Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GOIL Ghana Limited which operates in the downstream of the petroleum industry in Ghana, proposes to buy Benso Oil (BOPP) Ghana Limited which is

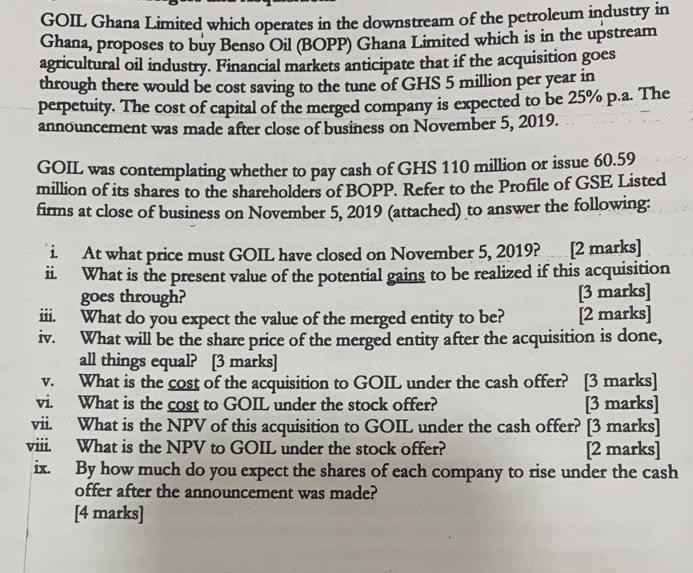

GOIL Ghana Limited which operates in the downstream of the petroleum industry in Ghana, proposes to buy Benso Oil (BOPP) Ghana Limited which is in the upstream agricultural oil industry. Financial markets anticipate that if the acquisition goes through there would be cost saving to the tune of GHS 5 million per year i perpetuity. The cost of capital of the merged company is expected to be 25% p.a. The announcement was made after close of business on November 5, 2019. in GOIL was contemplating whether to pay cash of GHS 110 million or issue 60.59 million of its shares to the shareholders of BOPP. Refer to the Profile of GSE Listed firms at close of business on November 5, 2019 (attached) to answer the following: i ii. iii. iv. V. S. vi. vii. At what price must GOIL have closed on November 5, 2019? [2 marks] What is the present value of the potential gains to be realized if this acquisition goes through? [3 marks] [2 marks] What do you expect the value of the merged entity to be? What will be the share price of the merged entity after the acquisition is done, all things equal? [3 marks] What is the cost of the acquisition to GOIL under the cash offer? [3 marks] What is the cost to GOIL under the stock offer? [3 marks] What is the NPV of this acquisition to GOIL under the cash offer? [3 marks] What is the NPV to GOIL under the stock offer? [2 marks] ix. By how much do you expect the shares of each company to rise under the cash offer after the announcement was made? [4 marks]

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

i To determine the price at which GOIL must have closed on November 5 2019 we need to use the information from the Profile of GSE Listed firms at close of business on November 5 2019 The profile shows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started