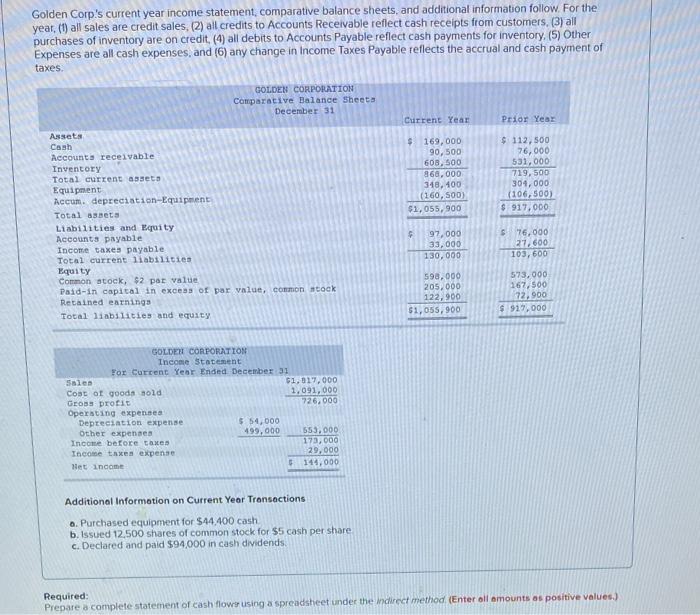

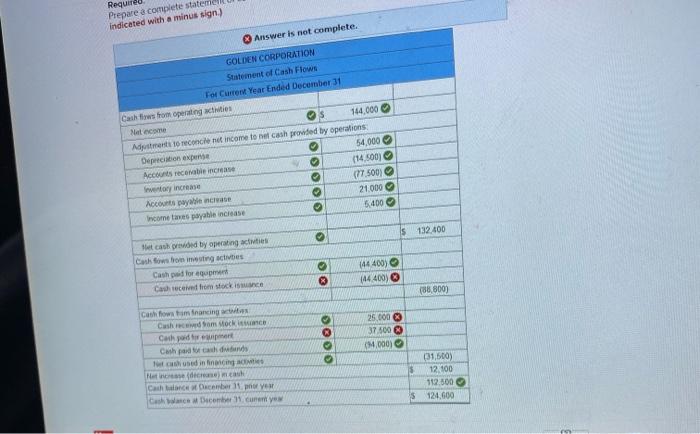

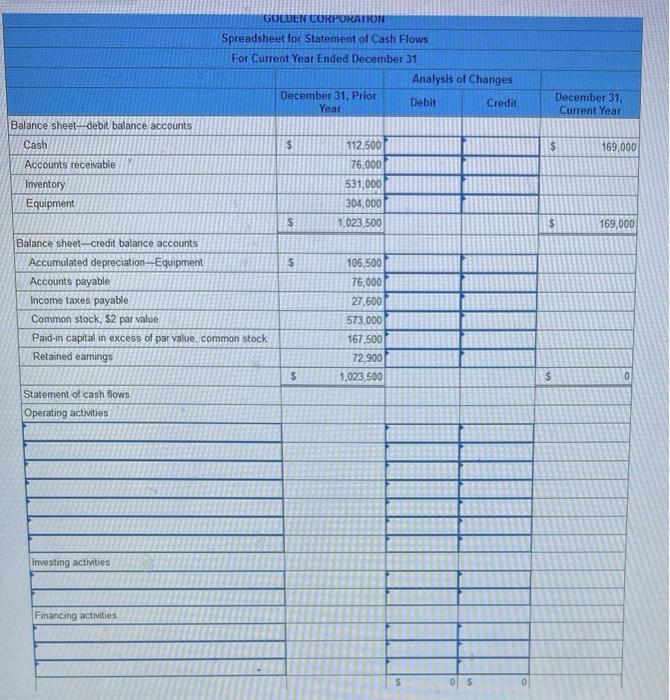

Golden Corp's current year income statement, comparative balance sheets, and additional information follow. For the year, (t) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, (5) Other Expenses are all cash expenses, and (6) any change in Income Taxes Payable reflects the accrual and cash payment of taxes GOLDEN CORPORATION Comparative Balance Sheets December 31 Current Year Prior Year $ 169,000 90,500 608,500 868.000 348, 100 (160.500) $1,055, 900 $ 112,500 76,000 531,000 719.500 301.000 (106,500) $ 917,000 Assets Cash Accounts receivable Inventory Total current assets Equipment Accum. depreciation Equipment Total assets Liabilities and Equity Accounts payable Income taxes payable Total current liabilities Equity Common stock, $2 pat value Paid-in capital in excess of par value, common stock Retained earnings Total liabilities and equity 97,000 33,000 130,000 576.000 27.600 103,600 590.000 205.000 122,900 $1,055, 900 573.000 167,500 72,900 $919.000 GOLDER CORPORATION Income Statement For Current Year Ended December 31 51.517.000 Cost of goods sold 1,091,000 Gross proti 726,000 Operating expenses Depreciation expense $ 54,000 Other expenses 499,000 553,000 Income before taxes 173,000 Income taxes expense 29,000 Net income 144,000 Additional Information on Current Year Transactions a. Purchased equipment for $44.400 cash b. Issued 12,500 shares of common stock for $5 cash per share c. Declared and paid $94.000 in cash dividends Required: Prepare a complete statement of cash flows using a spreadsheet under the indirect method (Enter all amounts as positive values.) Required Prepare a complete state indicated with a minus sign.) Answer is not complete. GOLDEN CORPORATION Statenent of Cash Flows For Cont Year Ended December 31 Cashews from operating action Nel come $ 144,000 Adjustments to reconcile net income to nel cash provided by operations Depreciation expense 54,000 Accounts recent increase (14.500) entory increase (77.500) Accounts payable chat 21.000 Income to payable increase 5400 00000 $ 132.400 Setcash vided by operating activities Cash Bows on insting activies Cash paid for equipment Checido stock (44.400) (44400) (88.800) Cath flows from inancing Cashcom Stock Cash ordent Cash and dinini Medical Cash becamber.ph Cascom ceye 25,000 37.500 (2.000) oooo (31,500) 12.100 112.500 $ 124,600 GOLDEN CORPORATION Spreadsheet for Statement of Cash Flows For Current Year Ended December 31 Analysis of Changes December 31, Prior Debit Year Credit December 31, Current Year Balance sheel-debit balance accounts Cash $ 169,000 112,500 76,000 Accounts receivable Inventory Equipment 531,000 304,000 1,023 500 5 $ 169,000 S Balance sheelcredit balance accounts Accumulated depreciation Equipment Accounts payable Income taxes payable Common stock, $2 par value Paid-in capital in excess of par value, common stock Retained earnings 106,500 76,000 27.600 573.000 167,500 72.900 1,023,500 $ Statement of cash flows Operating activities Investing activities Financing activities $