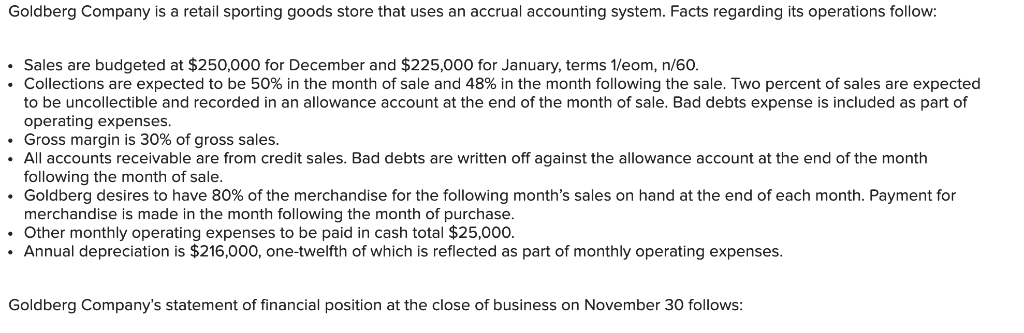

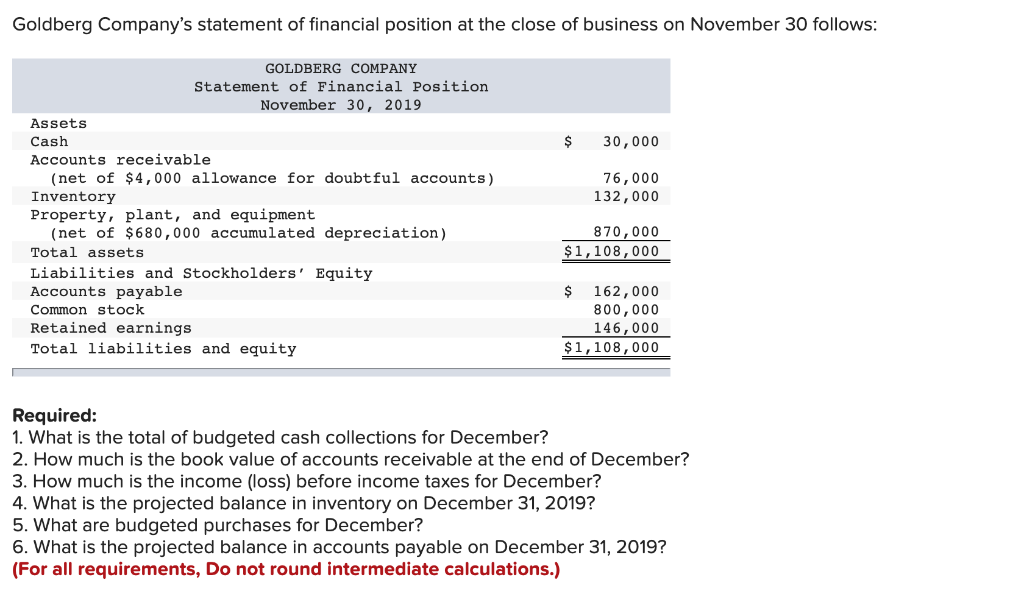

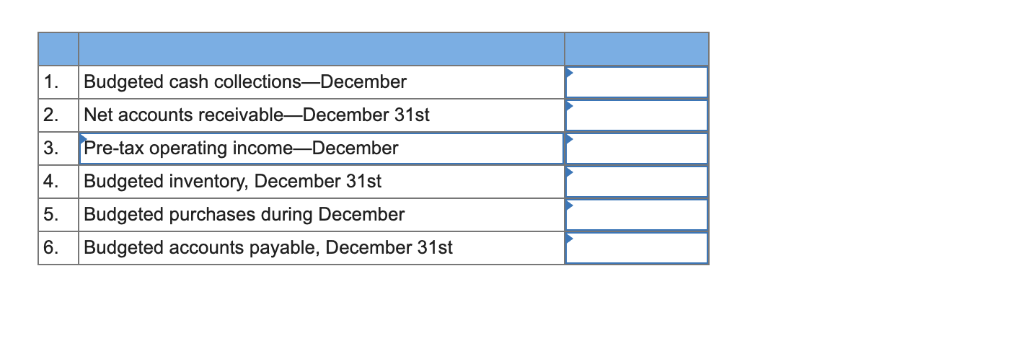

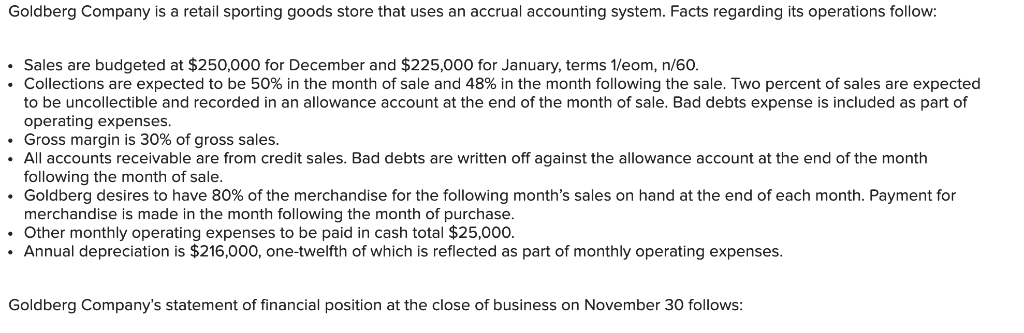

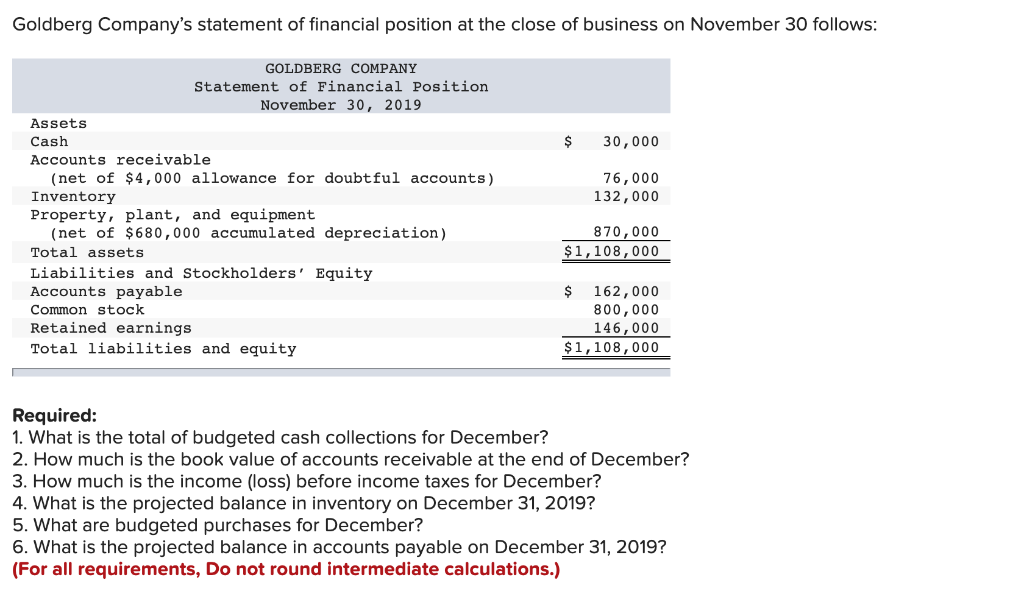

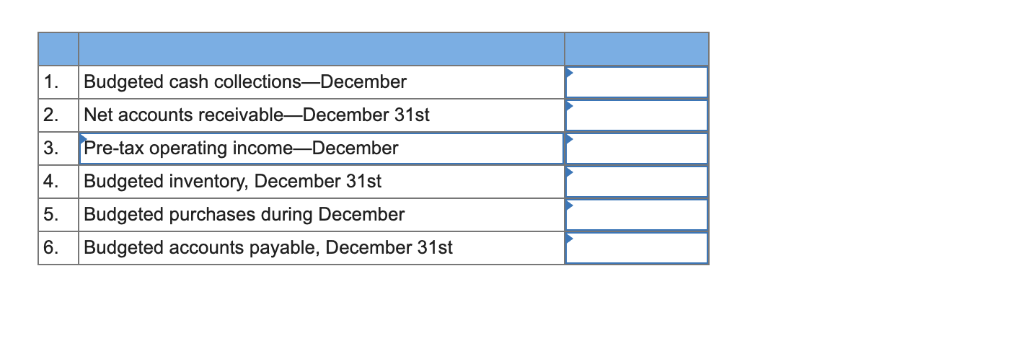

Goldberg Company is a retail sporting goods store that uses an accrual accounting system. Facts regarding its operations follow Sales are budgeted at $250,000 for December and $225,000 for January, terms 1/eom, n/60. Collections are expected to be 50% in the month of sale and 48% in the month following the sale. Two percent of sales are expected . Gross margin is 30% of gross sales. . Goldberg desires to have 80% of the merchandise for the following month's sales on hand at the end of each month. Payment for to be uncollectible and recorded in an allowance account at the end of the month of sale. Bad debts expense is included as part of operating expenses All accounts receivable are from credit sales. Bad debts are written off against the allowance account at the end of the month following the month of sale merchandise is made in the month following the month of purchase. Other monthly operating expenses to be paid in cash total $25,000. Annual depreciation is $216,000, one-twelfth of which is reflected as part of monthly operating expenses. Goldberg Company's statement of financial position at the close of business on November 30 follows Goldberg Company's statement of financial position at the close of business on November 30 follows GOLDBERG COMPANY Statement of Financial Position November 30, 2019 AssetS Casunts S41 $ 30,000 Accounts receivable 76,000 132,000 (net of $4,000 allowance for doubtful accounts) Inventory Property, plant, and equipment 870,000 $1,108,000 (net of $680,000 accumulated depreciation) Total assets Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and equity $ 162,000 800,000 146,000 $1,108,000 Required: 1. What is the total of budgeted cash collections for December? 2. How much is the book value of accounts receivable at the end of December? 3. How much is the income (loss) before income taxes for December? 4. What is the projected balance in inventory on December 31, 2019? 5. What are budgeted purchases for December? 6. What is the projected balance in accounts payable on December 31, 2019? (For all requirements, Do not round intermediate calculations.) 1. Budgeted cash collections-December 2. Net accounts receivable-December 31st 3. Pre-tax operating income-December 4. Budgeted inventory, December 31st 5. Budgeted purchases during December 6. Budgeted accounts payable, December 31st