Answered step by step

Verified Expert Solution

Question

1 Approved Answer

---- ------- Goderich Automotive (GA) wants to donate a vacant lot next door to its plant to the city for use as a public park

----

-------

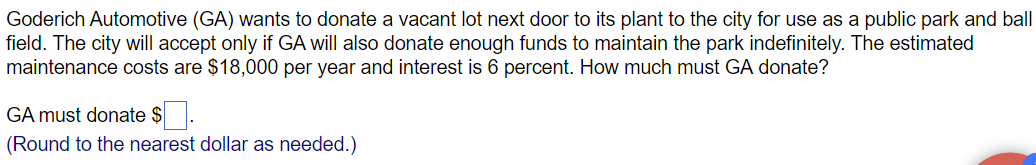

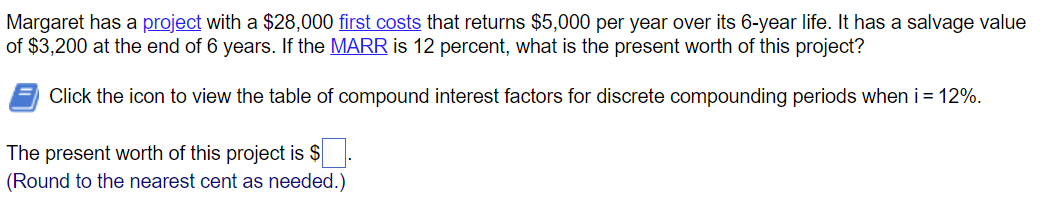

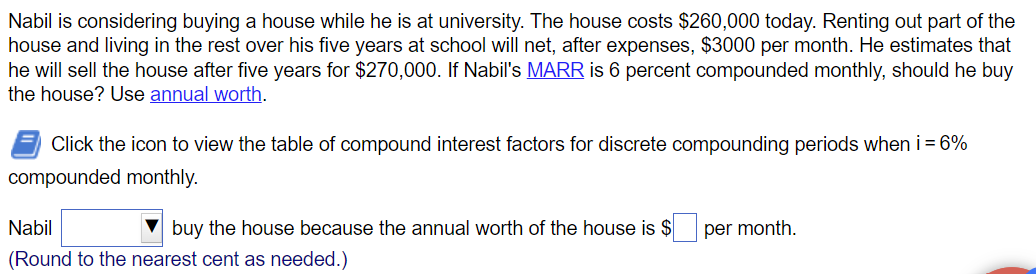

Goderich Automotive (GA) wants to donate a vacant lot next door to its plant to the city for use as a public park and ball field. The city will accept only if GA will also donate enough funds to maintain the park indefinitely. The estimated maintenance costs are $18,000 per year and interest is 6 percent. How much must GA donate? GA must donate $ (Round to the nearest dollar as needed.) Margaret has a project with a $28,000 first costs that returns $5,000 per year over its 6 -year life. It has a salvage value of $3,200 at the end of 6 years. If the MARR is 12 percent, what is the present worth of this project? Click the icon to view the table of compound interest factors for discrete compounding periods when i=12%. The present worth of this project is $ (Round to the nearest cent as needed.) Nabil is considering buying a house while he is at university. The house costs $260,000 today. Renting out part of the house and living in the rest over his five years at school will net, after expenses, $3000 per month. He estimates that he will sell the house after five years for $270,000. If Nabil's MARR is 6 percent compounded monthly, should he buy the house? Use annual worth. Click the icon to view the table of compound interest factors for discrete compounding periods when i=6% compounded monthly. Nabil buy the house because the annual worth of the house is $ per month. (Round to the nearest cent as needed.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started