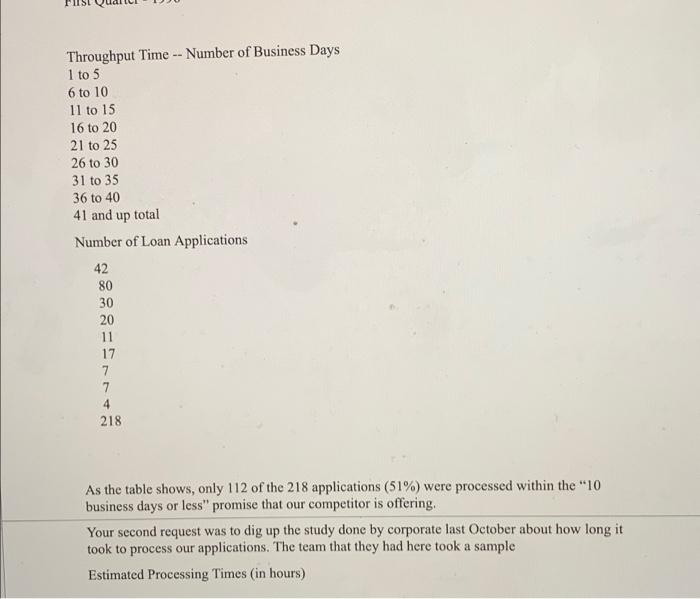

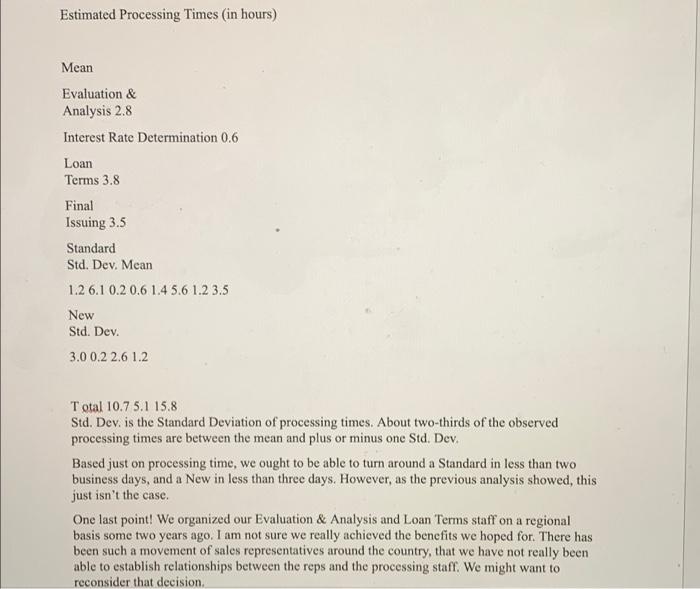

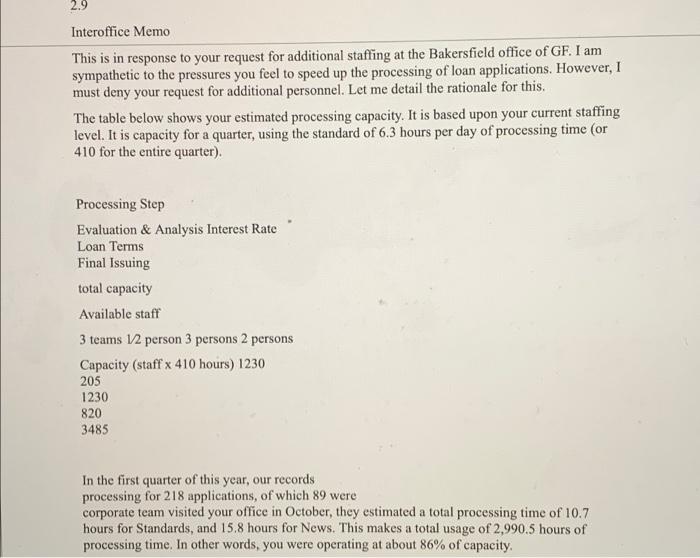

Global Equipment Company (GEC) manufactures and sells heavy equipment to construction companies, highway departments, farmers, and corporations. GEC has a sales force that calls on past customers and potential new ones to sell its equipment. GEC equipment is expensive, and an order may call for several pieces of equipment over a period. Much of the equipment purchased from GEC is financed by third-part financial organizations, sometimes involving lease arrangements. A given purchase can range from $50,000 to several million dollars. Such third- party financing can have certain tax advantages and is often a necessary condition for the sale. Global Financial Corporation (GF) is a subsidiary of GEC set up to handle the financing for those customers who wish it. The Bakersfield office of Global Financial handles the loan applications for the western United States. The office in Bakersfield, California, is relatively small, consisting of about 14 people who process and approve loans for financing. Nancy Rodriguez is a Vice President of Global Financial and the manager of the Bakersfield office. She has been in this position about one month, and a major crisis is in the making. Two weeks ago, she received a memo from the Director of Marketing at GEC indicating that the Bakersfield office was taking much too long to process loan applications. The chief competitor has promised to respond in 10 business days or less". She then asked John Rutherford, an analyst on her staff, to check on the actual processing times for loans for the past quarter, and this analysis produced an even gloomier picture (see Appendix B). Her request to corporate headquarters to hire more staff has been turned down, suggesting that she had adequate capacity. She has called for a meeting with the managers on her staff but is not sure what she or they might suggest. Processing of Loan Applications. When a GEC sales representative makes a sale to a customer who wishes to use financing, the sales representative works with the customer to fill out the necessary loan application papers. The application is then sent by FAX or overnight mail to the Bakersfield office. Applications are classified into one of two types, "Standards" and "News". A Standard application is from a customer who has purchased equipment and obtained a loan from Global Financial in the recent past. For such customers, the firm has a file of financial information and a past record of payments. About 40 percent of the loan applications are Standards. A loan application from a new customer is, of course, a New. The firm must obtain more detailed information in such cases. A loan application is also classified as a New if it is substantially different than past loans. For example, it may be for a substantially larger amount, or using a different payment schedule. a For example, it may be for a substantially larger amoli Evaluation and Analysis The first step in the loan processing is Evaluation and Analysis. This involves looking at the financial feasibility of the equipment loan from the buyer's perspective in order to determine the borrower's ability to repay. It also involves a credit analysis of the borrowing firm. The Evaluation and Analysis step is performed at GF by three teams of two persons each. The sales area is broken into three regions, and each team handles the applications from one of the three regions. This was originally organized in this way so that the analysis teams and the sales representatives would get to know each other and work more effectively together. The Evaluation and Analysis step is thorough, and therefore lengthy. It can take a team anywhere from 1 or 2 hours to 10 or 12 hours. News tends to take roughly twice as long as Standards, on average. But even within a category there is a great deal of variability because some loans are simple and straightforward, and others quite complicated involving lease-back and other arrangements. Interest Rate Determination. After the Evaluation and Analysis step has been completed a loan application file is passed on to the Interest Rate desk. Here the appropriate interest rate for the loan is determined. This depends upon general economic conditions in addition to specifics of the region and individual customer. This is a short step, taking about a half-hour per application. It is performed by one individual, who devotes about half his time to this task. Loan Terms. The next step in the application processing is to determine the exact loan and agreement terms. This often requires some financial analysis and can take from three to ten hours. It is performed by three individuals. As the case with Evaluation and Analysis, applications are sorted by regions, and everyone determines the loan terms for the applications from a particular region. Final Issuing. The final step in the process is the actual preparation of the paperwork for the loan. This involves taking what had been previously done by the others and, using individual plus "boiler plate" text, printing out the final papers. This takes about three or four hours and is performed by either of two individuals. No regional separation is used at this step. Last week we had a two-day meeting for all the sales representatives for GEC. A concern was raised on several occasions by sales representatives from the western region about the delay in getting loan approvals for equipment purchases. One or two reps claimed that it took six or seven weeks to get loan approvals through your office on a couple of occasions. I have not done a detailed study, and so I don't know if these were isolated incidents, but I do know that the concern about loan approval delay is widespread. This concern is heightened by the fact that our chief competitor has promised a "10 business day or less" response to potential customers. For some customers, the loan terms and conditions are an important part of the sale agreement, and if we do not get prompt response, we are in danger of losing the sale. I realize that some loan applications are quite complicated, involving new customers or large equipment purchases (I believe you refer to these cases as News). In situations like that, I think the customer would be more tolerant of delays. But for repeat business, we should be able to process the applications quickly. As you know we are initiating a very strong sales effort, with the hope of increasing our sales by 10 percent or more. To achieve this, we need fast turnaround time on loan applications. I would like to meet with you to see if we could make the same promise as our competitor of 10 business days or less" for approval. Interoffice Memo As you requested, I went through the loan applications that were completed in the first quarter of this year - there were 218 of them. They are time stamped when received and when sent back to the GEC sales representatives. So, I was able to get a good measurement of how long it took us to process them. The attached table gives a detailed breakdown of throughput time. A word of explanation is in order. As you know, we use a standard that says a workday is 6.3 hours of processing. Although we are here 8 hours, there is time spent in meetings, on personnel matters, etc. and the net effect is that 6.3 hours are devoted, on average, to application processing. This figure was estimated by the study that corporate did in October of last year. I used this 6.3-hour figure in calculating the throughput hours shown in the attached exhibit (Exhibit 1). You indicated that we might be expected to meet the "10 business days or less" standard advertised by our competitor. I have converted the last column of my exhibit into "business days" with the following result: First Quarter - 1996 Throughput Time -- Number of Business Days 1 to 5 6 to 10 11 to 15 16 to 20 21 to 25 26 to 30 31 to 35 36 to 40 41 and up total Number of Loan Applications 42 80 30 20 11 17 7 7 4 218 As the table shows, only 112 of the 218 applications (51%) were processed within the "10 business days or less" promise that our competitor is offering, Your second request was to dig up the study done by corporate last October about how long it took to process our applications. The team that they had here took a sample Estimated Processing Times (in hours) Estimated Processing Times (in hours) Mean Evaluation & Analysis 2.8 Interest Rate Determination 0.6 Loan Terms 3.8 Final Issuing 3.5 Standard Std. Dev. Mean 1.2 6.1 0.2 0.6 1.4 5.6 1.2 3.5 New Std. Dev. 3.0 0.2 2.6 1.2 Total 10.7 5.1 15.8 Std. Dev. is the Standard Deviation of processing times. About two-thirds of the observed processing times are between the mean and plus or minus one Std. Dev. Based just on processing time, we ought to be able to turn around a Standard in less than two business days, and a New in less than three days. However, as the previous analysis showed this just isn't the case. One last point! We organized our Evaluation & Analysis and Loan Terms staff on a regional basis some two years ago. I am not sure we really achieved the benefits we hoped for. There has been such a movement of sales representatives around the country, that we have not really been able to establish relationships between the reps and the processing staff. We might want to reconsider that decision 2.9 Interoffice Memo This is in response to your request for additional staffing at the Bakersfield office of GF. I am sympathetic to the pressures you feel to speed up the processing of loan applications. However, I must deny your request for additional personnel. Let me detail the rationale for this. The table below shows your estimated processing capacity. It is based upon your current staffing level. It is capacity for a quarter, using the standard of 6.3 hours per day of processing time (or 410 for the entire quarter). Processing Step Evaluation & Analysis Interest Rate Loan Terms Final Issuing total capacity Available staff 3 teams 12 person 3 persons 2 persons Capacity (staff x 410 hours) 1230 205 1230 820 3485 In the first quarter of this year, our records processing for 218 applications, of which 89 were corporate team visited your office in October, they estimated a total processing time of 10.7 hours for Standards, and 15,8 hours for News. This makes a total usage of 2,990.5 hours of processing time. In other words, you were operating at about 86% of capacity processing for 218 applications, of which 89 were corporate team visited your office in October, they estimated a total processing time of 10.7 hours for Standards, and 15.8 hours for News. This makes a total usage of 2,990.5 hours of processing time. In other words, you were operating at about 86% of capacity. Thus, the need for more staff is not apparent. In fact, you ought to be able to handle the 10% increase in applications you mentioned in your request. This would still leave you well below 100% of capacity. You might also be interested to know that the Northeast office handles about 35% more applications than your office does with essentially the same staff. They have organized the work much differently, and you may want to visit that office to get some ideas about how you might improve your efficiency. Questions: 1. Suggest a web/online strategy for the firm.? Global Equipment Company (GEC) manufactures and sells heavy equipment to construction companies, highway departments, farmers, and corporations. GEC has a sales force that calls on past customers and potential new ones to sell its equipment. GEC equipment is expensive, and an order may call for several pieces of equipment over a period. Much of the equipment purchased from GEC is financed by third-part financial organizations, sometimes involving lease arrangements. A given purchase can range from $50,000 to several million dollars. Such third- party financing can have certain tax advantages and is often a necessary condition for the sale. Global Financial Corporation (GF) is a subsidiary of GEC set up to handle the financing for those customers who wish it. The Bakersfield office of Global Financial handles the loan applications for the western United States. The office in Bakersfield, California, is relatively small, consisting of about 14 people who process and approve loans for financing. Nancy Rodriguez is a Vice President of Global Financial and the manager of the Bakersfield office. She has been in this position about one month, and a major crisis is in the making. Two weeks ago, she received a memo from the Director of Marketing at GEC indicating that the Bakersfield office was taking much too long to process loan applications. The chief competitor has promised to respond in 10 business days or less". She then asked John Rutherford, an analyst on her staff, to check on the actual processing times for loans for the past quarter, and this analysis produced an even gloomier picture (see Appendix B). Her request to corporate headquarters to hire more staff has been turned down, suggesting that she had adequate capacity. She has called for a meeting with the managers on her staff but is not sure what she or they might suggest. Processing of Loan Applications. When a GEC sales representative makes a sale to a customer who wishes to use financing, the sales representative works with the customer to fill out the necessary loan application papers. The application is then sent by FAX or overnight mail to the Bakersfield office. Applications are classified into one of two types, "Standards" and "News". A Standard application is from a customer who has purchased equipment and obtained a loan from Global Financial in the recent past. For such customers, the firm has a file of financial information and a past record of payments. About 40 percent of the loan applications are Standards. A loan application from a new customer is, of course, a New. The firm must obtain more detailed information in such cases. A loan application is also classified as a New if it is substantially different than past loans. For example, it may be for a substantially larger amount, or using a different payment schedule. a For example, it may be for a substantially larger amoli Evaluation and Analysis The first step in the loan processing is Evaluation and Analysis. This involves looking at the financial feasibility of the equipment loan from the buyer's perspective in order to determine the borrower's ability to repay. It also involves a credit analysis of the borrowing firm. The Evaluation and Analysis step is performed at GF by three teams of two persons each. The sales area is broken into three regions, and each team handles the applications from one of the three regions. This was originally organized in this way so that the analysis teams and the sales representatives would get to know each other and work more effectively together. The Evaluation and Analysis step is thorough, and therefore lengthy. It can take a team anywhere from 1 or 2 hours to 10 or 12 hours. News tends to take roughly twice as long as Standards, on average. But even within a category there is a great deal of variability because some loans are simple and straightforward, and others quite complicated involving lease-back and other arrangements. Interest Rate Determination. After the Evaluation and Analysis step has been completed a loan application file is passed on to the Interest Rate desk. Here the appropriate interest rate for the loan is determined. This depends upon general economic conditions in addition to specifics of the region and individual customer. This is a short step, taking about a half-hour per application. It is performed by one individual, who devotes about half his time to this task. Loan Terms. The next step in the application processing is to determine the exact loan and agreement terms. This often requires some financial analysis and can take from three to ten hours. It is performed by three individuals. As the case with Evaluation and Analysis, applications are sorted by regions, and everyone determines the loan terms for the applications from a particular region. Final Issuing. The final step in the process is the actual preparation of the paperwork for the loan. This involves taking what had been previously done by the others and, using individual plus "boiler plate" text, printing out the final papers. This takes about three or four hours and is performed by either of two individuals. No regional separation is used at this step. Last week we had a two-day meeting for all the sales representatives for GEC. A concern was raised on several occasions by sales representatives from the western region about the delay in getting loan approvals for equipment purchases. One or two reps claimed that it took six or seven weeks to get loan approvals through your office on a couple of occasions. I have not done a detailed study, and so I don't know if these were isolated incidents, but I do know that the concern about loan approval delay is widespread. This concern is heightened by the fact that our chief competitor has promised a "10 business day or less" response to potential customers. For some customers, the loan terms and conditions are an important part of the sale agreement, and if we do not get prompt response, we are in danger of losing the sale. I realize that some loan applications are quite complicated, involving new customers or large equipment purchases (I believe you refer to these cases as News). In situations like that, I think the customer would be more tolerant of delays. But for repeat business, we should be able to process the applications quickly. As you know we are initiating a very strong sales effort, with the hope of increasing our sales by 10 percent or more. To achieve this, we need fast turnaround time on loan applications. I would like to meet with you to see if we could make the same promise as our competitor of 10 business days or less" for approval. Interoffice Memo As you requested, I went through the loan applications that were completed in the first quarter of this year - there were 218 of them. They are time stamped when received and when sent back to the GEC sales representatives. So, I was able to get a good measurement of how long it took us to process them. The attached table gives a detailed breakdown of throughput time. A word of explanation is in order. As you know, we use a standard that says a workday is 6.3 hours of processing. Although we are here 8 hours, there is time spent in meetings, on personnel matters, etc. and the net effect is that 6.3 hours are devoted, on average, to application processing. This figure was estimated by the study that corporate did in October of last year. I used this 6.3-hour figure in calculating the throughput hours shown in the attached exhibit (Exhibit 1). You indicated that we might be expected to meet the "10 business days or less" standard advertised by our competitor. I have converted the last column of my exhibit into "business days" with the following result: First Quarter - 1996 Throughput Time -- Number of Business Days 1 to 5 6 to 10 11 to 15 16 to 20 21 to 25 26 to 30 31 to 35 36 to 40 41 and up total Number of Loan Applications 42 80 30 20 11 17 7 7 4 218 As the table shows, only 112 of the 218 applications (51%) were processed within the "10 business days or less" promise that our competitor is offering, Your second request was to dig up the study done by corporate last October about how long it took to process our applications. The team that they had here took a sample Estimated Processing Times (in hours) Estimated Processing Times (in hours) Mean Evaluation & Analysis 2.8 Interest Rate Determination 0.6 Loan Terms 3.8 Final Issuing 3.5 Standard Std. Dev. Mean 1.2 6.1 0.2 0.6 1.4 5.6 1.2 3.5 New Std. Dev. 3.0 0.2 2.6 1.2 Total 10.7 5.1 15.8 Std. Dev. is the Standard Deviation of processing times. About two-thirds of the observed processing times are between the mean and plus or minus one Std. Dev. Based just on processing time, we ought to be able to turn around a Standard in less than two business days, and a New in less than three days. However, as the previous analysis showed this just isn't the case. One last point! We organized our Evaluation & Analysis and Loan Terms staff on a regional basis some two years ago. I am not sure we really achieved the benefits we hoped for. There has been such a movement of sales representatives around the country, that we have not really been able to establish relationships between the reps and the processing staff. We might want to reconsider that decision 2.9 Interoffice Memo This is in response to your request for additional staffing at the Bakersfield office of GF. I am sympathetic to the pressures you feel to speed up the processing of loan applications. However, I must deny your request for additional personnel. Let me detail the rationale for this. The table below shows your estimated processing capacity. It is based upon your current staffing level. It is capacity for a quarter, using the standard of 6.3 hours per day of processing time (or 410 for the entire quarter). Processing Step Evaluation & Analysis Interest Rate Loan Terms Final Issuing total capacity Available staff 3 teams 12 person 3 persons 2 persons Capacity (staff x 410 hours) 1230 205 1230 820 3485 In the first quarter of this year, our records processing for 218 applications, of which 89 were corporate team visited your office in October, they estimated a total processing time of 10.7 hours for Standards, and 15,8 hours for News. This makes a total usage of 2,990.5 hours of processing time. In other words, you were operating at about 86% of capacity processing for 218 applications, of which 89 were corporate team visited your office in October, they estimated a total processing time of 10.7 hours for Standards, and 15.8 hours for News. This makes a total usage of 2,990.5 hours of processing time. In other words, you were operating at about 86% of capacity. Thus, the need for more staff is not apparent. In fact, you ought to be able to handle the 10% increase in applications you mentioned in your request. This would still leave you well below 100% of capacity. You might also be interested to know that the Northeast office handles about 35% more applications than your office does with essentially the same staff. They have organized the work much differently, and you may want to visit that office to get some ideas about how you might improve your efficiency. Questions: 1. Suggest a web/online strategy for the firm