Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of

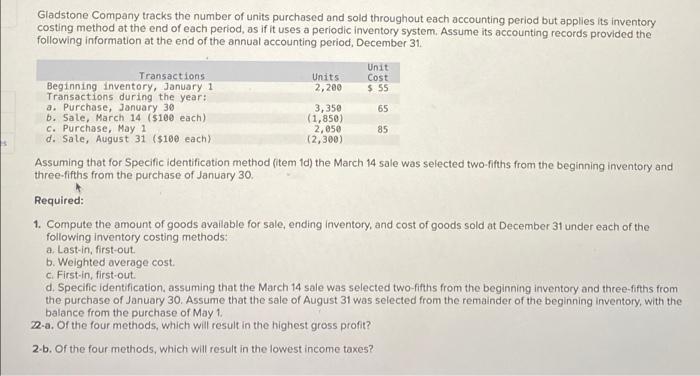

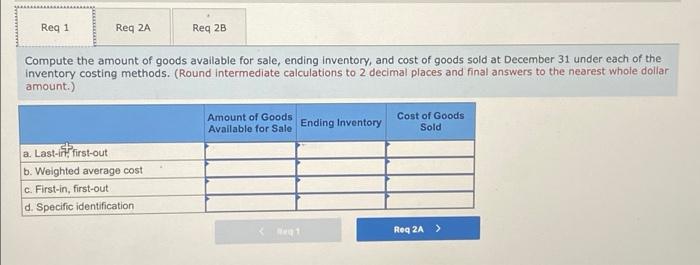

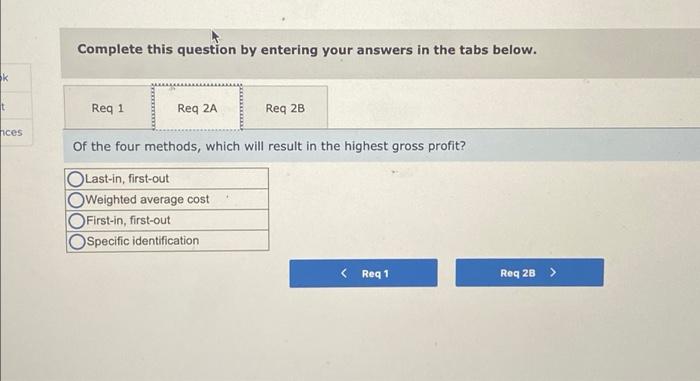

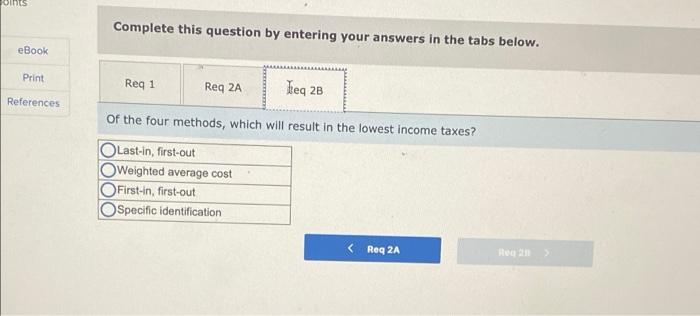

Gladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Unit Cost $ 55 Transactions Units 2,200 Beginning inventory, January 1 Transactions during the year: a. Purchase, January 30 b. Sale, March 14 ($100 each) c. Purchase, May 1 d. Sale, August 31 ($100 each) 3,350 (1,850) 2,050 (2,300) 65 85 Assuming that for Specific identification method (item 1d) the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods: a. Last-in, first-out. b. Weighted average cost. c. First-in, first-out. d. Specific identification, assuming that the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the sale of August 31 was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1. 2-a. Of the four methods, which will result in the highest gross profit? 2-b. Of the four methods, which will result in the lowest income taxes? Req 1 Req 2A Req 28 Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the inventory costing methods. (Round intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) Amount of Goods Cost of Goods Available for Sale Ending Inventory Sold a. Last-infirst-ot b. Weighted average cost c. First-in, first-out d. Specific identification Req 2A > Complete this question by entering your answers in the tabs below. Sk Req 1 Req 2A Req 2B hces Of the four methods, which will result in the highest gross profit? OLast-in, first-out OWeighted average cost First-in, first-out Specific identification Req 1 Req 28 Foints Complete this question by entering your answers in the tabs below. eBook Print Req 1 Reg 2A keq 28 References Of the four methods, which will result in the lowest income taxes? OLast-in, first-out OWeighted average cost First-in, first-out Specific identification < Req 2A Reg 2n

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

You can se...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started