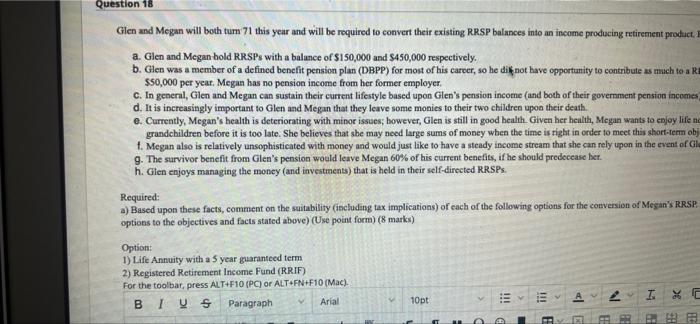

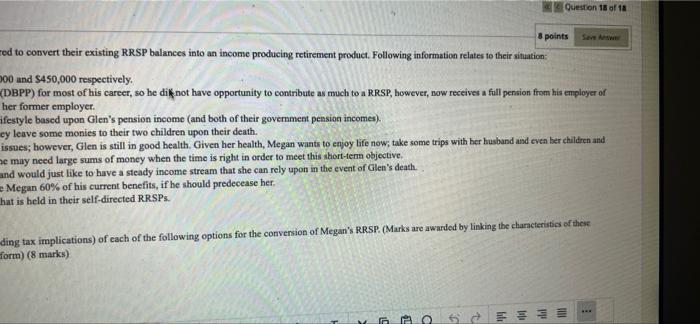

Gm MER we B. SOM en het ding .. Cherry Megana er heilige Geen how : lia Myrtilegt my www wysor y when their sem.com The mur bekom Cupom de Mehrheither Olen maging the money and held in their werd Required a) Mased upon theme for comme le tubey Clading te implication exchaft flowing prior to the content Man's Note dy options to the shoes and feated showe) (Uw point form) (mara) pien 1) Life Annuity with year ratood term Registered Reind Income Fund (KRIP w the toolbar, press ALTOPO) Or ALTEN.Ft Mad 8 / WS Paragraph Arial 10pt EA 2 T. 6F V TT 2 OR EB x x 93. 3. The * Q d r E s MacBook Air Question 18 Glen and Megan will both tum 71 this year and will be required to convert their existing RRSP balances into an income producing retirement product a. Glen and Megan hold RRSPs with a balance of $150,000 and $450,000 respectively. b. Glen was a member of a defined bencfit pension plan (DBPP) for most of his career, so he di not have opportunity to contribute as much to a R $50,000 per year. Megan has no pension income from her former employer. C. In general, Glen and Megan can sustain their current lifestyle based upon Glen's pension income (and both of their goverment pension incomes d. It is increasingly important to Glen and Megan that they leave some monies to their two children upon their death. e. Currently, Megan's health is deteriorating with minor issues; however, Glen is still in good health. Given her health, Megan wants to enjoy life ne grandchildren before it is too late. She believes that she may need large sums of money when the time is right in order to meet this short-term obj . Megan also is relatively unsophisticated with money and would just like to have a steady income stream that she can rely upon in the event of Gle 9. The survivor benefit from Glen's pension would leave Megan 60% of his current benefits, if he should predecease her. h. Glen enjoys managing the money (and investments) that is held in their self-directed RRSPs. Required: a) Based upon these facts, comment on the suitability (including tax implications) of each of the following options for the conversion of Megan's RRSP options to the objectives and facts stated above) (Use point form) (8 marks) Option: 1) Life Annuity with a 5 year guaranteed term 2) Registered Retirement Income Fund (RRIF) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIVS Paragraph 10pt !!! Arial III A XC 2 SF 1 FE RE HE Question 18 of 18 8 points red to convert their existing RRSP balances into an income producing retirement product. Following information relates to their sitation: 000 and $450,000 respectively. (DBPP) for most of his career, so he dike not have opportunity to contribute as much to a RRSP, however, now receives a full pension from his employer of her former employer. ifestyle based upon Glen's pension income (and both of their government pension incomes). ey leave some monies to their two children upon their death. issues; however, Glen is still in good health. Given her health, Megan wants to enjoy life now take some trips with her husband and even her children and me may need large sums of money when the time is right in order to meet this short-term objective, and would just like to have a steady income stream that she can rely upon in the event of Glen's death. Megan 60% of his current benefits, if he should predecease her. hat is held in their self-directed RRSPs. ding tax implications) of cach of the following options for the conversion of Megan's RRSP. (Marks are awarded by linking the characteristics of these worm) (8 marks) SEE Gm MER we B. SOM en het ding .. Cherry Megana er heilige Geen how : lia Myrtilegt my www wysor y when their sem.com The mur bekom Cupom de Mehrheither Olen maging the money and held in their werd Required a) Mased upon theme for comme le tubey Clading te implication exchaft flowing prior to the content Man's Note dy options to the shoes and feated showe) (Uw point form) (mara) pien 1) Life Annuity with year ratood term Registered Reind Income Fund (KRIP w the toolbar, press ALTOPO) Or ALTEN.Ft Mad 8 / WS Paragraph Arial 10pt EA 2 T. 6F V TT 2 OR EB x x 93. 3. The * Q d r E s MacBook Air Question 18 Glen and Megan will both tum 71 this year and will be required to convert their existing RRSP balances into an income producing retirement product a. Glen and Megan hold RRSPs with a balance of $150,000 and $450,000 respectively. b. Glen was a member of a defined bencfit pension plan (DBPP) for most of his career, so he di not have opportunity to contribute as much to a R $50,000 per year. Megan has no pension income from her former employer. C. In general, Glen and Megan can sustain their current lifestyle based upon Glen's pension income (and both of their goverment pension incomes d. It is increasingly important to Glen and Megan that they leave some monies to their two children upon their death. e. Currently, Megan's health is deteriorating with minor issues; however, Glen is still in good health. Given her health, Megan wants to enjoy life ne grandchildren before it is too late. She believes that she may need large sums of money when the time is right in order to meet this short-term obj . Megan also is relatively unsophisticated with money and would just like to have a steady income stream that she can rely upon in the event of Gle 9. The survivor benefit from Glen's pension would leave Megan 60% of his current benefits, if he should predecease her. h. Glen enjoys managing the money (and investments) that is held in their self-directed RRSPs. Required: a) Based upon these facts, comment on the suitability (including tax implications) of each of the following options for the conversion of Megan's RRSP options to the objectives and facts stated above) (Use point form) (8 marks) Option: 1) Life Annuity with a 5 year guaranteed term 2) Registered Retirement Income Fund (RRIF) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIVS Paragraph 10pt !!! Arial III A XC 2 SF 1 FE RE HE Question 18 of 18 8 points red to convert their existing RRSP balances into an income producing retirement product. Following information relates to their sitation: 000 and $450,000 respectively. (DBPP) for most of his career, so he dike not have opportunity to contribute as much to a RRSP, however, now receives a full pension from his employer of her former employer. ifestyle based upon Glen's pension income (and both of their government pension incomes). ey leave some monies to their two children upon their death. issues; however, Glen is still in good health. Given her health, Megan wants to enjoy life now take some trips with her husband and even her children and me may need large sums of money when the time is right in order to meet this short-term objective, and would just like to have a steady income stream that she can rely upon in the event of Glen's death. Megan 60% of his current benefits, if he should predecease her. hat is held in their self-directed RRSPs. ding tax implications) of cach of the following options for the conversion of Megan's RRSP. (Marks are awarded by linking the characteristics of these worm) (8 marks) SEE