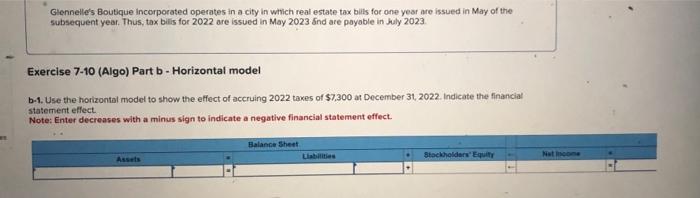

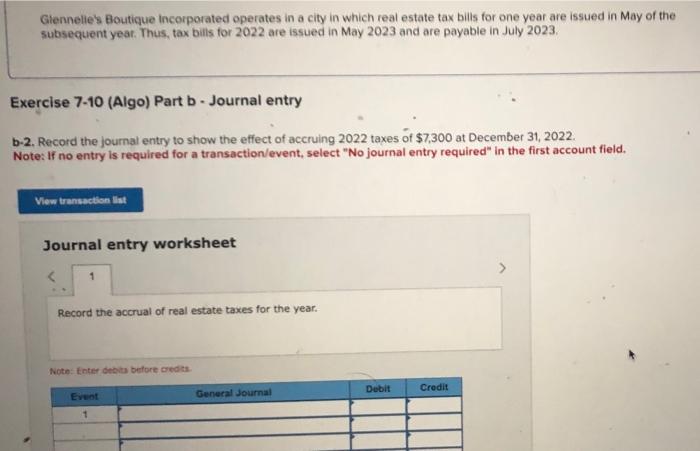

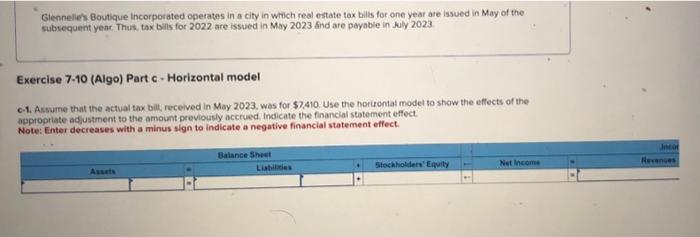

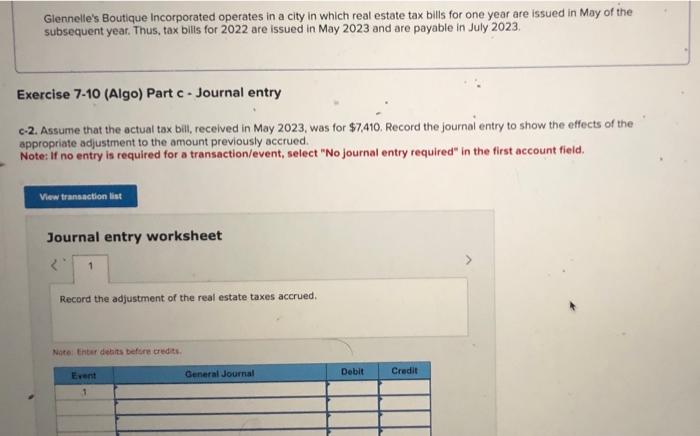

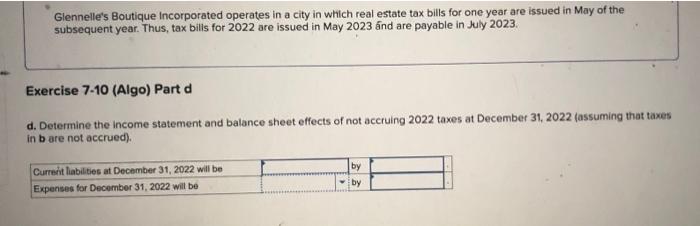

Glennelle's Boutique incerporated operates in a city in whith real estate tax blits for one year are issued in May of the subsequent year. Thus, tax bilis for 2022 are issued in May 2023 fnd are payable in luly 2023. Exercise 7-10 (Algo) Part b - Horizontal model b-1. Use the horizontal model to show the effect of accruing 2022 taxes of $7,300 at December 31,2022 . Indicate the financial statement effect. Note: Enter decreases with a minus sign to indicate a negative financial statement effect. Giennelies Boutique incorporated operates in a city in which real estate tax bills for one year are issued in May of the subsequent yeat. Thus, tax bills for 2022 are issued in May 2023 and are payable in July 2023. Exercise 7-10 (Algo) Part b - Journal entry b-2. Record the journal entry to show the effect of accruing 2022 taxes of $7,300 at December 31, 2022. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the accrual of real estate taxes for the year. Note: Leter dentu belpre ctedtit. Giennelles. Boutique incorporated operates in a city in which real estate tax bilis for one year are issued in May of the subsequent year. Thus. tax bills for 2022 are issued in May 2023 and are payable in July 2023 Exercise 7.10 (Algo) Part c - Horizontal model c-1. Assume that the actual tax bilt, received in May 2023, was for $7,410. Use the horirontal modet to show the effects of the appropriate adjustment to the amount previously accrued, Indicate the financial statement effect. Note: finter decreases with a minus sign to indicate a negative financial statement effect. Glennelle's Boutique Incorporated operates in a city in which real estate tax bills for one year are issued in May of the subsequent year. Thus, tax bilis for 2022 are issued in May 2023 and are payable in July 2023. Exercise 7-10 (Algo) Part c - Journal entry c-2. Assume that the actual tax bill, recelved in May 2023, was for $7.410. Record the journal entry to show the effects of the appropriate adjustment to the amount previously accrued. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the adjustment of the real estate taxes accrued. Glennelle's Boutique incorporated operates in a city in which real estate tax bills for one year are issued in May of the subsequent year. Thus, tax bills for 2022 are issued in May 2023 nd are payable in July 2023. Exercise 7-10 (Algo) Part d d. Determine the income statement and balance sheet effects of not accruing 2022 taxes at December 31,2022 (assuming that taxes in b are not accrued)