Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GoAsia Mining Sdn. Bhd. incurred qualifying mining expenditure in the sum of RM 900,000 and eligible to claim mining allowance for 12 years. It

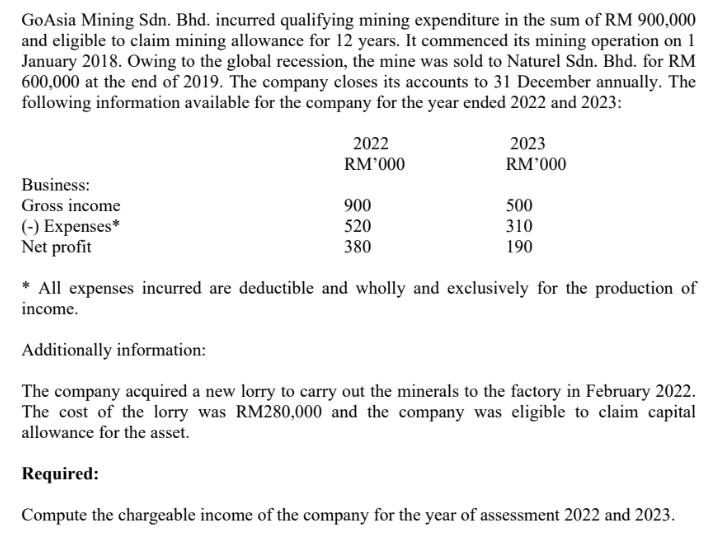

GoAsia Mining Sdn. Bhd. incurred qualifying mining expenditure in the sum of RM 900,000 and eligible to claim mining allowance for 12 years. It commenced its mining operation on 1 January 2018. Owing to the global recession, the mine was sold to Naturel Sdn. Bhd. for RM 600,000 at the end of 2019. The company closes its accounts to 31 December annually. The following information available for the company for the year ended 2022 and 2023: Business: Gross income (-) Expenses* Net profit 2022 RM'000 2023 RM'000 900 500 520 310 380 190 * All expenses incurred are deductible and wholly and exclusively for the production of income. Additionally information: The company acquired a new lorry to carry out the minerals to the factory in February 2022. The cost of the lorry was RM280,000 and the company was eligible to claim capital allowance for the asset. Required: Compute the chargeable income of the company for the year of assessment 2022 and 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started