Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gloria, a licensed life agent, meets annually with Bill when he makes his maximum contribution to his RRSP Bill earns over $200,000 annually as

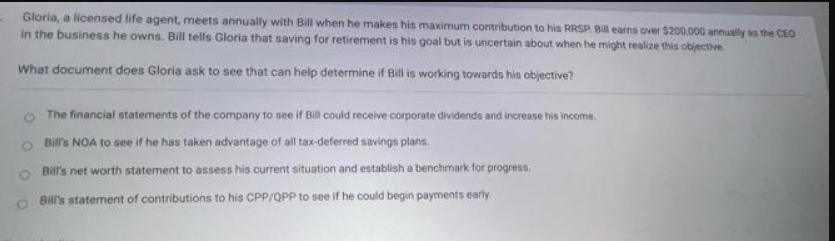

Gloria, a licensed life agent, meets annually with Bill when he makes his maximum contribution to his RRSP Bill earns over $200,000 annually as the CEO in the business he owns. Bill tells Gloria that saving for retirement is his goal but is uncertain about when he might realize this objective What document does Gloria ask to see that can help determine if Bill is working towards his objective? The financial statements of the company to see if Bill could receive corporate dividends and increase his income. Bill's NOA to see if he has taken advantage of all tax-deferred savings plans. Bill's net worth statement to assess his current situation and establish a benchmark for progress. Bill's statement of contributions to his CPP/QPP to see if he could begin payments early

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Gloria would likely ask to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started