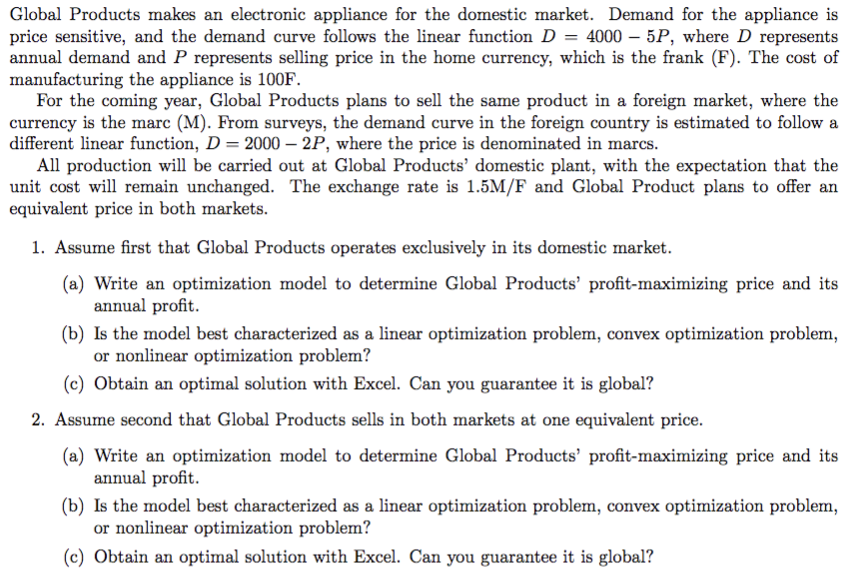

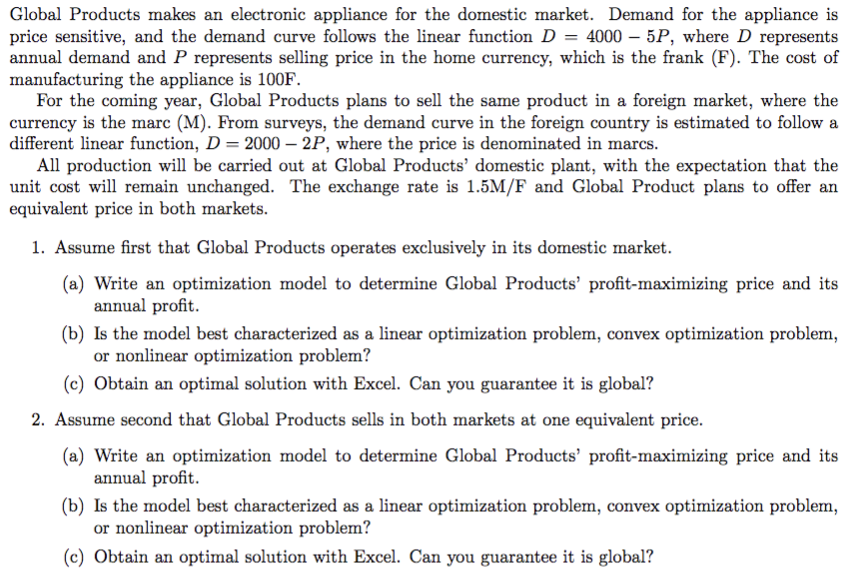

Global Products makes an electronic appliance for the domestic market. Demand for the appliance is price sensitive, and the demand curve follows the linear function D = 4000 5P, where D represents annual demand and P represents selling price in the home currency, which is the frank (F). The cost of manufacturing the appliance is 100F. For the coming year, Global Products plans to sell the same product in a foreign market, where the currency is the marc (M). From surveys, the demand curve in the foreign country is estimated to follow a different linear function, D = 2000 - 2P, where the price is denominated in marcs. All production will be carried out at Global Products' domestic plant, with the expectation that the unit cost will remain unchanged. The exchange rate is 1.5M/F and Global Product plans to offer an equivalent price in both markets. 1. Assume first that Global Products operates exclusively in its domestic market. (a) Write an optimization model to determine Global Products' profit-maximizing price and its annual profit. (b) is the model best characterized as a linear optimization problem, convex optimization problem, or nonlinear optimization problem? (c) Obtain an optimal solution with Excel. Can you guarantee it is global? 2. Assume second that Global Products sells in both markets at one equivalent price. (a) Write an optimization model to determine Global Products' profit-maximizing price and its annual profit. (b) Is the model best characterized as a linear optimization problem, convex optimization problem, or nonlinear optimization problem? (c) Obtain an optimal solution with Excel. Can you guarantee it is global? Global Products makes an electronic appliance for the domestic market. Demand for the appliance is price sensitive, and the demand curve follows the linear function D = 4000 5P, where D represents annual demand and P represents selling price in the home currency, which is the frank (F). The cost of manufacturing the appliance is 100F. For the coming year, Global Products plans to sell the same product in a foreign market, where the currency is the marc (M). From surveys, the demand curve in the foreign country is estimated to follow a different linear function, D = 2000 - 2P, where the price is denominated in marcs. All production will be carried out at Global Products' domestic plant, with the expectation that the unit cost will remain unchanged. The exchange rate is 1.5M/F and Global Product plans to offer an equivalent price in both markets. 1. Assume first that Global Products operates exclusively in its domestic market. (a) Write an optimization model to determine Global Products' profit-maximizing price and its annual profit. (b) is the model best characterized as a linear optimization problem, convex optimization problem, or nonlinear optimization problem? (c) Obtain an optimal solution with Excel. Can you guarantee it is global? 2. Assume second that Global Products sells in both markets at one equivalent price. (a) Write an optimization model to determine Global Products' profit-maximizing price and its annual profit. (b) Is the model best characterized as a linear optimization problem, convex optimization problem, or nonlinear optimization problem? (c) Obtain an optimal solution with Excel. Can you guarantee it is global