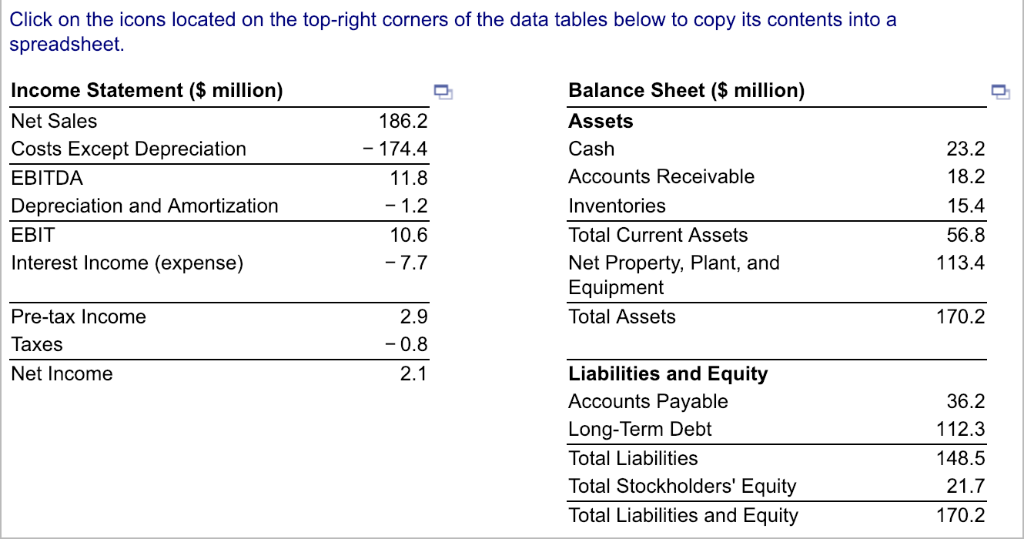

Global Corp. expects sales to grow by 7% next year. Assume that Global pays out 50% of its net income. Using the percent of sales

Global Corp. expects sales to grow by 7% next year. Assume that Global pays out 50% of its net income. Using the percent of sales method and the data provided in the following statement

forecast stockholders' equity.

The Tax Cuts and Jobs Act of 2017 temporarily allow 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career.

Example method

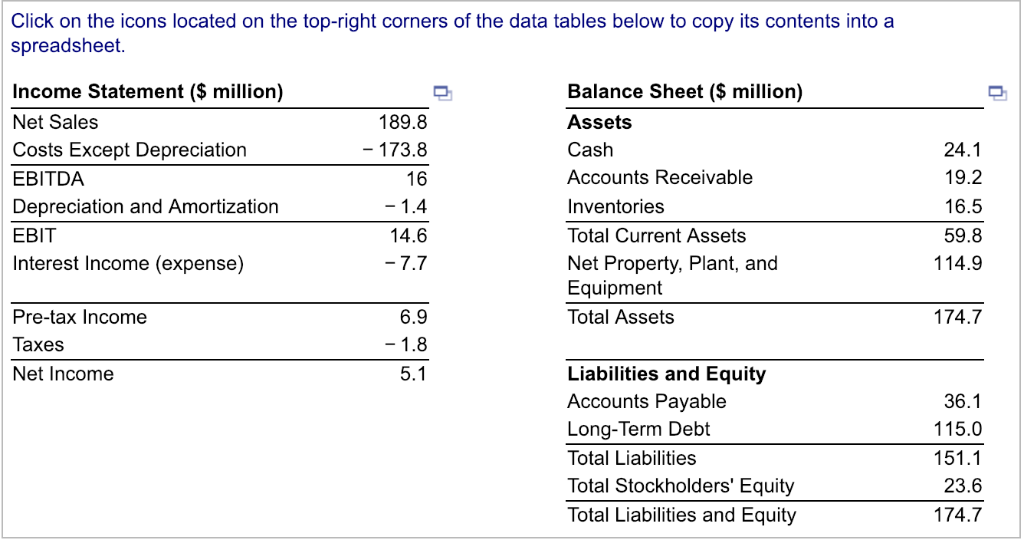

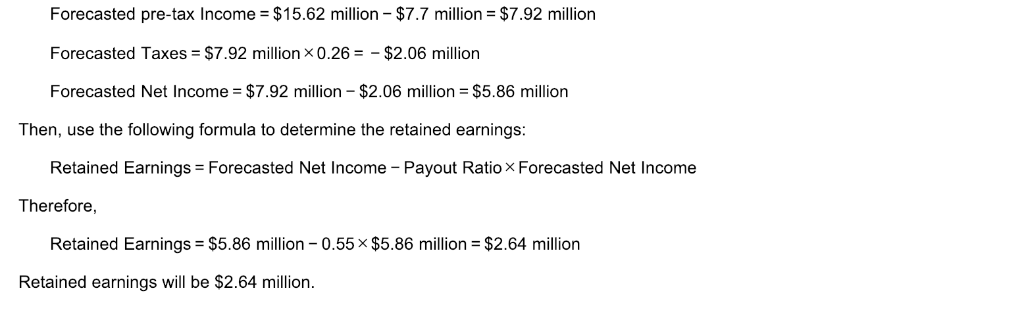

Click on the icons located on the top-right corners of the data tables below to copy its contents into a spreadsheet Income Statement ($ million) Net Sales Costs Except Depreciation EBITDA Depreciation and Amortization EBIT Interest Income (expense) Balance Sheet ($ million) Assets Cash Accounts Receivable Inventories Total Current Assets Net Property, Plant, and Equipment Total Assets 186.2 174.4 11.8 23.2 18.2 15.4 56.8 113.4 10.6 7.7 2.9 0.8 170.2 Pre-tax Income Taxes Net Income Liabilities and Equity Accounts Payable Long-Term Debt Total Liabilities Total Stockholders' Equity Total Liabilities and Equity 36.2 112.3 148.5 21.7 170.2 The forecasted stockholders' equity will be Smion. Round to two decimal places.) Click on the icons located on the top-right corners of the data tables below to copy its contents into a spreadsheet Income Statement ($million) Net Sales Costs Except Depreciation EBITDA Depreciation and Amortization EBIT Interest Income (expense) Balance Sheet ($ million) Assets Cash Accounts Receivable Inventories Total Current Assets Net Property, Plant, and Equipment Total Assets 189.8 173.8 24.1 19.2 16.5 59.8 114.9 14.6 7.7 6.9 5.1 174.7 Pre-tax Income Taxes Net Income Liabilities and Equity Accounts Payable Long-Term Debt Total Liabilities Total Stockholders' Equity Total Liabilities and Equity 36.1 115.0 151.1 23.6 174.7 Global Corp. expects sales to grow by 7% next year. Assume that Global pays out 55% of its net income. Using the percent of sales method and the data provided in the following statements, forecast stockholders' equity. The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. To determine the forecasted stockholders' equity, we need to know how much will be added to stockholders' equity from net income. First, to compute the forecasted sales, use the following formula: Forecasted Sales - Current Sales x (1+ Sales Growth Rate) Then, to compute the forecasted account value based on the percentage of sales method, use the following formula: Current EBIT Forecasted EBITx Forecasted Sales $14.6 million Forecasted EBIT- x $189.8 million (1 +0.07)= $15.62 million $189.8million Then, to get the forecasted pre-tax earnings deduct the interest expense from forecasted EBIT, and finally to get forecasted net income subtract the taxes from the forecasted pre-tax earning. Forecasted pre-tax income= $15.62 million-$7.7 million= $7.92 million Forecasted Taxes= $7.92 million 0.26--$2.06 million Forecasted Net Income $7.92 million -$2.06 million $5.86 million Then, use the following formula to determine the retained earnings: Retained Earnings = Forecasted Net Income-Payout Ratio Forecasted Net Income Therefore Retained Earnings-$5.86 million-0.55$5.86 million= $2.64 million Retained earnings will be $2.64 million. Then, to determine the forecasted stockholders' equity, use the following formula: Forecasted Stockholders' Equity Current Stockholders' Equity + Retained Earnings Therefore, Forecasted Stockholders' Equity $23.6 million+ $2.64 million $26.24 million The forecasted stockholders' equity will be $26.24 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started