Answered step by step

Verified Expert Solution

Question

1 Approved Answer

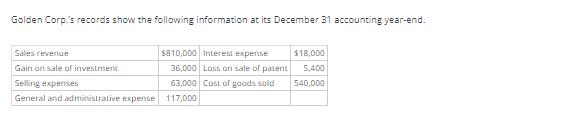

Golden Corp.'s records show the following information at its December 31 accounting year-end. $810,000 Interest expense 36,000 Loss on sale of patent Sales revenue

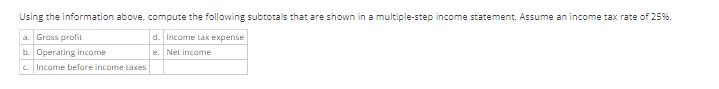

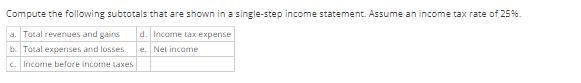

Golden Corp.'s records show the following information at its December 31 accounting year-end. $810,000 Interest expense 36,000 Loss on sale of patent Sales revenue Gain on sale of investment Selling expenses General and administrative expense 117,000 63,000 Cost of goods sold $18,000 5,400 540,000 Using the information above, compute the following subtotals that are shown in a multiple-step income statement. Assume an income tax rate of 25%. a. Gross profit d. Income tax expense b. Operating income e. Net income cIncome before income taxes Compute the following subtotals that are shown in a single-step income statement. Assume an income tax rate of 25%. d. Income tax expense a. Total revenues and gains b. Total expenses and losses e. Net income c. Income before income taxes

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To compute the subtotals shown in a multiplestep income statement we need to follow the given inform...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started