Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GOLDEN ACRES FARM Golden Acres Farm was organized by Julie Young on January 1, 2017 for the purpose of operating a farm. During the fiscal

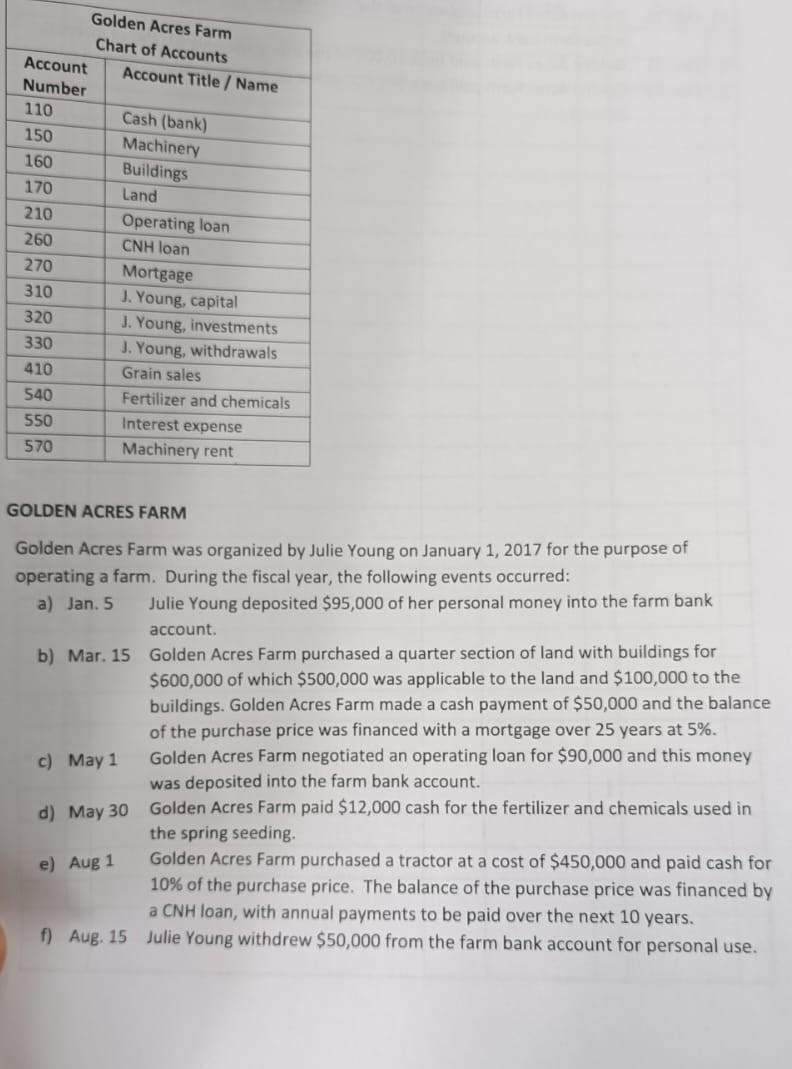

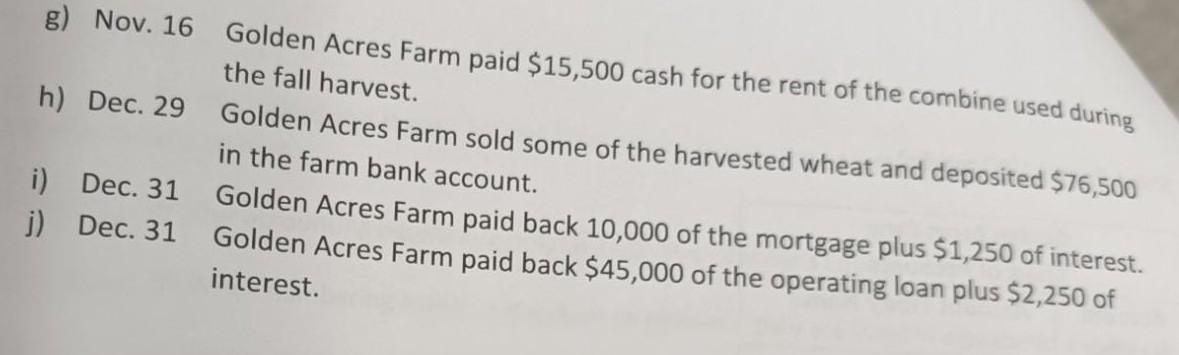

GOLDEN ACRES FARM Golden Acres Farm was organized by Julie Young on January 1, 2017 for the purpose of operating a farm. During the fiscal year, the following events occurred: a) Jan. 5 Julie Young deposited $95,000 of her personal money into the farm bank account. b) Mar. 15 Golden Acres Farm purchased a quarter section of land with buildings for $600,000 of which $500,000 was applicable to the land and $100,000 to the buildings. Golden Acres Farm made a cash payment of $50,000 and the balance of the purchase price was financed with a mortgage over 25 years at 5%. c) May 1 Golden Acres Farm negotiated an operating loan for $90,000 and this money was deposited into the farm bank account. d) May 30 Golden Acres Farm paid $12,000 cash for the fertilizer and chemicals used in the spring seeding. e) Aug 1 Golden Acres Farm purchased a tractor at a cost of $450,000 and paid cash for 10% of the purchase price. The balance of the purchase price was financed by a CNH loan, with annual payments to be paid over the next 10 years. f) Aug. 15 Julie Young withdrew $50,000 from the farm bank account for personal use. g) Nov. 16 Golden Acres Farm paid $15,500 cash for the rent of the combine used during the fall harvest. h) Dec. 29 Golden Acres Farm sold some of the harvested wheat and deposited $76,500 in the farm bank account. i) Dec. 31 Golden Acres Farm paid back 10,000 of the mortgage plus $1,250 of interest. j) Dec. 31 Golden Acres Farm paid back $45,000 of the operating loan plus $2,250 of interest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started