Answered step by step

Verified Expert Solution

Question

1 Approved Answer

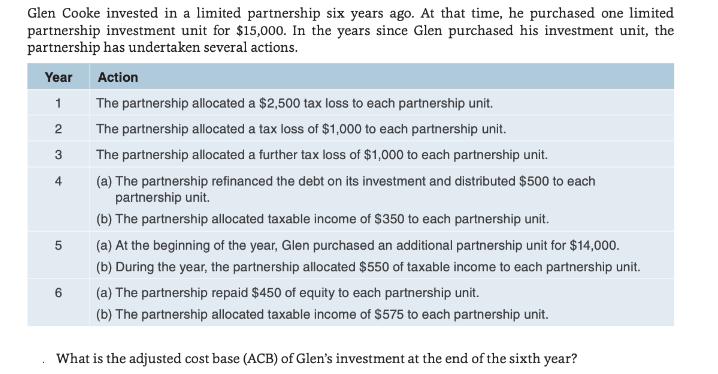

Glen Cooke invested in a limited partnership six years ago. At that time, he purchased one limited partnership investment unit for $15,000. In the

![]()

Glen Cooke invested in a limited partnership six years ago. At that time, he purchased one limited partnership investment unit for $15,000. In the years since Glen purchased his investment unit, the partnership has undertaken several actions. Year Action 1 The partnership allocated a $2,500 tax loss to each partnership unit. 2 The partnership allocated a tax loss of $1,000 to each partnership unit. 3 The partnership allocated a further tax loss of $1,000 to each partnership unit. 4 5 9 (a) The partnership refinanced the debt on its investment and distributed $500 to each partnership unit. (b) The partnership allocated taxable income of $350 to each partnership unit. (a) At the beginning of the year, Glen purchased an additional partnership unit for $14,000. (b) During the year, the partnership allocated $550 of taxable income to each partnership unit. (a) The partnership repaid $450 of equity to each partnership unit. (b) The partnership allocated taxable income of $575 to each partnership unit. What is the adjusted cost base (ACB) of Glen's investment at the end of the sixth year? If Glen sold his interest in the partnership today for $14,000 per investment unit, what would be Glen's capital gain or capital loss on the sale?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating Glens Adjusted Cost Base ACB Year 1 Glen purchased 1 unit for 15000 This is his initial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started