Question

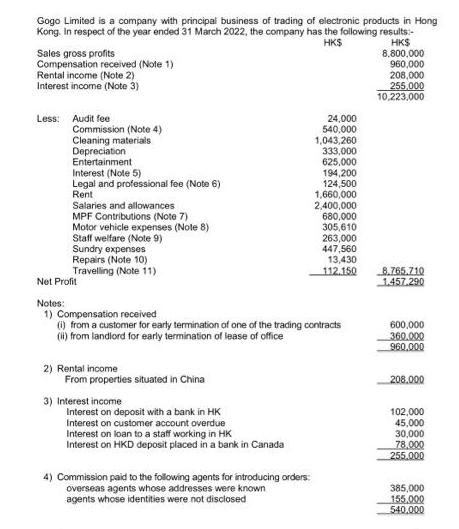

Gogo Limited is a company with principal business of trading of electronic products in Hong Kong. In respect of the year ended 31 March

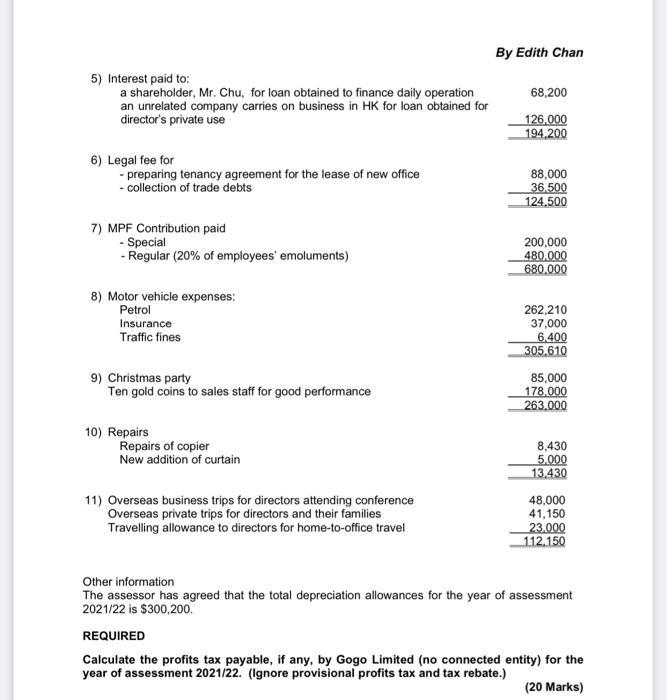

Gogo Limited is a company with principal business of trading of electronic products in Hong Kong. In respect of the year ended 31 March 2022, the company has the following results:- HK$ HK$ 8,800,000 960,000 208,000 255,000 10,223,000 Sales gross profits Compensation received (Note 1) Rental income (Note 2) Interest income (Note 3) Less: Audit fee Commission (Note 4) Cleaning materials Depreciation Entertainment Interest (Note 5) Legal and professional fee (Note 6) Rent Salaries and allowances MPF Contributions (Note 7) Motor vehicle expenses (Note 8) Staff welfare (Note 9) Sundry expenses Repairs (Note 10) Travelling (Note 11) 2) Rental income Net Profit Notes: 1) Compensation received (i) from a customer for early termination of one of the trading contracts (ii) from landlord for early termination of lease of office From properties situated in China 3) Interest income Interest on deposit with a bank in HK Interest on customer account overdue Interest on loan to a staff working in HK Interest on HKD deposit placed in a bank in Canada 24,000 540,000 1,043,260 333,000 625,000 194,200 124,500 1,660,000 4) Commission paid to the following agents for introducing orders: overseas agents whose addresses were known agents whose identities were not disclosed 2,400,000 680,000 305,610 263,000 447,560 13,430 112.150 8.765.710 1.457.290 600,000 360.000 960,000 208.000 102,000 45,000 30,000 78,000 255.000 385,000 155.000 540,000 5) Interest paid to: a shareholder, Mr. Chu, for loan obtained to finance daily operation an unrelated company carries on business in HK for loan obtained for director's private use 6) Legal fee for -preparing tenancy agreement for the lease of new office - collection of trade debts 7) MPF Contribution paid - Special - Regular (20% of employees' emoluments) 8) Motor vehicle expenses: Petrol Insurance Traffic fines 9) Christmas party Ten gold coins to sales staff for good performance 10) Repairs Repairs of copier New addition of curtain 11) Overseas business trips for directors attending conference Overseas private trips for directors and their families Travelling allowance to directors for home-to-office travel By Edith Chan 68,200 126,000 194,200 88,000 36,500 124,500 200,000 480.000 680,000 262,210 37,000 6.400 305.610 85,000 178,000 263.000 8,430 5.000 13,430 48,000 41,150 23.000 112.150 Other information The assessor has agreed that the total depreciation allowances for the year of assessment 2021/22 is $300,200. REQUIRED Calculate the profits tax payable, if any, by Gogo Limited (no connected entity) for the year of assessment 2021/22. (Ignore provisional profits tax and tax rebate.) (20 Marks)

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

REQUIRED Calculate the profits tax payable if any by Gogo Limited no connected entity for the year o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started