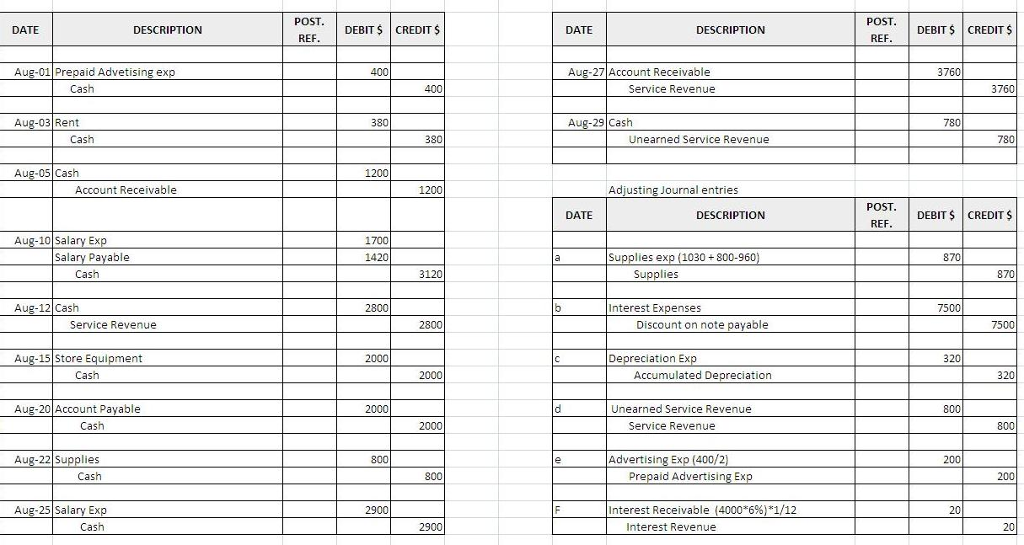

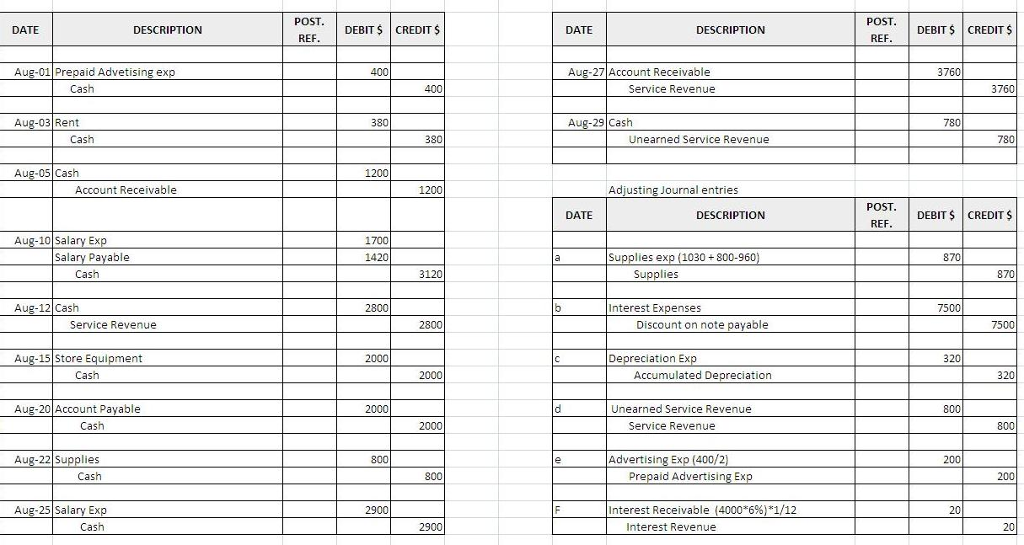

| GLS Problem ACR4-3 | | | | | Problem: | | | | | | | On August 1, 2017, the following were the account balances of B&B Repair Services. | | Debits | | | Credits | | Cash | $ 6,040 | | Accumulated DepreciationEquipment | $ 600 | | Accounts Receivable | 2,910 | | Accounts Payable | 2,300 | | Notes Receivable | 4,000 | | Unearned Service Revenue | 1,260 | | Supplies | 1,030 | | Salaries and Wages Payable | 1,420 | | Equipment | 10,000 | | Common Stock | 12,000 | | | | | Retained Earnings | 6,400 | | | $23,980 | | | $23,980 | During August, the following summary transactions were completed. | Aug. | 1 | Paid $400 cash for advertising in local newspapers. Advertising flyers will be included with newspapers delivered during August and September. | | | 3 | Paid August rent $380. | | | 5 | Received $1,200 cash from customers in payment of account. | | | 10 | Paid $3,120 for salaries due employees, of which $1,700 is for August and $1,420 is for July salaries payable. | | | 12 | Received $2,800 cash for services performed in August. | | | 15 | Purchased store equipment on account $2,000. | | | 20 | Paid creditors $2,000 of accounts payable due. | | | 22 | Purchased supplies on account $800. | | | 25 | Paid $2,900 cash for employees salaries. | | | 27 | Billed customers $3,760 for services performed. | | | 29 | Received $780 from customers for services to be performed in the future. | | | | | | | Instructions: | | Use 2017 as the year for this problem. | | | | 1 | To print this page, right click anywhere on the screen you want to print and click on Print. | | 2 | Use the Entries menu to journalize the August entries. The account balances shown at the beginning of the problem have been journalized and posted. | | 3 | Click on New for each transaction. | | 4 | Enter the correct transaction date and year given in the problem. | | 5 | These are considered Standard entries to be recorded in the General Journal (chosen by default). | | 6 | Click on the Save icon to save the transaction. | | 7 | Use the Reports menu to display/print and review your entries. To print a report, right click anywhere on the screen and click on Print (online version) or use the print icon (CD version). | | 8 | If you need to make changes return to the Entries menu. Get the entry by the number of the transaction. Make your correction and Save the entry. | | 9 | Use the Post menu to post the journal entries after all of the transactions are recorded. | | 10 | If you need to make changes to an entry once it has been posted, use the Entries menu to get the entry, click on the Void icon, then enter the transaction with a new entry and save and post that entry. | | 11 | Use the Reports menu to access/print the Trial Balance. Review the accounts for reasonableness. If changes are necessary see steps 8 and 9 above. | | 12 | Use the Entries menu to record the following adjusting entries. Check the box next to Adjusting Entries. A count shows supplies on hand of $960. Accrued but unpaid employees salaries are $1,540. Depreciation on equipment for the month is $320. Services were performed to satisfy $800 of unearned service revenue. One months worth of advertising services has been received. One month of interest revenue related to the $4,000 note receivable has accrued. The 4-month note has a 6% annual interest rate. (Hint: Use the formula from Illustration 4-18 to compute interest.) | | 13 | Use the Reports menu to display/print the entries. | | 14 | Use the Post menu to post the adjusting entries. | | 15 | Use the Reports menu to access/print the Adjusted Trial balance, Income Statement, Retained Earnings Statement, and the Balance Sheet. To print a report, right click anywhere on the screen and click on Print (online version) or use the print icon (CD version). | | 16 | Use the Close menu to close the books. Click on Continue when requested. | | 17 | To display/print the closing entries, click on System Closing Entries. | | 18 | To display/print the Post Closing Trial Balance use the Reports menu. | | 19 | To close a page click on the X in the upper right corner of the page. | Hint: Cash balance is $2,020; Trial Balance totals are $30,700; Adjusted Trial Balance totals are $32,580; and Net Loss is $530. | Most computerized accounting systems process the closing procedure automatically when initiated by the user. The closing procedures are: |