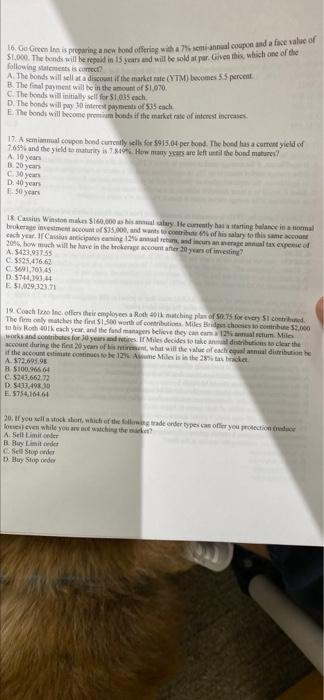

& Go Green Inn is preparing a new hond offering with a semiannual coupon and a face value of 51.000. The bonds will be repaid in 15 years and will be sold at par. Given this which one of the following statement is correct? A The bonds will sell at a discount is the market rate (YTM) becomes 55 percent The final payment will be in the amount of $1.070 The bonds will initially sell for 1035 each D. The bonds will pay 30 interest payment of 535 cach E The bonds will become premium bonds if the market rate of interest increases 17. Animal coupon bond currently sells for $915.04 per bond. The bood has a currand yield of 7.65% and the yield to maturity is 786. How many sure left the bond more! A 10 years 30 years 30 years D. 40 years Ese years 18 Cassius Winston 160.000 salary technical brokerage investment count of $35.000 and want to his salary to this an each year, Iranicicaning and taxeyco 2016. how much will be have in the botter 20 years of investing A5433.93755 C.5525.476.63 CSI.10345 15144394 E $1.009323.71 19. Coachine offers their employees a Rodonchilas of 0.15 for every Scott The firm only matches the first $1.500 wrth of contributis Miles Brides choses to contribute 52.000 to by Roth 20 exch year, and the fund map believe they cal return Milo works and contributes for years. I Miles decides to take a distribuclear the account during the fint 20 yean of what will the value of each equal al die the account estimat costs to be 12 Aline Miles is in the 28 de A. 572.695.95 B $100.96664 C. 52.66272 D. SO4930 E.575416164 20. If you will short which of the deter types or you protectie ou even while you waching the A Salt Limited B. Buy Limit oder csel Stop onder D. Buy Stop order & Go Green Inn is preparing a new hond offering with a semiannual coupon and a face value of 51.000. The bonds will be repaid in 15 years and will be sold at par. Given this which one of the following statement is correct? A The bonds will sell at a discount is the market rate (YTM) becomes 55 percent The final payment will be in the amount of $1.070 The bonds will initially sell for 1035 each D. The bonds will pay 30 interest payment of 535 cach E The bonds will become premium bonds if the market rate of interest increases 17. Animal coupon bond currently sells for $915.04 per bond. The bood has a currand yield of 7.65% and the yield to maturity is 786. How many sure left the bond more! A 10 years 30 years 30 years D. 40 years Ese years 18 Cassius Winston 160.000 salary technical brokerage investment count of $35.000 and want to his salary to this an each year, Iranicicaning and taxeyco 2016. how much will be have in the botter 20 years of investing A5433.93755 C.5525.476.63 CSI.10345 15144394 E $1.009323.71 19. Coachine offers their employees a Rodonchilas of 0.15 for every Scott The firm only matches the first $1.500 wrth of contributis Miles Brides choses to contribute 52.000 to by Roth 20 exch year, and the fund map believe they cal return Milo works and contributes for years. I Miles decides to take a distribuclear the account during the fint 20 yean of what will the value of each equal al die the account estimat costs to be 12 Aline Miles is in the 28 de A. 572.695.95 B $100.96664 C. 52.66272 D. SO4930 E.575416164 20. If you will short which of the deter types or you protectie ou even while you waching the A Salt Limited B. Buy Limit oder csel Stop onder D. Buy Stop order