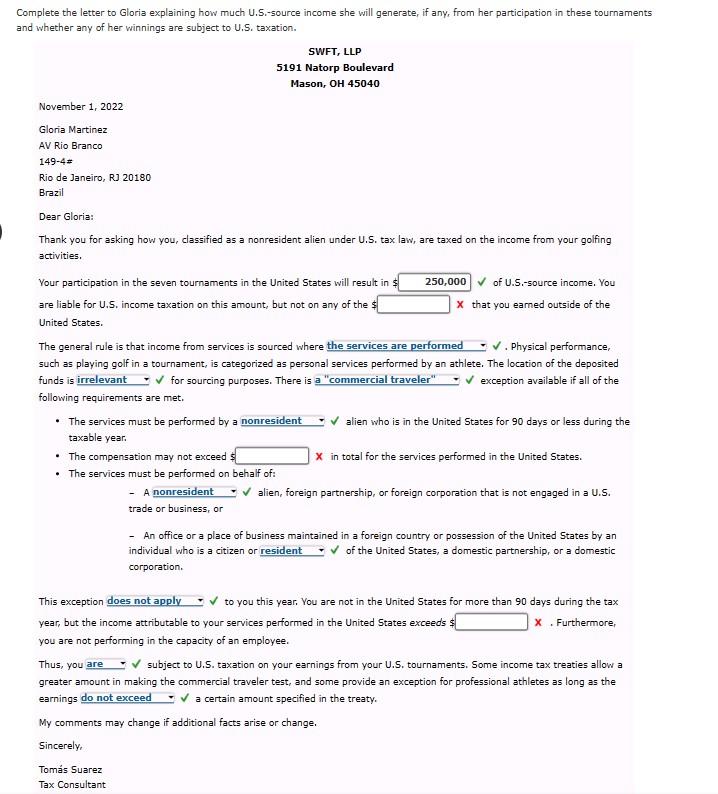

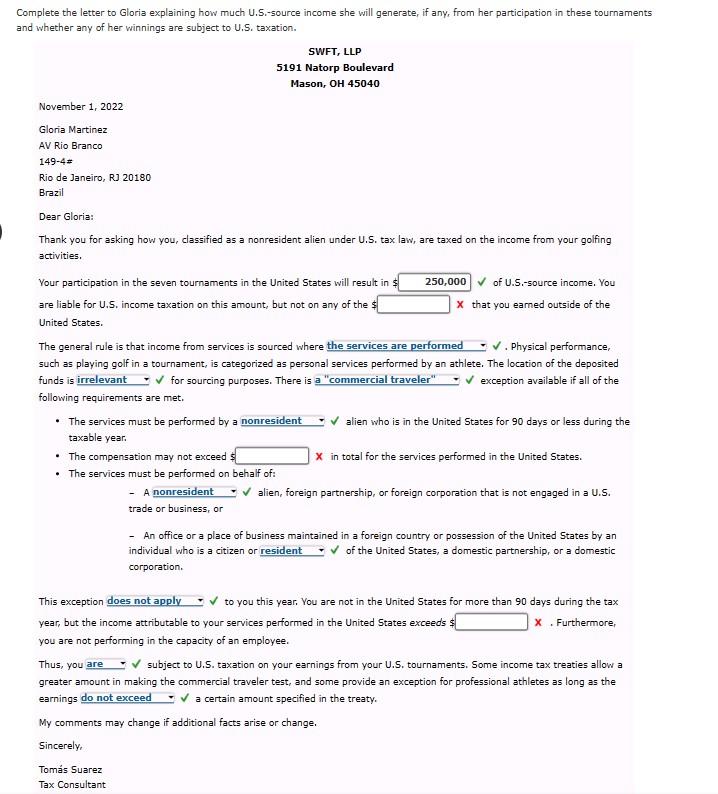

Gloria Martinez, an NRA, is a professional golfer. She played in seven tournaments in the United States in the current year and earned $250,000 in prizes from these tournaments. She deposited the winnings in a bank account she opened in Mexico City after her first tournament win. Gloria played a total of 30 tournaments for the year and earned $800,000 in total prize money. She spent 40 days in the United States, 60 days in England, 20 days in Scotland, and the rest of the time in South America. Complete the letter to Gloria explaining how much U.S.-source income she will generate, if any, from her participation in these tournaments and whether any of her winnings are subject to U.S. taxation. SWFT, LLP 5191 Natorp Boulevard Mason, OH 45040 November 1, 2022 Gloria Martinez AV Rio Branco 149-4# Rio de Janeiro, RJ 20180 Brazil Dear Gloria: Thank you for asking how you, classified as a nonresident alien under U.S. tax law, are taxed on the income from your golfing activities. Your participation in the seven tournaments in the United States will result in $fill in the blank 1 250,000 of U.S.-source income. You are liable for U.S. income taxation on this amount, but not on any of the $fill in the blank 2 that you earned outside of the United States. The general rule is that income from services is sourced where the services are performed . Physical performance, such as playing golf in a tournament, is categorized as personal services performed by an athlete. The location of the deposited funds is irrelevant for sourcing purposes. There is a "commercial traveler" exception available if all of the following requirements are met. The services must be performed by a nonresident alien who is in the United States for 90 days or less during the taxable year. The compensation may not exceed $fill in the blank 7 in total for the services performed in the United States. The services must be performed on behalf of: A nonresident alien, foreign partnership, or foreign corporation that is not engaged in a U.S. trade or business, or An office or a place of business maintained in a foreign country or possession of the United States by an individual who is a citizen or resident of the United States, a domestic partnership, or a domestic corporation. This exception does not apply to you this year. You are not in the United States for more than 90 days during the tax year, but the income attributable to your services performed in the United States exceeds $fill in the blank 11 . Furthermore, you are not performing in the capacity of an employee. Thus, you are subject to U.S. taxation on your earnings from your U.S. tournaments. Some income tax treaties allow a greater amount in making the commercial traveler test, and some provide an exception for professional athletes as long as the earnings do not exceed a certain amount specified in the treaty. My comments may change if additional facts arise or change. Sincerely, Toms Suarez Tax Consultant

Gloria Martinez, an NRA, is a professional golfer. She played in seven tournaments in the United States in the current year and earned $250,000 in prizes from these tournaments. She deposited the winnings in a bank account she opened in Mexico City after her first tournament win. Gloria played a total of 30 tournaments for the year and earned $800,000 in total prize money. She spent 40 days in the United States, 60 days in England, 20 days in Scotland, and the rest of the time in South America. Complete the letter to Gloria explaining how much U.S.-source income she will generate, if any, from her participation in these tournaments and whether any of her winnings are subject to U.S. taxation. SWFT, LLP 5191 Natorp Boulevard Mason, OH 45040 November 1, 2022 Gloria Martinez AV Rio Branco 149-4# Rio de Janeiro, RJ 20180 Brazil Dear Gloria: Thank you for asking how you, classified as a nonresident alien under U.S. tax law, are taxed on the income from your golfing activities. Your participation in the seven tournaments in the United States will result in $fill in the blank 1 250,000 of U.S.-source income. You are liable for U.S. income taxation on this amount, but not on any of the $fill in the blank 2 that you earned outside of the United States. The general rule is that income from services is sourced where the services are performed . Physical performance, such as playing golf in a tournament, is categorized as personal services performed by an athlete. The location of the deposited funds is irrelevant for sourcing purposes. There is a "commercial traveler" exception available if all of the following requirements are met. The services must be performed by a nonresident alien who is in the United States for 90 days or less during the taxable year. The compensation may not exceed $fill in the blank 7 in total for the services performed in the United States. The services must be performed on behalf of: A nonresident alien, foreign partnership, or foreign corporation that is not engaged in a U.S. trade or business, or An office or a place of business maintained in a foreign country or possession of the United States by an individual who is a citizen or resident of the United States, a domestic partnership, or a domestic corporation. This exception does not apply to you this year. You are not in the United States for more than 90 days during the tax year, but the income attributable to your services performed in the United States exceeds $fill in the blank 11 . Furthermore, you are not performing in the capacity of an employee. Thus, you are subject to U.S. taxation on your earnings from your U.S. tournaments. Some income tax treaties allow a greater amount in making the commercial traveler test, and some provide an exception for professional athletes as long as the earnings do not exceed a certain amount specified in the treaty. My comments may change if additional facts arise or change. Sincerely, Toms Suarez Tax Consultant

Complete the letter to Gloria explaining how much U.S.-source income she will generate, if any, from her participation in these tournaments and whether any of her winnings are subject to U.S. taxation. SWFT, LLP 5191 Natorp Boulevard Mason, OH 45040 November 1,2022 Gloria Martinez AV Rio Branco 1494= Rio de Janeiro, RJ 20180 Brazil Dear Gloria: Thank you for asking how you, classified as a nonresident alien under U.S. tax law, are taxed on the income from your golfing activities. Your participation in the seven toumaments in the United States will result in \& of U.S.-source income. You are liable for U.S. income taxation on this amount, but not on any of the \& x that you eamed outside of the United States. The general rule is that income from services is sourced where . Physical performance, such as playing golf in a tournament, is categorized as personal services performed by an athlete. The location of the deposited funds is for sourcing purposes. There is exception available if all of the following requirements are met. - The services must be performed by a alien who is in the United States for 90 days or less during the taxable year. - The compensation may not exceed \& X in total for the services performed in the United States. - The services must be performed on behalf of: - f alien, foreign partnership, or foreign corporation that is not engaged in a U.S. trade or business, or - An office or a place of business maintained in a foreign country or possession of the United States by an individual who is a citizen or of the United States, a domestic partnership, or a domestic corporation. This exception to you this year. You are not in the United States for more than 90 days during the tax year, but the income attributable to your services performed in the United States exceeds \& X. Furthermore, you are not performing in the capacity of an employee. Thus, you subject to U.S. taxation on your earnings from your U.S. tournaments. Some income tax treaties allow a greater amount in making the commercial traveler test, and some provide an exception for professional athletes as long as the earnings a certain amount specified in the treaty. My comments may change if additional facts arise or change. Sincerely, Toms Suarez Tax Consultant Complete the letter to Gloria explaining how much U.S.-source income she will generate, if any, from her participation in these tournaments and whether any of her winnings are subject to U.S. taxation. SWFT, LLP 5191 Natorp Boulevard Mason, OH 45040 November 1,2022 Gloria Martinez AV Rio Branco 1494= Rio de Janeiro, RJ 20180 Brazil Dear Gloria: Thank you for asking how you, classified as a nonresident alien under U.S. tax law, are taxed on the income from your golfing activities. Your participation in the seven toumaments in the United States will result in \& of U.S.-source income. You are liable for U.S. income taxation on this amount, but not on any of the \& x that you eamed outside of the United States. The general rule is that income from services is sourced where . Physical performance, such as playing golf in a tournament, is categorized as personal services performed by an athlete. The location of the deposited funds is for sourcing purposes. There is exception available if all of the following requirements are met. - The services must be performed by a alien who is in the United States for 90 days or less during the taxable year. - The compensation may not exceed \& X in total for the services performed in the United States. - The services must be performed on behalf of: - f alien, foreign partnership, or foreign corporation that is not engaged in a U.S. trade or business, or - An office or a place of business maintained in a foreign country or possession of the United States by an individual who is a citizen or of the United States, a domestic partnership, or a domestic corporation. This exception to you this year. You are not in the United States for more than 90 days during the tax year, but the income attributable to your services performed in the United States exceeds \& X. Furthermore, you are not performing in the capacity of an employee. Thus, you subject to U.S. taxation on your earnings from your U.S. tournaments. Some income tax treaties allow a greater amount in making the commercial traveler test, and some provide an exception for professional athletes as long as the earnings a certain amount specified in the treaty. My comments may change if additional facts arise or change. Sincerely, Toms Suarez Tax Consultant

Gloria Martinez, an NRA, is a professional golfer. She played in seven tournaments in the United States in the current year and earned $250,000 in prizes from these tournaments. She deposited the winnings in a bank account she opened in Mexico City after her first tournament win. Gloria played a total of 30 tournaments for the year and earned $800,000 in total prize money. She spent 40 days in the United States, 60 days in England, 20 days in Scotland, and the rest of the time in South America. Complete the letter to Gloria explaining how much U.S.-source income she will generate, if any, from her participation in these tournaments and whether any of her winnings are subject to U.S. taxation. SWFT, LLP 5191 Natorp Boulevard Mason, OH 45040 November 1, 2022 Gloria Martinez AV Rio Branco 149-4# Rio de Janeiro, RJ 20180 Brazil Dear Gloria: Thank you for asking how you, classified as a nonresident alien under U.S. tax law, are taxed on the income from your golfing activities. Your participation in the seven tournaments in the United States will result in $fill in the blank 1 250,000 of U.S.-source income. You are liable for U.S. income taxation on this amount, but not on any of the $fill in the blank 2 that you earned outside of the United States. The general rule is that income from services is sourced where the services are performed . Physical performance, such as playing golf in a tournament, is categorized as personal services performed by an athlete. The location of the deposited funds is irrelevant for sourcing purposes. There is a "commercial traveler" exception available if all of the following requirements are met. The services must be performed by a nonresident alien who is in the United States for 90 days or less during the taxable year. The compensation may not exceed $fill in the blank 7 in total for the services performed in the United States. The services must be performed on behalf of: A nonresident alien, foreign partnership, or foreign corporation that is not engaged in a U.S. trade or business, or An office or a place of business maintained in a foreign country or possession of the United States by an individual who is a citizen or resident of the United States, a domestic partnership, or a domestic corporation. This exception does not apply to you this year. You are not in the United States for more than 90 days during the tax year, but the income attributable to your services performed in the United States exceeds $fill in the blank 11 . Furthermore, you are not performing in the capacity of an employee. Thus, you are subject to U.S. taxation on your earnings from your U.S. tournaments. Some income tax treaties allow a greater amount in making the commercial traveler test, and some provide an exception for professional athletes as long as the earnings do not exceed a certain amount specified in the treaty. My comments may change if additional facts arise or change. Sincerely, Toms Suarez Tax Consultant

Gloria Martinez, an NRA, is a professional golfer. She played in seven tournaments in the United States in the current year and earned $250,000 in prizes from these tournaments. She deposited the winnings in a bank account she opened in Mexico City after her first tournament win. Gloria played a total of 30 tournaments for the year and earned $800,000 in total prize money. She spent 40 days in the United States, 60 days in England, 20 days in Scotland, and the rest of the time in South America. Complete the letter to Gloria explaining how much U.S.-source income she will generate, if any, from her participation in these tournaments and whether any of her winnings are subject to U.S. taxation. SWFT, LLP 5191 Natorp Boulevard Mason, OH 45040 November 1, 2022 Gloria Martinez AV Rio Branco 149-4# Rio de Janeiro, RJ 20180 Brazil Dear Gloria: Thank you for asking how you, classified as a nonresident alien under U.S. tax law, are taxed on the income from your golfing activities. Your participation in the seven tournaments in the United States will result in $fill in the blank 1 250,000 of U.S.-source income. You are liable for U.S. income taxation on this amount, but not on any of the $fill in the blank 2 that you earned outside of the United States. The general rule is that income from services is sourced where the services are performed . Physical performance, such as playing golf in a tournament, is categorized as personal services performed by an athlete. The location of the deposited funds is irrelevant for sourcing purposes. There is a "commercial traveler" exception available if all of the following requirements are met. The services must be performed by a nonresident alien who is in the United States for 90 days or less during the taxable year. The compensation may not exceed $fill in the blank 7 in total for the services performed in the United States. The services must be performed on behalf of: A nonresident alien, foreign partnership, or foreign corporation that is not engaged in a U.S. trade or business, or An office or a place of business maintained in a foreign country or possession of the United States by an individual who is a citizen or resident of the United States, a domestic partnership, or a domestic corporation. This exception does not apply to you this year. You are not in the United States for more than 90 days during the tax year, but the income attributable to your services performed in the United States exceeds $fill in the blank 11 . Furthermore, you are not performing in the capacity of an employee. Thus, you are subject to U.S. taxation on your earnings from your U.S. tournaments. Some income tax treaties allow a greater amount in making the commercial traveler test, and some provide an exception for professional athletes as long as the earnings do not exceed a certain amount specified in the treaty. My comments may change if additional facts arise or change. Sincerely, Toms Suarez Tax Consultant