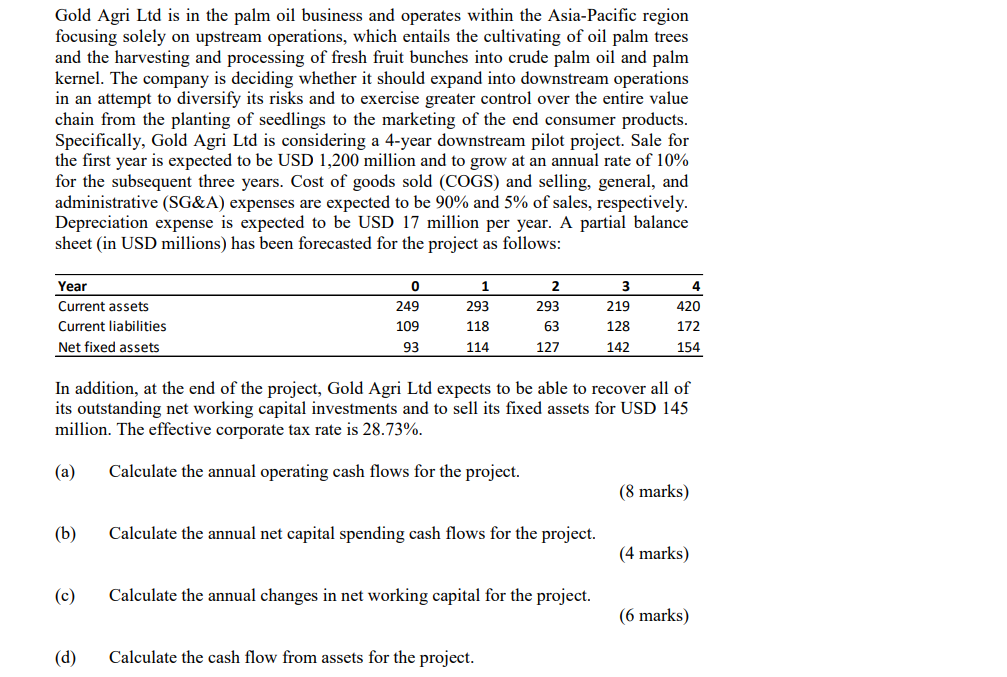

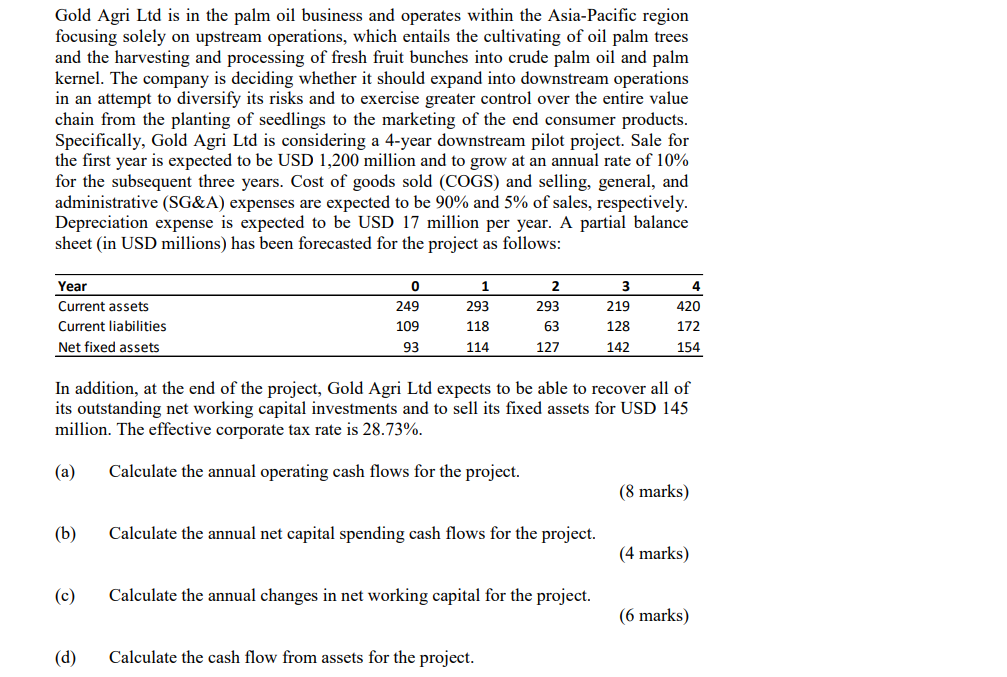

Gold Agri Ltd is in the palm oil business and operates within the Asia-Pacific region focusing solely on upstream operations, which entails the cultivating of oil palm trees and the harvesting and processing of fresh fruit bunches into crude palm oil and palm kernel. The company is deciding whether it should expand into downstream operations in an attempt to diversify its risks and to exercise greater control over the entire value chain from the planting of seedlings to the marketing of the end consumer products. Specifically, Gold Agri Ltd is considering a 4-year downstream pilot project. Sale for the first year is expected to be USD 1,200 million and to grow at an annual rate of 10% for the subsequent three years. Cost of goods sold (COGS) and selling, general, and administrative (SG&A) expenses are expected to be 90% and 5% of sales, respectively. Depreciation expense is expected to be USD 17 million per year. A partial balance sheet (in USD millions) has been forecasted for the project as follows: 3 Year Current assets Current liabilities Net fixed assets 0 249 109 93 1 293 118 114 2 293 63 127 219 128 142 4 420 172 154 In addition, at the end of the project, Gold Agri Ltd expects to be able to recover all of its outstanding net working capital investments and to sell its fixed assets for USD 145 million. The effective corporate tax rate is 28.73%. (a) Calculate the annual operating cash flows for the project. (8 marks) (b) Calculate the annual net capital spending cash flows for the project. (4 marks) (c) Calculate the annual changes in net working capital for the project. (6 marks) (d) Calculate the cash flow from assets for the project. Gold Agri Ltd is in the palm oil business and operates within the Asia-Pacific region focusing solely on upstream operations, which entails the cultivating of oil palm trees and the harvesting and processing of fresh fruit bunches into crude palm oil and palm kernel. The company is deciding whether it should expand into downstream operations in an attempt to diversify its risks and to exercise greater control over the entire value chain from the planting of seedlings to the marketing of the end consumer products. Specifically, Gold Agri Ltd is considering a 4-year downstream pilot project. Sale for the first year is expected to be USD 1,200 million and to grow at an annual rate of 10% for the subsequent three years. Cost of goods sold (COGS) and selling, general, and administrative (SG&A) expenses are expected to be 90% and 5% of sales, respectively. Depreciation expense is expected to be USD 17 million per year. A partial balance sheet (in USD millions) has been forecasted for the project as follows: 3 Year Current assets Current liabilities Net fixed assets 0 249 109 93 1 293 118 114 2 293 63 127 219 128 142 4 420 172 154 In addition, at the end of the project, Gold Agri Ltd expects to be able to recover all of its outstanding net working capital investments and to sell its fixed assets for USD 145 million. The effective corporate tax rate is 28.73%. (a) Calculate the annual operating cash flows for the project. (8 marks) (b) Calculate the annual net capital spending cash flows for the project. (4 marks) (c) Calculate the annual changes in net working capital for the project. (6 marks) (d) Calculate the cash flow from assets for the project