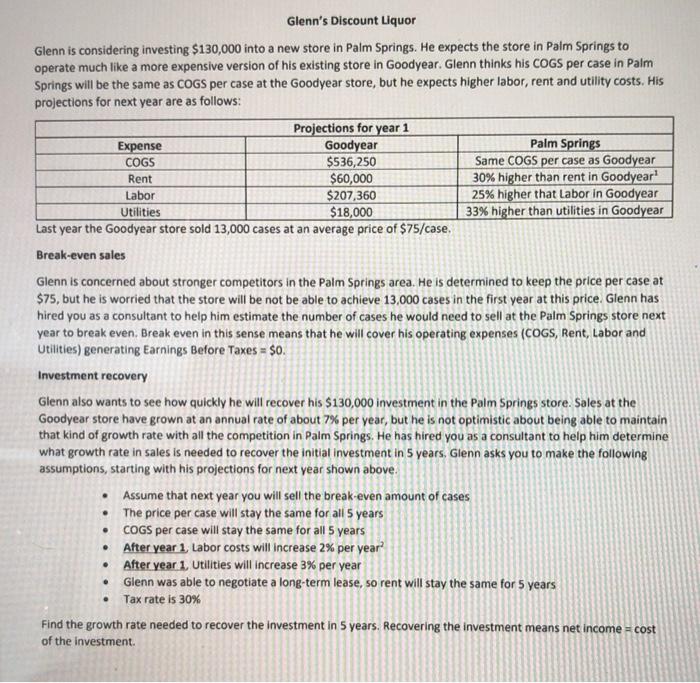

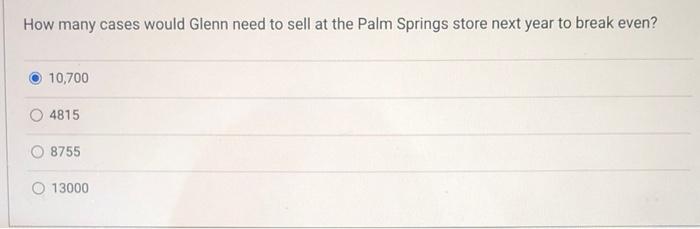

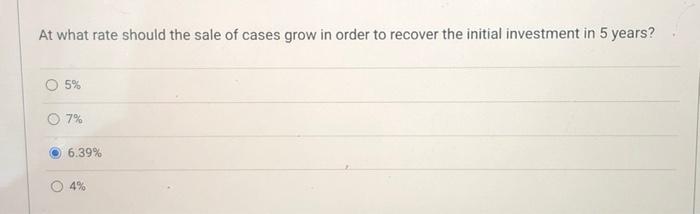

Glenn's Discount Liquor Glenn is considering investing $130,000 into a new store in Palm Springs. He expects the store in Palm Springs to operate much like a more expensive version of his existing store in Goodyear. Glenn thinks his COGS per case in Palm Springs will be the same as COGS per case at the Goodyear store, but he expects higher labor, rent and utility costs. His projections for next year are as follows: Projections for year 1 Expense Goodyear Palm Springs COGS $536,250 Same COGS per case as Goodyear Rent $60,000 30% higher than rent in Goodyear Labor $207,360 25% higher that Labor in Goodyear Utilities $18,000 33% higher than utilities in Goodyear Last year the Goodyear store sold 13,000 cases at an average price of $75/case. Break-even sales Glenn is concerned about stronger competitors in the Palm Springs area. He is determined to keep the price per case at $75, but he is worried that the store will be not be able to achieve 13,000 cases in the first year at this price. Glenn has hired you as a consultant to help him estimate the number of cases he would need to sell at the Palm Springs store next year to break even. Break even in this sense means that he will cover his operating expenses (COGS, Rent, Labor and Utilities) generating Earnings Before Taxes = $0. Investment recovery Glenn also wants to see how quickly he will recover his $130,000 investment in the Palm Springs store. Sales at the Goodyear store have grown at an annual rate of about 7% per year, but he is not optimistic about being able to maintain that kind of growth rate with all the competition in Palm Springs. He has hired you as a consultant to help him determine what growth rate in sales is needed to recover the initial investment in 5 years, Glenn asks you to make the following assumptions, starting with his projections for next year shown above. Assume that next year you will sell the break-even amount of cases The price per case will stay the same for all 5 years COGS per case will stay the same for all 5 years After year 1, Labor costs will increase 2% per year After year 1. Utilities will increase 3% per year Glenn was able to negotiate a long-term lease, so rent will stay the same for 5 years Tax rate is 30% Find the growth rate needed to recover the investment in 5 years. Recovering the investment means net income - cost of the investment a . How many cases would Glenn need to sell at the Palm Springs store next year to break even? 10,700 4815 8755 0 13000 At what rate should the sale of cases grow in order to recover the initial investment in 5 years? 5% O 7% 6.39% 4% Glenn's Discount Liquor Glenn is considering investing $130,000 into a new store in Palm Springs. He expects the store in Palm Springs to operate much like a more expensive version of his existing store in Goodyear. Glenn thinks his COGS per case in Palm Springs will be the same as COGS per case at the Goodyear store, but he expects higher labor, rent and utility costs. His projections for next year are as follows: Projections for year 1 Expense Goodyear Palm Springs COGS $536,250 Same COGS per case as Goodyear Rent $60,000 30% higher than rent in Goodyear Labor $207,360 25% higher that Labor in Goodyear Utilities $18,000 33% higher than utilities in Goodyear Last year the Goodyear store sold 13,000 cases at an average price of $75/case. Break-even sales Glenn is concerned about stronger competitors in the Palm Springs area. He is determined to keep the price per case at $75, but he is worried that the store will be not be able to achieve 13,000 cases in the first year at this price. Glenn has hired you as a consultant to help him estimate the number of cases he would need to sell at the Palm Springs store next year to break even. Break even in this sense means that he will cover his operating expenses (COGS, Rent, Labor and Utilities) generating Earnings Before Taxes = $0. Investment recovery Glenn also wants to see how quickly he will recover his $130,000 investment in the Palm Springs store. Sales at the Goodyear store have grown at an annual rate of about 7% per year, but he is not optimistic about being able to maintain that kind of growth rate with all the competition in Palm Springs. He has hired you as a consultant to help him determine what growth rate in sales is needed to recover the initial investment in 5 years, Glenn asks you to make the following assumptions, starting with his projections for next year shown above. Assume that next year you will sell the break-even amount of cases The price per case will stay the same for all 5 years COGS per case will stay the same for all 5 years After year 1, Labor costs will increase 2% per year After year 1. Utilities will increase 3% per year Glenn was able to negotiate a long-term lease, so rent will stay the same for 5 years Tax rate is 30% Find the growth rate needed to recover the investment in 5 years. Recovering the investment means net income - cost of the investment a . How many cases would Glenn need to sell at the Palm Springs store next year to break even? 10,700 4815 8755 0 13000 At what rate should the sale of cases grow in order to recover the initial investment in 5 years? 5% O 7% 6.39% 4%