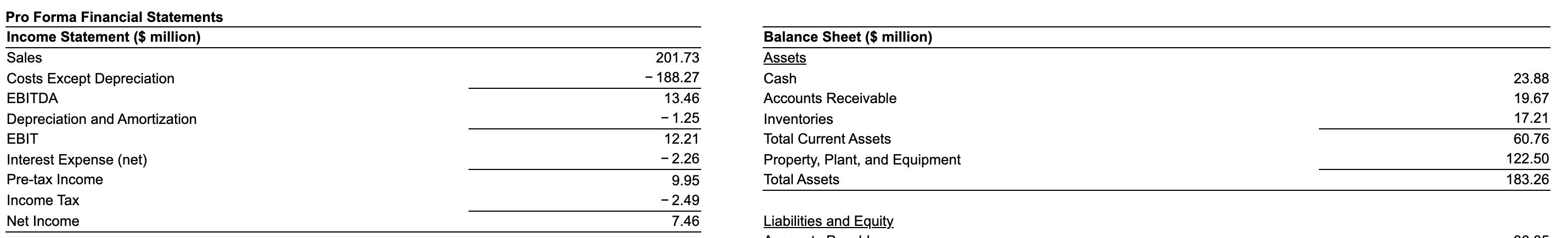

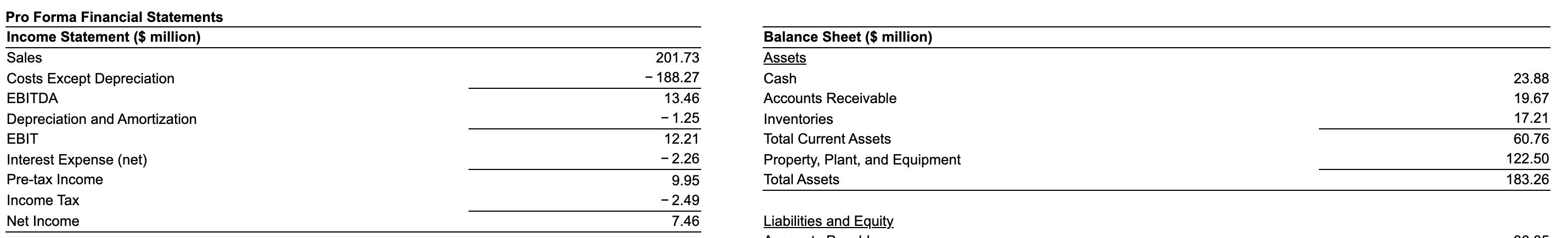

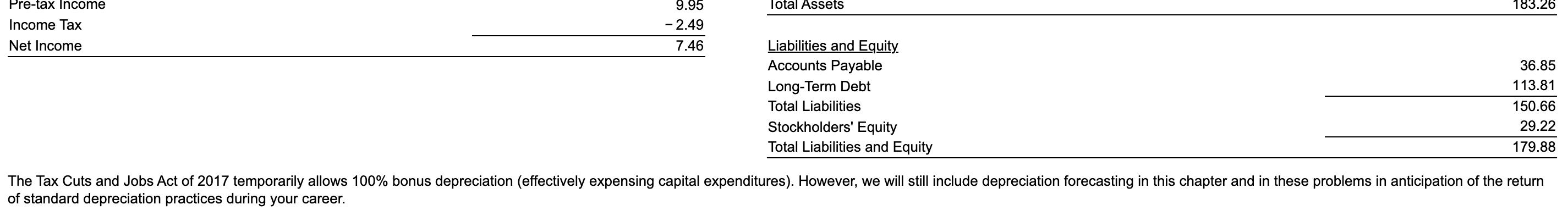

Global Corp. expects sales to grow by 8% next year. Assume that Global pays out 47% of its net income. Global developed the pro forma financial statements given below. If Global decides that it will limit its net new financing to no more than $3.10 million, how will this affect its payout policy? Global's current statements are in the following data table B. Click on the following icon for the pro forma income statement in order to copy its contents into a spreadsheet. Click on the following icon for the pro forma balance sheet in order to copy its contents into a spreadsheet. Pro Forma Financial Statements Pro Forma Financial Statements Income Statement ($ million) Sales Costs Except Depreciation EBITDA Depreciation and Amortization EBIT Interest Expense (net) Pre-tax Income Income Tax 201.73 - 188.27 13.46 - 1.25 12.21 - 2.26 9.95 -2.49 7.46 Balance Sheet ($ million) Assets Cash Accounts Receivable Inventories Total Current Assets Property, Plant, and Equipment Total Assets 23.88 19.67 17.21 60.76 122.50 183.26 Net Income Liabilities and Equity. nnn Total Assets 183.26 Pre-tax Income Income Tax 9.95 -2.49 Net Income 7.46 Liabilities and Equity. Accounts Payable Long-Term Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity 36.85 113.81 150.66 29.22 179.88 The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. Global Corp. expects sales to grow by 8% next year. Assume that Global pays out 47% of its net income. Global developed the pro forma financial statements given below. If Global decides that it will limit its net new financing to no more than $3.10 million, how will this affect its payout policy? Global's current statements are in the following data table B. Click on the following icon for the pro forma income statement in order to copy its contents into a spreadsheet. Click on the following icon for the pro forma balance sheet in order to copy its contents into a spreadsheet. Pro Forma Financial Statements Pro Forma Financial Statements Income Statement ($ million) Sales Costs Except Depreciation EBITDA Depreciation and Amortization EBIT Interest Expense (net) Pre-tax Income Income Tax 201.73 - 188.27 13.46 - 1.25 12.21 - 2.26 9.95 -2.49 7.46 Balance Sheet ($ million) Assets Cash Accounts Receivable Inventories Total Current Assets Property, Plant, and Equipment Total Assets 23.88 19.67 17.21 60.76 122.50 183.26 Net Income Liabilities and Equity. nnn Total Assets 183.26 Pre-tax Income Income Tax 9.95 -2.49 Net Income 7.46 Liabilities and Equity. Accounts Payable Long-Term Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity 36.85 113.81 150.66 29.22 179.88 The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career