Question

Glanmour plc's board of directors are considering the introduction of a new product developed in the company's laboratories.The company's research and development director estimates that

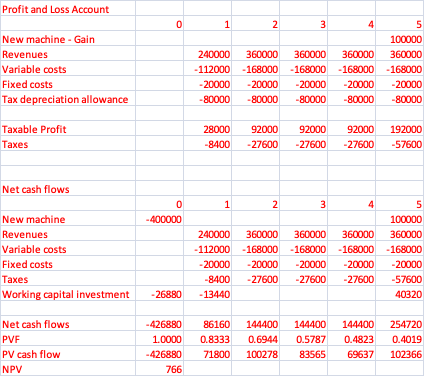

Glanmour plc's board of directors are considering the introduction of a new product developed in the company's laboratories.The company's research and development director estimates that the company has already spent 300,000 on the product and a further 80,000 has been spent on a market research study to assess the potential market for the product.On the basis of this study it is anticipated that the company will be able to sell 8,000 units at a price of 30 next year, with the market expanding to about 12,000 units a year in subsequent years.It is expected that the product will be withdrawn from the market after five years.It has been estimated that the direct costs of production (60 per cent labour and 40 per cent material costs), will be 14 per unit.The overheads attributable to the production, covering costs such as the share of the factory's rent, will amount to 20,000 per annum.The product will also be allocated through the company's management accounting system a charge of 10 per cent of revenues to cover more general overheads, eg. head office expense.To manufacture the product it will be necessary to invest in machinery that will cost 400,000.This will qualify for a writing down allowance of 20 per cent of the investment per annum.It is anticipated that the machinery will have a resale value of 100,000 at the end of the product's working life.Some investment in working capital will also be necessary.While it is anticipated that debtors and creditors will just about offset each other, an investment in stocks will be required.It is planned to hold at the start of each year raw materials equivalent to ten per cent of the expected production requirements and finished goods equivalent to 20 per cent of the year's expected sales.The company requires a twenty per cent after tax rate of return on such investments, and the tax rate is 30 per cent.

Determine the net present value of the proposed investment.

Provided Answer:

Profit and Loss Account New machine - Gain Revenues Variable costs Fixed costs Tax depreciation allowance Taxable Profit Taxes Net cash flows Net cash flows PVF 0 New machine Revenues Variable costs Fixed costs Taxes Working capital investment -26880 PV cash flow NPV 0 -400000 1 28000 -8400 2 240000 360000 360000 360000 -112000 -168000 -168000 -168000 -168000 -20000 -20000 -20000 -20000 -20000 -80000 -80000 -80000 -80000 -80000 1 -426880 1.0000 0.8333 -426880 71800 766 3 92000 92000 92000 -27600 -27600 -27600 2 3 5 100000 360000 360000 360000 240000 360000 -112000 -168000 -168000 -168000 -168000 -20000 -20000 -20000 -20000 -20000 -8400 -27600 -27600 -27600 -57600 -13440 40320 86160 144400 144400 0.6944 0.5787 100278 83565 4 5 100000 360000 192000 -57600 0.4823 69637 144400 254720 0.4019 102366

Step by Step Solution

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started