Question

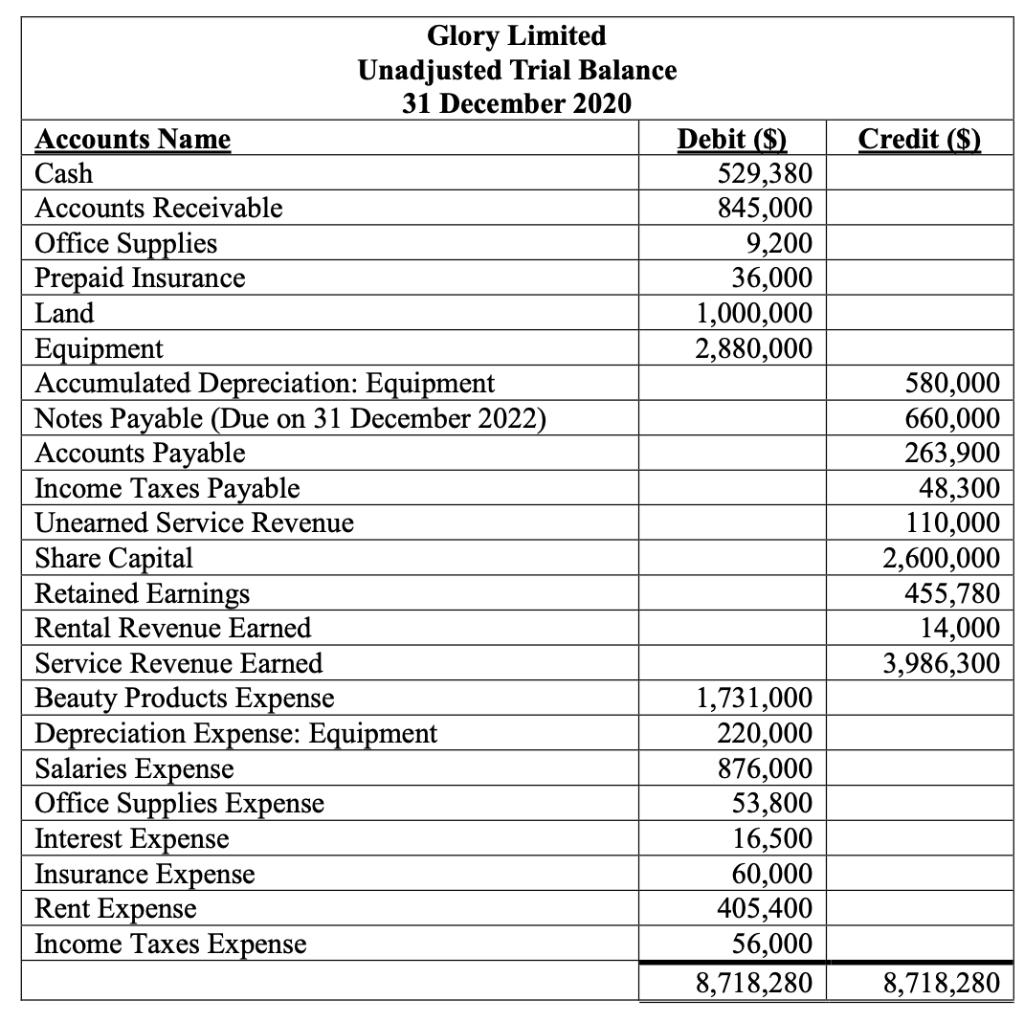

A) Glory Limited is a hair salon business. The company adjusts its accounts monthly. The companys unadjusted trial balance dated 31 December 2020 was shown

A) Glory Limited is a hair salon business. The company adjusts its accounts monthly. The company’s unadjusted trial balance dated 31 December 2020 was shown below

The following events have not yet been recorded to the above-unadjusted Office supplies on hand on 31 December 2020 were $4,800.

$90,000 of the unearned service revenue was now earned on 31 December 2020.

Equipment was bought at the start of the business and is to be depreciated over a period of twelve years. The straight-line depreciation method is used.

A 1-year insurance contract was purchased on 1 June 2020, with the coverage commenced on the same date.

On 31 December 2020, the company signed an agreement with Hong Kong Hospital to provide haircut services for their patients in 2021. This is expected to generate revenue of $120,000.

Dividends of $150,000 were declared and will be paid on 31 March 2021.

On 31 December 2020, Glory received $21,000 from a customer to provide service in 2021.

No entries have been made.

On 1 January 2020, the company borrowed $660,000 by signing a note payable. Interest on the note payable is 5% p.a. that has to be paid half-yearly, i.e. on every 1 January and 1 July. The first payment on interest was already made on 1 July 2020, and no adjusting entries were made to the books since that payment.

Income taxes expense for the year amounted to $79,000. The unpaid amount is due in March 2021.

Prepare the necessary adjusting entries on 31 December 2020. Round your answers to the nearest integer if necessary. For any event does not require adjustment, please state “No entry” with an explanation.

B)

Speedy Corporation is authorized to sell 1,000,000 its $10 par value ordinary shares and 50,000 shares of $100 par value, 6% preference shares. As at the end of the current year, the company has actually sold 600,000 ordinary shares at $13 per share and 45,000 preference shares at $100 per share. In addition, of the 600,000 ordinary shares that have been sold, 50,000 shares have been repurchased at $80 per share and are currently being held in treasury to be used to meet the future requirements of a share option plan that the company intends to implement.

Prepare the shareholders’ equity section of Speedy’s Statement of Financial Position to reflect the transactions you have recorded.

Glory Limited Unadjusted Trial Balance 31 December 2020 Debit ($) 529,380 845,000 9,200 36,000 1,000,000 2,880,000 Accounts Name Credit ($) Cash Accounts Receivable Office Supplies Prepaid Insurance Land Equipment Accumulated Depreciation: Equipment Notes Payable (Due on 31 December 2022) Accounts Payable Income Taxes Payable 580,000 660,000 263,900 48,300 110,000 2,600,000 455,780 14,000 3,986,300 Unearned Service Revenue Share Capital Retained Earnings Rental Revenue Earned Service Revenue Earned Beauty Products Expense Depreciation Expense: Equipment Salaries Expense Office Supplies Expense Interest Expense Insurance Expense Rent Expense Income Taxes Expense 1,731,000 220,000 876,000 53,800 16,500 60,000 405,400 56,000 8,718,280 8,718,280

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

b Date Accounts and Explanation Debit Credit Office Supplies Expense 4400 Office Supplies exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started