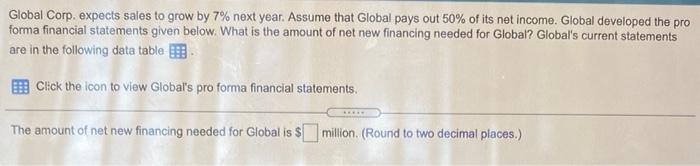

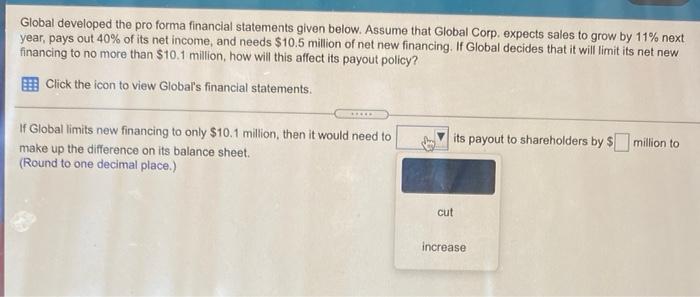

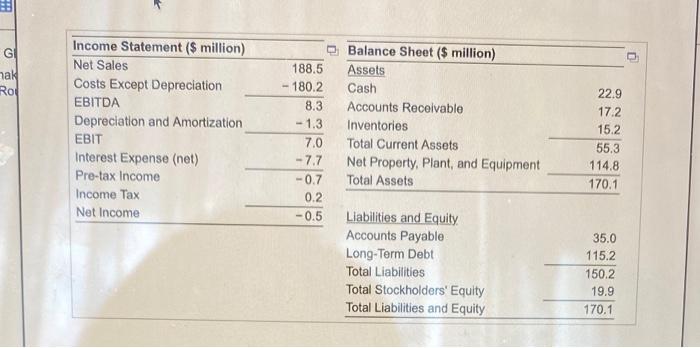

Global Corp. expects sales to grow by 7% next year. Assume that Global pays out 50% of its net income. Global developed the pro forma financial statements given below. What is the amount of net new financing needed for Global? Global's current statements are in the following data table B Click the icon to view Global's pro forma financial statements. The amount of net new financing needed for Global is $ million. (Round to two decimal places.) 33 nel 199.23 - 187.14 12.09 uur UrUSIVU Assets Cash Accounts Receivable 23.86 20.01 -1.39 We um Sales Costs Except Depreciation EBITDA Depreciation and Amortization EBIT Interest Expense (net) Pre-lax Income Income Tax Net Income 16.69 10.7 60.56 Inventories Total Current Assets Property, Plant, and Equipment Total Assets -7.7 121.12 181.68 3 -0.78 2.22 Liabilities and Equity Accounts Payable Long-Term Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity 36.49 121.18 157.67 24.01 181.68 Global developed the pro forma financial statements given below. Assume that Global Corp. expects sales to grow by 11% next year, pays out 40% of its net income, and needs $10.5 million of net new financing. If Global decides that it will limit its net new financing to no more than $10,1 million, how will this affect its payout policy? Click the icon to view Global's financial statements If Global limits new financing to only $10.1 million, then it would need to make up the difference on its balance sheet. (Round to one decimal place.) its payout to shareholders by $ million to cut increase G nak Rof Income Statement ($ million) Net Sales Costs Except Depreciation EBITDA Depreciation and Amortization EBIT Interest Expense (net) Pre-tax Income Income Tax Net Income 188.5 180.2 8.3 -1.3 7.0 -7.7 -0.7 0.2 -0.5 Balance Sheet ($ million) Assets Cash Accounts Receivable Inventories Total Current Assets Net Property, Plant, and Equipment Total Assets 22.9 172 15.2 55.3 114.8 170.1 Liabilities and Equity Accounts Payable Long-Term Debt Total Liabilities Total Stockholders' Equity Total Liabilities and Equity 35.0 115.2 150.2 19.9 170.1