Question

Gluon Inc. is considering the purchase of a new high pressure glueball. It can purchase the glueball for $40,000 and sell its old low-pressure

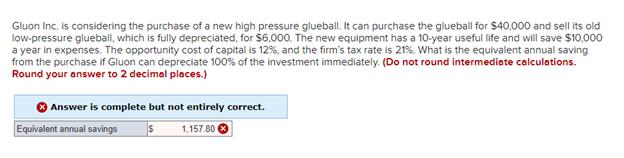

Gluon Inc. is considering the purchase of a new high pressure glueball. It can purchase the glueball for $40,000 and sell its old low-pressure glueball, which is fully depreciated, for $6,000. The new equipment has a 10-year useful life and will save $10,000 a year in expenses. The opportunity cost of capital is 12%, and the firm's tax rate is 21%. What is the equivalent annual saving from the purchase if Gluon can depreciate 100% of the investment immediately. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Equivalent annual savings 1,157.80

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the equivalent annual saving from the purchase we can use the equivalent annual cost fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Richard Brealey, Stewart Myers, Alan Marcus

10th edition

1260566099, 1260013960, 1260703900, 978-1260566093

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App