Question

Glovac Sdn Bhd was set up 5 years ago aiming to manufacture parts of hi-fi equipment. The companys customers usually are individuals who want to

Glovac Sdn Bhd was set up 5 years ago aiming to manufacture parts of hi-fi equipment. The companys customers usually are individuals who want to make their own systems. Recently the company has been approached by Pansonic Bhd, a multi-national company that manufactures consumer electronics. Pansonic offered Glovac a 3-year fixed contract to manufacture an amplifier for its latest consumer product. Financial data with regards to the contract is as follows:

i) Involve Glovac in purchasing a specialist machine for RM150,000 before it can proceed with the amplifier. The machine has a 6-year life but it will be written off within 3 years since it is highly specific and can only be used for manufacturing the amplifier.

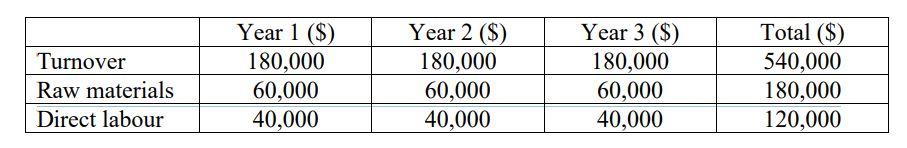

(ii) Increase turnover and direct production costs as follows:

(iii) The machine qualifies for a 20% written-down allowance on a straight-line basis. On ending the contract with Pansonic, the outstanding capital allowance can be claimed as a balancing allowance.

(iv) Cost of materials and labour are forecasted to increase by 5% in years 2 and 3.

(v) The corporate tax rate is 24% and the cost of capital is 18%.

Required: Calculate and compare Net Present Value (NPV) and Return on Capital Employed (ROCE). Show all calculations.

Turnover Raw materials Direct labour Year 1 ($) 180,000 60,000 40,000 Year 2 ($) 180,000 60,000 40,000 Year 3 ($) 180,000 60,000 40,000 Total ($) 540,000 180,000 120,000 Turnover Raw materials Direct labour Year 1 ($) 180,000 60,000 40,000 Year 2 ($) 180,000 60,000 40,000 Year 3 ($) 180,000 60,000 40,000 Total ($) 540,000 180,000 120,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started