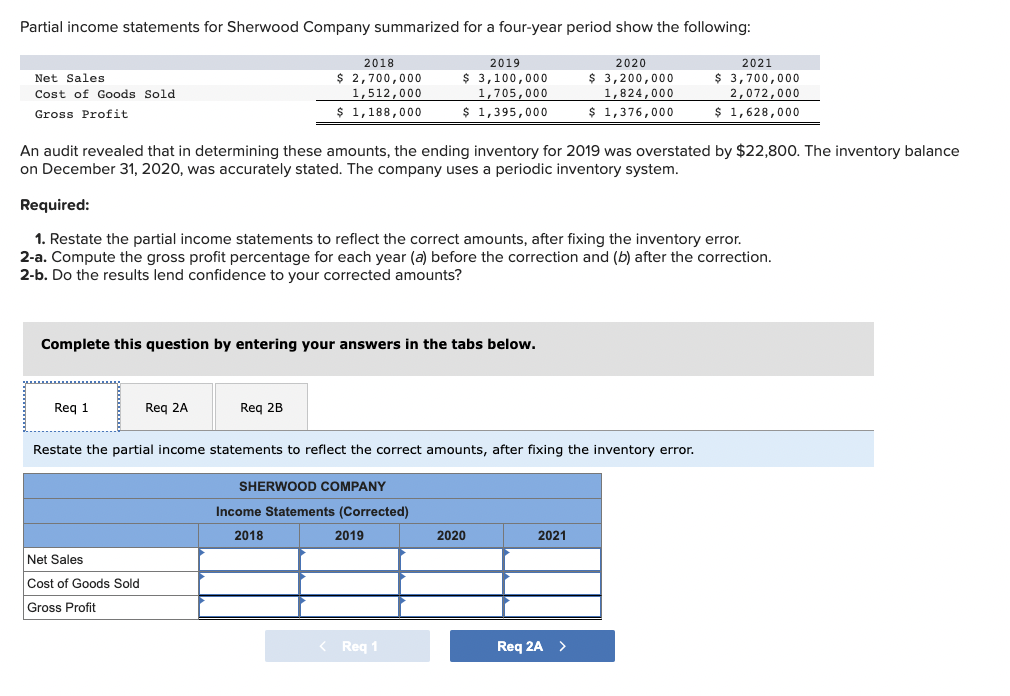

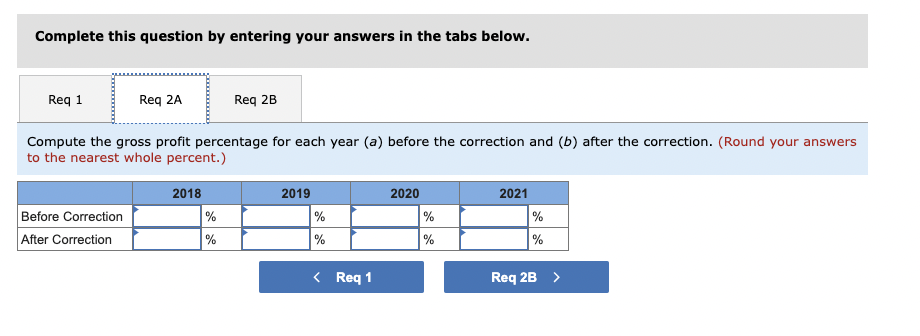

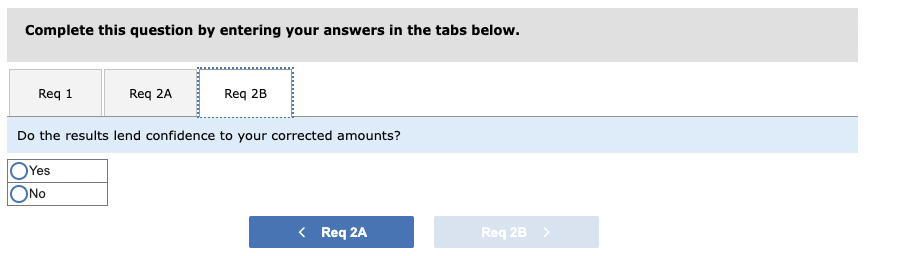

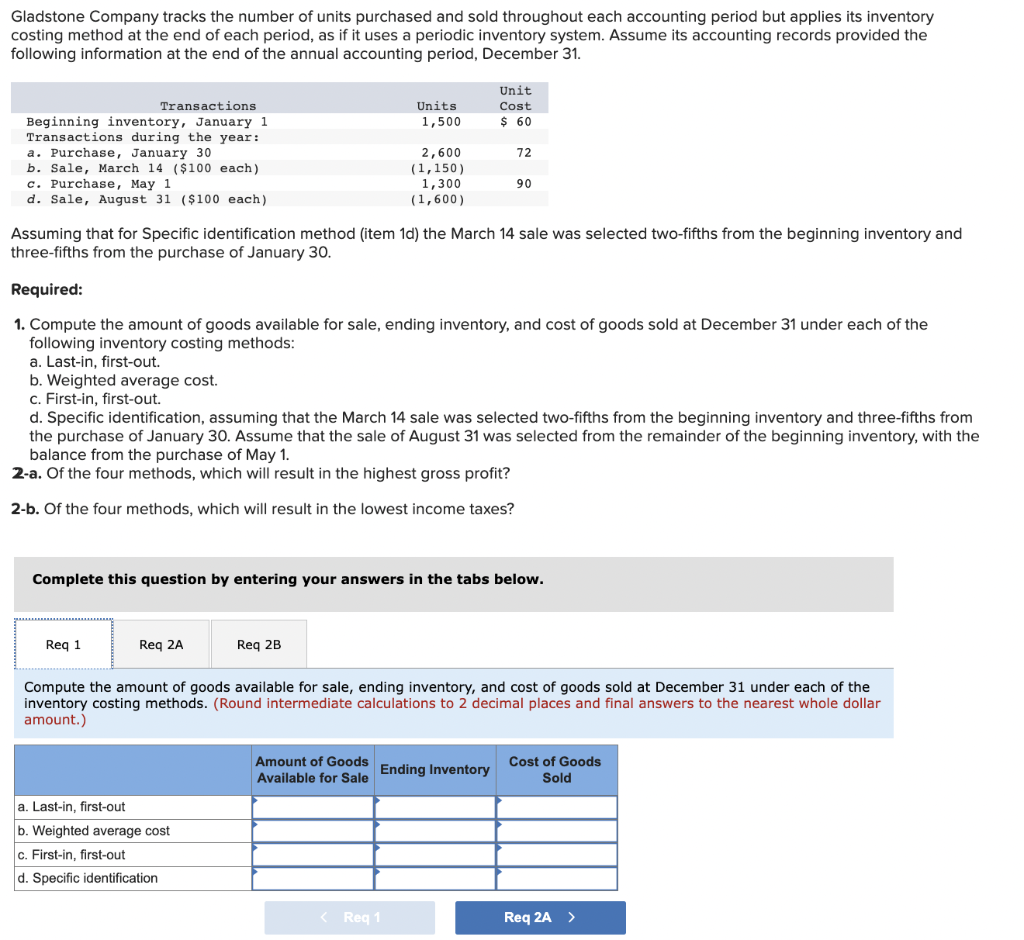

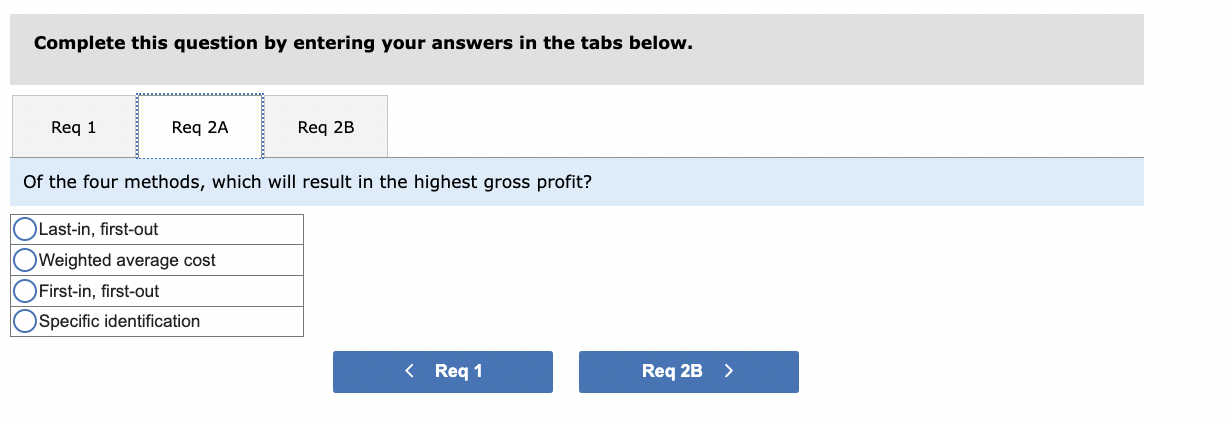

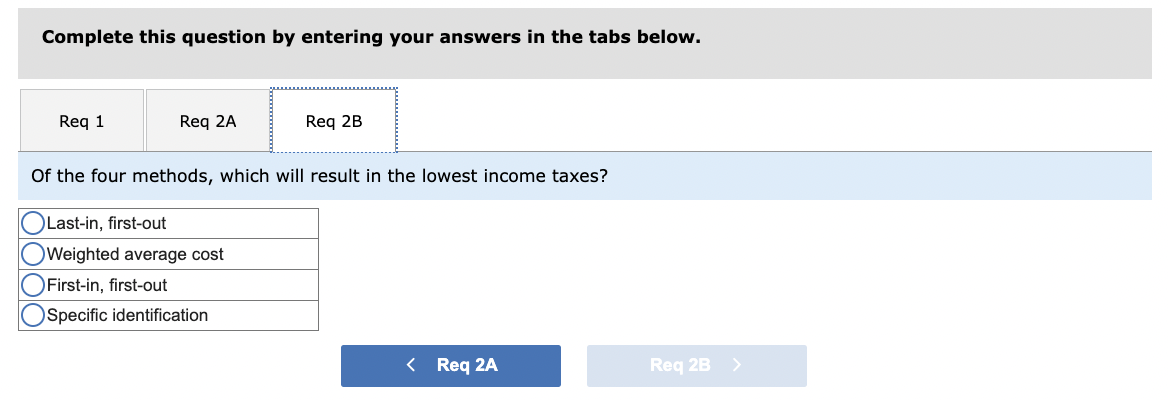

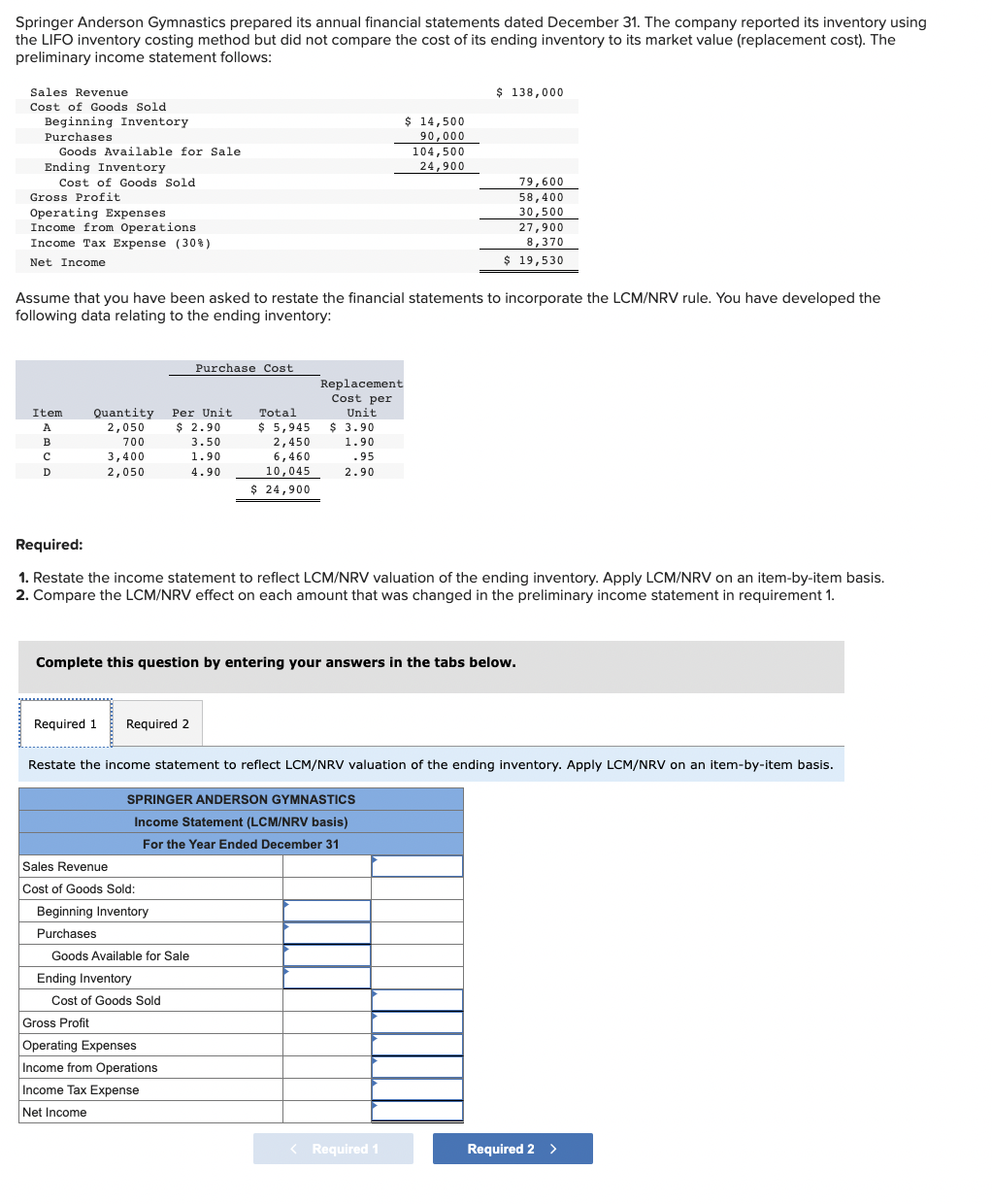

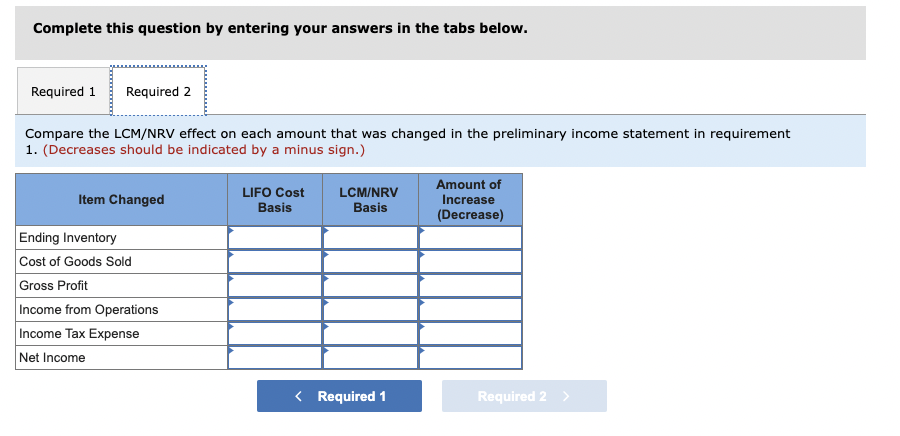

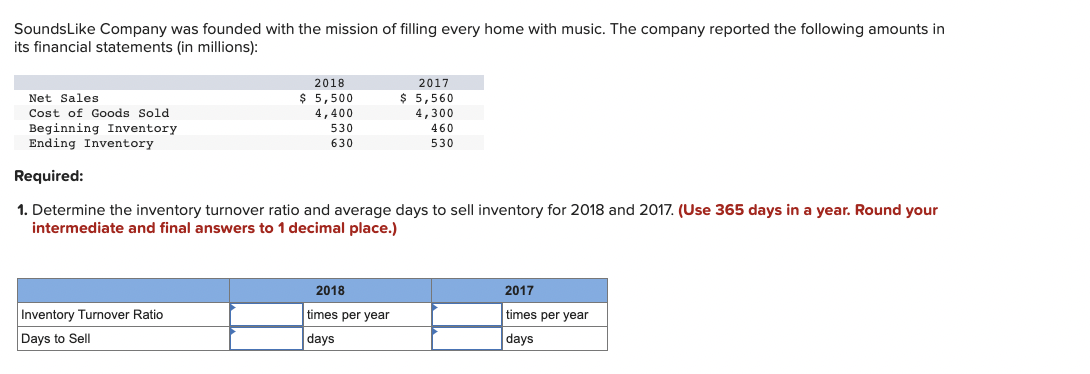

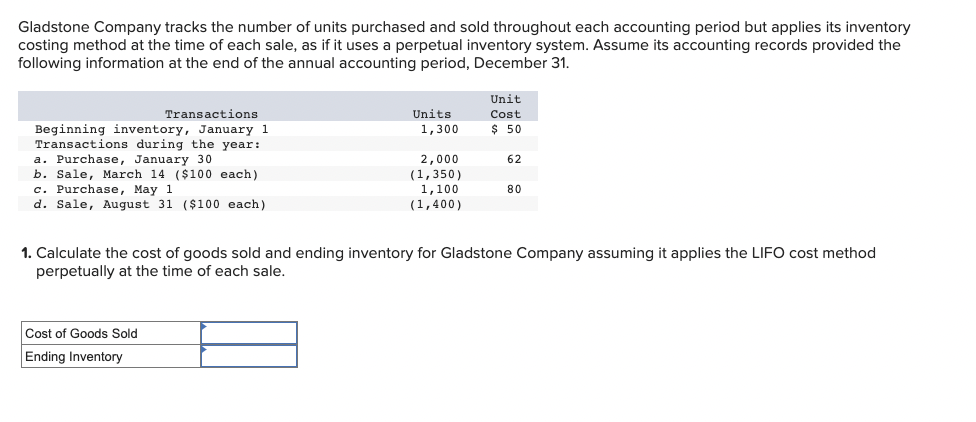

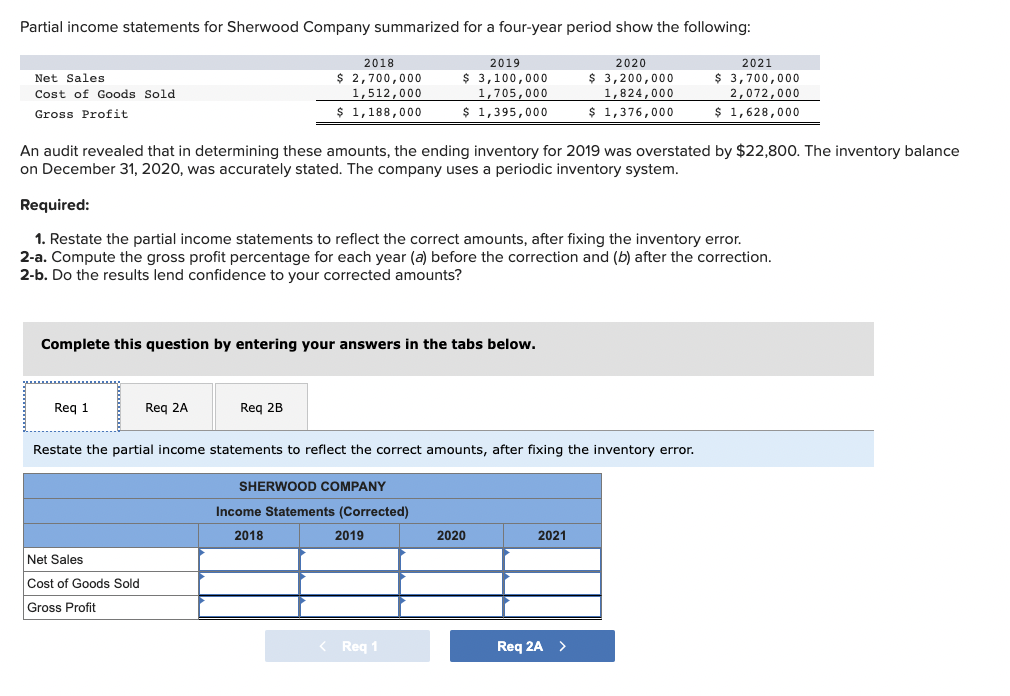

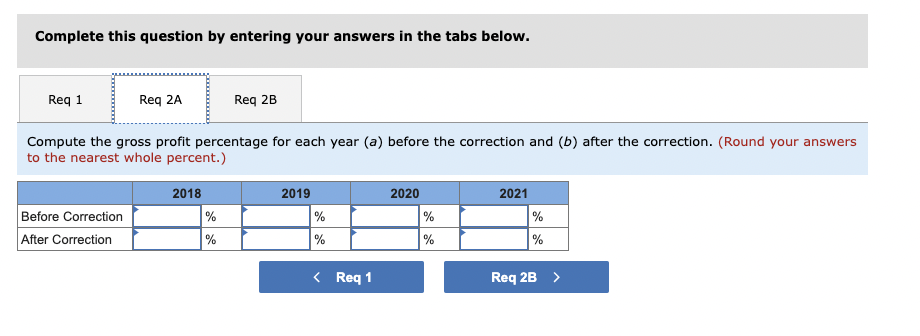

Gladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Assuming that for Specific identification method (item 1d) the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods: a. Last-in, first-out. b. Weighted average cost. c. First-in, first-out. d. Specific identification, assuming that the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30 . Assume that the sale of August 31 was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1 . 2-a. Of the four methods, which will result in the highest gross profit? 2-b. Of the four methods, which will result in the lowest income taxes? Complete this question by entering your answers in the tabs below. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the inventory costing methods. (Round intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) Complete this question by entering your answers in the tabs below. Of the four methods, which will result in the highest gross profit? Complete this question by entering your answers in the tabs below. Of the four methods, which will result in the lowest income taxes? Springer Anderson Gymnastics prepared its annual financial statements dated December 31 . The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You have developed the following data relating to the ending inventory: Required: 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. 2. Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. (Decreases should be indicated by a minus sign.) SoundsLike Company was founded with the mission of filling every home with music. The company reported the following amounts in its financial statements (in millions): Required: 1. Determine the inventory turnover ratio and average days to sell inventory for 2018 and 2017. (Use 365 days in a year. Round your intermediate and final answers to 1 decimal place.) Gladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the time of each sale, as if it uses a perpetual inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. 1. Calculate the cost of goods sold and ending inventory for Gladstone Company assuming it applies the LIFO cost method perpetually at the time of each sale. Partial income statements for Sherwood Company summarized for a four-year period show the following: An audit revealed that in determining these amounts, the ending inventory for 2019 was overstated by $22,800. The inventory balance on December 31,2020 , was accurately stated. The company uses a periodic inventory system. Required: 1. Restate the partial income statements to reflect the correct amounts, after fixing the inventory error. 2-a. Compute the gross profit percentage for each year (a) before the correction and (b) after the correction. 2-b. Do the results lend confidence to your corrected amounts? Complete this question by entering your answers in the tabs below. Restate the partial income statements to reflect the correct amounts, after fixing the inventory error. Complete this question by entering your answers in the tabs below. Compute the gross profit percentage for each year (a) before the correction and (b) after the correction. (Round your answers to the nearest whole percent.) Complete this question by entering your answers in the tabs below. Do the results lend confidence to your corrected amounts? Gladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Assuming that for Specific identification method (item 1d) the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods: a. Last-in, first-out. b. Weighted average cost. c. First-in, first-out. d. Specific identification, assuming that the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30 . Assume that the sale of August 31 was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1 . 2-a. Of the four methods, which will result in the highest gross profit? 2-b. Of the four methods, which will result in the lowest income taxes? Complete this question by entering your answers in the tabs below. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the inventory costing methods. (Round intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) Complete this question by entering your answers in the tabs below. Of the four methods, which will result in the highest gross profit? Complete this question by entering your answers in the tabs below. Of the four methods, which will result in the lowest income taxes? Springer Anderson Gymnastics prepared its annual financial statements dated December 31 . The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost). The preliminary income statement follows: Assume that you have been asked to restate the financial statements to incorporate the LCM/NRV rule. You have developed the following data relating to the ending inventory: Required: 1. Restate the income statement to reflect LCM/NRV valuation of the ending inventory. Apply LCM/NRV on an item-by-item basis. 2. Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Compare the LCM/NRV effect on each amount that was changed in the preliminary income statement in requirement 1. (Decreases should be indicated by a minus sign.) SoundsLike Company was founded with the mission of filling every home with music. The company reported the following amounts in its financial statements (in millions): Required: 1. Determine the inventory turnover ratio and average days to sell inventory for 2018 and 2017. (Use 365 days in a year. Round your intermediate and final answers to 1 decimal place.) Gladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the time of each sale, as if it uses a perpetual inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. 1. Calculate the cost of goods sold and ending inventory for Gladstone Company assuming it applies the LIFO cost method perpetually at the time of each sale. Partial income statements for Sherwood Company summarized for a four-year period show the following: An audit revealed that in determining these amounts, the ending inventory for 2019 was overstated by $22,800. The inventory balance on December 31,2020 , was accurately stated. The company uses a periodic inventory system. Required: 1. Restate the partial income statements to reflect the correct amounts, after fixing the inventory error. 2-a. Compute the gross profit percentage for each year (a) before the correction and (b) after the correction. 2-b. Do the results lend confidence to your corrected amounts? Complete this question by entering your answers in the tabs below. Restate the partial income statements to reflect the correct amounts, after fixing the inventory error. Complete this question by entering your answers in the tabs below. Compute the gross profit percentage for each year (a) before the correction and (b) after the correction. (Round your answers to the nearest whole percent.) Complete this question by entering your answers in the tabs below. Do the results lend confidence to your corrected amounts