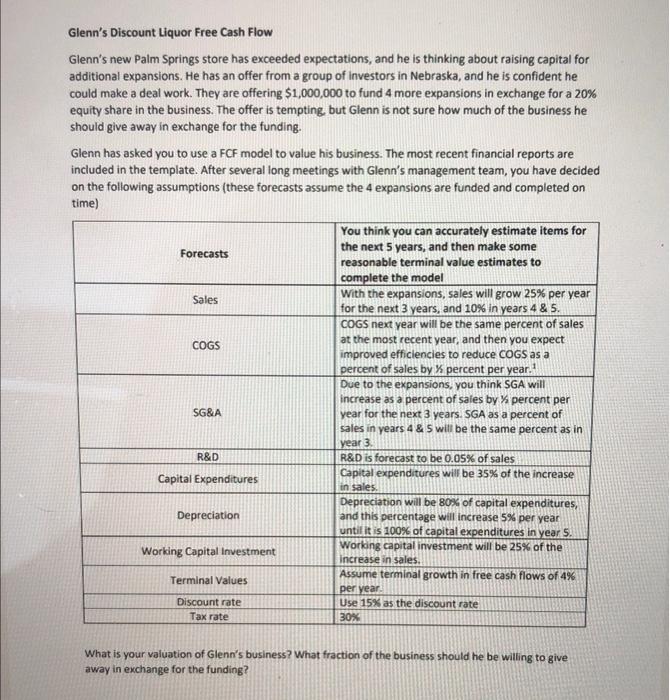

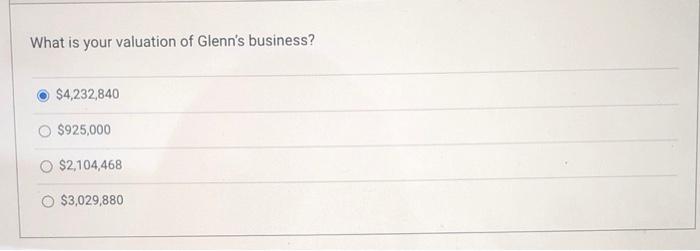

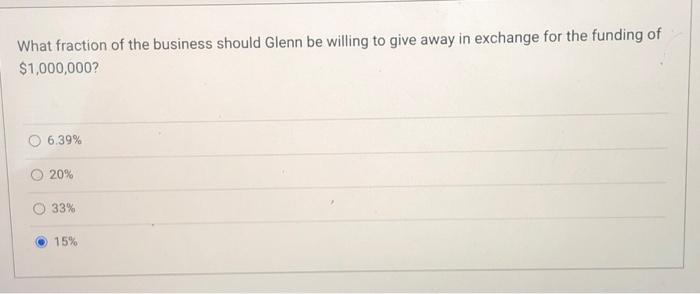

Glenn's Discount Liquor Free Cash Flow Glenn's new Palm Springs store has exceeded expectations, and he is thinking about raising capital for additional expansions. He has an offer from a group of investors in Nebraska, and he is confident he could make a deal work. They are offering $1,000,000 to fund 4 more expansions in exchange for a 20% equity share in the business. The offer is tempting, but Glenn is not sure how much of the business he should give away in exchange for the funding. Glenn has asked you to use a FCF model to value his business. The most recent financial reports are included in the template. After several long meetings with Glenn's management team, you have decided on the following assumptions (these forecasts assume the 4 expansions are funded and completed on time) You think you can accurately estimate items for the next 5 years, and then make some Forecasts reasonable terminal value estimates to complete the model Sales With the expansions, sales will grow 25% per year for the next 3 years, and 10% in years 4 & 5. COGS next year will be the same percent of sales COGS at the most recent year, and then you expect improved efficiencies to reduce COGS as a percent of sales by X percent per year. Due to the expansions, you think SGA will increase as a percent of sales by percent per SG&A year for the next 3 years. SGA as a percent of sales in years 4 & 5 will be the same percent as in year 3 R&D R&D is forecast to be 0.05% of sales Capital expenditures will be 35% of the increase Capital Expenditures in sales Depreciation will be 80% of capital expenditures, Depreciation and this percentage will increase 5% per year until it is 100% of capital expenditures in year 5. Working capital investment will be 25% of the Working Capital Investment increase in sales Terminal Values Assume terminal growth in free cash flows of 4% per year Discount rate Use 15% as the discount rate Tax rate 30% What is your valuation of Glenn's business? What fraction of the business should he be willing to give away in exchange for the funding? What is your valuation of Glenn's business? $4,232,840 $925,000 O $2,104,468 $3,029,880 What fraction of the business should Glenn be willing to give away in exchange for the funding of $1,000,000? 6.39% 20% 33% 15% Glenn's Discount Liquor Free Cash Flow Glenn's new Palm Springs store has exceeded expectations, and he is thinking about raising capital for additional expansions. He has an offer from a group of investors in Nebraska, and he is confident he could make a deal work. They are offering $1,000,000 to fund 4 more expansions in exchange for a 20% equity share in the business. The offer is tempting, but Glenn is not sure how much of the business he should give away in exchange for the funding. Glenn has asked you to use a FCF model to value his business. The most recent financial reports are included in the template. After several long meetings with Glenn's management team, you have decided on the following assumptions (these forecasts assume the 4 expansions are funded and completed on time) You think you can accurately estimate items for the next 5 years, and then make some Forecasts reasonable terminal value estimates to complete the model Sales With the expansions, sales will grow 25% per year for the next 3 years, and 10% in years 4 & 5. COGS next year will be the same percent of sales COGS at the most recent year, and then you expect improved efficiencies to reduce COGS as a percent of sales by X percent per year. Due to the expansions, you think SGA will increase as a percent of sales by percent per SG&A year for the next 3 years. SGA as a percent of sales in years 4 & 5 will be the same percent as in year 3 R&D R&D is forecast to be 0.05% of sales Capital expenditures will be 35% of the increase Capital Expenditures in sales Depreciation will be 80% of capital expenditures, Depreciation and this percentage will increase 5% per year until it is 100% of capital expenditures in year 5. Working capital investment will be 25% of the Working Capital Investment increase in sales Terminal Values Assume terminal growth in free cash flows of 4% per year Discount rate Use 15% as the discount rate Tax rate 30% What is your valuation of Glenn's business? What fraction of the business should he be willing to give away in exchange for the funding? What is your valuation of Glenn's business? $4,232,840 $925,000 O $2,104,468 $3,029,880 What fraction of the business should Glenn be willing to give away in exchange for the funding of $1,000,000? 6.39% 20% 33% 15%