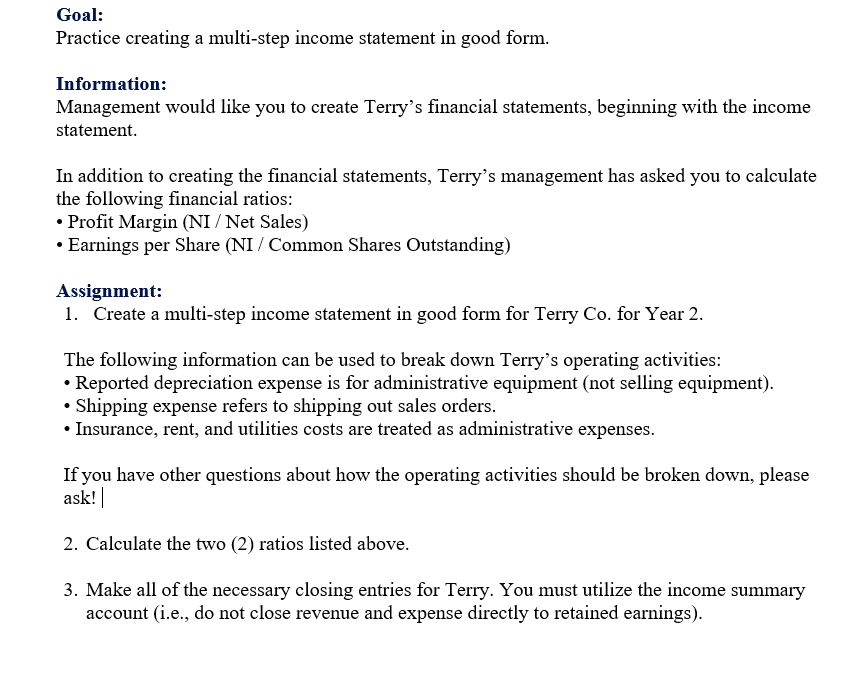

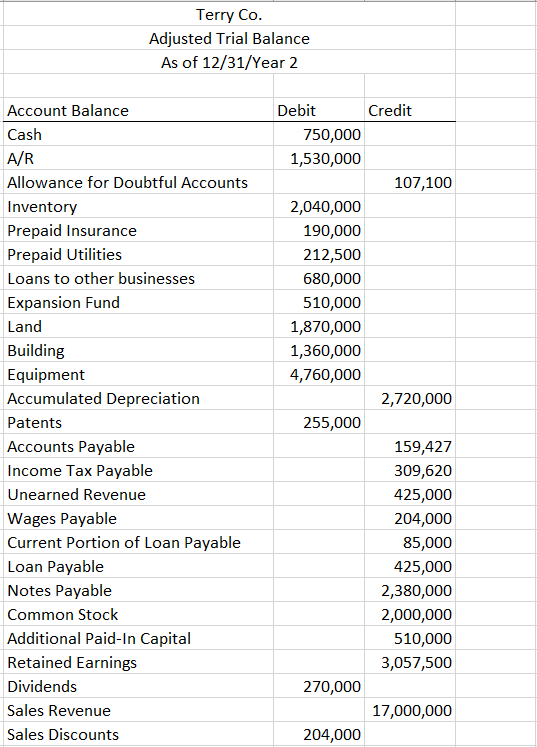

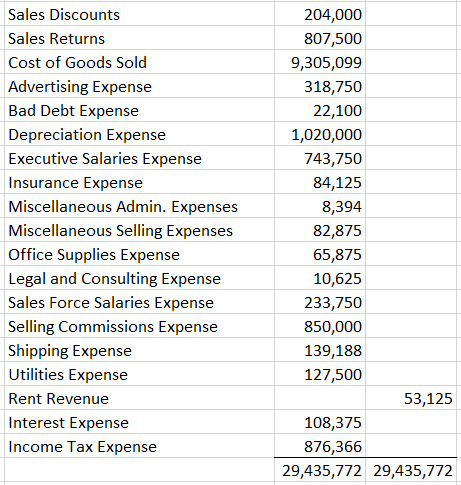

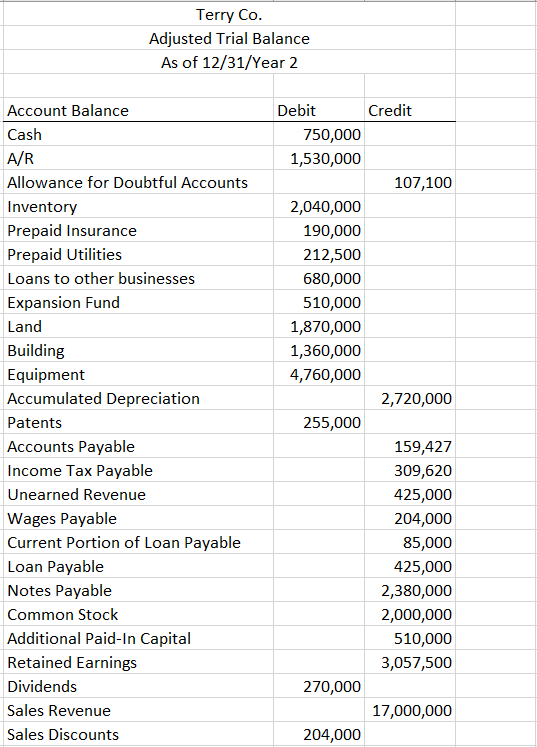

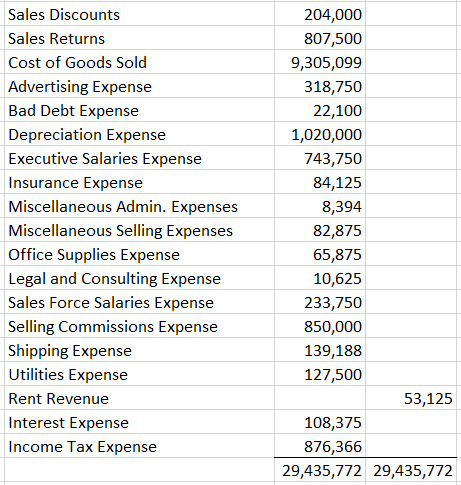

Goal: Practice creating a multi-step income statement in good form. Information: Management would like you to create Terry's financial statements, beginning with the income statement. In addition to creating the financial statements, Terry's management has asked you to calculate the following financial ratios: Profit Margin (NI / Net Sales) Earnings per Share (NI / Common Shares Outstanding) Assignment: 1. Create a multi-step income statement in good form for Terry Co. for Year 2. The following information can be used to break down Terry's operating activities: Reported depreciation expense is for administrative equipment (not selling equipment). Shipping expense refers to shipping out sales orders. Insurance, rent, and utilities costs are treated as administrative expenses. If you have other questions about how the operating activities should be broken down, please ask! 2. Calculate the two (2) ratios listed above. 3. Make all of the necessary closing entries for Terry. You must utilize the income summary account (i.e., do not close revenue and expense directly to retained earnings). Terry Co. Adjusted Trial Balance As of 12/31/Year 2 Account Balance Cash A/R Allowance for Doubtful Accounts Inventory Prepaid Insurance Prepaid Utilities Loans to other businesses Expansion Fund Land Building Equipment Accumulated Depreciation Patents Accounts Payable Income Tax Payable Unearned Revenue Wages Payable Current Portion of Loan Payable Loan Payable Notes Payable Common Stock Additional Paid-In Capital Retained Earnings Dividends Sales Revenue Sales Discounts Debit Credit 750,000 1,530,000 107,100 2,040,000 190,000 212,500 680,000 510,000 1,870,000 1,360,000 4,760,000 2,720,000 255,000 159,427 309,620 425,000 204,000 85,000 425,000 2,380,000 2,000,000 510,000 3,057,500 270,000 17,000,000 204,000 Sales Discounts Sales Returns Cost of Goods Sold Advertising Expense Bad Debt Expense Depreciation Expense Executive Salaries Expense Insurance Expense Miscellaneous Admin. Expenses Miscellaneous Selling Expenses Office Supplies Expense Legal and Consulting Expense Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Utilities Expense Rent Revenue Interest Expense Income Tax Expense 204,000 807,500 9,305,099 318,750 22,100 1,020,000 743,750 84,125 8,394 82,875 65,875 10,625 233,750 850,000 139,188 127,500 53,125 108,375 876,366 29,435,772 29,435,772