Question

Global Industries Inc. (GII), a US conglomerate, has a debt-to-equity ratio of 0.3 and a WACC of 10%. At this level of leverage, GII's debt

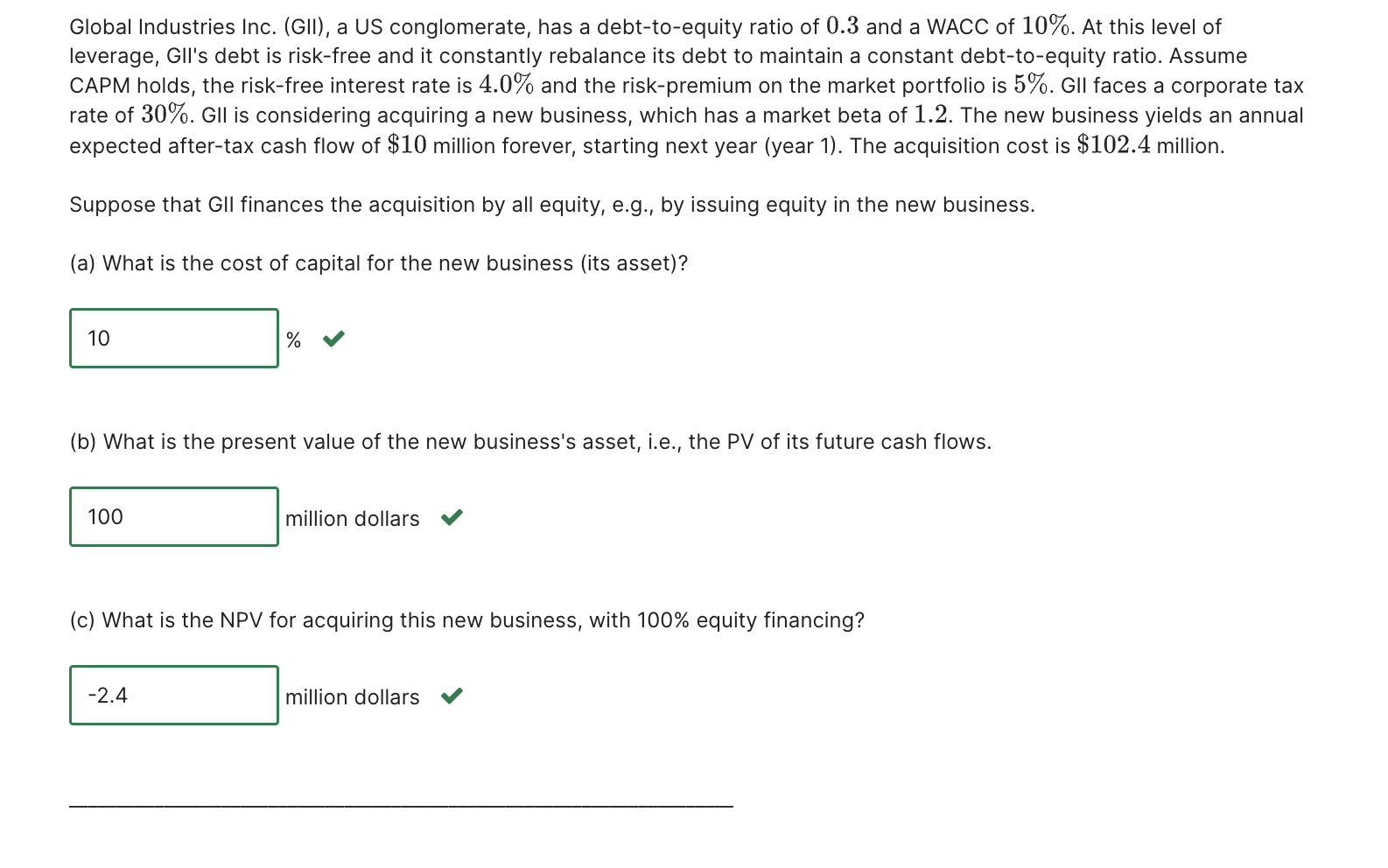

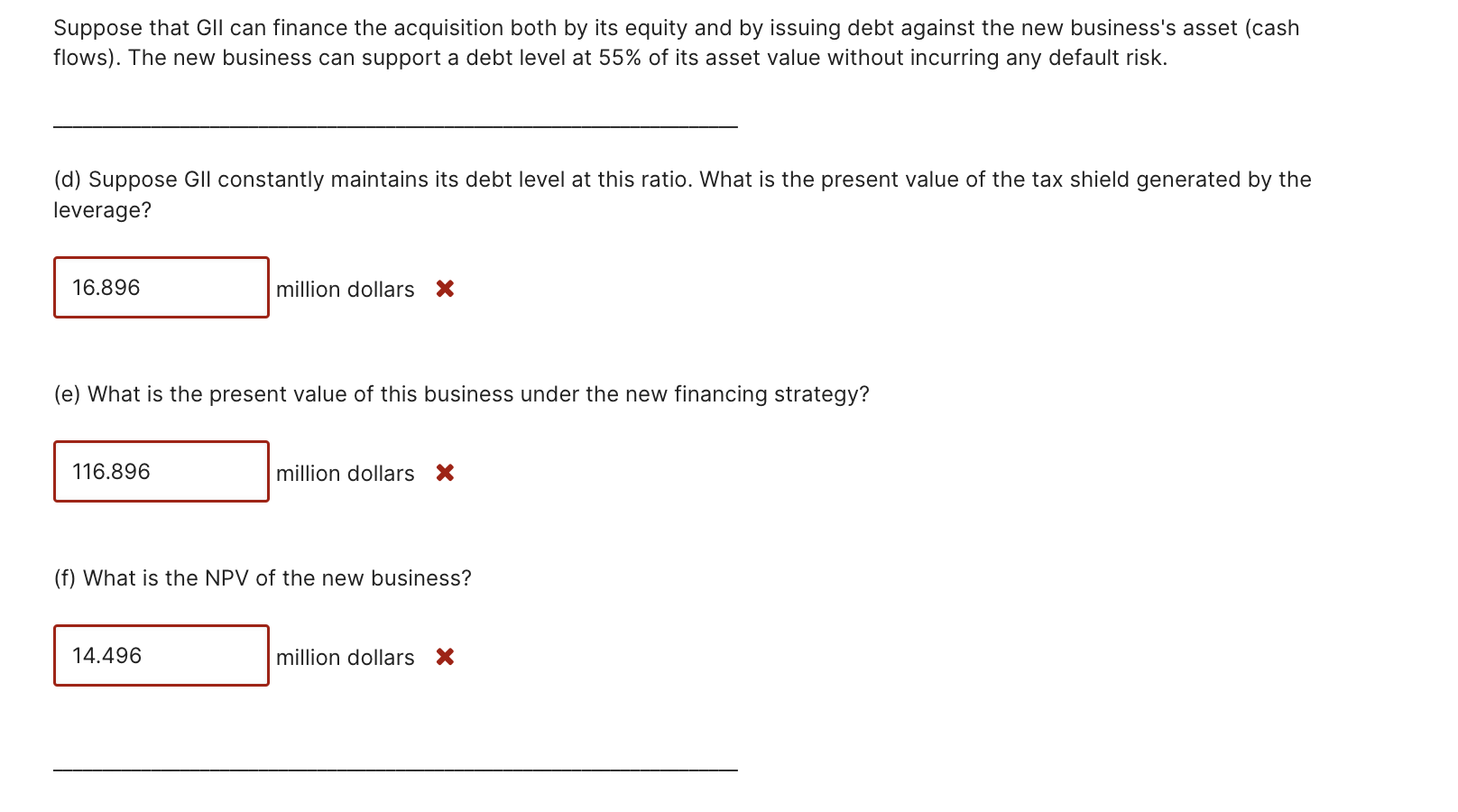

Global Industries Inc. (GII), a US conglomerate, has a debt-to-equity ratio of 0.3 and a WACC of 10%. At this level of leverage, GII's debt is risk-free and it constantly rebalance its debt to maintain a constant debt-to-equity ratio. Assume CAPM holds, the risk-free interest rate is 4.0% and the risk-premium on the market portfolio is 5%. GII faces a corporate tax rate of 30% . GII is considering acquiring a new business, which has a market beta of 1.2. The new business yields an annual expected after-tax cash flow of 10 million forever, starting next year (year 1). The acquisition cost is 102.4 million. Suppose that GII finances the acquisition by all equity, e.g., by issuing equity in the new business. Suppose that GII can finance the acquisition both by its equity and by issuing debt against the new business's asset (cash flows). The new business can support a debt level at 55% of its asset value without incurring any default risk. Please help to answer the incorrect ones. Don't copy from others!!!!! Urgent! (d) (e) (f)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started