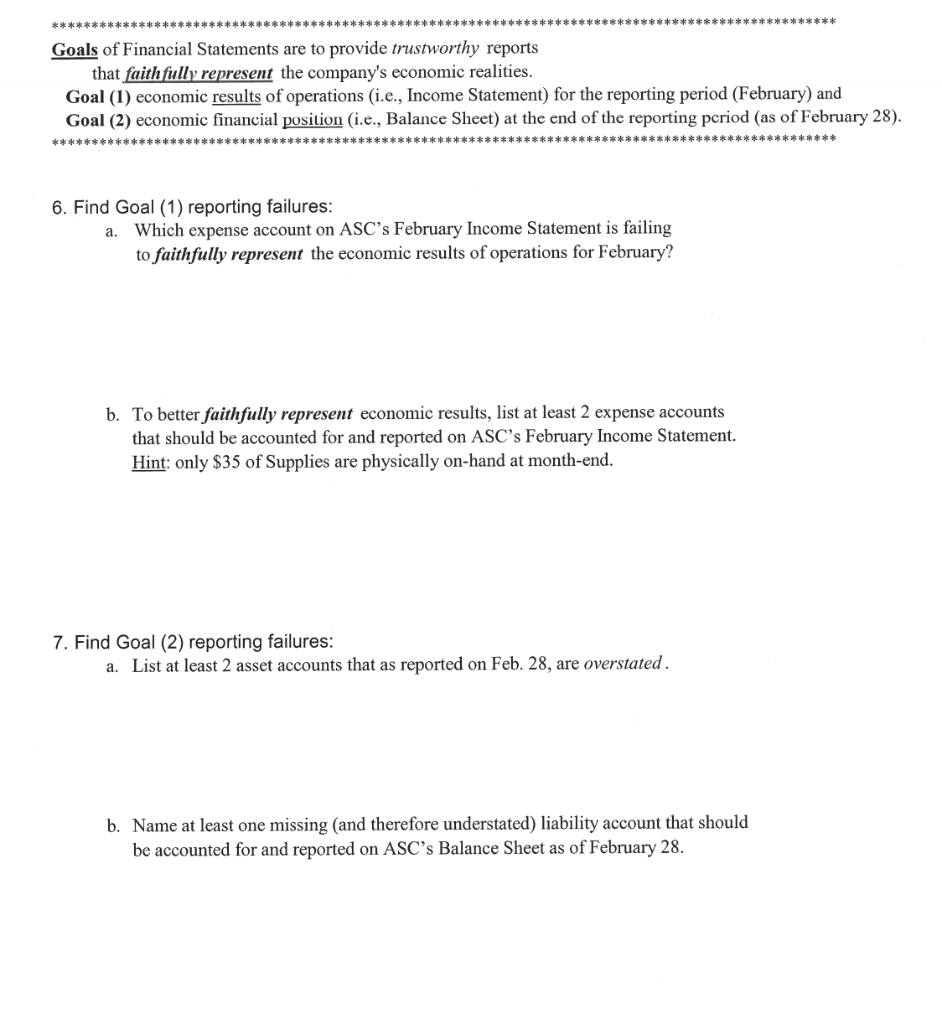

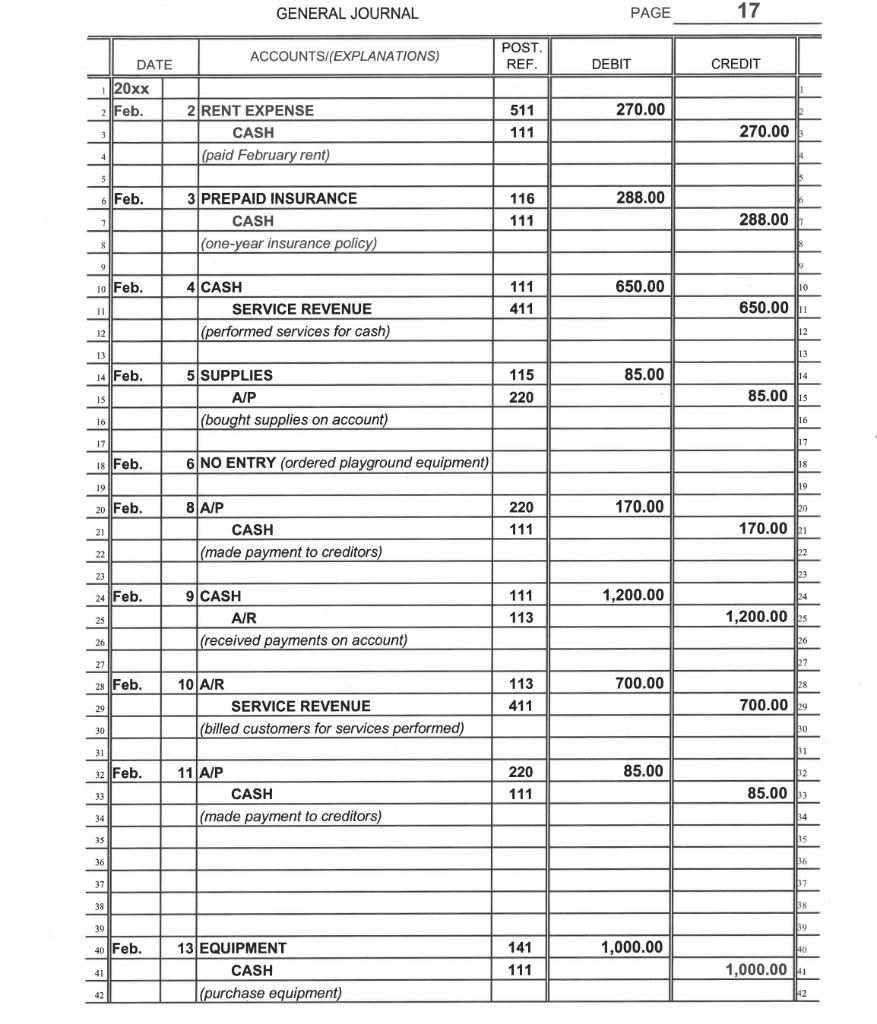

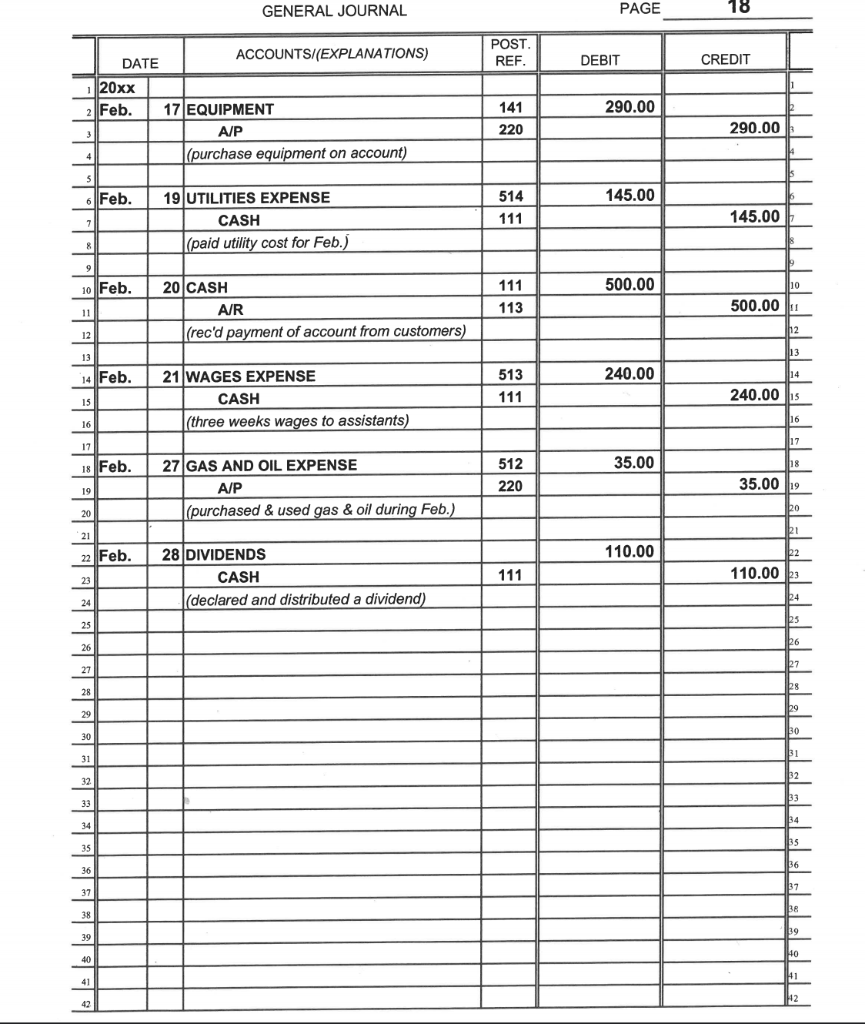

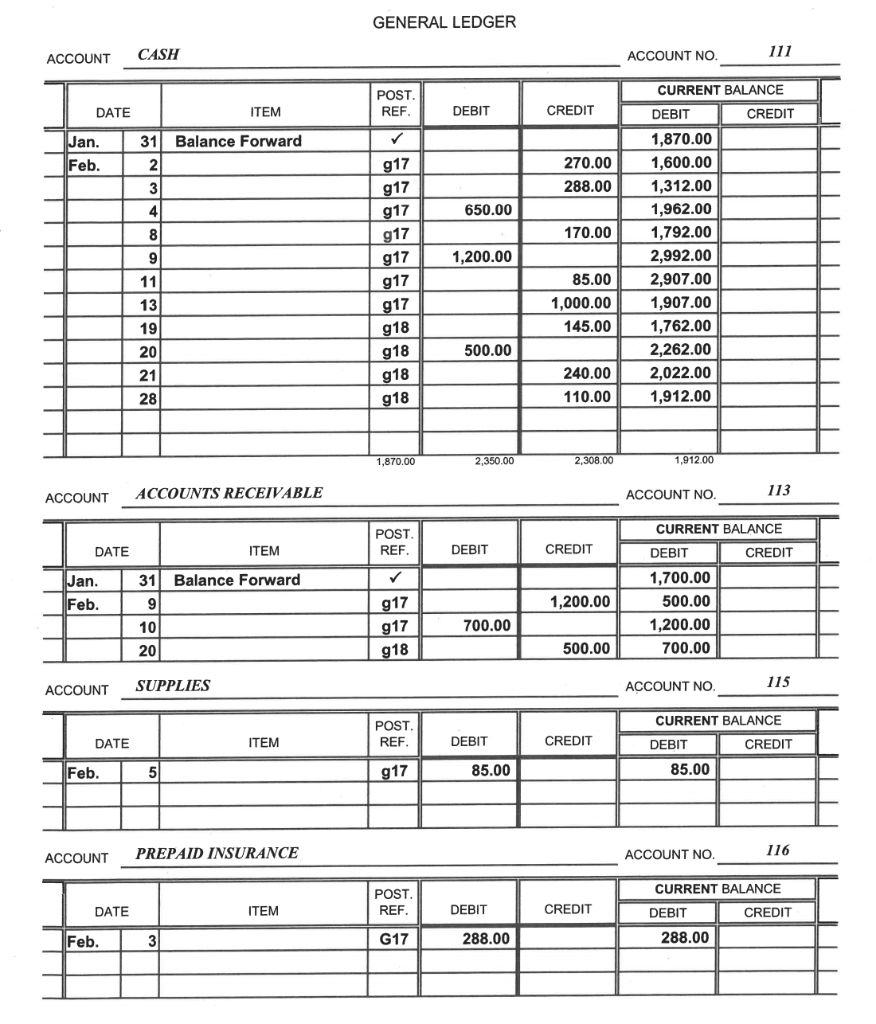

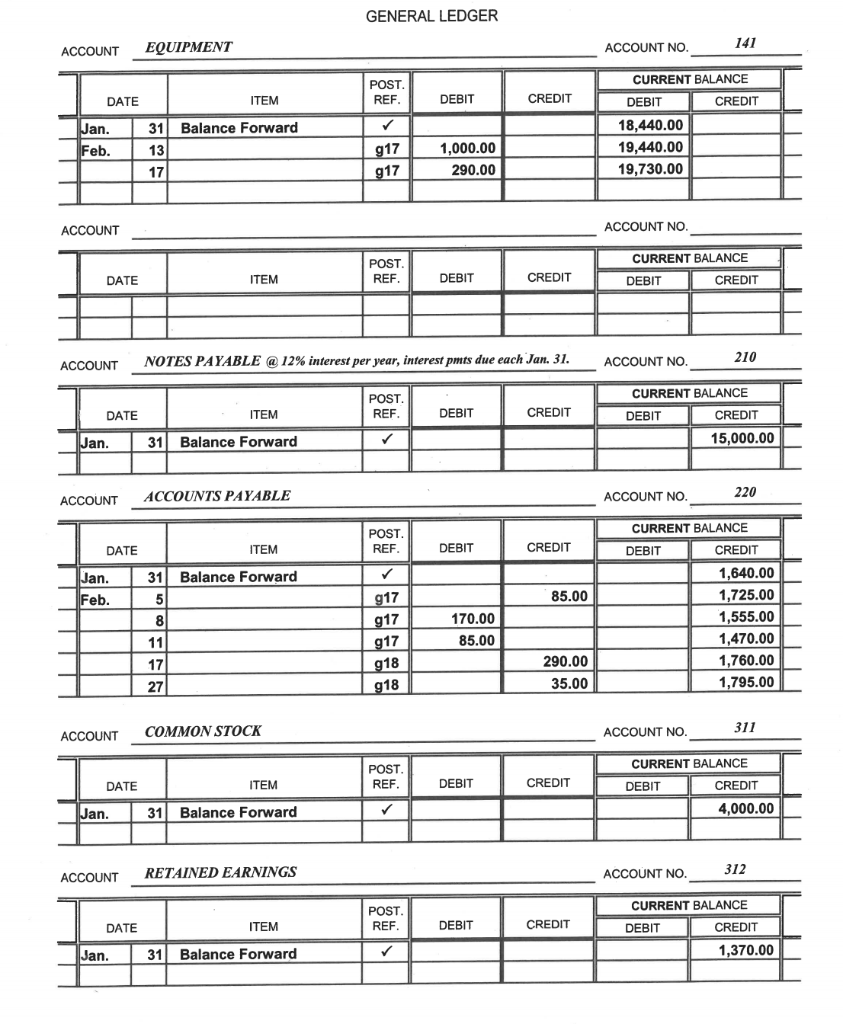

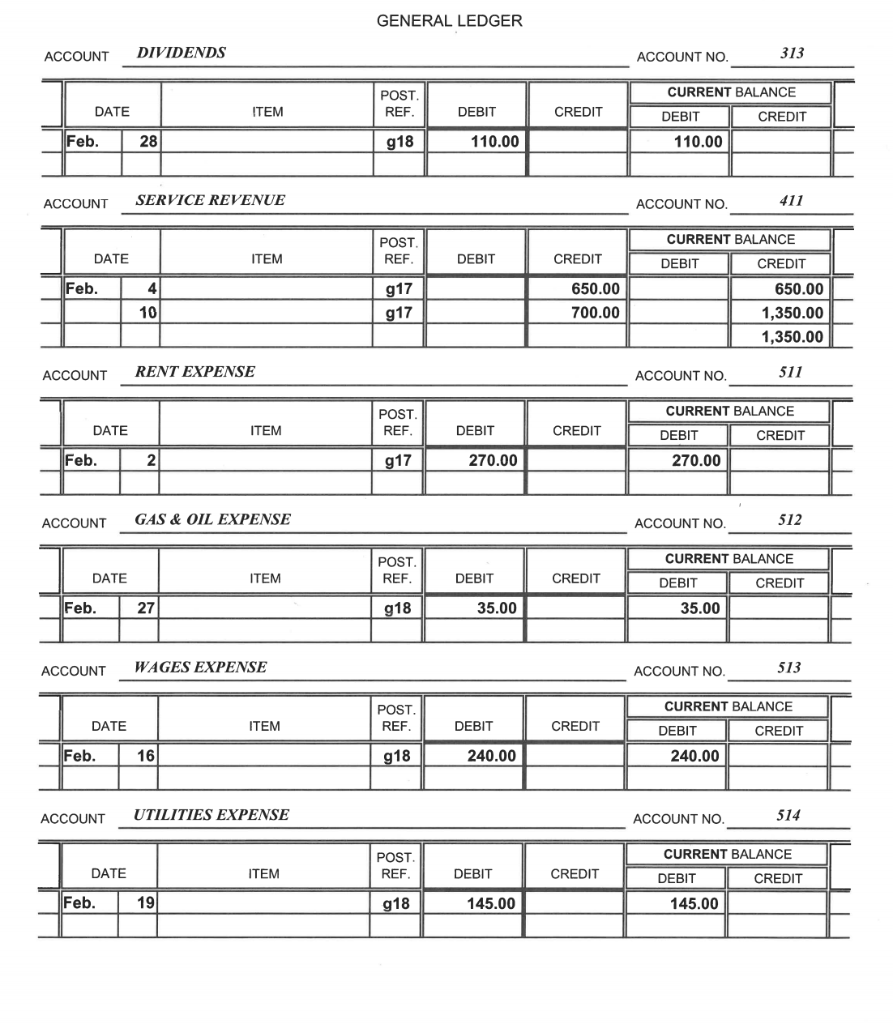

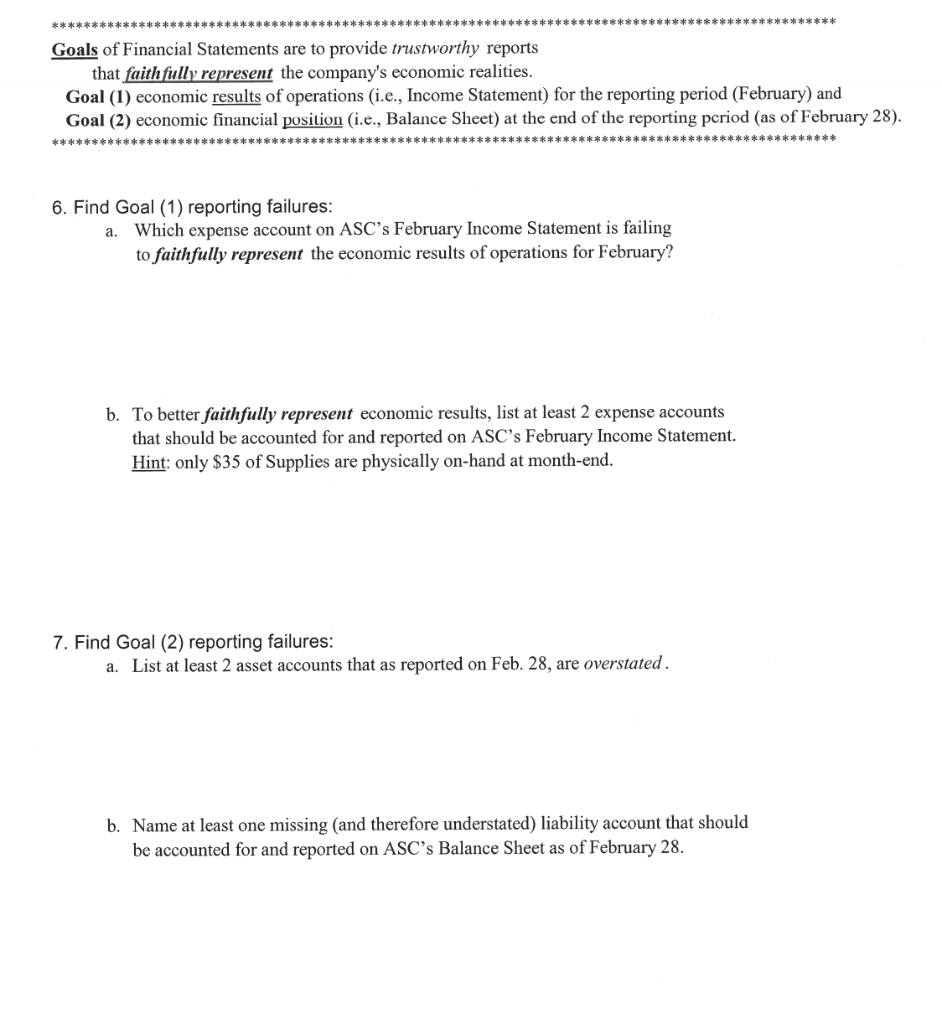

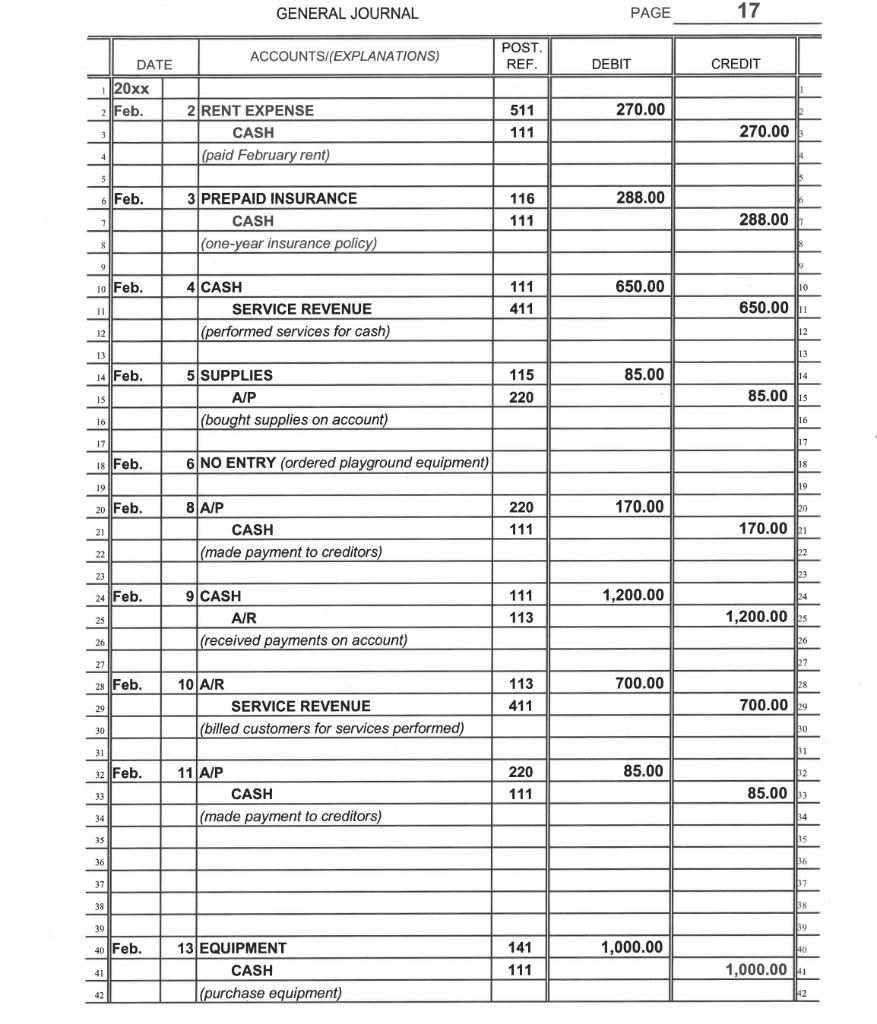

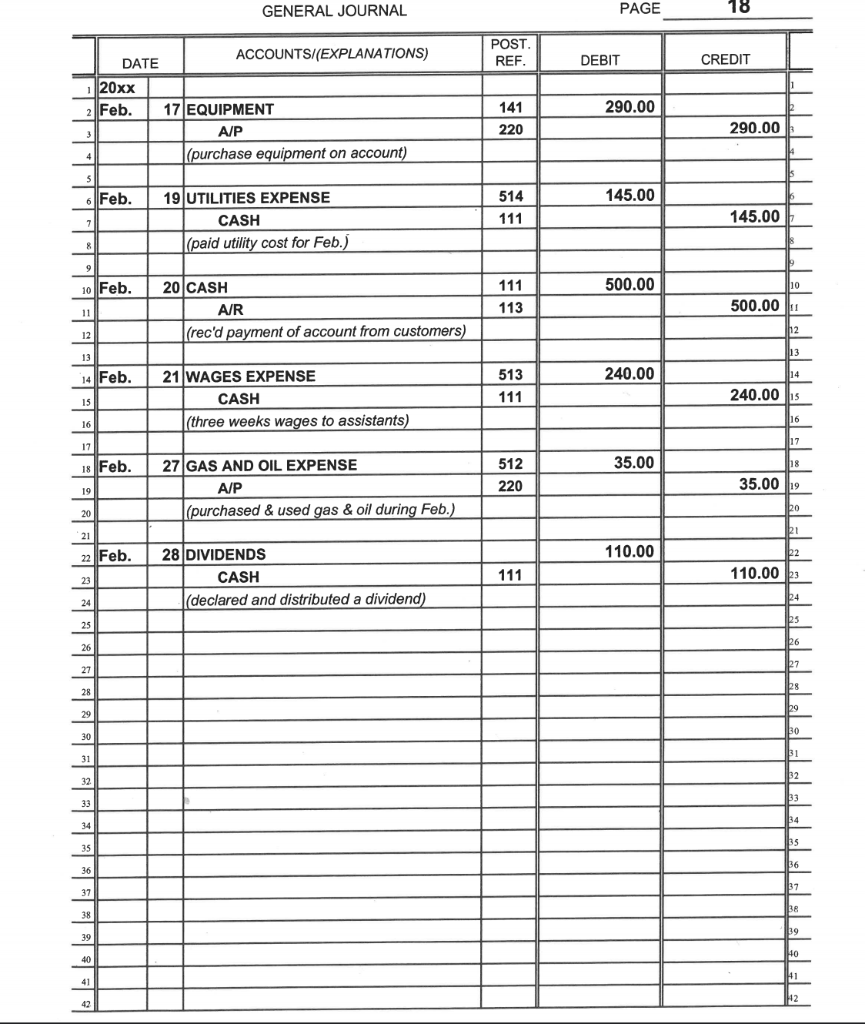

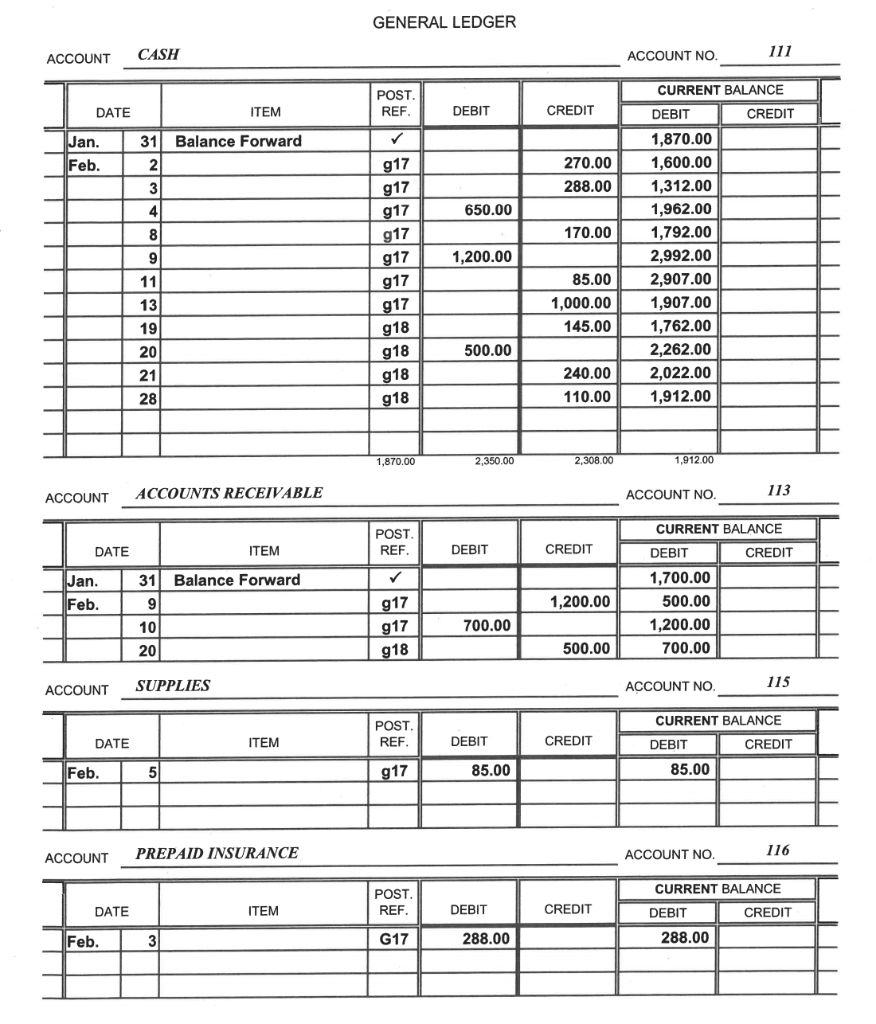

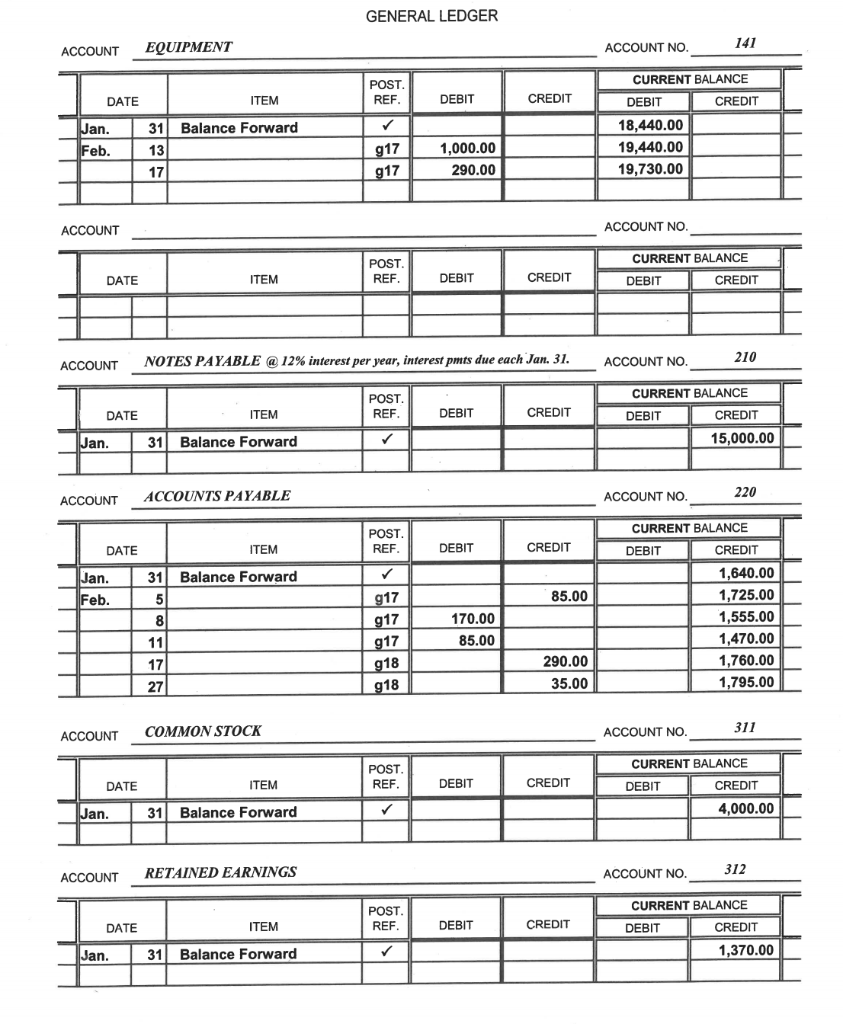

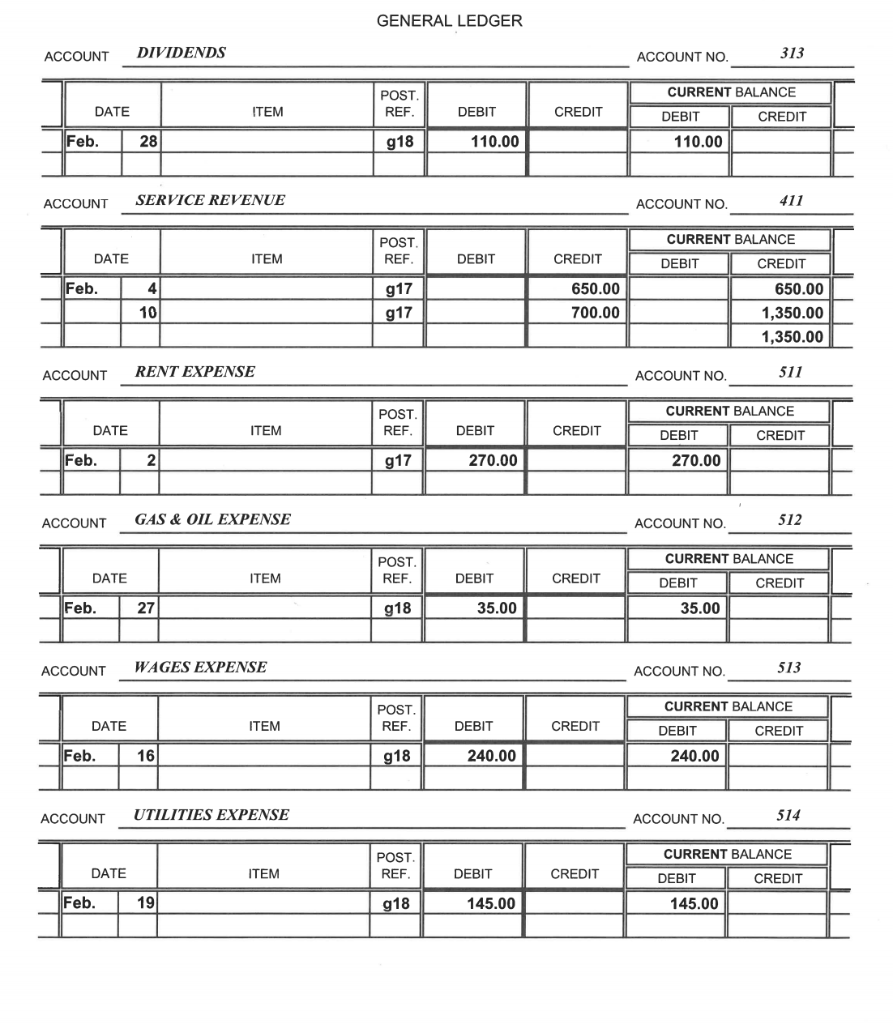

Goals of Financial Statements are to provide trustworthy reports that faith fully represent the company's economic realities. Goal (1) economic results of operations (i.e., Income Statement) for the reporting period (February) and Goal (2) economic financial position (i.e., Balance Sheet) at the end of the reporting period (as of February 28). 6. Find Goal (1) reporting failures: a. Which expense account on ASC's February Income Statement is failing to faithfully represent the economic results of operations for February? b. To better faithfully represent economic results, list at least 2 expense accounts that should be accounted for and reported on ASC's February Income Statement. Hint: only $35 of Supplies are physically on-hand at month-end. 7. Find Goal (2) reporting failures: a. List at least 2 asset accounts that as reported on Feb. 28, are overstated. b. Name at least one missing (and therefore understated) liability account that should be accounted for and reported on ASC's Balance Sheet as of February 28. GENERAL JOURNAL PAGE 17 ACCOUNTS (EXPLANATIONS) POST. REF DEBIT CREDIT DATE ||20xx 2 Feb. 270.00 2 RENT EXPENSE CASH (paid February rent) 511 111 3 270.00 6 Feb. 288.00 3 PREPAID INSURANCE CASH (one-year insurance policy) 116 111 7 288.00 8 9 10 Feb. 650.00 10 4 CASH SERVICE REVENUE (performed services for cash) 111 411 650.00 11 12 12 13 13 85.00 1114 14 Feb. 15 5 SUPPLIES A/P (bought supplies on account) 115 220 85.00 15 16 16 17 17 18 Feb. 6 NO ENTRY (ordered playground equipment) 18 19 119 20 Feb. 170.00 20 8 AP CASH (made payment to creditors) 220 111 21 170.00 21 22 22 23 23 24 Feb. 1,200.00 24 9 CASH A/R (received payments on account) 111 113 25 1,200.00 26 26 27 27 28 Feb. 700.00 28 10 AIR SERVICE REVENUE (billed customers for services performed) 113 411 29 700.009 30 30 31 31 32 Feb. 85.00 52 11 A/P CASH (made payment to creditors) 220 111 33 85.00 13 34 14 35 35 36 36 37 37 38 1538 39 39 40 Feb. 141 1,000.00 10 13 EQUIPMENT CASH (purchase equipment) 111 1,000.00 H2 GENERAL JOURNAL PAGE 18 ACCOUNTSI(EXPLANATIONS) POST REF. DATE DEBIT CREDIT 120xx 2 Feb. 290.00 17 EQUIPMENT A/P (purchase equipment on account) 141 220 290.00 6 Feb. 145.00 19 UTILITIES EXPENSE CASH (paid utility cost for Feb.) 514 111 145.00 8 10 Feb. 500.00 10 20 CASH A/R (rec'd payment of account from customers) 111 113 11 500.00 12 12 113 13 14 Feb. 240.00 14 21 WAGES EXPENSE CASH (three weeks wages to assistants) 513 111 15 240.00 15 16 16 117 17 18 Feb. 35.00 18 27 GAS AND OIL EXPENSE A/P (purchased & used gas & oil during Feb.) 512 220 35.00 19 19 20 20 21 21 22 Feb. 110.00 22 28 DIVIDENDS CASH (declared and distributed a dividend) 111 110.00 13 23 24 24 ps 25 226 26 27 27 28 28 ho 29 30 30 31 31 32 32 33 33 34 34 35 35 36 36 37 37 Be 38 39 39 HO 40 H1 H2 GENERAL LEDGER ACCOUNT CASH 111 ACCOUNT NO. POST REF DATE ITEM DEBIT CREDIT Jan. Feb. 31Balance Forward 2 31 4 270.00 288.00 650.00 g17 g17 g17 g17 g17 g17 g17 8 9 170.00 CURRENT BALANCE DEBIT CREDIT 1,870.00 1,600.00 1,312.00 1,962.00 1,792.00 2,992.00 2,907.00 1,907.00 1,762.00 2,262.00 2,022.00 1,912.00 1,200.00 11 13 19 85.00 1,000.00 145.00 g18 g18 20 500.00 21 g18 g18 240.00 110.00 28 1,870.00 2,350.00 2,308,00 1,912.00 ACCOUNT ACCOUNTS RECEIVABLE ACCOUNT NO 113 CURRENT BALANCE POST REF. DATE ITEM DEBIT CREDIT DEBIT CREDIT 31 Balance Forward Jan. Feb. 9 1,200.00 1,700.00 500.00 1,200.00 700.00 g17 g17 g18 10 700.00 20 500.00 ACCOUNT SUPPLIES ACCOUNT NO 115 POST CURRENT BALANCE DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Feb. 5 g17 85.00 85.00 ACCOUNT PREPAID INSURANCE 116 ACCOUNT NO POST REF DATE ITEM DEBIT CREDIT CURRENT BALANCE DEBIT CREDIT 288.00 Feb. 3 G17 288.00 GENERAL LEDGER ACCOUNT EQUIPMENT 141 ACCOUNT NO. CURRENT BALANCE POST REF. DATE ITEM DEBIT CREDIT CREDIT Jan. Feb. 31 Balance Forward 13 17 DEBIT 18,440.00 19,440.00 19,730.00 g17 g17 1,000.00 290.00 ACCOUNT ACCOUNT NO CURRENT BALANCE POST. REF. DATE ITEM DEBIT CREDIT DEBIT CREDIT NOTES PAYABLE @ 12% interest per year, interest pmts due each Jan. 31. ACCOUNT 210 ACCOUNT NO. CURRENT BALANCE POST. REF. DATE ITEM DEBIT CREDIT DEBIT CREDIT Jan. 31] Balance Forward 15,000.00 ACCOUNT ACCOUNTS PAYABLE 220 ACCOUNT NO. CURRENT BALANCE POST. REF. DATE ITEM DEBIT CREDIT DEBIT Jan. Feb. 31 Balance Forward 5 85.00 8 11 g17 g17 g17 918 g18 170.00 85.00 CREDIT 1,640.00 1,725.00 1,555.00 1,470.00 1,760.00 1,795.00 17 27 290.00 35.00 ACCOUNT COMMON STOCK ACCOUNT NO. 311 CURRENT BALANCE POST REF DATE ITEM DEBIT CREDIT DEBIT CREDIT Jan. 31 Balance Forward 4,000.00 ACCOUNT RETAINED EARNINGS 312 ACCOUNT NO. CURRENT BALANCE POST. REF DATE ITEM DEBIT CREDIT DEBIT CREDIT Jan. 31 Balance Forward 1,370.00 GENERAL LEDGER ACCOUNT DIVIDENDS ACCOUNT NO. 313 CURRENT BALANCE POST REF. DATE ITEM DEBIT CREDIT DEBIT CREDIT Feb. 28 g18 110.00 110.00 ACCOUNT SERVICE REVENUE ACCOUNT NO. 411 POST REF. DATE ITEM DEBIT CREDIT Feb. 41 g17 g17 650.00 700.00 CURRENT BALANCE DEBIT CREDIT 650.00 1,350.00 1,350.00 10 ACCOUNT RENT EXPENSE ACCOUNT NO. 511 CURRENT BALANCE POST REF DATE ITEM DEBIT CREDIT DEBIT CREDIT Feb. 2 g17 270.00 270.00 ACCOUNT GAS & OIL EXPENSE ACCOUNT NO 512 CURRENT BALANCE POST REF. DATE ITEM DEBIT CREDIT DEBIT CREDIT Feb. 27 g18 35.00 35.00 ACCOUNT WAGES EXPENSE ACCOUNT NO 513 CURRENT BALANCE POST REF DATE ITEM DEBIT CREDIT DEBIT CREDIT Feb. 16 918 240.00 240.00 ACCOUNT UTILITIES EXPENSE ACCOUNT NO. 514 POST REF CURRENT BALANCE DEBIT CREDIT DATE ITEM DEBIT CREDIT Feb. 19 g18 145.00 145.00 Goals of Financial Statements are to provide trustworthy reports that faith fully represent the company's economic realities. Goal (1) economic results of operations (i.e., Income Statement) for the reporting period (February) and Goal (2) economic financial position (i.e., Balance Sheet) at the end of the reporting period (as of February 28). 6. Find Goal (1) reporting failures: a. Which expense account on ASC's February Income Statement is failing to faithfully represent the economic results of operations for February? b. To better faithfully represent economic results, list at least 2 expense accounts that should be accounted for and reported on ASC's February Income Statement. Hint: only $35 of Supplies are physically on-hand at month-end. 7. Find Goal (2) reporting failures: a. List at least 2 asset accounts that as reported on Feb. 28, are overstated. b. Name at least one missing (and therefore understated) liability account that should be accounted for and reported on ASC's Balance Sheet as of February 28. GENERAL JOURNAL PAGE 17 ACCOUNTS (EXPLANATIONS) POST. REF DEBIT CREDIT DATE ||20xx 2 Feb. 270.00 2 RENT EXPENSE CASH (paid February rent) 511 111 3 270.00 6 Feb. 288.00 3 PREPAID INSURANCE CASH (one-year insurance policy) 116 111 7 288.00 8 9 10 Feb. 650.00 10 4 CASH SERVICE REVENUE (performed services for cash) 111 411 650.00 11 12 12 13 13 85.00 1114 14 Feb. 15 5 SUPPLIES A/P (bought supplies on account) 115 220 85.00 15 16 16 17 17 18 Feb. 6 NO ENTRY (ordered playground equipment) 18 19 119 20 Feb. 170.00 20 8 AP CASH (made payment to creditors) 220 111 21 170.00 21 22 22 23 23 24 Feb. 1,200.00 24 9 CASH A/R (received payments on account) 111 113 25 1,200.00 26 26 27 27 28 Feb. 700.00 28 10 AIR SERVICE REVENUE (billed customers for services performed) 113 411 29 700.009 30 30 31 31 32 Feb. 85.00 52 11 A/P CASH (made payment to creditors) 220 111 33 85.00 13 34 14 35 35 36 36 37 37 38 1538 39 39 40 Feb. 141 1,000.00 10 13 EQUIPMENT CASH (purchase equipment) 111 1,000.00 H2 GENERAL JOURNAL PAGE 18 ACCOUNTSI(EXPLANATIONS) POST REF. DATE DEBIT CREDIT 120xx 2 Feb. 290.00 17 EQUIPMENT A/P (purchase equipment on account) 141 220 290.00 6 Feb. 145.00 19 UTILITIES EXPENSE CASH (paid utility cost for Feb.) 514 111 145.00 8 10 Feb. 500.00 10 20 CASH A/R (rec'd payment of account from customers) 111 113 11 500.00 12 12 113 13 14 Feb. 240.00 14 21 WAGES EXPENSE CASH (three weeks wages to assistants) 513 111 15 240.00 15 16 16 117 17 18 Feb. 35.00 18 27 GAS AND OIL EXPENSE A/P (purchased & used gas & oil during Feb.) 512 220 35.00 19 19 20 20 21 21 22 Feb. 110.00 22 28 DIVIDENDS CASH (declared and distributed a dividend) 111 110.00 13 23 24 24 ps 25 226 26 27 27 28 28 ho 29 30 30 31 31 32 32 33 33 34 34 35 35 36 36 37 37 Be 38 39 39 HO 40 H1 H2 GENERAL LEDGER ACCOUNT CASH 111 ACCOUNT NO. POST REF DATE ITEM DEBIT CREDIT Jan. Feb. 31Balance Forward 2 31 4 270.00 288.00 650.00 g17 g17 g17 g17 g17 g17 g17 8 9 170.00 CURRENT BALANCE DEBIT CREDIT 1,870.00 1,600.00 1,312.00 1,962.00 1,792.00 2,992.00 2,907.00 1,907.00 1,762.00 2,262.00 2,022.00 1,912.00 1,200.00 11 13 19 85.00 1,000.00 145.00 g18 g18 20 500.00 21 g18 g18 240.00 110.00 28 1,870.00 2,350.00 2,308,00 1,912.00 ACCOUNT ACCOUNTS RECEIVABLE ACCOUNT NO 113 CURRENT BALANCE POST REF. DATE ITEM DEBIT CREDIT DEBIT CREDIT 31 Balance Forward Jan. Feb. 9 1,200.00 1,700.00 500.00 1,200.00 700.00 g17 g17 g18 10 700.00 20 500.00 ACCOUNT SUPPLIES ACCOUNT NO 115 POST CURRENT BALANCE DATE ITEM REF DEBIT CREDIT DEBIT CREDIT Feb. 5 g17 85.00 85.00 ACCOUNT PREPAID INSURANCE 116 ACCOUNT NO POST REF DATE ITEM DEBIT CREDIT CURRENT BALANCE DEBIT CREDIT 288.00 Feb. 3 G17 288.00 GENERAL LEDGER ACCOUNT EQUIPMENT 141 ACCOUNT NO. CURRENT BALANCE POST REF. DATE ITEM DEBIT CREDIT CREDIT Jan. Feb. 31 Balance Forward 13 17 DEBIT 18,440.00 19,440.00 19,730.00 g17 g17 1,000.00 290.00 ACCOUNT ACCOUNT NO CURRENT BALANCE POST. REF. DATE ITEM DEBIT CREDIT DEBIT CREDIT NOTES PAYABLE @ 12% interest per year, interest pmts due each Jan. 31. ACCOUNT 210 ACCOUNT NO. CURRENT BALANCE POST. REF. DATE ITEM DEBIT CREDIT DEBIT CREDIT Jan. 31] Balance Forward 15,000.00 ACCOUNT ACCOUNTS PAYABLE 220 ACCOUNT NO. CURRENT BALANCE POST. REF. DATE ITEM DEBIT CREDIT DEBIT Jan. Feb. 31 Balance Forward 5 85.00 8 11 g17 g17 g17 918 g18 170.00 85.00 CREDIT 1,640.00 1,725.00 1,555.00 1,470.00 1,760.00 1,795.00 17 27 290.00 35.00 ACCOUNT COMMON STOCK ACCOUNT NO. 311 CURRENT BALANCE POST REF DATE ITEM DEBIT CREDIT DEBIT CREDIT Jan. 31 Balance Forward 4,000.00 ACCOUNT RETAINED EARNINGS 312 ACCOUNT NO. CURRENT BALANCE POST. REF DATE ITEM DEBIT CREDIT DEBIT CREDIT Jan. 31 Balance Forward 1,370.00 GENERAL LEDGER ACCOUNT DIVIDENDS ACCOUNT NO. 313 CURRENT BALANCE POST REF. DATE ITEM DEBIT CREDIT DEBIT CREDIT Feb. 28 g18 110.00 110.00 ACCOUNT SERVICE REVENUE ACCOUNT NO. 411 POST REF. DATE ITEM DEBIT CREDIT Feb. 41 g17 g17 650.00 700.00 CURRENT BALANCE DEBIT CREDIT 650.00 1,350.00 1,350.00 10 ACCOUNT RENT EXPENSE ACCOUNT NO. 511 CURRENT BALANCE POST REF DATE ITEM DEBIT CREDIT DEBIT CREDIT Feb. 2 g17 270.00 270.00 ACCOUNT GAS & OIL EXPENSE ACCOUNT NO 512 CURRENT BALANCE POST REF. DATE ITEM DEBIT CREDIT DEBIT CREDIT Feb. 27 g18 35.00 35.00 ACCOUNT WAGES EXPENSE ACCOUNT NO 513 CURRENT BALANCE POST REF DATE ITEM DEBIT CREDIT DEBIT CREDIT Feb. 16 918 240.00 240.00 ACCOUNT UTILITIES EXPENSE ACCOUNT NO. 514 POST REF CURRENT BALANCE DEBIT CREDIT DATE ITEM DEBIT CREDIT Feb. 19 g18 145.00 145.00