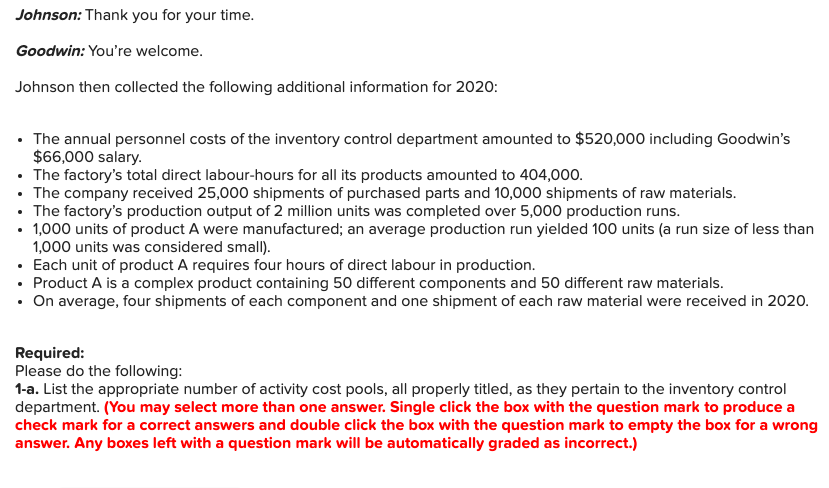

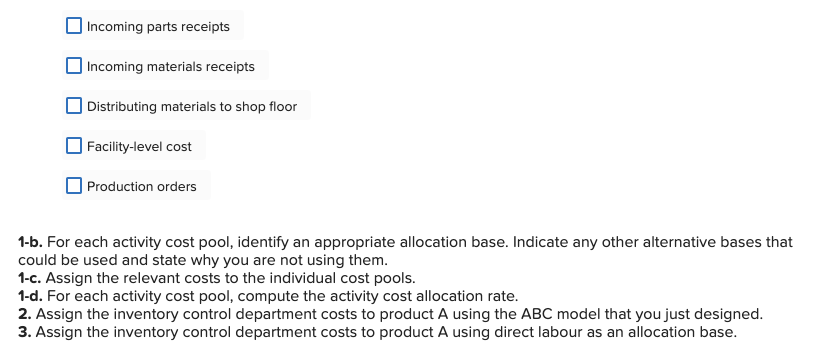

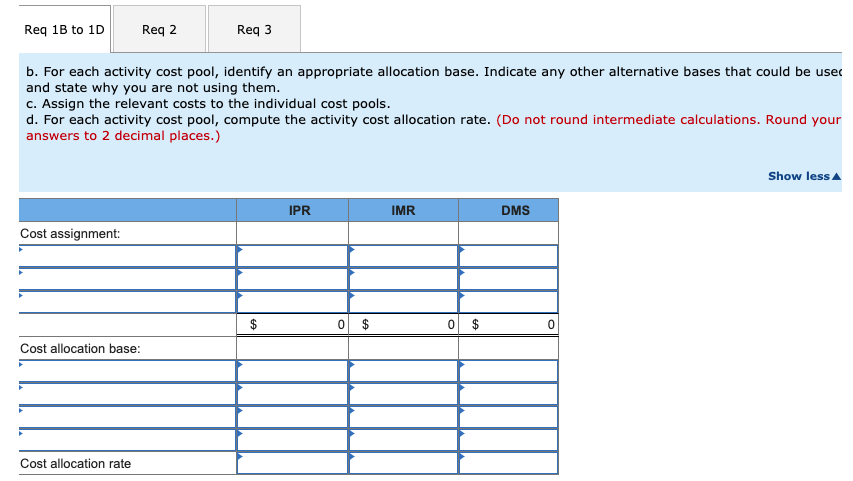

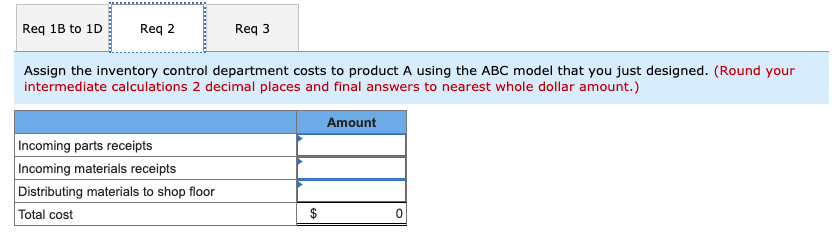

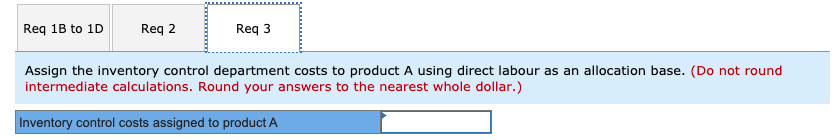

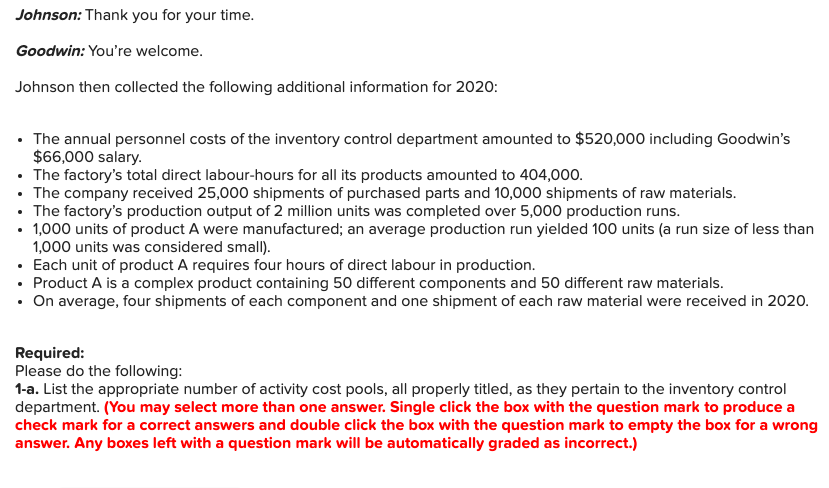

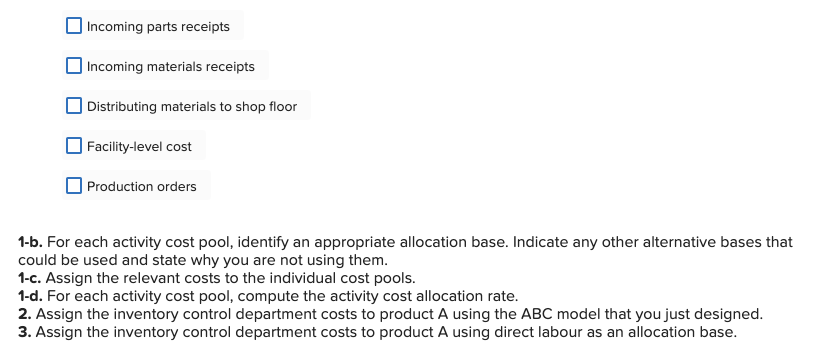

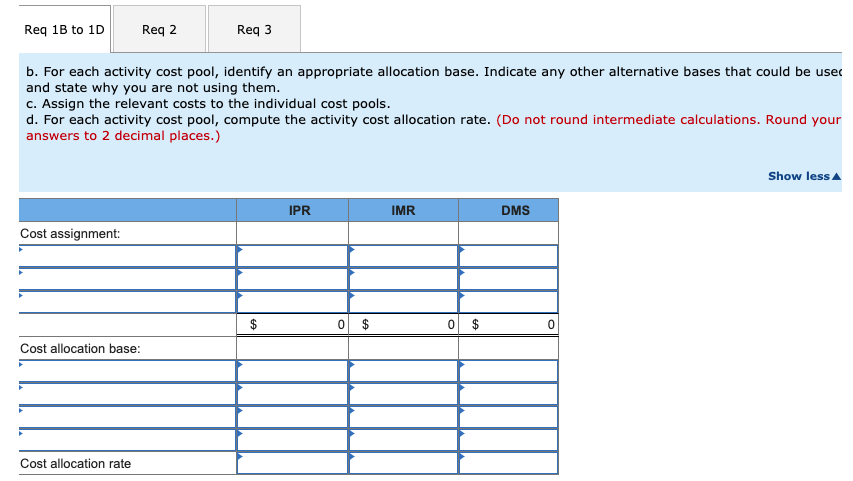

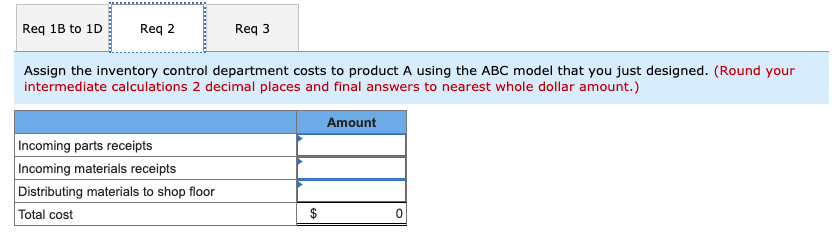

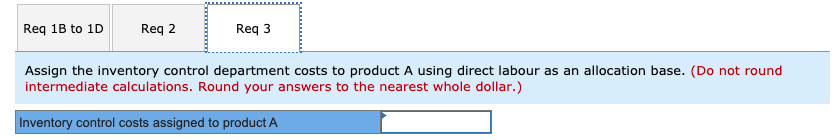

Glenda Johnson was hired as a summer intern to conduct an activity-based costing study in the inventory control department of a medium-sized manufacturing company located in Brandon, Manitoba. As a starting point, she decided to interview James Goodwin, the manager of the department, regarding the activities that are carried out in the department. Excerpts from the interview follow. Johnson: How many people work for you? Goodwin: Twelve. Johnson: What do they do? Goodwin: Six of them spend most of their time handling incoming shipments of purchased parts. They handle everything from documentation to transferring the parts to the work-in-progress (WIP) stockroom. Three others work in raw materials. After the material clears inspection, they move it into inventory and take care of the paperwork. Johnson: What determines the time required to process an incoming shipment? Does it matter if the individual components are small or large? Goodwin: Not for components. They go directly to the WIP stockroom and, unless the shipment is extremely large, it can be handled in one trip. With raw materials, though, volume can have a big effect on processing time. On average, 20% of the raw material shipments are large. Johnson: What other factors affect your department's workload? Goodwin: Well, there are three people I have not discussed yet! These three employees distribute raw materials to the manufacturing shop floor. Johnson: So, volume of raw materials must be important here. Goodwin: Well, the nature of this activity is such that volume is not much of an issue; it's more the number of times materials have to be distributed. Johnson: Do you usually distribute the total amount of raw material required for a production run all at once, or does it go out in smaller quantities? Goodwin: It varies with the size of the run. On a big run, we can't distribute it all at once, there would be too much raw material on the shop floor. On smaller runsand I'd say that's 80% of all runs-we'd send it out in a single trip once setup is complete. On the larger runs, materials are distributed in two trips. Johnson: What about your time? How do you spend it? Goodwin: I spend about 80% of my time supervising the work of the 12 employees and the remaining time doing administrative work not directly related to the department's activities. Johnson: How do you distribute your time across the different activities carried out in the department? Goodwin: That's difficult to say. I have never really kept track of my time across the different activities. Perhaps | should also start logging my time. Johnson: Besides personnel, what other resources does your department consume? Goodwin: Some organizational costs that I have no control over but it works out to about $38,000 per year. For the purposes of internal planning and decision making, the company believes only in applying controllable costs at the individual decision level. Johnson: Thank you for your time. Goodwin: You're welcome. Johnson then collected the following additional information for 2020: The annual personnel costs of the inventory control department amounted to $520,000 including Goodwin's $66,000 salary. The factory's total direct labour-hours for all its products amounted to 404,000. The company received 25,000 shipments of purchased parts and 10,000 shipments of raw materials. The factory's production output of 2 million units was completed over 5,000 production runs. 1,000 units of product A were manufactured; an average production run yielded 100 units (a run size of less than 1,000 units was considered small). Each unit of product A requires four hours of direct labour in production. Product A is a complex product containing 50 different components and 50 different raw materials. . On average, four shipments of each component and one shipment of each raw material were received in 2020. Required: Please do the following: 1-a. List the appropriate number of activity cost pools, all properly titled, as they pertain to the inventory control department. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answers and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Incoming parts receipts Incoming materials receipts Distributing materials to shop floor Facility-level cost Production orders 1-b. For each activity cost pool, identify an appropriate allocation base. Indicate any other alternative bases that could be used and state why you are not using them. 1-c. Assign the relevant costs to the individual cost pools. 1-d. For each activity cost pool, compute the activity cost allocation rate. 2. Assign the inventory control department costs to product A using the ABC model that you just designed. 3. Assign the inventory control department costs to product A using direct labour as an allocation base. Req 18 to 1D Req 2 Req 3 b. For each activity cost pool, identify an appropriate allocation base. Indicate any other alternative bases that could be use and state why you are not using them. C. Assign the relevant costs to the individual cost pools. d. For each activity cost pool, compute the activity cost allocation rate. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Show less IPR IMR DMS Cost assignment: $ 0 $ 0 $ 0 Cost allocation base: Cost allocation rate Reg 1B to 10 Req 2 Req3 Assign the inventory control department costs to product A using the ABC model that you just designed. (Round your intermediate calculations 2 decimal places and final answers to nearest whole dollar amount.) Amount Incoming parts receipts Incoming materials receipts Distributing materials to shop floor Total cost 0 Reg 1B to 1D Reg 2 Req3 Assign the inventory control department costs to product A using direct labour as an allocation base. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Inventory control costs assigned to product A Glenda Johnson was hired as a summer intern to conduct an activity-based costing study in the inventory control department of a medium-sized manufacturing company located in Brandon, Manitoba. As a starting point, she decided to interview James Goodwin, the manager of the department, regarding the activities that are carried out in the department. Excerpts from the interview follow. Johnson: How many people work for you? Goodwin: Twelve. Johnson: What do they do? Goodwin: Six of them spend most of their time handling incoming shipments of purchased parts. They handle everything from documentation to transferring the parts to the work-in-progress (WIP) stockroom. Three others work in raw materials. After the material clears inspection, they move it into inventory and take care of the paperwork. Johnson: What determines the time required to process an incoming shipment? Does it matter if the individual components are small or large? Goodwin: Not for components. They go directly to the WIP stockroom and, unless the shipment is extremely large, it can be handled in one trip. With raw materials, though, volume can have a big effect on processing time. On average, 20% of the raw material shipments are large. Johnson: What other factors affect your department's workload? Goodwin: Well, there are three people I have not discussed yet! These three employees distribute raw materials to the manufacturing shop floor. Johnson: So, volume of raw materials must be important here. Goodwin: Well, the nature of this activity is such that volume is not much of an issue; it's more the number of times materials have to be distributed. Johnson: Do you usually distribute the total amount of raw material required for a production run all at once, or does it go out in smaller quantities? Goodwin: It varies with the size of the run. On a big run, we can't distribute it all at once, there would be too much raw material on the shop floor. On smaller runsand I'd say that's 80% of all runs-we'd send it out in a single trip once setup is complete. On the larger runs, materials are distributed in two trips. Johnson: What about your time? How do you spend it? Goodwin: I spend about 80% of my time supervising the work of the 12 employees and the remaining time doing administrative work not directly related to the department's activities. Johnson: How do you distribute your time across the different activities carried out in the department? Goodwin: That's difficult to say. I have never really kept track of my time across the different activities. Perhaps | should also start logging my time. Johnson: Besides personnel, what other resources does your department consume? Goodwin: Some organizational costs that I have no control over but it works out to about $38,000 per year. For the purposes of internal planning and decision making, the company believes only in applying controllable costs at the individual decision level. Johnson: Thank you for your time. Goodwin: You're welcome. Johnson then collected the following additional information for 2020: The annual personnel costs of the inventory control department amounted to $520,000 including Goodwin's $66,000 salary. The factory's total direct labour-hours for all its products amounted to 404,000. The company received 25,000 shipments of purchased parts and 10,000 shipments of raw materials. The factory's production output of 2 million units was completed over 5,000 production runs. 1,000 units of product A were manufactured; an average production run yielded 100 units (a run size of less than 1,000 units was considered small). Each unit of product A requires four hours of direct labour in production. Product A is a complex product containing 50 different components and 50 different raw materials. . On average, four shipments of each component and one shipment of each raw material were received in 2020. Required: Please do the following: 1-a. List the appropriate number of activity cost pools, all properly titled, as they pertain to the inventory control department. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answers and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Incoming parts receipts Incoming materials receipts Distributing materials to shop floor Facility-level cost Production orders 1-b. For each activity cost pool, identify an appropriate allocation base. Indicate any other alternative bases that could be used and state why you are not using them. 1-c. Assign the relevant costs to the individual cost pools. 1-d. For each activity cost pool, compute the activity cost allocation rate. 2. Assign the inventory control department costs to product A using the ABC model that you just designed. 3. Assign the inventory control department costs to product A using direct labour as an allocation base. Req 18 to 1D Req 2 Req 3 b. For each activity cost pool, identify an appropriate allocation base. Indicate any other alternative bases that could be use and state why you are not using them. C. Assign the relevant costs to the individual cost pools. d. For each activity cost pool, compute the activity cost allocation rate. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Show less IPR IMR DMS Cost assignment: $ 0 $ 0 $ 0 Cost allocation base: Cost allocation rate Reg 1B to 10 Req 2 Req3 Assign the inventory control department costs to product A using the ABC model that you just designed. (Round your intermediate calculations 2 decimal places and final answers to nearest whole dollar amount.) Amount Incoming parts receipts Incoming materials receipts Distributing materials to shop floor Total cost 0 Reg 1B to 1D Reg 2 Req3 Assign the inventory control department costs to product A using direct labour as an allocation base. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Inventory control costs assigned to product A